SPI Energy Co., Ltd. Reports Unaudited Interim Report for the Six-Month Ended June 30, 2016

May 16 2017 - 6:00AM

SPI Energy Co., Ltd. (“SPI Energy” or the “Company”) (NASDAQ:SPI),

a global clean energy market place for business, residential,

government and utility customers and investors, today reported its

unaudited interim report for the six months ended June 30, 2016.

As previously reported on January 13, 2017, the Company received

a letter from Nasdaq stating that the Company was not in compliance

with Nasdaq listing rules because the Company had not submitted on

a Form 6-K an interim balance sheet and income statement for

the six-month period ended June 30, 2016. In the letter, Nasdaq

requested that the Company submit a plan to regain compliance with

Nasdaq listing rules within 60 days.

As previously reported on March 20, 2017, the Company submitted

to Nasdaq a plan to regain compliance with Nasdaq listing rules and

Nasdaq granted an exception to enable the Company to regain

compliance, under the condition that the Company must submit its

interim balance sheet and income statement for the six-month period

ended June 30, 2016 on or before May 15, 2017.

The Company hereby furnishes its Unaudited Condensed

Consolidated Statements of Balance Sheet and Unaudited Condensed

Consolidated Statements of Operations for the six-month period

ended June 30, 2016 (the “Interim Report”) as attached in Exhibit

A. Upon filing of Form 6-K, the Company anticipates that it will

regain compliance with relevant Nasdaq listing rules solely with

respect to its failure to file its Interim Report.

The Company’s Interim Report is prepared and presented in

accordance with U.S. GAAP. However, they have not been audited or

reviewed by the Company’s independent registered accounting firm.

During the course of preparing the Interim Report, the Company

noted various significant outstanding and uncertain matters,

including but not limited to, its liquidity and ability to continue

as a going concern, contingent liabilities arising from

litigations, suspected related party transactions and unusual

transactions and compliance with laws and regulations. The Company

has formulated certain liquidity plan as previously disclosed on

its 2015 annual report on Form 20-F. However, the Company cannot

assure you that it will be able to successfully execute its

liquidity plan. The level of liquidity that the Company needs may

be greater than the Company currently anticipates as a result of

both general industry and market factors and Company-specific

factors, such as global economic slowdown, continued downturn in

the global PV market, changes in the regulatory and business

environments, and the ongoing dispute with the Company’s investors

regarding its Solarbao investment programs. All of these and other

factors and occurrences may increase the Company’s cash

requirements and make the Company unable to satisfy its liquidity

requirements and the Company may, as a result, be unable to

continue as a going concern.

The company is preparing and finalizing the Consolidated

Financial Statement as of and for the year ended December 31, 2016.

Further evidences obtained subsequently during the finalizing

process may provide additional information, which may cause the

Consolidated Statement of Financial Position and Consolidated

Statement of Operation as of and for the six-month period ended

June 31, 2016 to be adjusted accordingly. In addition, accounting

estimates and assumptions made in preparing the Company’s

consolidated financial statements for the financial year ended

December 31, 2016 may differ from that used in Interim Report due

to the differences in reporting periods and changes in the

Company’s financial conditions during those periods. As a result,

the Company cannot assure you that its consolidated financial

statements as of and for the year ended December 31, 2016 will not

contain significant difference, adjustment or discrepancies from

its Interim Report. The Company’s historical results do not

necessarily indicate results expected for any future periods.

Exhibit ASPI Energy Co., Ltd. Unaudited

Condensed Consolidated Statements of Balance Sheet and Unaudited

Condensed Consolidated Statements of Operations for the six-month

period ended June 30, 2016.

