Insurers' ill-fated $48 billion tie-up hits dead end, but battle

over damages looms

By Anna Wilde Mathews and Brent Kendall

Anthem Inc. said it would finally give up on its ill-starred

deal for Cigna Corp., setting the stage for a rancorous court

battle between the companies over billions in potential

damages.

The fight will play out in a Delaware court where each company

has sued the other, both alleging breaches of their merger

agreement. Late Thursday, a Delaware judge denied Anthem's request

to keep Cigna locked in the $48 billion deal as Anthem continued

trying to overcome antitrust rulings against the combination -- but

he also signaled that Anthem appeared to have a good chance of

proving its case that Cigna had violated their pact.

Anthem and Cigna originally unveiled their deal in July 2015,

amid a frenzy of health-insurer deal-making that aimed to

consolidate the top of the industry into a few behemoths that could

wield enormous negotiating heft. But behind-the-scenes conflict

between the two partners quickly set in, even as they publicly

moved forward with their combination. Last year, the Justice

Department filed an antitrust suit to block the deal, which would

have created a company with a huge footprint in commercial

insurance. A federal judge ruled against the merger in February and

an appeals court upheld that decision last month. Anthem had sought

to appeal that verdict to the Supreme Court.

But Anthem said Friday that it was giving Cigna notice that it

was terminating the merger agreement. Anthem immediately reiterated

its argument that its erstwhile partner sabotaged the deal, and it

said Cigna isn't entitled to the $1.85 billion breakup fee laid out

in the merger agreement. The bigger insurer said it would seek to

claim "massive damages" against Cigna.

Cigna, for its part, wants the $1.85 billion and an additional

$13 billion in damages from Anthem. In a statement Friday, Cigna

said it believed Anthem didn't use its "reasonable best efforts" to

get regulatory approval, and as a result the acquisition was

blocked. Cigna said it seeks the damages against Anthem "for the

harm that it caused Cigna and its shareholders." It also said it

would ramp up its share repurchases in the wake of the deal's

formal termination.

Jeffrey S. Jacobovitz, an antitrust lawyer with Arnall Golden

Gregory LLP, said it isn't uncommon for there to be hard feelings

between merging companies when a deal goes sour, "but you never

really see bad blood like you've seen here." The situation "was

highly unusual, particularly for two companies that wanted to get

married, at least at the start," Mr. Jacobovitz said. The

hostilities appeared even deeper than in a normal hostile-takeover

transaction, he added.

The Delaware judge who will oversee the dueling Anthem and Cigna

suits, Vice Chancellor J. Travis Laster, of the Delaware Chancery

Court, said in his Thursday decision that Anthem "has a reasonable

probability of prevailing on its claim" that Cigna breached the

deal terms. The record in the antitrust proceedings indicates that

"Cigna did not oppose the antitrust lawsuit fully or vigorously, as

it was required to do," he said. However, he said it was a "tossup"

whether Anthem would be able to prove that Cigna's actions led to

the deal's failure to win antitrust approvals.

The judge also wrote that if Anthem's account of Cigna's

behavior is correct, "then the damages it can recover from Cigna

are potentially massive. ... At this point, in my view, a damages

award is the only realistic form of relief."

A long and bitter legal road lies ahead, as the two sides spar

over who did what to whom and rehash the troubled history of their

deal.

The fight is already intensely personal, with Anthem accusing

Cigna's chief executive, David Cordani, along with others at the

company, of working against the deal after Mr. Cordani was at one

point offered a postmerger position that fell short of the scope he

thought was due to him. "Furious that he was not being provided

with all of the postmerger powers that he desired, Cordani walked

out of the meeting and never again would meet with [Anthem CEO

Joseph R.] Swedish one-on-one," Anthem said in a filing.

Anthem said that Mr. Cordani was later offered broader

responsibilities but "Cordanni, nonetheless, disengaged from the

merger process and Cigna embarked on an unprecedented campaign to

sabotage the merger and procure a $1.85 billion termination fee."

Anthem said Cigna hired lawyers specifically to focus on ensuring

it could get the termination fee, and it undermined Anthem's

arguments for the deal in the antitrust case.

For its part, Cigna argues that the merger failed to pass

antitrust muster because of the strategy that Anthem chose in

defending the deal, which Cigna says was selected over its

objections. Cigna said in a filing that Mr. Swedish and another

Anthem executive plotted to "'get rid of Cordani' even before the

merger agreement was negotiated and were still discussing their

desire to 'take him out' months after the deal was signed." At

another point, Cigna said, Mr. Swedish called Mr. Cordani "a

'bully' and refused to meet with him."

Cigna said that it "undertook enormous efforts toward

integration."

Even when merger partners have tensions in the wake of a failed

deal, litigation is unusual, said Jonathan Corsico, an attorney at

Gibson, Dunn & Crutcher. Usually, executives say, "'it's over,

let's move on,'" he said. Also, many contingencies for a blocked

deal are pre-negotiated in the merger agreement, heading off

suits.

It is also rare for merging companies to work at cross-purposes

during a government antitrust review and court case. For instance,

the Anthem-Cigna situation stands in contrast to court proceedings

in 2015, when the Justice Department challenged Electrolux AB's

planned $3.3 billion purchase of General Electric Co.'s appliance

business. GE participated in the merger defense with Electrolux,

even as it was considering exercising its right to terminate the

deal.

GE, facing an improved market for its business, ultimately

walked away from the merger during the court case, and later sold

its appliance business to Chinese manufacturer Haier Group for $5.4

billion.

There has been recent litigation involving other quarrelsome

merger partners, although under different circumstances.

Abbott Laboratories, for example, last year agreed to acquire

Alere Inc. but the deal produced tensions, with both sides going to

court. Alere filed a lawsuit to force Abbott to complete the

transaction, while Abbott filed suit seeking to get out of it,

saying that developments had reduced Alere's value. The two sides

reached a pact last month, with Abbott agreeing to pay a lower

price for Alere.

--Anne Steele contributed to this article.

Write to Anna Wilde Mathews at anna.mathews@wsj.com and Brent

Kendall at brent.kendall@wsj.com

(END) Dow Jones Newswires

May 13, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

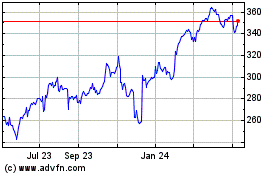

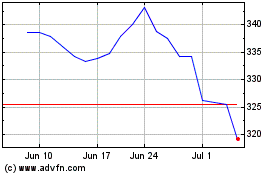

Cigna (NYSE:CI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cigna (NYSE:CI)

Historical Stock Chart

From Apr 2023 to Apr 2024