UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

10-Q

|

☒

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended

March

31, 2017

OR

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period to

Commission File No.

000-55364

HELIUS MEDICAL TECHNOLOGIES, INC.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

Wyoming

|

|

36-4787690

|

|

(State or other jurisdiction of

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

Identification Number)

|

Suite 400, 41 University Drive

Newtown, Pennsylvania, 18940

(Address of principal executive office) (Zip Code)

(215)

809-2018

(Registrant’s telephone number, including area code)

N/A

(Former name, former

address and former fiscal year, if changed since last report)

Indicate by check mark whether

the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days: Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required

to be submitted and posted pursuant to Rule 405 of Regulation

S-T

(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post

such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is

a large accelerated filer, an accelerated filer, a

non-accelerated

filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,”

“accelerated filer,” “smaller reporting company and “emerging growth company” in Rule

12b-2

of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☐

|

|

Accelerated filer

|

|

☐

|

|

|

|

|

|

|

Non-accelerated filer

|

|

☐ (Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

☒

|

|

|

|

|

|

|

Emerging growth company

|

|

☒

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2

of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

|

|

|

|

|

Class

|

|

Outstanding as of May 8, 2017

|

|

Class

A Common Stock

|

|

91,246,676

|

HELIUS MEDICAL TECHNOLOGIES, INC.

INDEX

2

Helius Medical Technologies, Inc.

Unaudited Condensed Consolidated Balance Sheets

(Expressed in United States Dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2017

|

|

|

December 31, 2016

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

7,666,164

|

|

|

$

|

2,668,655

|

|

|

Receivables

|

|

|

574,602

|

|

|

|

225,155

|

|

|

Prepaid expenses and other current assets

|

|

|

340,032

|

|

|

|

556,456

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

8,580,798

|

|

|

|

3,450,266

|

|

|

Other assets

|

|

|

18,277

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

|

$

|

8,599,075

|

|

|

$

|

3,450,266

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities

|

|

$

|

4,518,237

|

|

|

$

|

2,420,761

|

|

|

Derivative liability

|

|

|

4,989,801

|

|

|

|

4,473,800

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

9,508,038

|

|

|

|

6,894,561

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES

|

|

|

9,508,038

|

|

|

|

6,894,561

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies (Note 5)

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ DEFICIT

|

|

|

|

|

|

|

|

|

|

Common stock (Unlimited Class A common shares authorized); (91,246,676 shares issued and

outstanding as of March 31, 2017 and 84,630,676 shares issued and outstanding as of December 31, 2016)

|

|

|

38,844,767

|

|

|

|

30,897,064

|

|

|

Additional

paid-in

capital

|

|

|

6,001,261

|

|

|

|

5,731,508

|

|

|

Accumulated other comprehensive loss

|

|

|

(1,732,165

|

)

|

|

|

(1,727,633

|

)

|

|

Accumulated deficit

|

|

|

(44,022,826

|

)

|

|

|

(38,345,234

|

)

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL STOCKHOLDERS’ DEFICIT

|

|

|

(908,963

|

)

|

|

|

(3,444,295

|

)

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT

|

|

$

|

8,599,075

|

|

|

$

|

3,450,266

|

|

|

|

|

|

|

|

|

|

|

|

(The accompanying notes are an integral part of the condensed consolidated financial statements.)

3

Helius Medical Technologies, Inc.

Unaudited Condensed Consolidated Statements of Operations and Comprehensive Loss

(Expressed in United States Dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

|

March 31,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

$

|

3,018,871

|

|

|

$

|

981,733

|

|

|

General and administrative

|

|

|

2,014,696

|

|

|

|

1,933,557

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

5,033,567

|

|

|

|

2,915,290

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss

|

|

|

(5,033,567

|

)

|

|

|

(2,915,290

|

)

|

|

Other expense:

|

|

|

|

|

|

|

|

|

|

Interest and other expense

|

|

|

—

|

|

|

|

(20,411

|

)

|

|

Change in fair value of derivative liability

|

|

|

(516,001

|

)

|

|

|

(30,688

|

)

|

|

Foreign exchange loss

|

|

|

(128,024

|

)

|

|

|

(863,931

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total other expense

|

|

|

(644,025

|

)

|

|

|

(915,030

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

|

(5,677,592

|

)

|

|

|

(3,830,320

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive loss

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments

|

|

|

(4,532

|

)

|

|

|

862,931

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive loss

|

|

$

|

(5,682,124

|

)

|

|

$

|

(2,967,389

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

(0.06

|

)

|

|

$

|

(0.05

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Diluted

|

|

$

|

(0.06

|

)

|

|

$

|

(0.05

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

87,869,832

|

|

|

|

71,826,909

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted

|

|

|

87,869,832

|

|

|

|

71,826,909

|

|

|

|

|

|

|

|

|

|

|

|

(The accompanying notes are an integral part of the condensed consolidated financial statements.)

4

Helius Medical Technologies, Inc.

