By David Benoit

Activist investors, a perennial nuisance for chief executives,

are becoming an existential threat.

Since January, they have helped push out the leaders of three

high-profile S&P 500 companies: insurance giant American

International Group Inc., railroad CSX Corp. and aerospace-parts

maker Arconic Inc. They are gunning for the CEOs at other companies

including Buffalo Wild Wings Inc. and Avon Products Inc.

Chief executives have long felt pressure from these investors,

who take stakes and push for changes to boost the stock, and

turnover at the top tends to increase after they show up. But

activists are increasingly asking for CEOs' heads at the outset of

campaigns, a new level of aggressiveness for a group already known

for its bold actions and impact on corporate America in recent

years.

So far in 2017, activists have started nine campaigns targeting

top management, the fastest pace on record, according to

FactSet.

The shift has been years in the making. After the financial

crisis, activists regularly won board seats and successfully pushed

for moves that can produce quick returns like breakups or share

buybacks. Many activists and analysts now question whether the easy

pickings are gone.

The answer for some is to pursue changes in operations, which

can be more of a slog and require new management.

"The activists are finding that just settling for board seats is

not all that productive," said Peter Michelsen, president of

CamberView Partners LLC, which advises some of the largest U.S.

companies on how to deal with activists. "They are having to get

more involved, including pushing for changes in management and

operations."

Some CEOs who have been targeted complain privately that

activists don't understand their businesses. "They've never built

anything in their life, except a spreadsheet," one said recently.

Others say boards should determine the CEO. They argue that

activists seek too much power given the size of their stakes, which

amount to as little as 1% in some cases.

The increased aggressiveness portends even nastier fights

between activists and their targets. It may also make

private-company executives more reluctant to tap public markets and

prompt them to employ stronger defenses when they do. Many

well-funded startups are already staying away, contributing to a

roughly one-third decline in the number of public companies since

1997, according to the University of Chicago's Center for Research

in Security Prices.

"Why would you want to go public if you can you lose control of

your company that easily because somebody makes a public statement

and the stock goes up," Jeffrey Ubben, founder of activist ValueAct

Capital Management LP, said at a conference last month. "You are

hijacked."

What happened at CSX Corp. could be cited as a case in

point.

Paul Hilal, formerly of William Ackman's Pershing Square Capital

Management LP, raised his own fund with the sole purpose of

replacing the railroad's CEO with Hunter Harrison. When The Wall

Street Journal reported the plan in January, CSX stock shot up

23%.

The market's endorsement helped Mr. Hilal, with 4.9% of CSX's

stock, push for board changes he argued were needed to support Mr.

Harrison and his efficiency strategy, known as precision

railroading.

CSX, already planning succession, agreed to hire Mr. Harrison

and name five new directors.

That wasn't even the most dramatic activist-fueled CEO change

this year.

Elliott Management Corp.'s fight with Klaus Kleinfeld at Arconic

resulted in the CEO's exit in April, though not for reasons either

side anticipated. In pushing for his ouster, Elliott called Mr.

Kleinfeld the worst CEO in the S&P 500. It cited missed targets

and what it characterized as his lavish spending -- like on ads

based on the Jetsons cartoon.

"CEOs do not hold the job by right," Elliott wrote in one letter

to Arconic, which was created when Alcoa broke into two companies.

"The Board must continually evaluate who should be running the

company."

Arconic defended Mr. Kleinfeld, saying he deserves credit for

building the company and breaking up Alcoa. Last month, Mr.

Kleinfeld sent a vaguely threatening note to Elliott's founder.

Arconic said at the time that Mr. Kleinfeld has stepped down by

mutual agreement. He hasn't commented since.

What happened at AIG is more typical. In late 2015, Carl Icahn

agitated for a breakup of the insurance company and a CEO change.

The sides settled, with Mr. Icahn getting a board seat and CEO

Peter Hancock pledging to improve performance. When AIG missed its

targets, Mr. Hancock resigned because, he said, he lacked

"wholehearted shareholder support."

At Avon Products, Barington Capital Group LP and NuOrion

Partners AG called for a CEO change after the beauty-products

seller reported a surprise loss this month, claiming a turnaround

is taking too long. The company said its plan is on track.

Even CEOs with strong overall returns aren't safe.

Sally Smith has led sports-bar chain Buffalo Wild Wings since

1996, presiding over rapid store growth and a roughly 1700% stock

return. The company still increased stock buybacks, added five new

directors and made other changes activist Marcato Capital

Management LP sought. Marcato nonetheless last month called on

Buffalo Wild Wings to fire Ms. Smith, saying the company has lost

its way amid slowing growth. Buffalo Wild Wings says she is the

right person for the job.

Write to David Benoit at david.benoit@wsj.com

(END) Dow Jones Newswires

May 16, 2017 08:14 ET (12:14 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

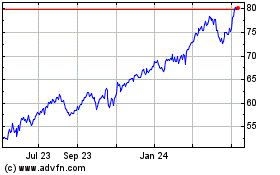

American (NYSE:AIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

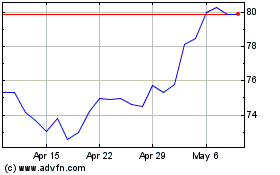

American (NYSE:AIG)

Historical Stock Chart

From Apr 2023 to Apr 2024