UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________

FORM SD

Specialized Disclosure Report

____________________________________________________

KULICKE AND SOFFA INDUSTRIES, INC.

(Exact Name of Registrant as Specified in Charter)

____________________________________________________

|

|

|

|

|

|

|

|

|

Pennsylvania

|

|

000-00121

|

|

23-1498399

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

23A Serangoon North Avenue 5, #01-01 K&S Corporate Headquarters, Singapore

|

|

554369

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (215) 784-6000

N/A

(Former Name or Former Address, if Changed Since Last Report)

____________________________________________________

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

|

|

|

|

|

|

ý

|

Rule 13p-1 under the Securities Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2016

|

|

|

|

Section 1 - Conflict Minerals Disclosure

Item 1.01 Conflict Minerals Disclosure and Report.

Conflict Minerals Disclosure

The products named in this report were either manufactured by Kulicke and Soffa Industries, Inc. (“K&S” or the “Company”) or contracted by the Company to be manufactured. The listed products may contain conflict minerals necessary to their functionality or production.

With regard to the conflict minerals used in the products named in this report, pursuant to Rule 13p-1 under the Securities Exchange Act ("the Rule"), the Company has conducted in good faith a reasonable country of origin inquiry designed to determine whether any of the conflict minerals originated in the Democratic Republic of Congo (the “DRC”) or an adjoining country or are from recycled or scrapped sources.

The Company also undertook due diligence on the source and chain of custody of necessary conflict minerals contained in its Covered Products. Its due diligence approach was designed to conform in all material respects with the

OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas

and the related Supplements (“OECD Guidance”). The tantalum, tin, tungsten and gold ("3TG") analysis of the corresponding spares for the Equipment under study has also been completed.

On January 9, 2015, Kulicke & Soffa Holdings B.V. (“KSH”), the Company's wholly owned subsidiary, completed the acquisition of Assembléon Holding B.V. (“Assembléon”). The assessment of Assembléon's products are included from the beginning of the current reporting period.

There are certain legacy spare parts pertaining to discontinued Equipment products, that constitute an insignificant portion of the Company's total sales. These have been excluded in this report as these are discontinued products and the proportion of sale of such spares will further decline in the coming years.

The results of the Company’s reasonable country of origin inquiry can be found in the Company’s Conflict Minerals Report. A copy of Kulicke and Soffa Industries, Inc.’s Conflict Minerals Report is filed as Exhibit 1.01 hereto and is publicly available at www.kns.com. We are not including the information contained on our website as a part of, or incorporating it by reference into, this filing.

We operate two main business segments, Equipment and Expendable Tools.

Our list of Equipment segment products analyzed by the Company is shown in the table below:

|

|

|

|

|

|

|

|

|

Business Line

|

|

Product Name (1)

|

|

Typical Served Market

|

|

|

|

|

|

|

|

Ball bonders

|

|

IConn

PS

PLUS

series (2) (3) (4)

|

|

Advanced and ultra fine pitch applications

|

|

|

|

|

|

|

|

|

|

IConn

PS

ProCu

PLUS

series

(2) (3)

|

|

High-end copper wire applications demanding advanced process capability and high productivity

|

|

|

|

|

|

|

|

|

|

IConn

PS

MEM

PLUS

series

|

|

Memory applications

|

|

|

|

|

|

|

|

|

|

ConnX

PS

PLUS

series (2) (3) (4)

|

|

High productivity bonder for low-to-medium pin count applications

|

|

|

|

|

|

|

|

|

|

ConnX

PS

LED

|

|

LED applications

|

|

|

|

|

|

|

|

|

|

ConnX

PS

LED

PLUS

|

|

LED applications

|

|

|

|

|

|

|

|

Wedge bonders

|

|

3600

PLUS

|

|

Power hybrid and automotive modules using either heavy aluminum wire or PowerRibbon®

|

|

|

|

|

|

|

|

|

|

3700

PLUS

|

|

Hybrid and automotive modules using thin aluminum wire

|

|

|

|

|

|

|

|

|

|

PowerFusion

PS

TL

|

|

Power semiconductors using either aluminum wire or PowerRibbon®

|

|

|

|

|

|

|

|

|

|

PowerFusion

PS

HL

|

|

Smaller power packages using either aluminum wire or PowerRibbon®

|

|

|

|

|

|

|

|

|

|

Asterion

TM

|

|

Power hybrid and automotive modules with extended area using heavy and thin aluminum

|

|

|

|

|

|

|

|

|

|

Asterion

TM

EV

|

|

Extended area for battery bonding and dual lane hybrid module bonding

|

|

|

|

|

|

|

|

Advanced Packaging

|

|

AT Premier

PLUS

|

|

Advanced wafer level bonding application

|

|

|

|

|

|

|

|

|

|

APAMA C2W

|

|

Thermo-compression for chip-to-wafer, HA FC and high density fan-out wafer level packaging ("HD FOWLP") bonding applications

|

|

|

|

|

|

|

|

|

|

Hybrid Series

|

|

Advanced packages assembly applications requiring high throughput such as flip chip, WLP, FOWLP, embedded die, SiP, package-on-package ("POP"), and modules

|

(1) Power Series (

“

PS

”

)

(2) Standard version

(3) Large area version

(4) Extended large area version

|

|

|

|

|

|

|

|

|

Business Line

|

|

Product Name (1)

|

|

Typical Served Market

|

|

|

|

|

|

|

|

Electronics Assembly

|

|

iX Series

|

|

Advanced Surface Mount Technology ("SMT") applications requiring extremely high output of passive and active components

|

|

|

|

|

|

|

|

|

|

iFlex Series

|

|

Advanced SMT applications requiring multi-lane or line balancing solutions for standard or oddform passive and active components

|

We also sell manual wire bonders, and we offer spare parts, equipment repair, maintenance and servicing, training services, and upgrades for our equipment through our Support Services business unit.

