- PROGRESSED TO THE FINAL OF THE UEFA

EUROPA LEAGUE TO BE HELD ON 24TH MAY IN STOCKHOLM.

Manchester United (NYSE: MANU; the “Company” and the “Group”) –

one of the most popular and successful sports teams in the world -

today announced financial results for the 2017 fiscal third quarter

and nine months ended 31 March 2017.

Highlights

- Won the English Football League Cup

Final at Wembley.

- Broadcasting revenues of £31.4

million up 12.9% for the quarter.

- Two sponsorship deals announced in

the quarter.

- Uber (Global)

- Aladdin Street (Global)

Commentary

Ed Woodward, Executive Vice Chairman, commented, “As we near the

end of the season, I am delighted we have picked up two trophies so

far, and look forward to competing for a third in the Europa League

final, the only trophy we have never won.

We are forecasting better full year financial performance than

expected and as such have raised our revenue and profit guidance

for the year. We look forward to a strong finish to 2016-17, both

on and off the pitch.”

Outlook

For fiscal 2017, Manchester United expects:

- Revenue to be £560m to £570m.

- Adjusted EBITDA to be £185m to

£195m.

Key Financials

(unaudited)

£ million (except (loss)/earnings per share)

Three months

ended

31 March

Nine months ended

31 March

2017 2016 Change

2017 2016 Change Commercial revenue

66.5 65.8 1.1%

207.6

203.1 2.2% Broadcasting revenue

31.4

27.8 12.9%

113.0 92.7

21.9% Matchday revenue

29.3 29.8 (1.7%)

84.7 85.0 (0.4%) Total revenue

127.2 123.4 3.1%

405.3

380.8 6.4% Adjusted EBITDA1

30.0 44.9

(33.2%)

130.2 142.6 (8.7%)

Operating (loss)/profit

(4.1) 23.2 -

39.7 65.3 (39.2%) (Loss)/profit

for the period (i.e. net income)

(3.8) 13.7

-

14.9 37.3 (60.1%) Basic

(loss)/earnings per share

(2.30) 8.40 -

9.10 22.78 (60.1%) Adjusted

(loss)/profit for the period (i.e. adjusted net income)1

(6.3) 11.7 -

11.8 32.1

(63.2%) Adjusted basic (loss)/earnings per share (pence)1

(3.84) 7.17 -

7.22

19.60 (63.2%) Net debt1/2

366.3

348.7 5.0%

366.3 348.7 5.0% 1

Adjusted EBITDA, adjusted (loss)/profit for the period,

adjusted basic (loss)/earnings per share and net debt are non-IFRS

measures. See “Non-IFRS Measures: Definitions and Use” below and

the accompanying Supplemental Notes for the definitions and

reconciliations for these non-IFRS measures and the reasons we

believe these measures provide useful information to investors

regarding the Group’s financial condition and results of

operations. 2 The gross USD debt principal remains

unchanged. The increase in net debt is due to the strengthening US

dollar, with the USD/GBP exchange rate moving from 1.4332 at 31

March 2016 to 1.2520 at 31 March 2017.

Revenue

Analysis

Commercial

Commercial revenue for the quarter was £66.5 million, an

increase of £0.7 million, or 1.1%, over the prior year quarter.

- Sponsorship revenue for the quarter was

£39.6 million, an increase of £0.8 million, or 2.1%, over the prior

year quarter;

- Retail, Merchandising, Apparel &

Product Licensing revenue for the quarter was £24.7 million, an

increase of £0.3 million, or 1.2%, over the prior year quarter;

and

- Mobile & Content revenue for the

quarter was £2.2 million, a decrease of £0.4 million, or 15.4%,

over the prior year quarter.

Broadcasting

Broadcasting revenue for the quarter was £31.4 million, an

increase of £3.6 million, or 12.9%, over the prior year quarter,

primarily due to the impact of the new PL broadcasting agreement,

partially offset by playing one fewer PL home game.

Matchday

Matchday revenue for the quarter was £29.3 million, a decrease

of £0.5 million, or 1.7%, over the prior year quarter.

Other Financial

Information

Operating expenses

Total operating expenses for the quarter were £129.8 million, an

increase of £27.6 million, or 27.0%, over the prior year

quarter.

Employee benefit expenses

Employee benefit expenses for the quarter

were £66.5 million, an increase of £10.3 million, or 18.3%, over

the prior year quarter.

Other operating expenses

Other operating expenses for the quarter were

£30.7 million, an increase of £8.4 million, or 37.7%, over the

prior year quarter, reflecting higher home domestic cup revenue

share costs and adverse foreign exchange movements.