Unaudited Condensed Consolidated Statement of Stockholders’ Deficit

(Expressed in United States Dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional

|

|

|

|

|

|

Other

|

|

|

|

|

|

|

|

Common Stock

|

|

|

Common Stock

|

|

|

Paid-In

|

|

|

Accumulated

|

|

|

Comprehensive

|

|

|

|

|

|

|

|

Shares

|

|

|

Amount

|

|

|

Capital

|

|

|

Deficit

|

|

|

Loss

|

|

|

Total

|

|

|

Balance as of January 1, 2016

|

|

|

66,637,653

|

|

|

$

|

20,125,864

|

|

|

$

|

2,155,199

|

|

|

$

|

(22,474,943

|

)

|

|

$

|

(1,862,329

|

)

|

|

$

|

(2,056,209

|

)

|

|

Shares issued at a debt discount

|

|

|

—

|

|

|

|

5,087

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

5,087

|

|

|

Issuance of common stock for draw down of remaining credit facility

|

|

|

5,555,556

|

|

|

|

5,000,000

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

5,000,000

|

|

|

Fair value of options exercised

|

|

|

—

|

|

|

|

13,924

|

|

|

|

(13,924

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Stock-based compensation expense

|

|

|

—

|

|

|

|

—

|

|

|

|

799,264

|

|

|

|

—

|

|

|

|

—

|

|

|

|

799,264

|

|

|

Fair value of warrants issued in connection with draw down of remaining credit facility,

classified to derivative liability

|

|

|

—

|

|

|

|

(796,945

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(796,945

|

)

|

|

Net loss

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(3,830,320

|

)

|

|

|

—

|

|

|

|

(3,830,320

|

)

|

|

Foreign currency translation adjustments

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

862,931

|

|

|

|

862,931

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of March 31, 2016

|

|

|

72,193,209

|

|

|

$

|

24,347,930

|

|

|

$

|

2,940,539

|

|

|

$

|

(26,305,263

|

)

|

|

$

|

(999,398

|

)

|

|

$

|

(16,192

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(The accompanying notes are an integral part of the condensed consolidated financial statements.)

5

Helius Medical Technologies, Inc.

Unaudited Condensed Consolidated Statement of Stockholders’ Deficit

(Expressed in United States Dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional

|

|

|

|

|

|

Other

|

|

|

|

|

|

|

|

Common Stock

|

|

|

Common Stock

|

|

|

Paid-In

|

|

|

Accumulated

|

|

|

Comprehensive

|

|

|

|

|

|

|

|

Shares

|

|

|

Amount

|

|

|

Capital

|

|

|

Deficit

|

|

|

Loss

|

|

|

Total

|

|

|

Balance as of January 1, 2017

|

|

|

84,630,676

|

|

|

$

|

30,897,064

|

|

|

$

|

5,731,508

|

|

|

$

|

(38,345,234

|

)

|

|

$

|

(1,727,633

|

)

|

|

$

|

(3,444,295

|

)

|

|

Issuance of common stock in public offering

|

|

|

6,555,000

|

|

|

|

9,186,708

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

9,186,708

|

|

|

Share issuance costs

|

|

|

—

|

|

|

|

(1,239,005

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(1,239,005

|

)

|

|

Stock-based compensation expense

|

|

|

—

|

|

|

|

—

|

|

|

|

241,517

|

|

|

|

—

|

|

|

|

—

|

|

|

|

241,517

|

|

|

Proceeds from the exercise of stock options and warrants

|

|

|

61,000

|

|

|

|

—

|

|

|

|

28,236

|

|

|

|

—

|

|

|

|

—

|

|

|

|

28,236

|

|

|

Net loss

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(5,677,592

|

)

|

|

|

—

|

|

|

|

(5,677,592

|

)

|

|

Foreign currency translation adjustments

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(4,532

|

)

|

|

|

(4,532

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of March 31, 2017

|

|

|

91,246,676

|

|

|

$

|

38,844,767

|

|

|

$

|

6,001,261

|

|

|

$

|

(44,022,826

|

)

|

|

$

|

(1,732,165

|

)

|

|

$

|

(908,963

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(The accompanying notes are an integral part of the condensed consolidated financial statements.)

6

Helius Medical Technologies, Inc.

Unaudited Condensed Consolidated Statements of Cash Flows

(Expressed in United States Dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

|

March 31,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(5,677,592

|

)

|

|

$

|

(3,830,320

|

)

|

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Change in fair value of derivative liability

|

|

|

516,001

|

|

|

|

30,688

|

|

|

Interest accretion

|

|

|

—

|

|

|

|

5,086

|

|

|

Stock-based compensation expense

|

|

|

241,517

|

|

|

|

799,264

|

|

|

Unrealized foreign exchange loss

|

|

|

110,265

|

|

|

|

780,642

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Receivables

|

|

|

(349,447

|

)

|

|

|

(270,706

|

)

|

|

Prepaid expenses and other current assets

|

|

|

85,632

|

|

|

|

292,985

|

|

|

Other assets

|

|

|

(18,277

|

)

|

|

|

—

|

|

|

Accounts payable and accrued liabilities

|

|

|

2,228,268

|

|

|

|

359,478

|

|

|

Shares to be issued

|

|

|

—

|

|

|

|

150,000

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash used in operating activities

|

|

|

(2,863,633

|

)

|

|

|

(1,682,883

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Proceeds from the issuance of common stock

|

|

|

9,186,708

|

|

|

|

—

|

|

|

Share issuance costs

|

|

|

(1,239,005

|

)

|

|

|

—

|

|

|

Proceeds from the exercise of stock options and warrants

|

|

|

28,236

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by financing activities

|

|

|

7,975,939

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

Effect of foreign exchange rate changes on cash

|

|

|

(114,797

|

)

|

|

|

(23,530

|

)

|

|

Net increase (decrease) in cash and cash equivalents

|

|

|

4,997,509

|

|

|

|

(1,706,413

|

)

|

|

Cash and cash equivalents at beginning of period

|

|

|

2,668,655

|

|

|

|

4,350,350

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at end of period

|

|

$

|

7,666,164

|

|

|

$

|

2,643,937

|

|

|

|

|

|

|

|

|

|

|

|

(The accompanying notes are an integral part of the condensed consolidated financial statements.)

