ChinaNet Online Holdings, Inc. (Nasdaq:CNET) ("ChinaNet" or the

"Company"), an integrated online advertising, precision marketing

and data-analysis and management services platform, announced today

financial results for the first quarter of 2017.

Summary Financials

|

First Quarter 2017 Financial Results (USD) |

| |

2017 |

2016 |

CHANGE |

| Sales |

$7.3 million |

|

$5.1 million |

|

+43.6 |

% |

| Gross Profit |

$1.3 million |

|

$1.6 million |

|

-20.7 |

% |

| Gross Margin |

|

|

17.5% |

|

|

|

31.7% |

|

-44.8 |

% |

| Net Loss Attributable

to ChinaNet |

($1.1) million |

|

($1.4) million |

|

23.0 |

% |

| EPS from continuing

operations* (Basic & Diluted) |

|

($0.09) |

|

|

($0.12) |

|

25.0 |

% |

*Per share amount for the three months ended March 31, 2016 has

been retroactively restated to reflect the Company’s 1 for 2.5

reverse stock split, which was effective on August 19, 2016.

For the three months ended March 31, 2017, total revenues

increased to $7.3 million from $5.1 million in the prior year,

primarily due to the increase from search engine marketing revenue

during the quarter.

During the quarter, revenues from internet advertising and data

services was $2.3 million, which decreased 36.8% from $3.6 million

in the first quarter of 2016. ChinaNet continues to focus on

integrating and upgrading its internet advertising and data service

to SME clients and investing in developing new service modules for

clients, and believes that the launch of new services in future

will help to increase market penetration and recurring revenues.

The decline was offset by an increase in search engine marketing

services revenue of 252.1% from $1.4 million in the first quarter

of 2016 to $5.0 million in the first quarter of 2017. This increase

was supported by the CloudX system, which drove more precision

marketing and ROI for clients.

Gross profit for the quarter ended March 31, 2017 was $1.3

million compared to $1.6 million in the first quarter of 2016, a

decrease of 20.7%. Gross margin was 17.5%, down from 31.7% in 2016,

primarily due to the increase in relative lower margin revenues

from search engine marketing services during the quarter. Internet

advertising and data service gross margin increased to 49% in the

first quarter of 2017 from 43% in 2016. The improvement in gross

margin of the internet advertising and data service was primarily

due to optimizing and upgrading of the Company's online promotion

analysis and cost control system.

Operating expenses decreased by 22.9% to $2.3 million for the

three months ended March 31, 2017. Sales and marketing expenses

decreased by 5.2% to $0.8 million. General and administrative

expenses decreased by 36% to $1.1 million. Loss from operations was

$1.0 million in the first quarter of 2017, an improvement of 25.5%

compared to $1.4 million in the first quarter of 2016.

Net loss attributable to ChinaNet for the three months ended

March 31, 2017 was $1.1 million and loss per share from continuing

operations was $0.09, compared to a net loss of $1.4 million and

loss per share from continuing operations of $0.12 in the first

quarter of 2016. The weighted average diluted shares outstanding

for the three months ended March 31, 2017 was 12.0 million shares

versus 11.3 million for the three months ended March 31, 2016.

Balance Sheet and Cash Flow

The Company had $1.0 million in cash and cash equivalents as of

March 31, 2017, compared to $3.0 million as of December 31, 2016,

working capital of $6.4 million compared to $6.9 million as of

December 31, 2016, and a current ratio of 1.6 to 1, compared 1.9 to

1 as of December 31, 2016. Total shareholders' equity of ChinaNet

was $21.5 million at March 31, 2017 compared to $22.2 million at

December 31, 2016.

The Company generated approximately $2.0 million of cash

outflows from operations for the quarter ended March 31, 2017

compared to a $0.4 million of cash inflows for the quarter ended

March 31, 2016.

Business Updates

In January 2017, ChinaNet announced the launch of its updated

comprehensive website www.chinanet-online.com, reflecting

ongoing efforts to provide up-to-date information for customers,

investors and shareholders. The new ChinaNet website has been

redesigned to be more dynamic, user-friendly and content rich. The

website allows visitors to efficiently access information needed

regarding ChinaNet's profile and history, products and services,

and investor relations content including press releases and SEC

reporting. The website now also includes enhanced video, including

a compressive overview of the Company's business which can be

viewed directly

at: http://www.chinanet-online.com/english_index.html

About ChinaNet Online Holdings, Inc.

