Koss Corp Releases Third Quarter Results

May 11 2017 - 5:15PM

Koss Corporation (NASDAQ:KOSS), the U.S. based high-fidelity

headphone company, has reported its third quarter results for the

quarter ended March 31, 2017.

Sales for the third quarter were $4,773,915,

which is a 20.5% decrease from sales of $6,002,059 for the same

three month period one year ago. The three month net loss was

$1,117,582, compared to net income of $869,686 for the third

quarter last year. Diluted and basic loss per common share

for the quarter was $0.15 compared to income per common share of

$0.12 for the three month period one year ago.

"Sales were weak in the quarter with continued

decrease in orders from distributors in Asia and Scandinavia as

well as lower demand for the OEM products in Asia. The lower

order volume is driven by distributors working off inventory levels

as well as the continued strength of the dollar," Michael J. Koss,

Chairman and CEO, told employees here today. "Earnings were

negatively impacted by the low export sales and a charge to

earnings to write down the inventory value on a group of

products."

In the three months ended March 31, 2017, a

valuation allowance was established against deferred tax assets

resulting in a charge of $444,000 to income tax expense. The

net income for the three months ended March 31, 2016 included the

benefit of settling a lawsuit.

Sales for the nine months ended March 31, 2017

decreased by 5.1% to $17,810,418 compared with $18,762,662 for the

same nine month period a year ago. Nine month net loss was

$893,259 compared to net income of $1,155,513 for the same nine

months last year. Diluted and basic loss per common share was

$0.12 for the nine months ended March 31, 2017, compared with

income of $0.16 for the same nine month period a year

ago.

In the first nine months, sales to the OEM

customer in Asia combined with improved sales to domestic

distributors partially offset the decline in sales to distributors

in Scandinavia, Asia and Africa. In the domestic market, Koss

also had increased sales through on-line retail.

"While traditional brick and mortar retail

continues to be a key component of our distribution, we are fully

aware of the sweeping changes happening in traditional retail that

will continue to have a negative impact on headphone offerings as

more retail outlets close stores," Koss continued. "Our direct to

consumer initiatives are designed to make our products easier to

access than ever before by using the on-line channels that

consumers around the world are choosing now more than ever."

Koss Corporation markets a complete line of

high-fidelity headphones, wireless Bluetooth® speakers, computer

headsets, telecommunications headsets, active noise canceling

headphones, wireless headphones, and compact disc recordings of

American Symphony Orchestras on the Koss Classics®

label.

This press release contains forward-looking statements. These

statements relate to future events or our future financial

performance. In some cases, you can identify forward-looking

statements by terminology such as "anticipates," "believes,"

"estimates," "expects," "intends," "plans," "may," "will,"

"should," "forecasts," "predicts," "potential," "continue," or the

negative of such terms and other comparable terminology.

These statements are based on currently available operating,

financial and competitive information and are subject to various

risks and uncertainties. Actual events or results may differ

materially. In evaluating forward-looking statements, you

should specifically consider various factors that may cause actual

results to vary from those contained in the forward-looking

statements, such as general economic conditions, in particular,

consumer demand for the Company's and its customers' products,

competitive and technological developments, foreign currency

fluctuations, and costs of operations. Shareholders,

potential investors and other readers are urged to consider these

factors carefully in evaluating the forward-looking statements and

are cautioned not to place undue reliance on such forward-looking

statements. The forward-looking statements made herein are

only made as of the date of this press release and the Company

undertakes no obligation to publicly update such forward-looking

statements to reflect subsequent events or circumstances or new

information. In addition, such uncertainties and other

operational matters are discussed further in the Company's

quarterly and annual filings with the Securities and Exchange

Commission.

|

|

| KOSS CORPORATIONCONDENSED

CONSOLIDATED STATEMENTS OF

INCOME(Unaudited) |

|

|

| |

|

Three Months Ended |

|

Nine Months Ended |

| |

|

March 31 |

|

March 31 |

| |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| Net sales |

|

$ |

4,773,915 |

|

|

$ |

6,002,059 |

|

|

$ |

17,810,418 |

|

|

$ |

18,762,662 |

|

| Cost of goods sold |

|

3,823,613 |

|

|

3,889,719 |

|

|

12,711,146 |

|

|

12,341,164 |

|

| Gross profit |

|

950,302 |

|

|

2,112,340 |

|

|

5,099,272 |

|

|

6,421,498 |

|

| |

|

|

|

|

|

|

|

|

| Selling, general and

administrative expenses |

|

1,965,698 |

|

|

2,105,740 |

|

|

5,728,860 |

|

|

5,860,601 |

|

| Unauthorized

transaction related costs (recoveries), net |

|

39,663 |

|

|

(1,360,951 |

) |

|

73,759 |

|

|

(1,286,001 |

) |

| Interest expense |

|

— |

|

|

— |

|

|

964 |

|

|

6,075 |

|

| (Loss)

income before income tax provision |

|

(1,055,059 |

) |

|

1,367,551 |

|

|

(704,311 |

) |

|

1,840,823 |

|

| |

|

|

|

|

|

|

|

|

| Income tax

provision |

|

62,523 |

|

|

497,865 |

|

|

188,948 |

|

|

685,310 |

|

|

|

|

|

|

|

|

|

|

|

| Net

(loss) income |

|

$ |

(1,117,582 |

) |

|

$ |

869,686 |

|

|

$ |

(893,259 |

) |

|

$ |

1,155,513 |

|

| |

|

|

|

|

|

|

|

|

| (Loss) income per

common share: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.15 |

) |

|

$ |

0.12 |

|

|

$ |

(0.12 |

) |

|

$ |

0.16 |

|

|

Diluted |

|

$ |

(0.15 |

) |

|

$ |

0.12 |

|

|

$ |

(0.12 |

) |

|

$ |

0.16 |

|

CONTACT:

Michael J. Koss

Chairman & CEO

(414) 964-5000

mjkoss@koss.com

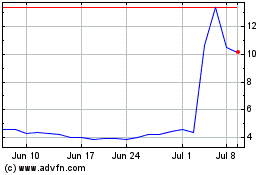

Koss (NASDAQ:KOSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

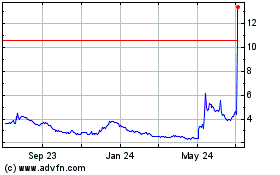

Koss (NASDAQ:KOSS)

Historical Stock Chart

From Apr 2023 to Apr 2024