7

Helius Medical Technologies, Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

|

1.

|

DESCRIPTION OF BUSINESS

|

Helius Medical Technologies, Inc. (the “Company”) is engaged

primarily in the medical technology industry focused on neurological wellness. The Company’s planned principal operations include the development, licensing and acquisition of unique and

non-invasive

platform technologies to amplify the brain’s ability to heal itself. To date, the Company has not generated any revenue.

The Company was

incorporated in British Columbia, Canada, on March 13, 2014. On May 28, 2014, the Company completed a continuation via a plan of arrangement whereby the Company moved from being a corporation governed by the British Columbia Corporations

Act to a corporation governed by the Wyoming Business Corporations Act. The Company is based in Newtown, Pennsylvania.

The Company has two wholly-owned

subsidiaries, Neurohabilitation Corporation (“Neuro”) and Helius Medical Technologies (Canada), Inc. (“Helius Canada”).

The Company

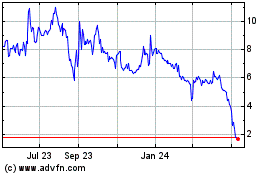

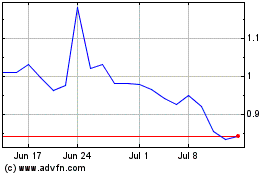

is currently listed on the Toronto Stock Exchange (the “TSX”). The Company began trading on the Canadian Securities Exchange on June 23, 2014, under the ticker symbol “HSM”, and subsequently moved to the TSX on

April 18, 2016. The Company also began trading on the OTCQB under the ticker symbol “HSDT” on February 10, 2015. The financial information is presented in United States Dollars.

Going Concern

As of March 31, 2017, the

Company’s cash and cash equivalents were $7,666,164. During the three months ended March 31, 2017, the Company incurred a net loss of $5,677,592, and, as of March 31, 2017 its’ accumulated deficit was $44,022,826. The Company has

not generated any product revenues and has not achieved profitable operations. The Company expects to continue to incur operating losses and net cash outflows until such time as it generates a level of revenue to support its cost structure. There is

no assurance that profitable operations will ever be achieved, and, if achieved, will be sustained on a continuing basis. These factors raise substantial doubt about the Company’s ability to continue as a going concern. The Company’s

condensed consolidated financial statements have been prepared on the basis of continuity of operations, realization of assets and satisfaction of liabilities in the ordinary course of business.

The Company intends to fund ongoing activities by utilizing current cash and cash equivalents and by raising additional capital through equity or debt

financings. There can be no assurance that the Company will be successful in raising additional capital or that such capital, if available, will be on terms that are acceptable to the Company. If the Company is unable to raise sufficient additional

capital, the Company may be compelled to reduce the scope of its operations and planned capital expenditure or sell certain assets, including intellectual property assets.

|

2.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

|

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the

United States of America (“GAAP”), applicable to interim periods and, in the opinion of management, include all normal and recurring adjustments that are necessary to state fairly the results of operations for the reported periods. The

condensed consolidated financial statements have also been prepared on a basis substantially consistent with, and should be read in conjunction with, the Company’s audited consolidated financial statements for the nine months ended

December 31, 2016, included in its Transition Report on Form

10-K

that was filed with the Securities and Exchange Commission, or SEC, on April 3, 2017. The

year-end

condensed consolidated balance sheet data was derived from the audited financial statements, but does not include all disclosures required by GAAP. The results of our operations for any interim period

are not necessarily indicative of the results of the Company’s operations for any other interim period or for a full fiscal year.

Use of

Estimates

The preparation of the condensed consolidated financial statements in accordance with GAAP requires management to make estimates and

assumptions that affect the amounts reported in the consolidated financial statements and disclosure of contingent assets and liabilities. Significant estimates include the assumptions used in the fair value pricing model for stock-based

compensation and deferred income tax asset valuation allowances. Financial statements include estimates which, by their nature, are uncertain. Actual outcomes could differ from these estimates.

Principles of Consolidation

The accompanying unaudited

condensed consolidated financial statements reflect the operations of Helius Medical Technologies, Inc. and its wholly-owned subsidiaries. All intercompany balances and transactions have been eliminated.

Cash and Cash Equivalents

Cash and cash equivalents

comprise cash at banks and on hand, and short-term highly liquid investments that have an original maturity of three months or less.

8

Concentrations of Credit Risk

The Company is subject to credit risk in respect of its cash. The Company is not currently exposed to any significant concentrations of credit risk from these

financial instruments. The Company seeks to maintain safety and preservation of principal and diversification of risk, liquidity of investments sufficient to meet cash flow requirements and a competitive

after-tax

rate of return.

Receivables

Receivable are stated at their net realizable value. As of March 31, 2017, receivables consisted primarily of Goods and Services Tax (“GST”) and

Quebec Sales Tax (‘QST”) refunds related to the Company’s expenditures as well as reimbursements from the U.S. Army.

Stock-Based

Compensation

The Company accounts for all stock-based payments and awards under the fair value based method. The Company recognizes its stock-based

compensation using the straight-line method.

