Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

May 15 2017 - 5:09PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus filed pursuant to Rule 433

supplementing the Preliminary Prospectus Supplement dated May 15, 2017

and the Prospectus dated June 4, 2015

Registration No. 333-203444

Pricing Term Sheet

May 15, 2017

4.200% Senior Notes due May 15, 2047

|

Issuer:

|

W.W. Grainger, Inc.

|

|

|

|

|

Principal Amount:

|

$400,000,000

|

|

|

|

|

Ratings (Moody’s / S&P):*

|

(A2 Negative / A+ Stable)

|

|

|

|

|

Maturity Date:

|

May 15, 2047

|

|

|

|

|

Coupon (Interest Rate):

|

4.200% per annum

|

|

|

|

|

Price to Public:

|

99.646% of Principal Amount

|

|

|

|

|

Yield to Maturity:

|

4.221%

|

|

|

|

|

Benchmark Treasury:

|

3.000% due February 15, 2047

|

|

|

|

|

Spread to Benchmark Treasury:

|

+120 bps

|

|

|

|

|

Benchmark Treasury Price / Yield:

|

99-19 / 3.021%

|

|

|

|

|

Interest Payment Dates:

|

May 15 and November 15, commencing November 15, 2017

|

|

|

|

|

Make-whole Call:

|

Prior to November 15, 2046, make-whole call at Treasury rate plus 20 basis points

|

|

|

|

|

Par Call:

|

On or after November 15, 2046

|

|

|

|

|

Trade Date:

|

May 15, 2017

|

|

|

|

|

Settlement Date:

|

May 22, 2017 (T+5)

|

|

|

|

|

CUSIP / ISIN:

|

384802AD6 / US384802AD60

|

|

|

|

|

Joint Book-Running Managers:

|

Morgan Stanley & Co. LLC

J.P. Morgan Securities LLC

U.S. Bancorp Investments, Inc.

Barclays Capital Inc.

RBC Capital Markets, LLC

|

Pro Forma Ratio of Earnings to Fixed Charges:

As adjusted to give effect to the issuance of the notes in this offering and the application of the net proceeds from this offering as described in “Use of Proceeds” in the prospectus supplement, and assuming the offering had been completed on (i) January 1, 2017, the ratio of earnings to fixed charges would have been 11.1x for the three months ended March 31, 2017 and (ii) January 1, 2016, the ratio of earnings to fixed charges would have been 10.3x for the year ended December 31, 2016. The pro forma ratio of earnings to fixed charges does not necessarily represent what the actual ratio of earnings to fixed charges would have been had those transactions occurred on the date assumed.

*Note: An explanation of the significance of ratings may be obtained from the ratings agencies. Generally, ratings agencies base their ratings on such material and information, and such of their own investigations, studies and assumptions, as they deem appropriate. The security ratings above are not a recommendation to buy, sell or hold the securities offered hereby. The ratings may be subject to review, revision, suspension, reduction or withdrawal at any time by the rating agencies. Each of the security ratings above should be evaluated independently of any other security rating.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus and supplement(s) thereto, if you request it by calling Morgan Stanley & Co. LLC toll-free at 1-866-718-1649, J.P. Morgan Securities LLC collect at 1-212-834-4533 and U.S. Bancorp Investments, Inc. toll-free at 1-877-558-2607.

2

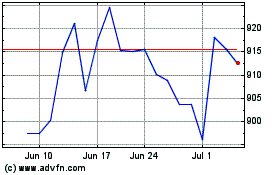

WW Grainger (NYSE:GWW)

Historical Stock Chart

From Mar 2024 to Apr 2024

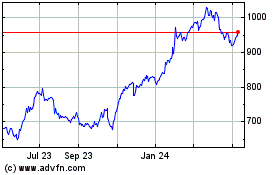

WW Grainger (NYSE:GWW)

Historical Stock Chart

From Apr 2023 to Apr 2024