ChinaNet Online Holdings, a parent company of ChinaNet Online

Media Group Ltd., incorporated in the BVI (ChinaNet), is an

integrated online advertising, precision marketing and

data-analysis and management services platform. ChinaNet provides

prescriptive analysis for its clients to improve business outcomes

and to create more efficient enterprises. The Company leverages an

optimization framework, provided by its comprehensive data-analysis

infrastructure, to blend data, mathematical, and computational

sciences into an outcome management platform for which it monetizes

on a per client basis. ChinaNet uniquely optimizes and prescribes

its clients decision making processes based on its proprietary

ecosystem. For more information,

visit www.chinanet-online.com.

Safe Harbor

This release contains certain "forward-looking statements"

relating to the business of ChinaNet Online Holdings, Inc., which

can be identified by the use of forward-looking terminology such as

"believes," "expects," "anticipates," "estimates" or similar

expressions. Such forward-looking statements involve known and

unknown risks and uncertainties, including business uncertainties

relating to government regulation of our industry, market demand,

reliance on key personnel, future capital requirements, competition

in general and other factors that may cause actual results to be

materially different from those described herein as anticipated,

believed, estimated or expected. Certain of these risks and

uncertainties are or will be described in greater detail in our

filings with the Securities and Exchange Commission. These

forward-looking statements are based on ChinaNet's current

expectations and beliefs concerning future developments and their

potential effects on the Company. There can be no assurance that

future developments affecting ChinaNet will be those anticipated by

ChinaNet. These forward-looking statements involve a number of

risks, uncertainties (some of which are beyond the control of the

Company) or other assumptions that may cause actual results or

performance to be materially different from those expressed or

implied by such forward-looking statements. ChinaNet undertakes no

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as may be required under applicable securities

laws.

| |

|

| CHINANET ONLINE HOLDINGS, INC. |

|

| CONSOLIDATED BALANCE

SHEETS |

|

| (In thousands, except for number of

shares and per share data) |

|

| |

|

|

|

|

|

|

|

|

March 31, 2017 |

|

December 31, 2016 |

|

|

|

|

|

|

|

|

(US $) |

|

(US $) |

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

| Cash and

cash equivalents |

|

|

|

|

|

$ |

1,047 |

|

|

|

|

$ |

3,035 |

|

|

| Term

deposit |

|

|

|

|

|

|

3,073 |

|

|

|

|

|

3,056 |

|

|

| Accounts

receivable, net |

|

|

|

|

|

|

4,242 |

|

|

|

|

|

3,322 |

|

|

|

Prepayment and deposit to suppliers |

|

|

|

|

|

|

7,928 |

|

|

|

|

|

4,754 |

|

|

| Due from

related parties, net |

|

|

|

|

|

|

1,082 |

|

|

|

|

|

213 |

|

|

| Other

current assets |

|

|

|

|

|

|

143 |

|

|

|

|

|

95 |

|

|

|

Total current assets |

|

|

|

|

|

|

17,515 |

|

|

|

|

|

14,475 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Long-term

investments |

|

|

|

|

|

|

1,348 |

|

|

|

|

|

1,340 |

|

|

| Property and equipment,

net |

|

|

|

|

|

|

423 |

|

|

|

|

|

471 |

|

|

| Intangible assets,

net |

|

|

|

|

|

|

7,001 |

|

|

|

|

|

7,264 |

|

|

| Goodwill |

|

|

|

|

|

|

4,998 |

|

|

|

|

|

4,970 |

|

|

| Deferred tax

assets |

|

|

|

|

|

|

1,531 |

|

|

|

|

|

1,522 |

|

|

|

Total Assets |

|

|

|

|

|

$ |

32,816 |

|

|

|

|

$ |

30,042 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and

Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-term bank loan * |

|

|

|

|

|

$ |

725 |

|

|

|

|

$ |

721 |

|

|

| Accounts

payable * |

|

|

|

|

|

|

398 |

|

|

|

|

|

102 |

|

|

| Advances

from customers * |

|

|

|

|

|

|

4,606 |

|

|

|

|

|

1,420 |

|

|

| Accrued

payroll and other accruals * |

|

|

|

|

|

|

597 |

|

|

|

|

|

685 |

|

|

| Due to

new investors related to terminated security purchase

agreements |

|

|

|

|

|

|

888 |

|

|

|

|

|

884 |

|

|

| Payable

for purchasing of software technology * |

|

|

|

|

|

|

413 |

|

|

|

|

|

411 |

|

|

| Taxes

payable * |

|

|

|

|

|

|

2,963 |

|

|

|

|

|

2,910 |

|

|

| Other

payables * |

|

|

|

|

|

|

555 |

|

|

|

|

|

487 |

|

|

|

Total current liabilities |

|

|

|

|

|

|

11,145 |

|

|

|

|

|

7,620 |

|

|

| Long-term

liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Long-term borrowing from a director |