The Company accounts for the granting of stock options to employees using the fair value method whereby all

awards to employees will be measured at fair value on the date of the grant. The fair value of all stock options is expensed over their vesting period with a corresponding increase to additional

paid-in

capital. Upon exercise of stock options, the consideration paid by the option holder, together with the amount previously recognized in additional

paid-in

capital is recorded as an increase to share capital.

Stock options granted to employees are accounted for as liabilities when they contain conditions or other features that are indexed to other than a market, performance or service condition.

Stock-based payments to

non-employees

are measured at the fair value of the consideration received, or the fair value

of the equity instruments issued, or liabilities incurred, whichever is more reliably measurable. The fair value of stock-based payments to

non-employees

is periodically

re-measured

until the counterparty performance is complete, and any change therein is recognized over the vesting period of the award and in the same manner as if the Company had paid cash instead of paying

with or using equity based instruments. The fair value of the stock-based payments to

non-employees

that are fully vested and

non-forfeitable

as at the grant date are

measured and recognized at that date.

The Company uses the Black-Scholes option pricing model to calculate the fair value of stock options. The use of

the Black-Scholes option pricing model requires management to make assumptions with respect to the expected term of the option, the expected volatility of the common stock consistent with the expected term of the option, risk-free interest rates,

the value of the common stock and expected dividend yield of the common stock. Changes in these assumptions can materially affect the fair value estimate.

Foreign Currency

The functional currency of the Company

and Helius Canada is the Canadian dollar (“CAD”) and the functional currency of Neuro is the U.S. dollar (“USD”). The Company’s reporting currency is the U.S. dollar. Transactions in foreign currencies are remeasured into

the functional currency of the relevant subsidiary at the exchange rate in effect at the date of the transaction. Any monetary assets and liabilities arising from these transactions are translated into the functional currency at exchange rates in

effect at the balance sheet date or on settlement. Resulting gains and losses are recorded in foreign exchange gain (loss) within the condensed consolidated statements of operations and comprehensive loss. The foreign exchange adjustment in the

books of Neuro relating to intercompany advances from Helius that are denominated in Canadian dollars is recorded in the condensed consolidated statements of operations and comprehensive loss as other comprehensive income.

Income Taxes

The Company accounts for income taxes using

the asset and liability method. The asset and liability method provides that deferred tax assets and liabilities are recognized for the expected future tax consequences of temporary differences between the financial reporting and tax bases of assets

and liabilities, and for operating loss and tax credit carry-forwards. Deferred tax assets and liabilities are measured using the currently enacted tax rates and laws that will be in effect when the differences are expected to reverse. The Company

records a valuation allowance to reduce deferred tax assets to the amount that is believed more likely than not to be realized.

The Company has adopted

the provisions of Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 740

Income Taxes

regarding accounting for uncertainty in income taxes. The Company initially recognizes tax

provisions in the financial statements when it is more likely than not the position will be sustained upon examination by the tax authorities. Such tax positions are initially and subsequently measured as the largest amount of the tax benefit that

is greater than 50% likely of being realized upon ultimate settlement with the tax authority, assuming full knowledge of the position and all relevant facts. Application requires numerous estimates based on available information. The Company

considers many factors when evaluating and estimating its tax positions and tax benefits. These periodic adjustments may have a material impact on the condensed consolidated statements of operations and comprehensive loss. When applicable, the

Company classifies penalties and interest associated with uncertain tax positions as a component of income tax expense in its consolidated statements of operations and comprehensive loss.

Research and Development Expenses

Research and

development (“R&D”) expenses consist primarily of personnel costs, including salaries, benefits and stock-based compensation, clinical studies performed by contract research organizations, development and manufacturing of clinical

trial devices and devices for manufacturing testing and materials and supplies. R&D costs are charged to operations when they are incurred.

9

Segment Information

Operating segments are defined as components of an enterprise about which separate discrete information is available for evaluation by the chief operating

decision maker, or decision-making group, in deciding how to allocate resources and in assessing performance. The Company views its operations and manages the business in one segment.

Derivative Liabilities

The Company evaluates its

financial instruments and other contracts to determine if those contracts or embedded components of those contracts qualify as derivatives to be separately accounted for in accordance with ASC 815

Derivatives and Hedging

. The result of this

accounting treatment is that the fair value of the derivative is

marked-to-market

at each balance sheet date and recorded as a liability and the change in fair value is

recorded in the consolidated statements of operations and comprehensive loss. Upon conversion or exercise of a derivative instrument, the instrument is marked to fair value at the conversion date and then that fair value is reclassified to equity.

The classification of derivative instruments, including whether such instruments should be recorded as liabilities or as equity, is reassessed at the end

of each reporting period. Derivative instruments that become subject to reclassification are reclassified at the fair value of the instrument on the reclassification date. Derivative instrument liabilities will be classified in the consolidated

balance sheet as current if the right to exercise or settle the derivative instrument lies with the holder.

Fair Value Measurements

The Company’s financial instruments consist primarily of cash and cash equivalents, receivables, accounts payable and accrued liabilities. The book values

of these instruments approximate their fair values due to the immediate or short-term nature of those instruments.

ASC 820 establishes a fair value

hierarchy based on the level of independent, objective evidence surrounding the inputs used to measure fair value. A financial instrument’s categorization within the fair value hierarchy is based upon the lowest level of input that is

significant to the fair value measurement. ASC 820 prioritizes the inputs into three levels that may be used to measure fair value:

Level 1 –

Quoted prices in active markets for identical assets or liabilities;

Level 2 – Inputs other than Level 1 that are observable, either

directly or indirectly, such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of

the assets or liabilities; and

Level 3 – Unobservable inputs that are supported by little or no market activity and that are significant to the

fair value of the assets or liabilities. To the extent that the valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of

judgment exercised by the Company in determining fair value is greatest for instruments categorized in Level 3. A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input that is significant to

the fair value measurement.

