Current Report Filing (8-k)

May 17 2017 - 4:14PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 17, 2017

GROUPON, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

(State or other

jurisdiction

of incorporation)

|

|

1-35335

(Commission

File Number)

|

|

27-0903295

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

600 West Chicago Avenue

Suite 400

Chicago, Illinois

(Address of principal executive offices)

|

|

60654

(Zip Code)

|

312-334-1579

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 8.01.

Other Events.

Groupon, Inc. (the "Company") is filing this Current Report on Form 8-K to present retrospectively revised historical consolidated financial statements and other information included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016 (as amended, the "2016 Form 10-K"). Information included in this Current Report on Form 8-K presents the financial results of businesses recently disposed of as discontinued operations for the years ended December 31, 2016, 2015 and 2014. Information included in this Current Report on Form 8-K also presents updated segment information for the years ended December 31, 2016, 2015 and 2014. These updates are consistent with the presentation of discontinued operations and segment information included in the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2017 filed with the Securities and Exchange Commission (the "SEC") on May 3, 2017. The information contained in this Current Report on Form 8-K does not otherwise amend or restate any information in the 2016 Form 10-K.

In October 2016, the Company completed a strategic review of its international markets in connection with its efforts to optimize its global footprint and focus on the markets that it believes have the greatest potential to benefit the Company's long-term financial performance. Based on that review, the Company decided to focus its business on 15 core countries and to pursue strategic alternatives for its operations in the remaining 11 countries, which were primarily based in Asia and Latin America. The Company completed dispositions of its operations in those countries between November 2016 and March 2017. The Company determined that the decision reached by its management and Board of Directors to exit those 11 non-core countries, which comprised a substantial majority of its operations outside of North America and EMEA, represented a strategic shift in its business. Additionally, based on its review of quantitative and qualitative factors relevant to the dispositions, the Company determined that the disposition of the businesses in those 11 countries will have a major effect on its operations and financial results. As such, the consolidated financial statements for the years ended December 31, 2016, 2015 and 2014 included in this Current Report on Form 8-K have been retrospectively adjusted to present the financial results of the operations in those 11 countries as discontinued operations. In addition, the related financial statement schedule of Valuation and Qualifying Accounts has been retrospectively adjusted to reflect the discontinued operations presentation.

As a result of the dispositions, which represented a substantial majority of the Company's international operations outside of EMEA and resulted in changes to the Company's internal reporting and leadership structure, the Company updated its segments during the first quarter 2017 to report two segments: North America and International. In addition, the Company changed its measure of segment profitability during the first quarter of 2017. Historically, segment operating results reflected operating income (loss) excluding stock-based compensation and acquisition-related expense (benefit), net. In connection with the internal reporting changes, the measure of segment profitability was changed to operating income (loss), unadjusted. The consolidated financial statements for the years ended December 31, 2016, 2015 and 2014 included in this Current Report on Form 8-K have been retrospectively adjusted to reflect that updated segment information.

To retrospectively reflect the changes resulting from discontinued operations and the updated segment information described above, Exhibit 99.1 of this Current Report on Form 8-K updates information that was originally included in the following sections of the 2016 Form 10-K:

|

|

|

|

•

|

Part II, Item 8 - Financial Statements and Supplementary Data

|

|

|

|

|

•

|

Part IV, Item 15 - Exhibits and Financial Statement Schedules

|

Other than the items listed above, the Company is not updating any other information from the 2016 Form 10-K at the present time.

This Current Report on Form 8-K does not modify or update the disclosures contained in the 2016 Form 10-K in any way, nor does it reflect any subsequent information, activities or events, other than those required to reflect the changes in presentation due to discontinued operations and segment information described above. More current information may be included in the Company’s other filings with the SEC from time to time. This Current Report on Form 8-K should be read in conjunction with the 2016 Form 10-K (except for the Company's consolidated financial statements included in Part II, Item 8, and the related financial statement schedule included in Part IV, Item 15) and the Company’s other filings with the SEC.

Item 9.01.

Financial Statements and Exhibits.

|

|

|

|

|

|

|

|

|

|

|

(d)

|

Exhibits:

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

23.1

|

|

Consent of Ernst & Young LLP

|

|

|

|

99.1

|

|

Consolidated Financial Statements and Financial Statement Schedule of Groupon, Inc. as of December 31, 2016 and 2015 and for the years ended December 31, 2016, 2015 and 2014 (revised solely to present discontinued operations and updated segment information as described in this Current Report on Form 8-K)

|

|

|

|

101

|

|

Consolidated Financial Statements of Groupon, Inc. as of December 31, 2016 and 2015 and for the years ended December 31, 2016, 2015 and 2014 formatted in XBRL: (i) the Consolidated Balance Sheets; (ii) the Consolidated Statements of Operations; (iii) the Consolidated Statements of Comprehensive Income (Loss); (iv) the Consolidated Statements of Stockholders' Equity, (v) the Consolidated Statements of Cash Flows and (vi) the Notes to the Consolidated Financial Statements filed herewith (revised solely to present discontinued operations and updated segment information as described in this Current Report on Form 8-K)

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GROUPON, INC.

|

|

|

|

|

|

|

|

|

|

Dated: May 17, 2017

|

By:

|

/s/ Michael Randolfi

|

|

|

Name:

|

Michael Randolfi

|

|

|

Title:

|

Chief Financial Officer

|

Exhibit Index

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

|

|

|

|

23.1

|

Consent of Ernst & Young LLP

|

|

|

|

99.1

|

Consolidated Financial Statements and Financial Statement Schedule of Groupon, Inc. as of December 31, 2016 and 2015 and for the years ended December 31, 2016, 2015 and 2014 (revised solely to present discontinued operations and updated segment information as described in this Current Report on Form 8-K)

|

|

|

|

101

|

Consolidated Financial Statements of Groupon, Inc. as of December 31, 2016 and 2015 and for the years ended December 31, 2016, 2015 and 2014 formatted in XBRL: (i) the Consolidated Balance Sheets; (ii) the Consolidated Statements of Operations; (iii) the Consolidated Statements of Comprehensive Income (Loss); (iv) the Consolidated Statements of Stockholders' Equity, (v) the Consolidated Statements of Cash Flows and (vi) the Notes to the Consolidated Financial Statements filed herewith (revised solely to present discontinued operations and updated segment information as described in this Current Report on Form 8-K)

|

|

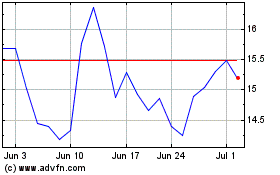

Groupon (NASDAQ:GRPN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Groupon (NASDAQ:GRPN)

Historical Stock Chart

From Apr 2023 to Apr 2024