|

|

|

|

|

127 |

|

|

|

|

|

126 |

|

|

| Total Liabilities |

|

|

|

|

|

11,272 |

|

|

|

|

|

7,746 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ChinaNet Online Holdings, Inc.’s stockholders’ equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common stock (US$0.001 par value; authorized 50,000,000

shares; issued and outstanding 12,265,542 shares and 12,158,542

shares at March 31, 2017 and December 31, 2016, respectively) |

|

|

|

|

|

12 |

|

|

|

|

|

12 |

|

|

| Additional paid-in capital |

|

|

|

|

|

29,496 |

|

|

|

|

|

29,285 |

|

|

| Statutory reserves |

|

|

|

|

|

2,607 |

|

|

|

|

|

2,607 |

|

|

| Retained deficit |

|

|

|

|

|

(11,449 |

) |

|

|

|

|

(10,362 |

) |

|

| Accumulated other comprehensive income |

|

|

|

|

|

843 |

|

|

|

|

|

700 |

|

|

| Total ChinaNet Online Holdings, Inc.’s stockholders’

equity |

|

|

|

|

|

21,509 |

|

|

|

|

|

22,242 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noncontrolling interests |

|

|

|

|

|

35 |

|

|

|

|

|

54 |

|

|

| Total equity |

|

|

|

|

|

21,544 |

|

|

|

|

|

22,296 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Liabilities and Equity |

|

|

|

|

$ |

32,816 |

|

|

|

|

$ |

30,042 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CHINANET ONLINE HOLDINGS, INC. |

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE LOSS |

|

|

(In thousands, except for number of shares and

per share data) |

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

|

|

2017 |

|

|

2016 |

| |

|

|

(US $) |

|

|

|

|

(US $) |

|

| |

|

|

(Unaudited) |

|

|

|

|

(Unaudited) |

|

|

Revenues |

|

|

|

|

|

|

|

|

|

| From unrelated parties |

|

|

7,245 |

|

|

|

|

5,012 |

|

| From related parties |

|

|

19 |

|

|

|

|

48 |

|

| Total revenues |

|

|

7,264 |

|

|

|

|

5,060 |

|

| Cost of revenues |

|

|

5,992 |

|

|

|

|

3,456 |

|

| Gross profit |

|

|

1,272 |

|

|

|

|

1,604 |

|

| |

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

| Sales and marketing expenses |

|

|

834 |

|

|

|

|

880 |

|

| General and administrative expenses |

|

|

1,092 |

|

|

|

|

1,706 |

|

| Research and development expenses |

|

|

395 |

|

|

|

|

426 |

|

| Total operating expenses |

|

|

2,321 |

|

|

|

|

3,012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

|

(1,049 |

) |

|

|

|

(1,408 |

) |

| |

|

|

|

|

|

|

|

|

|

| Other income/(expenses) |

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

19 |

|

|

|

|

27 |

|

| Interest expense |

|

|

(36 |

) |

|

|

|

- |

|

| Other expenses |

|

|

(3 |

) |

|

|

|

(12 |

) |

| Total other (expense)/income |

|

|

(20 |

) |

|

|

|

15 |

|

|

Loss before income tax benefit, noncontrolling interests

and discontinued operation |

|

|

(1,069 |

) |

|

|

|

(1,393 |

) |

| Income tax

benefit |

|

|

- |

|

|

|

|

28 |

|

|

Loss from continuing operation |

|

|

(1,069 |

) |

|

|

|

(1,365 |

) |

| Loss from discontinued operation, net of income

tax |

|

|

- |

|

|

|

|

(46 |

) |

| Net

loss |

|

|

(1,069 |

) |

|

|

|

(1,411 |

) |

| Net income attributable to noncontrolling interests from

continuing operations |

|

|

(18 |

) |

|

|

|

- |

|

| Net

loss attributable to ChinaNet Online Holdings, Inc. |

|

|

(1,087 |

) |

|

|

|

(1,411 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Net

loss |

|

|

|

|

(1,069 |

) |

|

|

|

(1,411 |

) |

| |

Foreign currency translation gain |

|

|

|

|

106 |

|

|

|

|

112 |

|

| |

Comprehensive Loss |

|

|

|

|

(963 |

) |

|

|

|

(1,299 |

) |

| |

Comprehensive loss attributable to noncontrolling interests |

|

|

|

|

19 |

|

|

|

|

17 |

|

| |

Comprehensive

loss attributable to ChinaNet Online Holdings, Inc. |

|

|

|

|

(944 |

) |

|

|

|

(1,282 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Loss per share |

|

|

|

|

|

|

|

|

|

|

|

| |

Loss

from continuing operations per common share |

|

|

|

|

|

|

|

|

|

|

|

| |

Basic and diluted |

|

|

|

$ |

(0.09 |

) |

|

|

$ |

(0.12 |

) |

| |

Loss

from discontinued operations per common share |

|

|

|

|

|

|

|

|

|

|

|

| |

Basic and diluted |

|

|

|

$ |

- |

|

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Weighted average number of common shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