The Company had certain Level 3 derivative liabilities required to be recorded at fair value on a recurring basis.

Unobservable inputs used in the valuation of these liabilities includes volatility of the underlying share price and the expected term. See Note 3 for the inputs used in the Black-Scholes option pricing model as of March 31, 2017 and 2016 and

the roll forward of the warrant liability and see Note 4 for the inputs used in the Black-Scholes option pricing model as of March 31, 2017 and 2016 for the roll forward of the derivative liability for

non-employee

stock options.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value

|

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

March 31, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-employee

options

|

|

$

|

1,778,724

|

|

|

|

—

|

|

|

|

—

|

|

|

$

|

1,778,724

|

|

|

Warrants

|

|

|

3,211,077

|

|

|

|

—

|

|

|

|

—

|

|

|

|

3,211,077

|

|

|

December 31, 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-employee

options

|

|

$

|

1,616,739

|

|

|

|

—

|

|

|

|

—

|

|

|

$

|

1,616,739

|

|

|

Warrants

|

|

|

2,857,061

|

|

|

|

—

|

|

|

|

—

|

|

|

|

2,857,061

|

|

There were no transfers between any of the levels during the three months ended March 31, 2017 or the nine months ended

December 31, 2016.

Basic and Diluted Income (Loss) per Share

Earnings or loss per share (“EPS”) is computed by dividing net income (loss) by the weighted average number of common shares outstanding during the

period. Diluted EPS is computed by dividing net income (loss) by the weighted average of all potentially dilutive shares of common stock that were outstanding during the periods presented.

The treasury stock method is used in calculating diluted EPS for potentially dilutive stock options and share purchase warrants, which assumes that any

proceeds received from the exercise of

in-the-money

stock options and warrants, would be used to purchase common shares at the average market price for the period.

10

The basic and diluted loss per share for the periods noted below is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

|

March 31,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

Basic

|

|

|

|

|

|

|

|

|

|

Numerator

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(5,677,592

|

)

|

|

$

|

(3,830,320

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Denominator

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding

|

|

|

87,869,832

|

|

|

|

71,826,909

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net loss per share

|

|

$

|

(0.06

|

)

|

|

$

|

(0.05

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Diluted

|

|

|

|

|

|

|

|

|

|

Numerator

|

|

|

|

|

|

|

|

|

|

Net loss, basic

|

|

$

|

(5,677,592

|

)

|

|

$

|

(3,830,320

|

)

|

|

Effect of dilutive securities: Change in fair value of derivative liability

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss, diluted

|

|

|

(5,677,592

|

)

|

|

|

(3,830,320

|

)

|

|

Denominator

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding

|

|

|

87,869,832

|

|

|

|

71,826,909

|

|

|

Effect of dilutive securities: stock options and warrants

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding

|

|

|

87,869,832

|

|

|

|

71,826,909

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted net loss per share

|

|

$

|

(0.06

|

)

|

|

$

|

(0.05

|

)

|

|

|

|

|

|

|

|

|

|

|

During the three months ended March 31, 2017 a total of 9,785,000 options and 10,085,762 warrants were excluded from

the calculation of diluted loss per share as their effect would have been anti-dilutive. During the three months ended March 31, 2016 a total of 6,675,360 options and 12,958,609 warrants were excluded from the calculation of diluted loss per

share as their effect would have been anti-dilutive.

Recent Accounting Pronouncements

In March 2016, the FASB issued ASU

2016-09,

Compensation—Stock Compensation (Topic 718): Improvements to

Employee Share-Based Payment Accounting

. The amendments in this update change existing guidance related to accounting for employee share-based payments affecting the income tax consequences of awards, classification of awards as equity or

liabilities, and classification on the statement of cash flows. ASU

2016-09

is effective for annual reporting periods beginning after December 15, 2016, including interim periods within those annual

periods, with early adoption permitted. The updated accounting guidance was effective for the Company on January 1, 2017 and it did not have a material effect on the Company’s consolidated financial statements and any deferred tax benefits

would be offset by a valuation allowance.

In February 2016, the FASB issued ASU

2016-02,

Leases (Topic

842)

. The new standard establishes a

right-of-use

(“ROU”) model that requires a lessee to record a ROU asset and a lease liability on the consolidated

balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the consolidated income statement. ASU

2016-02

is effective for annual periods beginning after December 15, 2018, including interim periods within those annual periods, with early adoption permitted. A modified retrospective transition approach is

required for lessees for capital and operating leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements, with certain practical expedients available. The Company is currently

evaluating the potential impact of the adoption of this standard.

11

|

3.

|

COMMON STOCK AND WARRANTS

|

As of March 31, 2017, the Company’s certificate of incorporation

authorized the Company to issue unlimited Class A common shares without par value. Each Class A common share is entitled to have the right to vote at any shareholder meeting on the basis of one vote per share. Each Class A share held

entitles the holder to receive dividends as declared by the directors. No dividends have been declared through March 31, 2017. In the event of the liquidation, dissolution or

winding-up

of the Company

other distribution of assets of the Company among its shareholders for the purposes of

winding-up

its affairs or upon a reduction of capital the holders of the Class A common shares shall, share equally,

share for share, in the remaining assets and property of the Company.

