Current Report Filing (8-k)

May 11 2017 - 5:17PM

Edgar (US Regulatory)

UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event

Reported): May 10, 2017

Atossa Genetics Inc.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

|

001-35610

|

|

26-4753208

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

107 Spring Street

Seattle, Washington

|

|

98104

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code: (206) 325-6086

Not Applicable

Former name or former address, if changed

since last report

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 2.02. Results of Operations and Financial Condition.

On May 11, 2017, Atossa Genetics Inc. (the “Company”)

issued a press release announcing first quarter 2017 financial results and a company update. A copy of the press release is attached

as Exhibit 99.1 to this current report and is incorporated herein by reference.

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued

Listing Rule or Standard; Transfer of Listing.

On May 11, 2017, the Company received a letter from NASDAQ that

the Company was not in compliance with NASDAQ Listing Rule 5550(a)(2) – bid price, because the Company's common stock failed

to maintain a minimum closing bid price of $1.00 per share for 30 consecutive business days. The Company has until November 7,

2017 to regain compliance. In the event the Company does not regain compliance by then, the Company may be eligible for additional

time if at that time it meets the continued listing requirement for market value of publicly held shares and all other initial

listing standards, with the exception of the bid price requirement, and provides written notice to NASDAQ of its intention to cure

the deficiency during the second compliance period, including by effecting a reverse stock split, if necessary. The letter also

states that the NASDAQ staff will provide written notification that the Company has regained compliance if the bid price of the

Company's common stock closes at $1.00 per share or more for a minimum of 10 consecutive business days.

The NASDAQ notice has no immediate effect on the listing or trading

of the Company’s common stock on the NASDAQ Stock Market. The Company intends to actively monitor the bid price for its common

stock between now and November 7, 2017, and will consider available options to resolve the deficiency and regain compliance with

the minimum bid price requirement.

Item 5.07. Submission of Matters to a Vote of Security

Holders

On May 9, 2017, the Company held its 2017 Annual Meeting of

Stockholders (the “Annual Meeting”). The following items of business were considered and voted upon at the Annual Meeting:

(1) the election of two Class II directors named in the proxy statement; (2) the ratification of the selection of BDO USA LLP as

our independent registered public accounting firm for the fiscal year ending December 31, 2017; (3) the approval to increase authorized

shares under Atossa Genetics 2010 Stock Option and Incentive Plan by 1,500,000 shares; and (4) the transaction of any other business

that may properly come before the meeting or any adjournment thereof.

The number of shares of common stock entitled to vote at the

Annual Meeting was 6,008,913. The number of shares of common stock present or represented by valid proxy at the annual meeting

was 3,133,002. All proposals passed. The number of votes cast for and against, and the number of abstentions and broker non-votes

with respect to the matters voted upon at the Annual Meeting are set forth below:

|

|

(i)

|

Election of two Class II Directors

|

The stockholders elected two Class II directors as set forth

below:

|

Nominee

|

|

Votes For

|

|

|

Votes Withheld

|

|

|

Broker Non-Votes

|

|

|

Dr. Stephen Galli

|

|

|

1,298,422

|

|

|

|

0

|

|

|

|

1,834,580

|

|

|

Richard Steinhart

|

|

|

1,283,042

|

|

|

|

15,380

|

|

|

|

1,834,580

|

|

|

|

(ii)

|

Ratification of Auditors

|

The stockholders ratified the appointment of BDO USA LLP as

the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2017 as set forth below:

|

Votes For

|

|

|

Votes Against

|

|

|

Abstain

|

|

|

Broker Non-Votes

|

|

|

|

3,094,484

|

|

|

|

17,837

|

|

|

|

20,681

|

|

|

|

0

|

|

|

|

(iii)

|

Increase Authorized Shares under Option Plan

|

The stockholders approved an increase of 1,500,000 shares to

the option plan as follows:

|

Votes For

|

|

|

Votes Against

|

|

|

Abstain

|

|

|

Broker Non-Votes

|

|

|

|

857,839

|

|

|

|

432,020

|

|

|

|

8,563

|

|

|

|

1,834,580

|

|

The information in the report, including Exhibit 99.1 attached

hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended,

or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended.

The information contained herein and in the accompanying exhibit shall not be incorporated by reference into any filing with the

U.S. Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general

incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

Press Release, dated May 11, 2017

|

* * *

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: May 11, 2017

|

Atossa Genetics Inc.

|

|

|

|

|

|

|

|

By:

|

/s/ Kyle Guse

|

|

|

|

|

Kyle Guse

|

|

|

|

|

Chief Financial Officer, General Counsel and Secretary

|

|

Exhibit Index

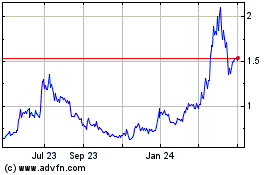

Atossa Therapeutics (NASDAQ:ATOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Atossa Therapeutics (NASDAQ:ATOS)

Historical Stock Chart

From Apr 2023 to Apr 2024