Notice of Exempt Solicitation. Definitive Material. (px14a6g)

May 17 2017 - 3:36PM

Edgar (US Regulatory)

May 17, 2017

Please vote on June 14, 2017, at the annual meeting of

Caterpillar, Inc. (NYSE: CAT):

1.

AGAINST

the re-election of Directors Daniel Dickinson, Dennis Muilenburg, and William Osborn;

and

2.

FOR

Proposal 10, amending the company clawback policy.

Dear Caterpillar shareholder,

Caterpillar, Inc. stands at a critical juncture. With $2

billion in income taxes and penalties assessed by the Internal Revenue Service

(“IRS”), a Senate investigation finding that the company avoided paying $2.4

billion in taxes through an abusive tax shelter, possible charges of tax fraud,

1

and an ongoing

federal investigation that may preclude the company from participating in

lucrative government contracts, the overwhelming liabilities associated with

Caterpillar’s offshore tax structure have reached a tipping point requiring

director level accountability.

As a consequence, shareholders must clearly signal to the

board that the long term regulatory risks of the tax strategy outweigh its

financial benefits by voting AGAINST Directors Dickinson, Muilenburg and

Osborn. Shareholders should also vote FOR Proposal 10, to amend the company’s

clawback policy to include events that may result in reputational damage to the

company.

For investors the following are of immediate concern:

·

Failure of Risk Oversight Despite Multiple Warnings:

Caterpillar Audit Committee’s failure to manage the risks associated with the

offshore tax structure, despite warnings by both internal and external parties,

calls into question the effectiveness of the members of the Audit Committee. At

least two employees and the company’s internal risk assessment system had warned

of the risks of the offshore tax plan, all of which the Audit Committee appears

to have ignored. Further, Caterpillar continued to implement the offshore tax

structure despite significant scrutiny from federal regulators, as well as

shareholders themselves through various lawsuits.

·

Auditor Conflict of Interest:

The Audit Committee has

failed to manage the conflict of interest presented by PricewaterhouseCoopers

(“PWC”), which both developed the tax avoidance scheme and continues to be responsible

for the company’s external auditing. Caterpillar also has a history of a

revolving door of employees with PWC, including the current CFO. The failure

to address PWC’s conflict of interest raises concern over the Audit Committee’s

commitment to independent review of the accuracy of the company’s financial

statements, and the Audit Committee’s overall supervision of the company’s

external audits.

·

Audit Committee Composition is in Urgent Need of Change:

Messrs.

Dickinson, Muilenburg, and Osborn have sat on the committee for the duration of

the IRS and Senate investigations. In fact, Committee Chairman Osborn has sat

on the board almost since the inception of the tax strategy, over 15 years.

Given their long tenure and the Audit Committee’s lack of response, we question

these directors’ ability to provide adequate oversight of the ongoing federal

investigation of the offshore tax structure and outside auditors.

1

The company is contesting the IRS assessments.

·

Stronger Pay Accountability:

Strengthening the clawback

policy by including recoupment of pay for conduct that might result in significant

reputational damage to the company is a common sense reform and is particularly

warranted at Caterpillar given the potential liabilities associated with the

offshore tax structure.

As Caterpillar’s performance slowly improves, it is even

more critical that the board take a fresh look at the company’s risk mitigation

practices so that the reputational costs of the tax strategy do not derail the

company’s recovery. Although we recognize the addition of Rayford Wilkins to

the board and the Audit Committee, three of the four members of the committee,

entrusted with monitoring the company’s tax compliance and risk management

framework, have sat on the committee for the duration of multiple

investigations. Yet Caterpillar appears to have continued to implement the tax

strategy for over 15 years. For all of these reasons, we urge a vote against

the three directors and a vote for the clawback proposal.

The CtW Investment Group works with pension funds sponsored

by unions affiliated with Change to Win, a federation of unions representing

nearly 5.5 million members, to enhance long term shareholder value through

active ownership. These funds invest over $250 billion in the global capital

markets and are substantial investors of Caterpillar. We previously engaged

with the company over executive compensation issues for the past two years.

The Company’s Response to Multiple Warnings Regarding the

Offshore Tax Strategy Has Been Inadequate

Since its inception in 1999, Caterpillar’s offshore tax

structure has been subject to both internal and external scrutiny. In 2004, the

company’s CEO and tax department received an anonymous letter warning that the

tax strategy had no legitimate business purpose. Further, in 2007, the company’s

own Global Tax Strategy Manager, Daniel Schlicksup, raised concerns with the

company’s legal department, ethics office, and Executive Office

2

that the tax

scheme was being conducted for tax avoidance purposes only, stating that “the

pressure to look the other way is overwhelming.”

3

Caterpillar’s tax department created a tax risk rating system in 2006 that

evaluated elements of the Swiss tax strategy, and subsequently gave those

elements a “high” risk rating. Rather than eliminate the Swiss tax strategy,

however, the company attempted to reduce the rating. When it was unable to do

so, the company eliminated the rating system altogether in 2008. At several

points throughout the first nine years of the tax strategy, Caterpillar’s own

employees and rating system warned the company that its offshore tax strategy

created undue risks, yet Caterpillar appears to have continued its

implementation as if these warnings did not exist.

Additionally, the tax strategy has been subject to several

investigations, even before the March 2017 raid of Caterpillar’s facilities. According

to the IRS investigation in 2013 and Senate investigation in 2014, the company’s

executives and directors participated in improper and potentially illegal

conduct by engaging in an offshore tax strategy, avoiding the payment of nearly

$2.4 billion in taxes, and failing to disclose to the Securities and Exchange

Commission (“SEC”) and investors the status of IRS’ findings

against

these arrangements. The company has also been subject to pending lawsuits and

grand jury investigation related to Caterpillar shifting its profits to benefit

from the lower Swiss tax rate. Each of these investigations and lawsuits, and

the reputational and financial liability associated with them, call into

question the Audit Committee’s ability to provide adequate risk oversight

regarding the company’s tax strategy over the long term.