| SPI Energy Co., Ltd. |

| Unaudited Condensed Consolidated Balance

Sheet |

| (In thousands, except for share and per share

data) |

| |

|

|

|

|

| |

|

June 30, |

|

December 31, |

| |

|

2016 |

|

2015 |

| |

|

|

|

|

|

ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

| Cash and

cash equivalents |

|

$ |

31,015 |

|

|

$ |

82,124 |

|

|

Restricted cash |

|

|

7,443 |

|

|

|

83,191 |

|

| Accounts

receivable, net of allowance for doubtful accounts of $27,810 and

$36,553,respectively |

|

|

44,224 |

|

|

|

73,383 |

|

| Accounts

receivable, related party |

|

|

110 |

|

|

|

- |

|

| Notes

receivable |

|

|

9,680 |

|

|

|

3,541 |

|

| Costs and

estimated earnings in excess of billings on uncompleted contracts,

net ofallowance for doubtful accounts of $15,655 and nil,

respectively |

|

|

22,150 |

|

|

|

32,426 |

|

|

Inventories, net |

|

|

15,049 |

|

|

|

27,245 |

|

| Project

assets |

|

|

41,178 |

|

|

|

35,355 |

|

| Prepaid

expenses and other current assets |

|

|

44,034 |

|

|

|

41,197 |

|

| Other

receivable, related parties |

|

|

38 |

|

|

|

2,589 |

|

| Finance

lease receivable |

|

|

15,328 |

|

|

|

12,518 |

|

| Total

current assets |

|

|

230,249 |

|

|

|

393,569 |

|

|

Intangible assets |

|

|

4,409 |

|

|

|

4,526 |

|

|

Goodwill |

|

|

75,969 |

|

|

|

75,969 |

|

| Accounts

receivable, noncurrent |

|

|

7,652 |

|

|

|

7,463 |

|

| Other

receivable, noncurrent |

|

|

550 |

|

|

|

550 |

|

| Notes

receivable, noncurrent |

|

|

5,769 |

|

|

|

6,399 |

|

| Property,

plant and equipment, net |

|

|

124,485 |

|

|

|

125,793 |

|

| Project

assets, noncurrent |

|

|

48,281 |

|

|

|

60,371 |

|

|

Derivative asset |

|

|

- |

|

|

|

2,328 |

|

|

Investment in an affiliate |

|

|

11,913 |

|

|

|

13,950 |

|

| Deferred

tax assets, net |

|

|

832 |

|

|

|

848 |

|

| Finance

lease receivable, noncurrent |

|

|

39,260 |

|

|

|

17,804 |

|

| Total

assets |

|

$ |

549,369 |

|

|

$ |

709,570 |

|

| |

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

| Current

liabilities: |

|

|

|

|

| Accounts

payable |

|

$ |

77,420 |

|

|

$ |

97,803 |

|

| Accounts

payable, related parties |

|

|

7,723 |

|

|

|

5,128 |

|

| Notes

payable |

|

|

9,073 |

|

|

|

34,301 |

|

| Accrued

liabilities |

|

|

29,252 |

|

|

|

26,741 |

|

| Income

taxes payable |

|

|

3,716 |

|

|

|

4,002 |

|

| Advance

from customers |

|

|

25,656 |

|

|

|

19,693 |

|

| Short

term borrowings |

|

|

94,384 |

|

|

|

160,400 |

|

|

Convertible bonds |

|

|

55,000 |

|

|

|

54,062 |

|

| Other

current liabilities, related parties |

|

|

62 |

|

|

|

42 |

|

| Other

current liabilities |

|

|

36,661 |

|

|

|

71,379 |

|

| Total

current liabilities |

|

|

338,947 |

|

|

|

473,551 |

|

| Financing

and capital lease obligations |

|

|

23,194 |

|

|

|

8,796 |

|

| Long term

borrowings |

|

|

6,081 |

|

|

|

4,451 |

|

| Deferred

tax liability, net |

|

|

4,275 |

|

|

|

4,199 |

|

| Other

noncurrent liabilities |

|

|

42,469 |

|

|

|

2,015 |

|

| Total

liabilities |

|

|

414,966 |

|

|

|

493,012 |

|

| Commitments and

contingencies |

|

|

- |

|

|

|

- |

|

| Stockholders’

equity: |

|

|

|

|

| Common

stock, par $0.000001, 150,000,000,000 shares authorized,

respectively;641,665,172 and 639,065,172 shares issued and

outstanding, respectively |

|

|

64 |

|

|

|

64 |

|

|

Additional paid in capital |

|

|

481,771 |

|

|

|

475,492 |

|

|

Accumulated other comprehensive loss |

|

|

(17,707 |

) |

|

|

(16,509 |

) |

|

Accumulated deficit |

|

|

(333,122 |

) |

|

|

(246,068 |

) |

| Total

equity attributable to the shareholders of the Company |

|

|

131,006 |

|

|

|

212,979 |

|

| Noncontrolling

interests |

|

|

3,397 |

|

|

|

3,579 |

|

| Total stockholders’