We manufacture and sell a variety of Expendable Tools for a broad range of semiconductor packaging applications. Our principal Expendable Tools segment products include capillaries, bonding wedges and dicing blades.

Engineering team and efforts to analyze for presence of 3TG

Generally, our Engineering team analyzed each part in the Bill of Materials ("BOM") for presence of 3TG. If the part did not contain 3TG, there was no further action taken and the Company's database was updated. The drawing and data sheet and material composition were examined. The following is a flow chart illustrating the approach taken by the Engineering team:

Each part was listed in a file as per the below example:

The file contains a listing of each item by part number, a description of the part, the material contained in the part, the finishing of the part, a column for each 3TG item, and a course of action. Under the "Action" column, it was noted "Yes" if the part contained 3TG or was undeterminable, and "No" if there was no presence of 3TG. If it was established that the item did contain 3TG or was undeterminable, the part was referred to the Supply Chain department for identification of the supplier of the part.

For Assembléon, we sent the Electronics Industry Citizenship Coalition/Global e-Sustainability Initiative ("EICC/GeSI") Conflict Minerals Reporting Template ("CMRT") to the top 80% of the suppliers in terms of total purchases.

Supply chain and efforts to determine country of origin

Generally, the Supply Chain team linked each part to the purchasing function to identify the supplier of the material, component or sub assembly. Requests for information were forwarded to our direct suppliers ("Tier-1 suppliers"). The Company based the survey on the Conflicts Minerals Reporting Template (the "CMRT") to establish the source of the 3TG for each of the items that were identified to contain 3TG. The CMRT included questions regarding the Company’s conflict-free policy, engagement with its direct suppliers, and a listing of the smelters that the Company and its suppliers use. In addition, the template contained questions

about the origin of conflict minerals included in their products, as well as the suppliers' due diligence. The Company understands that the CMRT is being used by many companies in their due diligence processes related to conflict minerals.

The Conflict Minerals document package sent to the Company's Tier-1 suppliers contained the following:

|

|

|

|

•

|

Supplier Letter - Notification to suppliers that K&S is subject to Section 1502 of the Dodd-Frank Act, that K&S needs to comply and that their cooperation is requested.

|

|

|

|

|

•

|

K&S Conflict Minerals Policy

|

|

|

|

|

•

|

Conflict Minerals K&S Training Presentation

|

Standard communication documents were intended to be communicated through the Supply Chain to sub-suppliers.

Suppliers were expected to respond as follows:

•

Acknowledge the receipt of the request

•

Understand the Conflict Minerals Policy and K&S requirements

•

Perform due diligence on their supply chains to identify the smelter sources

•

Consolidate the sub-suppliers responses and integrate them into their responses

•

Submit the completed and signed CMRT to K&S within the requested time frame

A tracking system was implemented to monitor supplier response performance and due diligence progress. The responses received from suppliers were reviewed, and suppliers reporting 3TG items being purchased from the DRC or its adjoining countries were flagged and a risk mitigation strategy was developed for those suppliers.

The Company also holds a Supplier Day from time to time for most of its Tier-1 suppliers to, among other things, explain the requirements of the Conflict Minerals disclosure subsequent to the distribution of the standard communication documents. Presentations are made to the suppliers detailing the requirements of the Conflict Minerals rule and K&S's Conflict Minerals policy.

We rely on our Tier-1 suppliers to provide information on the origin of the 3TG contained in components and sub-assemblies supplied to us - including the sources of 3TG that are supplied to them by their sub-suppliers. However, contracts with our suppliers are usually in force for three to five years or more and typically, we cannot unilaterally impose new contract terms and flow-down requirements, such as those required by our Conflict Minerals Policy, midway through such contracts, although we attempt and encourage our suppliers to adhere to those terms, to the extent possible.

As we enter into new contracts, or when our existing contracts come up for renewal, we are adding clauses to require our suppliers to submit their declaration per the CMRT. Because of our size, the complexity of our products, and the depth, breadth, and constant evolution of our supply chain, it is difficult to identify sub-suppliers upstream from our direct suppliers.

Item 1.02 Exhibit.

The Conflict Minerals Report required by Item 1.01 is filed as an exhibit to this Form SD.

Section 2 - Exhibits

|

|

|

|

|

|

Item 2.01

|

Exhibits.

|

|

|

|

|

Exhibit No.

|

Description

|

|

1.01

|

Conflict Minerals Report as required by Items 1.01 and 1.02 of this Form.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

KULICKE AND SOFFA INDUSTRIES, INC.

|

|

|

|

|

Date: May 17, 2017

|

By:

|

/s/ JONATHAN CHOU

|

|

|

|

Jonathan Chou

|

|

|

|

Executive Vice President and Chief Financial Officer

|

EXHIBIT INDEX

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

1.01

|

Conflict Minerals Report as required by Items 1.01 and 1.02 of this Form.

|

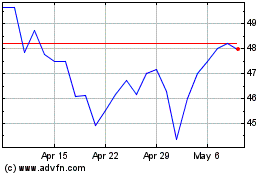

Kulicke and Soffa Indust... (NASDAQ:KLIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

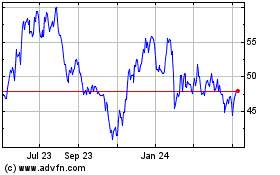

Kulicke and Soffa Indust... (NASDAQ:KLIC)

Historical Stock Chart

From Apr 2023 to Apr 2024