Depreciation & amortization

Depreciation for the quarter was £2.5

million, which was unchanged from the prior year quarter.

Amortization for the quarter was £30.1 million, an increase of £8.9

million, or 42.0%, over the prior year quarter. The unamortized

balance of registrations at 31 March 2017 was £280.7 million.

(Loss)/profit on disposal of intangible assets

Loss on disposal of intangible assets for the quarter was £1.5

million compared to a profit of £2.0 million in the prior year

quarter.

Net finance costs

Net finance costs for the quarter were £3.3 million, a decrease

of £0.3 million, or 8.3%, over the prior year quarter.

Tax

The tax credit for the quarter was £3.6 million, compared to an

expense of £5.9 million in the prior year quarter.

Cash flows

Net cash generated from operating activities for the quarter was

£39.8 million, an increase of £33.9 million over the prior year

quarter.

Net capital expenditure on property, plant and equipment for the

quarter was £2.6 million, an increase of £2.4 million over the

prior year quarter.

Net capital proceeds on intangible assets for the quarter was

£6.6 million, compared to net capital expenditure of £16.1 million

in the prior year quarter.

Overall cash and cash equivalents (including the effects of

exchange rate movements) increased by £29.9 million in the

quarter.

Net debt

Net debt as of 31 March 2017 was £366.3 million, an increase of

£17.6 million over the year. The gross USD debt principal remains

unchanged.

The increase in net debt is due to the strengthening US dollar,

with the USD/GBP exchange rate moving from 1.4332 at 31 March 2016

to 1.2520 at 31 March 2017.

Dividend

A dividend of $0.09 per share was paid during the quarter. A

further semi-annual cash dividend of $0.09 per share will be paid

on 8 June 2017, to shareholders of record on 28 April 2017. The

shares began trading ex-dividend on 26 April 2017.

Conference Call

Information

The Company’s conference call to review third quarter fiscal

2017 results will be broadcast live over the internet today, 16 May

2017 at 8:00 a.m. Eastern Time and will be available on Manchester

United’s investor relations website at http://ir.manutd.com.

Thereafter, a replay of the webcast will be available for thirty

days.

About Manchester

United

Manchester United is one of the most popular and successful

sports team in the world, playing one of the most popular spectator

sports on Earth.

Through our 139-year heritage we have won 65 trophies, enabling

us to develop the world’s leading sports brand and a global

community of 659 million followers. Our large, passionate

community provides Manchester United with a worldwide platform to

generate significant revenue from multiple sources, including

sponsorship, merchandising, product licensing, mobile &

content, broadcasting and matchday.

Cautionary

Statement

This press release contains forward-looking statements. You

should not place undue reliance on such statements because they are

subject to numerous risks and uncertainties relating to the

Company’s operations and business environment, all of which are

difficult to predict and many are beyond the Company’s control.

Forward-looking statements include information concerning the

Company’s possible or assumed future results of operations,

including descriptions of its business strategy. These statements

often include words such as “may,” “might,” “will,” “could,”

“would,” “should,” “expect,” “plan,” “anticipate,” “intend,”

“seek,” “believe,” “estimate,” “predict,” “potential,” “continue,”

“contemplate,” “possible” or similar expressions. The

forward-looking statements contained in this press release are

based on our current expectations and estimates of future events

and trends, which affect or may affect our businesses and

operations. You should understand that these statements are not

guarantees of performance or results. They involve known and

unknown risks, uncertainties and assumptions. Although the Company

believes that these forward-looking statements are based on

reasonable assumptions, you should be aware that many factors could

affect its actual financial results or results of operations and

could cause actual results to differ materially from those in these

forward-looking statements. These factors are more fully discussed

in the “Risk Factors” section and elsewhere in the Company’s

Registration Statement on Form F-1, as amended (File No.

333-182535) and the Company’s Annual Report on Form 20-F (File No.

001-35627).

Non-IFRS Measures:

Definitions and Use

1. Adjusted EBITDA

Adjusted EBITDA is defined as profit for the period before

depreciation, amortization, profit/(loss) on disposal of intangible

assets, exceptional items, net finance costs, and tax.

We believe adjusted EBITDA is useful as a measure of comparative

operating performance from period to period and among companies as

it is reflective of changes in pricing decisions, cost controls and

other factors that affect operating performance, and it removes the

effect of our asset base (primarily depreciation and amortization),

capital structure (primarily finance costs), and items outside the

control of our management (primarily taxes). Adjusted EBITDA has

limitations as an analytical tool, and you should not consider it

in isolation, or as a substitute for an analysis of our results as

reported under IFRS as issued by the IASB. A reconciliation of

(loss)/profit for the period to adjusted EBITDA is presented in

supplemental note 2.