2

This included then group president Douglas Oberhelman. Mr. Oberhelman would

later become CEO and Chair, and recently stepped down from the board.

3

Peoria Journal Star

, “Roots of Caterpillar Raid Reach Back Years,”

available

at

http://www.pjstar.com/news/20170304/roots-of-caterpillar-raid-reach-back-years.

The Audit Committee has Failed to Manage PWC’s

Conflict of Interest.

We are particularly worried over the conflict of interest

resulting from the continued role of PWC as Caterpillar’s external auditor for

over 80 years.

4

In 1999, Caterpillar paid PWC $55 million to create the very offshore tax

strategy that PWC now evaluates as part of the annual audit process.

Furthermore, Caterpillar has a history of relying on former employees of PWC to

lead the company’s finance and tax departments. The company’s current CFO,

Bradley Halverson, started his career at PWC before joining Caterpillar. David

Burritt was an auditor with PWC prior to joining the company, as its Chief

Accounting Officer and later its Chief Financial Officer, from 2004-2010. Additionally,

Robin Beran, Caterpillar’s Chief Tax Officer until 2015 (who provided allegedly

false testimony to the Senate

5

)

was also a former PWC partner.

The conflict of interest presented by PWC and the shared

personnel between the two entities is especially concerning in light of the

high degree of regulatory scrutiny that the company’s tax strategy has

received, even prior to the federal raid on March 2

nd

. The Audit

Committee’s failure to replace PWC as the company auditor raises serious concerns

over the Committee’s ability to recognize real conflicts of interest that

endanger the quality of the company’s auditing and financial statements.

The Audit Committee’s Composition is in Urgent Need of

Change

Despite the risk of a $2 billion assessment by the IRS and

the possibility of charges of tax fraud, the company has continued to rely on

the offshore tax strategy. By leaving the company open to these risks,

shareholders have little option but to hold Directors Dickinson, Muilenburg,

and Osborn accountable.

Further Directors Dickinson, Muilenburg and Osborn sat on

the Audit Committee during the IRS investigations and Senate hearing related to

the tax strategy in 2013 and 2014, respectively. In fact, Audit Committee

Chair Osborn has sat on the board effectively since the tax strategy began,

over 16 years. Given the events that have taken place during their tenure, and

the company’s scant response, we question these directors ability to provide

adequate oversight with regards to the ongoing federal investigation of the

offshore tax structure.

4

Caterpillar’s Offshore Strategy, Permanent Subcommittee of Investigation, U.S.

Senate, Majority Staff Report (“PSI Reprt”), p. 41.

5

A memorandum prepared by Senate staff cites

contradictions between Mr. Beran’s testimony and other evidence in the record.

See

False Testimony Related to IRS’ Position

on Caterpillar’s Tax Liability

, Hearing Before the Permanent Subcommittee

on Investigations of the Committee on Homeland Security and Government Affairs,

Caterpillar’s Offshore Tax Strategy, p. 633,

available at

https://www.gpo.gov/fdsys/pkg/CHRG-113shrg89523/pdf/CHRG-113shrg89523.pdf

.

Stronger Pay Accountability is

Needed Now More than Ever

Findings from the Senate investigation demonstrate that Caterpillar

executives were aware of the risks associated with the tax scheme, but

nonetheless agreed to the arrangement, improperly reporting profits and

enriching themselves in the process through their equity compensation awards.

For example, internal company documents from 2008 estimated an annual tax

benefit of $250 - $300 million per year and $0.40 - $0.48 profits per share.

6

An accounting

professor responsible for a recent government-sanctioned report on the

company’s possible accounting fraud has also stated that “the company’s

noncompliance with these rules was deliberate and primarily with the intention

of maintaining a higher share price.”

7

Given the potential damage to the company, both reputation and otherwise, as a

result of its tax strategy, shareholders should take immediate action to strengthen

executive pay accountability by adopting the changes to the company’s clawback

policy, as outlined in Proposal 10.

Conclusion

:

As shareholders, we must send the board a clear message at

this year’s shareholder meeting on June 14

th

that we are exasperated

by the board’s continued disregard of the apparent risks of Caterpillar’s offshore

tax strategy. Therefore, we urge you to vote AGAINST the re-election of Audit

Committee Members Dickinson, Muilenburg, and Osborn and FOR Proposal 10, the

shareholder proposal amending the company’s clawback policy.

Please contact my colleague Tejal K. Patel at tejal.patel@ctwinvestmentgroup.com

with any questions.

Sincerely,

Dieter Waizenegger

Executive Director, CtW Investment Group

This is not a

solicitation of authority to vote your proxy. Please DO NOT send us your proxy

card as it will not be accepted.

7

Caterpillar Is Accused in Report to Federal Investigators of Tax Fraud

,

NYT,

available at

https://www.nytimes.com/2017/03/07/business/caterpillar-tax-fraud.html?smid=nytcore-ipad-share&smprod=nytcore-ipad

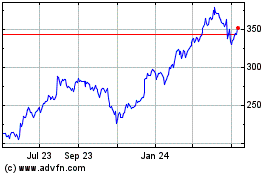

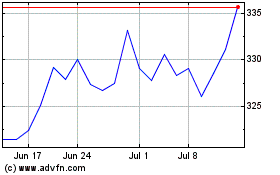

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024