The Company is subject to a stockholders’ agreement, which places certain

restrictions on the Company’s stock and its stockholders. These restrictions include approvals prior to sale or transfer of stock, a right of first refusal to purchase stock held by the Company and a secondary right of refusal to stockholders,

right of

co-sale

whereby certain stockholders may be enabled to participate in a sale of other stockholders to obtain the same price, term and conditions on a

pro-rata

basis, rights of first offer of new security issuances to current stockholders on a

pro-rata

basis and certain other restrictions.

On December 29, 2015, the Company drew down the remaining $5.0 million commitment through the issuance of 5,555,556 shares of common stock at a

price of $0.90 per share and 2,777,778 warrants exercisable at $1.35 for a period of three years from the date of issuance. The shares of common stock and the warrants were issued on January 7, 2016.

On April 18, 2016, the Company closed its short form prospectus offering in Canada and a concurrent U.S. private placement (the “Offering”) of

units (the “Units”) with gross proceeds to the Company of $7,184,190 through the issuance of Units at a price of CAD $1.00 per Unit. Each Unit consists of one Class A common share in the capital of the Company (a “Common

Share”) and one half of one Common Share purchase warrant (each whole warrant, a “Warrant”). Each Warrant entitles the holder thereof to acquire one additional Common Share at an exercise price of CAD $1.50 on or before April 18,

2019. Mackie Research Capital Corporation (the “Agent”) acted as agent and sole bookrunner in connection with the Offering. The Company paid the Agent a cash commission of $340,250 and has granted to the Agent compensation options

exercisable to purchase 436,050 Units at an exercise price of CAD $1.00 per Unit for a period of 24 months from the closing of the Offering. The Company incurred other cash issuance costs of $1,116,545 related to this offering.

On May 2, 2016, the Company closed the sale of the additional units issued pursuant to the exercise of the over-allotment option (“Over-Allotment

Option”) granted to the Agent in connection with the Offering. The Offering was made pursuant to a short form prospectus filed with the securities regulatory authorities in each of the provinces of Canada, except Québec. Pursuant to the

exercise of the Over-Allotment Option, the Company issued an additional 1,090,125 Units (the “Over-Allotment Units”) at a price of CAD $1.00 per Over-Allotment Unit for additional gross proceeds to the Company of $868,721, bringing the

total aggregate gross proceeds to the Company under the Offering to $8,052,911. Each Over-Allotment Unit consists of one Class A common share in the capital of the Company (an “Over-Allotment Common Share”) and one half of one Common

Share purchase warrant (each whole warrant, an “Over-Allotment Warrant”). Each Over-Allotment Warrant entitles the holder thereof to acquire one additional Over-Allotment Common Share at an exercise price of CAD $1.50 on or before

April 18, 2019. In connection with the closing of the Over-Allotment Option, the Company paid the Agent a cash commission of $52,124 and granted to the Agent compensation options exercisable to purchase 65,407 Over-Allotment Units at an

exercise price of CAD $1.00 per Over-Allotment Unit for a period of 24 months from the closing of the Offering.

The warrants issued in each of the

April 18, 2016 and May 2, 2016 closings are classified within equity. The proceeds from the Offering were allocated on a relative fair value basis between the Class A common shares and the warrants issued. The compensation options are

accounted for as warrants. These warrants represent additional share issuance costs and are recorded within equity at their fair value.

The fair value of

the warrants granted in the Offering was estimated using the Black-Scholes option pricing model with the following weighted average assumptions:

|

|

|

|

|

|

|

Stock price

|

|

|

CAD $1.09

|

|

|

Exercise price

|

|

|

CAD $1.50

|

|

|

Expected life

|

|

|

3.0 years

|

|

|

Expected volatility

|

|

|

83.83

|

%

|

|

Risk-free interest rate

|

|

|

0.60

|

%

|

|

Dividend rate

|

|

|

0.00

|

%

|

12

The fair value of the compensation options granted during the Offering was estimated using the Black-Scholes

option pricing model with the following weighted average assumptions:

|

|

|

|

|

|

|

Stock price

|

|

|

CAD $1.36

|

|

|

Exercise price

|

|

|

CAD $1.00

|

|

|

Expected life

|

|

|

2.0 years

|

|

|

Expected volatility

|

|

|

126.76

|

%

|

|

Risk-free interest rate

|

|

|

0.61

|

%

|

|

Dividend rate

|

|

|

0.00

|

%

|

On June 6, 2016, the Company received proceeds of $1,397,679 from the exercise of 1,825,600 outstanding warrants which

were issued in connection with the Company’s private placement of subscription receipts that closed on May 30, 2014. The remaining 6,604,400 warrants issued in this offering expired unexercised.

On February 16, 2017, the Company completed an underwritten registered public offering and issued an aggregate of 6,555,000 shares of common stock for

gross proceeds of $9,186,708. The Company incurred cash issuance costs of $1,239,005 in connection with this offering.

Pursuant to the guidance of

ASC 815

Derivatives and Hedging

, the Company determined that all of the warrants issued during the year ended March 31, 2016 as described above are required to be accounted for as liabilities because they are considered not to be indexed

to the Company’s stock due to the exercise price being denominated in a currency other than the Company’s functional currency. Consequently, the Company determined the fair value of each warrant issuance using the Black-Scholes option

pricing model, with the remainder of the proceeds allocated to the common shares.