2. Adjusted (loss)/profit for the period

(i.e. adjusted net income)

Adjusted (loss)/profit for the period is calculated, where

appropriate, by adjusting for charges/credits related to

exceptional items, foreign exchange gains/losses on unhedged US

dollar denominated borrowings, and fair value movements on

derivative financial instruments, adding/subtracting the actual tax

expense/credit for the period, and subtracting/adding the adjusted

tax expense/credit for the period (based on an normalized tax rate

of 35%; 2016: 35%). The normalized tax rate of 35% is management’s

estimate of the tax rate likely to be applicable to the Group for

the foreseeable future.

We believe that in assessing the comparative performance of the

business, in order to get a clearer view of the underlying

financial performance of the business, it is useful to strip out

the distorting effects of charges/credits related to ‘one-off’

transactions and then to apply a ‘normalized’ tax rate (for both

the current and prior periods) of the US federal income tax rate of

35%. A reconciliation of (loss)/profit for the period to adjusted

(loss)/profit for the period is presented in supplemental note

3.

3. Adjusted basic and diluted

(loss)/earnings per share

Adjusted basic and diluted (loss)/earnings per share are

calculated by dividing the adjusted (loss)/profit for the period by

the weighted average number of ordinary shares in issue during the

period. Adjusted diluted (loss)/earnings per share is calculated by

adjusting the weighted average number of ordinary shares in issue

during the period to assume conversion of all dilutive potential

ordinary shares. We have one category of dilutive potential

ordinary shares: share awards pursuant to the 2012 Equity Incentive

Plan (the “Equity Plan”). Share awards pursuant to the Equity Plan

are assumed to have been converted into ordinary shares at the

beginning of the financial year. Adjusted basic and diluted

(loss)/earnings per share are presented in supplemental note 3.

4. Net debt

Net debt is calculated as non-current and current borrowings

minus cash and cash equivalents.

Key Performance

Indicators

Three months ended Nine months ended

31 March 31 March

2017 2016

2017 2016

Commercial % of total revenue

52.3%

53.3%

51.2% 53.3%

Broadcasting % of

total revenue

24.7% 22.5%

27.9%

24.4%

Matchday % of total revenue

23.0%

24.2%

20.9% 22.3% Home Matches Played

PL

4 5

14 14 UEFA competitions

2 2

5 6 Domestic Cups

3 2

5 4 Away Matches

Played UEFA

competitions

2 2

5 6

Domestic Cups

4 2

5 2

Other

Employees at period end

888 797

888 797 Employee benefit expenses % of revenue

52.3% 45.5%

47.5% 44.8%

Phasing of Premier League

home games Quarter 1

Quarter 2 Quarter 3

Quarter 4 Total 2016/17 season 3

7 4 5 19 2015/16

season 4 5 5 5

19

CONSOLIDATED INCOME STATEMENT

(unaudited; in £ thousands, except per

share and shares outstanding data)

Three months ended31

March

Nine months ended31

March

2017 2016

2017

2016

Revenue 127,197

123,444

405,268 380,770 Operating expenses

(129,799 ) (102,168 )

(373,197 )

(310,578 ) (Loss)/profit on disposal of intangible assets

(1,521 ) 1,950

7,599

(4,838 )

Operating (loss)/profit

(4,123 ) 23,226

39,670

65,354 Finance costs

(3,391 )

(3,747 )

(21,605 ) (12,925 ) Finance income

113 185

424

290 Net finance costs

(3,278 )

(3,562 )

(21,181 ) (12,635 )

(Loss)/profit before tax (7,401 ) 19,664

18,489 52,719 Tax credit/(expense)

3,632

(5,903 )

(3,564 ) (15,391

)

(Loss)/profit for the period (3,769 )

13,761

14,925 37,328

Basic (loss)/earnings per share: Basic

(loss)/earnings per share (pence)

(2.30 ) 8.40

9.10 22.78 Weighted average number of ordinary shares

outstanding (thousands)

164,025 163,892

164,025

163,889

Diluted (loss)/earnings per share: Diluted

(loss)/earnings per share (pence)1

(2.30 ) 8.38

9.08 22.72 Weighted average number of ordinary shares

outstanding (thousands)

164,025 164,288

164,448 164,288 1

For the three months ended 31 March 2017 potential ordinary shares

are anti-dilutive, as their inclusion in the diluted loss per share

calculation would reduce the loss per share, and hence have been

excluded.

