A Toshiba Sale Hits Resistance -- WSJ

May 15 2017 - 3:03AM

Dow Jones News

By Ted Greenwald

Western Digital Corp. on Sunday ratcheted up the pressure in its

dispute with Toshiba Corp., filing a request for binding

arbitration to prevent the troubled Japanese company from selling

its stake in operations jointly owned by the two companies.

In its arbitration request, Western Digital claims Toshiba

breached its contract by transferring its interest in the

flash-memory joint ventures to an affiliated company without

Western Digital's consent.

The request is the latest spat between Western Digital and

Toshiba, which is trying to sell its profitable memory-chip

business in an effort to bolster its ailing finances. Western

Digital, which jointly owns a flash-memory semiconductor plant in

Japan with Toshiba, has said the Japanese company promised not to

sell its stake without Western Digital's approval.

Toshiba has accused Western Digital of interfering with the

chip-business sale and threatened to sue the California company

unless it drops the breach-of-contract assertion.

A Toshiba spokesman on Monday declined to comment specifically

on Western Digital's arbitration request but reiterated his

company's view that the planned sale doesn't violate any agreement

between the two firms and that Western Digital has no right to stop

it.

Western Digital said Sunday that the contracts forming the joint

ventures, which involve NAND flash-memory chips used in data

storage, include provisions that require one party's consent before

the other party can sell its stake. Western Digital also said the

agreements allow one party to seek arbitration and an injunction if

it believes the other party has breached the terms.

A panel in San Francisco will hear the arbitration under the

rules of the International Chamber of Commerce, as required by the

joint-venture agreements, Western Digital said. The arbitration

would kick off a legal process that could take more than a

year.

Toshiba in its most recent earnings report warned that its

future was uncertain after losses at its U.S. nuclear unit,

Westinghouse Electric Co., which filed for bankruptcy in March.

Toshiba has said the sale of the chip business is crucial to its

survival.

On Monday, Toshiba said it expected to book a net loss of Yen950

billion ($8.4 billion) for the fiscal year ended March 31 due to

losses stemming from the Westinghouse filing. For the current

fiscal year, Toshiba said it expected to book a net profit of Yen50

billion.

Several companies are bidding for the Toshiba semiconductor

unit, including Western Digital as well as Foxconn Technology Group

of Taiwan, SK Hynix Inc. of South Korea, and U.S.-based Broadcom

Ltd. The joint ventures at issue originally were formed between

Toshiba and SanDisk Corp., a supplier of memory for smartphones.

Western Digital acquired SanDisk in 2016.

--Takashi Mochizuki in Tokyo contributed to this article.

Write to Ted Greenwald at Ted.Greenwald@wsj.com

(END) Dow Jones Newswires

May 15, 2017 02:48 ET (06:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

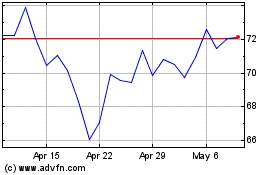

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Mar 2024 to Apr 2024

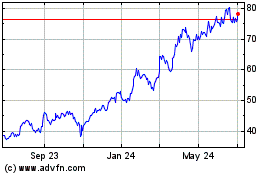

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Apr 2023 to Apr 2024