The warrants having an exercise price denominated in a currency other

than the functional currency of the Company that are required to be accounted for as liabilities are summarized as follows for the three months ended March 31, 2017 and 2016:

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

Fair value of warrants at beginning of period

|

|

$

|

2,857,061

|

|

|

$

|

351,318

|

|

|

Issuance of warrants

|

|

|

—

|

|

|

|

796,945

|

|

|

Change in fair value of warrants during the period

|

|

|

354,016

|

|

|

|

56,318

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair value of warrants at end of period

|

|

$

|

3,211,077

|

|

|

$

|

1,204,581

|

|

|

|

|

|

|

|

|

|

|

|

The warrants are required to be

re-valued

with the change in fair value of the

liability recorded as a gain or loss in the change of fair value of derivative liability, included in other income (expense) in the Company’s condensed consolidated statements of operations and comprehensive loss. The fair value of the warrants

will continue to be classified as a liability until such time as they are exercised, expire or there is an amendment to the respective agreements that renders these financial instruments to be no longer classified as a liability.

The fair value of liability classified warrants outstanding as of March 31, 2017 and 2016 were estimated using the Black-Scholes option pricing model

with the following weighted average assumptions:

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2017

|

|

|

March 31, 2016

|

|

|

Stock price

|

|

$

|

1.56

|

|

|

$

|

0.78

|

|

|

Exercise price

|

|

$

|

1.62

|

|

|

$

|

1.62

|

|

|

Expected life

|

|

|

1.65 years

|

|

|

|

2.65 years

|

|

|

Expected volatility

|

|

|

94.21

|

%

|

|

|

83.86

|

%

|

|

Risk-free interest rate

|

|

|

0.75

|

%

|

|

|

0.83

|

%

|

|

Dividend rate

|

|

|

0.00

|

%

|

|

|

0.00

|

%

|

The following is a summary of warrant activity

during the three months ended March 31, 2017:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of Warrants

|

|

|

Weighted Average

Exercise Price

|

|

|

|

|

CAD

|

|

|

US

|

|

|

CAD$

|

|

|

US$

|

|

|

Outstanding as of January 1, 2017

|

|

|

5,557,653

|

|

|

|

4,528,609

|

|

|

$

|

1.46

|

|

|

$

|

1.62

|

|

|

Granted

|

|

|

500

|

|

|

|

—

|

|

|

|

1.50

|

|

|

|

—

|

|

|

Exercised

|

|

|

(1,000

|

)

|

|

|

—

|

|

|

|

1.00

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Outstanding as of March 31, 2017

|

|

|

5,557,153

|

|

|

|

4,528,609

|

|

|

$

|

1.46

|

|

|

$

|

1.62

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13

The warrants outstanding and exercisable as of March 31, 2017 were as follows:

|

|

|

|

|

|

|

|

|

Number of Warrants Outstanding

|

|

Exercise Price

|

|

|

Expiration Date

|

|

452,032

|

|

US $

|

3.00

|

|

|

April 30, 2018

|

|

167,731

|

|

US $

|

3.00

|

|

|

June 26, 2018

|

|

18,978

|

|

US $

|

2.15

|

|

|

June 26, 2020

|

|

62,878

|

|

US $

|

3.00

|

|

|

July 17, 2018

|

|

7,545

|

|

US $

|

2.15

|

|

|

July 17, 2020

|

|

1,041,667

|

|

US $

|

1.44

|

|

|

November 10, 2018

|

|

2,777,778

|

|

US $

|

1.35

|

|

|

December 29, 2018

|

|

5,057,446

|

|

CAD $

|

1.50

|

|

|

April 18, 2019

|

|

499,707

|

|

CAD $

|

1.00

|

|

|

April 18, 2018

|

On June 18, 2014, the Company’s Board of Directors authorized and

approved the adoption of the 2014 Plan (“2014 Plan”), under which an aggregate of 12,108,016 shares of common stock may be issued. Pursuant to the terms of the 2014 Plan, the Company is authorized to grant stock options, as well as awards

of stock appreciation rights, restricted stock, unrestricted shares, restricted stock units and deferred stock units. These awards may be granted to directors, officers, employees and eligible consultants. Vesting and the term of an option is

determined at the discretion of the Company’s Board of Directors.

On August 8, 2016, the Company’s Board of Directors authorized and

approved the adoption of the 2016 Omnibus Incentive Plan (“2016 Plan”), under which an aggregate of 15,000,000 shares of common stock may be issued. Pursuant to the terms of the 2016 Plan, the Company is authorized to grant stock options,

as well as awards of stock appreciation rights, restricted stock, unrestricted shares, restricted stock units, stock equivalent units and performance based cash awards. These awards may be granted to directors, officers, employees and eligible

consultants. Vesting and the term of an option is determined at the discretion of the Company’s Board of Directors.

As March 31, 2017, there

were an aggregate of 16,958,376 shares of common stock remaining available for grant under the 2014 and 2016 Plans.

The following is a summary of stock

option activity during the three months ended March 31, 2017:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number

of Options

|

|

|

Weighted

Average

Exercise Price

(CAD$)

|

|

|

Aggregate

Intrinsic Value

(CAD$)

|

|

|

Outstanding as of January 1, 2017

|

|

|

9,845,000

|

|

|

$

|

1.20

|

|

|

$

|

8,218,150

|

|

|

Exercised

|

|

|

(60,000

|

)

|

|

|

0.60

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Outstanding as of March 31, 2017

|

|

|

9,785,000

|

|

|

$

|

1.21

|

|

|

$

|

9,693,250

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exercisable as of March 31, 2017

|

|

|

6,994,168

|

|

|

$

|

1.17

|

|

|

$

|

7,475,376

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The aggregate intrinsic value of stock options exercised during the three months ended March 31, 2017 was $64,383. There

were no stock options exercised during the three months ended March 31, 2016.