equity |

|

|

134,403 |

|

|

|

216,558 |

|

| Total liabilities and

stockholders’ equity |

|

$ |

549,369 |

|

|

$ |

709,570 |

|

| |

|

|

|

|

| SPI Energy Co., Ltd. |

| Unaudited Condensed Consolidated Statements of

Operation |

| (In thousands, except for share and per share

data) |

| |

|

|

|

|

| |

|

For the Six Months Ended |

| |

|

June 30, |

| |

|

2016 |

|

2015 |

| Net

sales: |

|

|

|

|

| Net

sales |

|

$ |

65,396 |

|

|

$ |

59,879 |

|

| Cost of

goods sold: |

|

|

|

|

| Cost of

goods sold |

|

|

(54,856 |

) |

|

|

(48,954 |

) |

| Provision

for losses on contracts |

|

|

(396 |

) |

|

|

(329 |

) |

| Total

cost of goods sold |

|

|

(55,252 |

) |

|

|

(49,283 |

) |

| Gross

profit |

|

|

10,144 |

|

|

|

10,596 |

|

| Operating

expenses: |

|

|

|

|

| General

and administrative |

|

|

17,284 |

|

|

|

49,915 |

|

| Sales,

marketing and customer service |

|

|

16,525 |

|

|

|

12,404 |

|

| Provision

for doubtful accounts and notes and impairmentchanges |

|

|

52,560 |

|

|

|

- |

|

| Total

operating expenses |

|

|

86,369 |

|

|

|

62,319 |

|

| Operating loss |

|

|

(76,225 |

) |

|

|

(51,723 |

) |

| Other income

(expense): |

|

|

|

|

| Interest

expense |

|

|

(3,796 |

) |

|

|

(3,878 |

) |

| Interest

income |

|

|

830 |

|

|

|

1,665 |

|

| Change in

fair value of derivative asset/liability |

|

|

(2,328 |

) |

|

|

- |

|

| Loss on

investment in affiliates |

|

|

(6,551 |

) |

|

|

- |

|

| Net

foreign exchange gain |

|

|

1,309 |

|

|

|

3,443 |

|

|

Others |

|

|

(324 |

) |

|

|

142 |

|

| Total

other expense, net |

|

|

(10,860 |

) |

|

|

1,372 |

|

| Loss before income

taxes |

|

|

(87,085 |

) |

|

|

(50,351 |

) |

| Income

tax expense |

|

|

(255 |

) |

|

|

(1,306 |

) |

| |

|

|

|

|

| Net loss |

|

$ |

(87,340 |

) |

|

$ |

(51,657 |

) |

| Net loss

attributable to noncontrolling interests |

|

|

(286 |

) |

|

|

(53 |

) |

| Net loss attributable

to stockholders of the Company |

|

$ |

(87,054 |

) |

|

$ |

(51,604 |

) |

| Net loss

per common share: |

|

|

|

|

| Basic and

Diluted |

|

|

(0.14 |

) |

|

|

(0.09 |

) |

| Weighted

average number of common shares used in computing per

shareamounts: |

|

|

|

|

| Basic and

Diluted |

|

|

641,457,479 |

|

|

|

595,100,462 |

|

| |

|

|

|

|

About SPI Energy Co., Ltd.

SPI Energy Co., Ltd. is a global provider of

photovoltaic (PV) solutions for business, residential, government

and utility customers and investors. SPI Energy focuses on the

downstream PV market including the development, financing,

installation, operation and sale of utility-scale and residential

solar power projects in China, Japan, Europe and North America. The

Company operates an innovative online energy e-commerce and

investment platform, www.solarbao.com, which enables individual and

institutional investors to purchase innovative PV-based investment

and other products; as well as www.solartao.com, a B2B e-commerce

platform offering a range of PV products for both upstream and

downstream suppliers and customers. The Company has its operating

headquarters in Hong Kong and maintains global operations in Asia,

Europe, North America and Australia. For additional information,

please visit: www.spisolar.com

Safe Harbor Statement

This release contains certain “forward-looking

statements.” These statements are forward-looking in nature and

subject to risks and uncertainties that may cause actual results to

differ materially. All forward-looking statements included in this

release are based upon information available to the Company as of

the date of this release, which may change, and the Company

undertakes no obligation to update or revise any forward-looking

statements, except as may be required under applicable securities

law.

For investors and media inquiries please contact:

SPI Energy Co., Ltd.

IR Department

Email: ir@spisolar.com

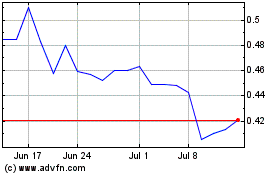

SPI Energy (NASDAQ:SPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

SPI Energy (NASDAQ:SPI)

Historical Stock Chart

From Apr 2023 to Apr 2024