U.S. Industrial Production Surged in April -- 2nd Update

May 16 2017 - 3:40PM

Dow Jones News

By Jeffrey Sparshott

WASHINGTON -- U.S. industrial output rose sharply in April, the

latest evidence that economic growth is picking up following a

lackluster start to the year.

Industrial production -- a measure of output at factories, mines

and utilities -- jumped 1.0% from a month earlier, the Federal

Reserve said Tuesday. That was the largest gain in more than three

years.

The strong showing follows a string of upbeat April indicators,

including the unemployment rate falling to its lowest level since

2007, solid consumer spending gains at online sellers, restaurants

and other retailers, and existing-home sales climbing at their

fastest pace in a decade. The broad-based growth across key sectors

of the economy suggests healthy demand from consumers and

businesses, reversing some gloomier readings from earlier in the

year.

"If you filter through the noise and look at the broader trend,

things are starting to get a little better," said Richard Moody,

chief economist at Regions Financial Corp.

Tuesday's report from the Federal Reserve showed manufacturing

output, the biggest component of industrial production, posted its

strongest gain since early in 2014, pushing the Fed's manufacturing

index to a new postrecession high.

U.S. factory activity was stagnant through much of 2015 and 2016

as the dollar strengthened, making U.S. goods more expensive to

sell overseas, and global economic growth remained tepid. Now, the

dollar has stabilized and overseas demand has picked up, helping

American factories.

It is less clear if April's strong performance will repeat. The

auto industry, which helped drive manufacturing output in April,

now faces plateauing sales. Auto makers sold 1.43 million vehicles

in the U.S. in April, down 4.7% from a year earlier, according to

Autodata Corp. The slump follows a record year for sales in 2016

and is leaving a glut of unsold vehicles piling up on dealer

lots.

Other sectors, such as electronics and food manufacturers,

posted smaller but perhaps more enduring gains.

"This will be remembered as the year when almost everything in

manufacturing got healthy except for motor vehicles," Michael

Montgomery, U.S. economist at IHS Markit, said in a research

note.

The Institute for Supply Management earlier this month said its

closely watched index of U.S. manufacturing activity fell in April

but still indicated the sector was expanding. ISM manufacturing

readings for each month this year have been higher than any month

in 2015 or 2016.

With the latest readings on the economy, forecasters expect a

pickup in gross domestic product from the paltry 0.7% annual rate

in the opening three months of the year. Macroeconomic Advisers, a

research firm, estimates second-quarter growth is tracking at a

3.9% pace.

Tuesday's Fed report showed output in the volatile mining sector

advanced 1.2% in April. The mining index, which includes oil and

natural gas extraction, was up 7.3% from a year earlier but remains

well below its peak. The sector had been weighed down by weak

commodity prices but appears to be rebounding.

Utility output rose 0.7% from the prior month but was down 0.5%

from a year earlier. Utility use is typically more a reflection of

the weather than economic vigor.

Write to Jeffrey Sparshott at jeffrey.sparshott@wsj.com

(END) Dow Jones Newswires

May 16, 2017 15:25 ET (19:25 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

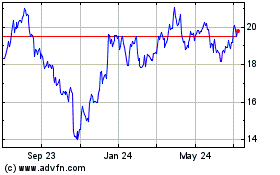

Regions Financial (NYSE:RF)

Historical Stock Chart

From Mar 2024 to Apr 2024

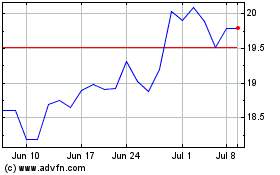

Regions Financial (NYSE:RF)

Historical Stock Chart

From Apr 2023 to Apr 2024