14

The stock options outstanding and exercisable as of March 31, 2017 were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number

of

Options Outstanding

|

|

|

Expiration Date

|

|

|

Options

Outstanding

Remaining

Contractual Life

(In Years)

|

|

|

Exercise

Price (CAD)

|

|

|

Grant Date

Fair Value

(CAD)

|

|

|

Number of

Options

Exercisable

|

|

|

|

3,250,000

|

|

|

|

June 18, 2019

|

|

|

|

2.22

|

|

|

$

|

0.60

|

|

|

$

|

0.26

|

|

|

|

3,250,000

|

|

|

|

100,000

|

|

|

|

July 14, 2017

|

|

|

|

0.29

|

|

|

$

|

2.52

|

|

|

$

|

1.05

|

|

|

|

100,000

|

|

|

|

450,000

|

|

|

|

December 8, 2019

|

|

|

|

2.69

|

|

|

$

|

2.92

|

|

|

$

|

1.65

|

|

|

|

450,000

|

|

|

|

100,000

|

|

|

|

December 8, 2019

|

|

|

|

2.69

|

|

|

$

|

2.92

|

|

|

$

|

1.31

|

|

|

|

100,000

|

|

|

|

400,000

|

|

|

|

December 8, 2019

|

|

|

|

2.69

|

|

|

$

|

2.96

|

|

|

$

|

1.29

|

|

|

|

400,000

|

|

|

|

100,000

|

|

|

|

March 16, 2020

|

|

|

|

2.96

|

|

|

$

|

3.20

|

|

|

$

|

1.42

|

|

|

|

100,000

|

|

|

|

50,000

|

|

|

|

August 15, 2020

|

|

|

|

3.38

|

|

|

$

|

0.98

|

|

|

$

|

0.39

|

|

|

|

33,334

|

|

|

|

750,000

|

|

|

|

October 21, 2020

|

|

|

|

3.56

|

|

|

$

|

0.87

|

|

|

$

|

0.36

|

|

|

|

375,000

|

|

|

|

550,000

|

|

|

|

October 28, 2020

|

|

|

|

3.58

|

|

|

$

|

0.84

|

|

|

$

|

0.44

|

|

|

|

550,000

|

|

|

|

400,000

|

|

|

|

October 28, 2020

|

|

|

|

3.58

|

|

|

$

|

0.84

|

|

|

$

|

0.36

|

|

|

|

400,000

|

|

|

|

100,000

|

|

|

|

December 31, 2020

|

|

|

|

3.76

|

|

|

$

|

1.24

|

|

|

$

|

0.50

|

|

|

|

66,668

|

|

|

|

3,025,000

|

|

|

|

July 13, 2020

|

|

|

|

3.29

|

|

|

$

|

1.39

|

|

|

$

|

0.65

|

|

|

|

1,041,666

|

|

|

|

100,000

|

|

|

|

August 8, 2020

|

|

|

|

3.36

|

|

|

$

|

1.31

|

|

|

$

|

0.65

|

|

|

|

25,000

|

|

|

|

410,000

|

|

|

|

October 3, 2020

|

|

|

|

3.51

|

|

|

$

|

1.35

|

|

|

$

|

0.80

|

|

|

|

102,500

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9,785,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,994,168

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Included in the table above are

non-employee

awards that are subject to

re-measurement

each reporting period until vested. As a result, the grant date fair value is not representative of the total expense that will be recorded for these awards. As of March 31, 2017, the

unrecognized compensation cost related to

non-vested

stock options outstanding, was $977,415 to be recognized over a weighted-average remaining vesting period of approximately 1.20 years. The Company

recognizes compensation expense for only the portion of awards that are expected to vest. During the three months ended March 31, 2017 and 2016, the Company applied an expected forfeiture rate of 0% based on its historical experience.

Non-Employee

Stock Options

In accordance with the guidance of ASC

815-40-15,

stock options awarded to

non-employees

that are performing services for Neuro are required to be accounted for as derivative liabilities once the services have been performed and the options have vested because they are considered not to be

indexed to the Company’s stock due to their exercise price being denominated in a currency other than Neuro’s functional currency. Stock options awarded to

non-employees

that are not vested are

re-measured

at their respective fair values at each reporting period and accounted for as equity awards until the terms associated with their vesting requirements have been met. The changes in fair value of the

unvested

non-employee

awards are reflected in their respective operating expense classification in the Company’s consolidated statements of operations and comprehensive loss.

The

non-employee

stock options that are required to be accounted for as liabilities are summarized as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

Fair value of

non-employee

options at beginning of

period

|

|

$

|

1,616,739

|

|

|

$

|

546,809

|

|

|

Change in fair value of

non-employee

stock options during

the period

|

|

|

161,985

|

|

|

|

(25,630

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Fair value of

non-employee

options at end of

period

|

|

$

|

1,778,724

|

|

|

$

|

521,179

|

|

|

|

|

|

|

|

|

|

|

|

The

non-employee

options that have vested are required to be

re-valued

with the change in fair value of the liability recorded as a gain or loss on the change of fair value of derivative liability and included in other items in the Company’s consolidated statements of