CONSOLIDATED BALANCE SHEET

(unaudited; in £ thousands)

As of As of As of

31

March 30 June 31 March

2017 2016

2016

ASSETS Non-current assets

Property, plant and equipment

244,137 245,714 247,200

Investment property

14,017 13,447 13,475 Intangible assets

707,578 665,634 651,683 Derivative financial instruments

2,127 3,760 2,692 Trade and other receivables

14,983

11,223 10,542 Deferred tax asset

144,329 145,460

133,640

1,127,171 1,085,238

1,059,232

Current assets Inventories

1,348 926 1,293 Derivative financial instruments

3,977 7,888 4,553 Trade and other receivables

86,290

128,657 95,238 Tax receivable

375 - - Cash and cash

equivalents

152,653

229,194

104,202

244,643

366,665

205,286

Total assets

1,371,814 1,451,903

1,264,518

CONSOLIDATED BALANCE SHEET

(continued)

(unaudited; in £ thousands)

As of As of As of

31

March 30 June 31 March

2017 2016

2016

EQUITY AND LIABILITIES Equity

Share capital

52 52 52 Share premium

68,822 68,822

68,822 Merger reserve

249,030 249,030 249,030 Hedging

reserve

(37,997) (32,989) (18,324) Retained earnings

177,904

173,367 178,779

457,811

458,282 478,359

Non-current

liabilities Derivative financial instruments

1,398

10,637 7,473 Trade and other payables

63,744 41,450 19,620

Borrowings

516,286 484,528 450,551 Deferred revenue

34,142 38,899 15,961 Deferred tax liabilities

12,092

14,364 12,740

627,662

589,878 506,345

Current

liabilities Derivative financial instruments

2,418 2,800

2,407 Tax liabilities

5,296 6,867 7,626 Trade and other

payables

176,427 199,668 163,014 Borrowings

2,700

5,564 2,356 Deferred revenue

99,500 188,844

104,411

286,341 403,743

279,814

Total equity and liabilities

1,371,814

1,451,903 1,264,518

CONSOLIDATED STATEMENT OF CASH

FLOWS

(unaudited; in £ thousands)

Three months ended 31

March

Nine months ended31

March

2017 2016

2017 2016

Cash flows from operating

activities Cash generated from operations (see

supplemental note 4)

48,070 14,493

71,220 45,601

Interest paid

(8,116 ) (8,419 )

(17,763

) (11,537 ) Interest received

113 129

424 246

Tax paid

(290 ) (296 )

(3,953 ) (1,898 )

Net cash generated from

operating activities 39,777 5,907

49,928 32,412

Cash

flows from investing activities Payments for property, plant

and equipment

(2,644 ) (207 )

(6,352 )

(783 ) Proceeds from sale of property, plant and equipment

-

-

- 19 Payments for investment property

- -

(659 ) - Payments for intangible assets

(4,871

) (17,048 )

(170,282 ) (112,940 ) Proceeds

from sale of intangible assets

11,537

956

50,605 36,729

Net

cash generated from/(used in) investing activities

4,022 (16,299 )

(126,688

) (76,975 )

Cash flows from financing

activities Repayment of borrowings

(101 ) (94 )

(295 ) (277 ) Dividends paid

(11,824

) (10,191 )

(11,824 )

(15,004 )

Net cash used in financing activities

(11,925 ) (10,285 )

(12,119

) (15,281 )

Net increase/(decrease) in cash and

cash equivalents 31,874 (20,677 )

(88,879

) (59,844 ) Cash and cash equivalents at beginning of period

122,704 121,611

229,194 155,752 Effects of exchange

rate changes on cash and cash equivalents

(1,925

) 3,268

12,338

8,294

Cash and cash equivalents at end of period

152,653 104,202

152,653 104,202

SUPPLEMENTAL NOTES

1 General information

Manchester United plc (the “Company”) and its subsidiaries

(together the “Group”) is a professional football club together

with related and ancillary activities. The Company incorporated

under the Companies Law (2011 Revision) of the Cayman Islands, as

amended and restated from time to time.