| |

Basic and diluted |

|

|

|

|

11,982,504 |

|

|

|

|

11,342,971 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| CHINANET ONLINE HOLDINGS, INC. |

| CONSOLIDATED STATEMENTS OF CASH

FLOWS |

| (In thousands) |

| |

| |

|

Three Months Ended March 31, |

| |

|

|

2017 |

|

|

|

2016 |

|

| |

|

(US $) |

|

(US $) |

| |

|

(Unaudited) |

|

(Unaudited) |

| Cash flows from operating

activities |

|

|

|

|

| Net loss |

|

$ |

(1,069 |

) |

|

$ |

(1,411 |

) |

|

Adjustments to reconcile net loss

to net cash (used in)/provided by

operating activities |

|

|

|

|

| Depreciation and amortization |

|

|

354 |

|

|

|

384 |

|

| Share-based compensation expenses |

|

|

211 |

|

|

|

564 |

|

| Loss on disposal of fixed assets/other long-term assets |

|

|

- |

|

|

|

21 |

|

| (Reverse of)/provision for allowances for doubtful

accounts |

|

|

(29 |

) |

|

|

- |

|

| Deferred taxes |

|

|

- |

|

|

|

(28 |

) |

|

Changes in operating assets and liabilities |

|

|

|

|

| Accounts receivable |

|

|

(903 |

) |

|

|

(507 |

) |

| Other receivables |

|

|

20 |

|

|

|

1,464 |

|

| Prepayment and deposit to suppliers |

|

|

(3,154 |

) |

|

|

(152 |

) |

| Due from related parties |

|

|

(870 |

) |

|

|

(19 |

) |

| Other current assets |

|

|

(38 |

) |

|

|

29 |

|

| Accounts payable |

|

|

295 |

|

|

|

190 |

|

| Advances from customers |

|

|

3,185 |

|

|

|

64 |

|

| Accrued payroll and other accruals |

|

|

(90 |

) |

|

|

(89 |

) |

| Other payables |

|

|

44 |

|

|

|

(114 |

) |

| Taxes payable |

|

|

37 |

|

|

|

47 |

|

| Net cash (used in)/provided

by operating activities |

|

|

(2,007 |

) |

|

|

443 |

|

| |

|

|

|

|

| Cash flows from investing

activities |

|

|

|

|

| Payment for office equipment and leasehold improvement |

|

|

- |

|

|

|

(117 |

) |

| Long-term investment in cost/equity method investees |

|

|

- |

|

|

|

(693 |

) |

| Payment for purchasing of software technology |

|

|

- |

|

|

|

(1,394 |

) |

| Net cash used

in investing

activities |

|

|

- |

|

|

|

(2,204 |

) |

| |

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by/(used in)

financing activities |

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

Changes in cash and cash equivalents included in assets classified

as held for sale |

|

|

- |

|

|

|

(6 |

) |

|

|

|

|

|

|

|

Effect of exchange rate fluctuation on cash and cash

equivalents |

|

|

19 |

|

|

|

8 |

|

|

|

|

|

|

|

|

Net decrease in cash and cash equivalents |

|

|

(1,988 |

) |

|

|

(1,759 |

) |

|

|

|

|

|

|

|

Cash and cash equivalents at beginning of the period |

|

|

3,035 |

|

|

|

5,503 |

|

|

Cash and cash equivalents at end of the period |

|

$ |

1,047 |

|

|

$ |

3,744 |

|

|

|

|

|

|

|

Contact:

MZ North America

Ted Haberfield, President

Direct: +1-760-755-2716

Email: thaberfield@mzgroup.us

Web: www.mzgroup.us

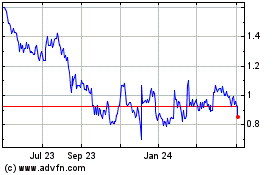

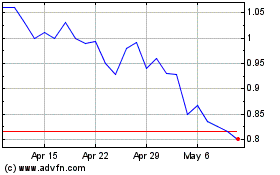

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Mar 2024 to Apr 2024

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Apr 2023 to Apr 2024