Ahead of the Tape: Cisco's Future Is Looking More Secure

May 16 2017 - 5:22PM

Dow Jones News

By Steven Russolillo

Cybersecurity is giving investors a new reason to look at an old

tech giant, Cisco Systems Inc.

Cisco was one of several stocks that jumped Monday following a

malware attack dubbed WannaCry that has affected more than 150

countries. It might seem odd to lump Cisco together with

cybersecurity stocks as it is known for selling networking gear.

But Cisco's security business, growing at a double-digit rate, is

one of its few bright spots.

Expect more good news when the tech giant reports earnings on

Wednesday.

Granted, Cisco's fiscal third-quarter results probably won't be

great overall. Analysts polled by FactSet forecast earnings for the

period that ended in April of 58 cents a share, up a penny from a

year earlier. Revenue is expected to have slipped 0.8% to $11.9

billion, which would be a sixth straight quarterly decline.

But security, the key segment to watch, is garnering more

attention as growth stagnates in Cisco's larger, more-established

segments. For example, networking, responsible for 83% of revenue

when the tech bubble peaked in 2000, is at just 45% today. Security

is still small on a relative basis, generating about $2 billion in

annual revenue, or about 4% of Cisco's total. But that still makes

Cisco one of the biggest security vendors in the world.

Analysts say its exposure could increase if the Trump

administration implements a repatriation tax holiday that would

free up some of Cisco's offshore cash stockpile. Some $62 billion

of Cisco's $72 billion in cash and cash equivalents is held

overseas. To put that in perspective, Cisco's offshore cash as a

percentage of its market capitalization is 36%, even greater than

Apple Inc.'s 28%.

Unlocking some of that money could help Cisco further diversify.

Its $3.7 billion acquisition of AppDynamics earlier this year was

its largest in five years. Analysts at Credit Suisse say a

repatriation holiday may help Cisco transition away from

networking, boost growth and make its revenue stream more

recurring. They highlighted Palo Alto Networks Inc., a fast-growing

security company, as well as Splunk Inc. and ServiceNow Inc. as

three top potential acquisition targets.

Cisco has a decent track record in deal-making, too, having

acquired Sourcefire in 2013, a deal that helped juice growth in its

security business.

Cisco shares have been perennial underperformers, lagging behind

the Nasdaq Composite Index over the past one, three, five and 10

years. But, as Monday's security-inspired trading showed, that

could change if the market starts valuing Cisco more as a

cybersecurity firm. Shares trade at 14 times projected earnings

over the next 12 months. By comparison, Splunk, ServiceNow and Palo

Alto Networks all command valuations many times higher. None of

those firms pays a dividend, while Cisco's shares yield 3.2%.

It is about time for investors to reconnect with this tech

stalwart.

Write to Steven Russolillo at steven.russolillo@wsj.com

(END) Dow Jones Newswires

May 16, 2017 17:07 ET (21:07 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

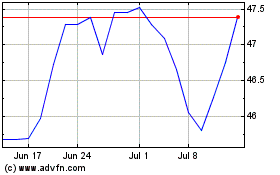

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Apr 2023 to Apr 2024