2 Reconciliation of (loss)/profit for the period to

adjusted EBITDA

Three months ended31

March

Nine months ended31

March

2017

£’000

2016

£’000

2017

£’000

2016

£’000

(Loss)/profit for the period (3,769 )

13,761

14,925 37,328 Adjustments: Tax

(credit)/expense

(3,632 ) 5,903

3,564 15,391

Net finance costs

3,278 3,562

21,181 12,635

Loss/(profit) on disposal of intangible assets

1,521 (1,950

)

(7,599 ) 4,838 Exceptional credit

- -

(4,753 ) - Amortization

30,138 21,164

95,159 64,950 Depreciation

2,458 2,524

7,721 7,491

Adjusted EBITDA

29,994

44,964

130,198

142,633

3 Reconciliation of (loss)/profit for the period to

adjusted (loss)/profit for the period and adjusted basic and

diluted (loss)/earnings per share

Three months ended31

March

Nine months ended31

March

2017

£’000

2016

£’000

2017

£’000

2016

£’000

(Loss)/profit for the period (3,769 )

13,761

14,925 37,328 Exceptional credit

- -

(4,753 ) - Foreign exchange (gains)/losses

on unhedged US dollar borrowings

(2,943 ) (242 )

4,151 972 Fair value movement on derivative financial

instruments

645 (1,351 )

344 (4,263 ) Tax

(credit)/expense

(3,632 ) 5,903

3,564 15,391 Adjusted

(loss)/profit before tax

(9,699 ) 18,071

18,231 49,428

Adjusted tax credit/(expense) (using a

normalised tax rate of 35% (2016: 35%))

3,395 (6,325 )

(6,381

) (17,300 )

Adjusted (loss)/profit for the period

(i.e. adjusted net income) (6,304 )

11,746

11,850 32,128

Adjusted basic (loss)/earnings per share: Adjusted

basic (loss)/earnings per share (pence)

(3.84 ) 7.17

7.22 19.60 Weighted average number of ordinary shares

outstanding (thousands)

164,025 163,892

164,025

163,889

Adjusted diluted (loss)/earnings per share: Adjusted

diluted (loss)/earnings per share (pence)1

(3.84 )

7.15

7.21 19.56 Weighted average number of ordinary shares

outstanding (thousands)

164,025 164,288

164,448 164,288 1

For the three months ended 31 March 2017 potential ordinary shares

are anti-dilutive, as their inclusion in the diluted loss per share

calculation would reduce the loss per share, and hence have been

excluded.

4 Cash generated from operations

Three months ended31

March

Nine months ended31

March

2017

£’000

2016

£’000

2017

£’000

2016

£’000

(Loss)/profit for the period

(3,769 )

13,761

14,925 37,328 Tax (credit)/expense

(3,632 ) 5,903

3,564

15,391 (Loss)/profit before tax

(7,401

) 19,664

18,489 52,719 Depreciation

2,458

2,524

7,721 7,491 Amortization

30,138 21,164

95,159 64,950 Reversal of impairment

- -

(4,753 ) - Loss/(profit) on disposal of intangible

assets

1,521 (1,950 )

(7,599 ) 4,838 Net

finance costs

3,278 3,562

21,181 12,635 Loss on

disposal of property, plant and equipment

- -

- 10

Equity-settled share-based payments

498 375

1,436

1,170 Foreign exchange losses/(gains) on operating activities

1,526 (1,838 )

2,404 (3,695 ) Reclassified from

hedging reserve

1,161 345

2,407 1,008

(Increase)/decrease in inventories

(255 ) 211

(422 ) (1,293 ) Decrease/(increase) in trade and

other receivables

51,887 (12,605 )

33,270 1,774

Decrease in trade and other payables and deferred revenue

(36,741 ) (16,959 )

(98,073

) (96,006 )

Cash generated from operations

48,070 14,493

71,220 45,601

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170516005824/en/

Manchester United plcInvestor Relations:Cliff BatyChief

Financial Officer+44 161 868 8650ir@manutd.co.ukorMedia: Philip

TownsendManchester United plc+44 161 868

8148philip.townsend@manutd.co.ukorJim Barron / Michael HensonSard

Verbinnen & Co+ 1 212 687 8080JBarron@SARDVERB.com

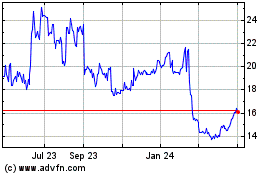

Manchester United (NYSE:MANU)

Historical Stock Chart

From Mar 2024 to Apr 2024

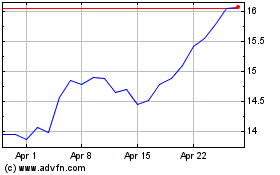

Manchester United (NYSE:MANU)

Historical Stock Chart

From Apr 2023 to Apr 2024