Net loss improved to $(1.4) million for the

three months ended March 31, 2017 compared to $(1.5) million for

the three months ended March 31, 2016

Luna Innovations Incorporated (NASDAQ: LUNA) today announced its

financial results for the three months ended March 31,

2017.

For the three months ended March 31, 2017, Luna reported

revenues of $13.1 million and a net loss of $(1.4) million compared

to revenues of $14.0 million and a net loss of $(1.5) million for

the three months ended March 31, 2016. Adjusted earnings before

interest, taxes, depreciation and amortization ("Adjusted EBITDA")

was $0.1 million for the three months ended March 31, 2017 and

2016. A reconciliation of net loss to Adjusted EBITDA can be found

in the schedules included in this release.

“As we described last quarter, with the transition to a new

vendor managed inventory arrangement with our largest customer in

Asia as of January 1, 2017, we shipped fewer of our 100G integrated

coherent receivers during the first quarter of 2017 than we did in

the first quarter of 2016. As a result, our overall products and

licensing revenue declined year over year," said My Chung,

president and chief executive officer of Luna. "We anticipate the

market for 100G products to return to significant growth in the

second half of this year, driven by the build-out of metro networks

in China and the adoption of our second generation 100G integrated

coherent receivers. We remain focused on the execution of our key

strategic growth initiatives, and continue to be excited about the

growth opportunities they provide for the full year of 2017 and

beyond."

First Quarter Financial

Summary

Total revenues for the three months ended March 31, 2017

were $13.1 million compared to $14.0 million for the three months

ended March 31, 2016. Technology development revenues

increased 15% to $4.3 million for the three months ended March 31,

2017, compared to $3.7 million for the three months ended March 31,

2016. Products and licensing revenues were $8.8 million for the

three months ended March 31, 2017, compared to $10.3 million

for the three months ended March 31, 2016. The decline in products

and licensing revenues year over year resulted primarily from lower

sales of 100G receivers in Asia compared to the first quarter of

the previous year as Luna transitioned to a new vendor managed

inventory arrangement with its largest customer in that region.

Gross profit was $4.7 million, or 36% of revenues, for the three

months ended March 31, 2017, compared to gross profit of $4.8

million, or 35% of revenues, for the three months ended

March 31, 2016.

Selling, general and administrative expenses were $4.5 million

for the three months ended March 31, 2017, compared to $4.6

million for the three months ended March 31, 2016.

Research, development and engineering expenses decreased to $1.4

million for the three months ended March 31, 2017 compared to $1.6

million for the three months ended March 31, 2016.

Operating loss improved to $(1.3) million for the three months

ended March 31, 2017, compared to an operating loss of $(1.4)

million for the three months ended March 31, 2016. Net loss

attributable to common stockholders improved to $(1.4) million for

the three months ended March 31, 2017, compared to a net loss

attributable to common stockholders of $(1.5) million for the three

months ended March 31, 2016. Adjusted EBITDA was unchanged at

$(0.1) million for the three months ended March 31, 2017 and

2016.

Non-GAAP Measures

In evaluating the operating performance of its business, Luna’s

management considers Adjusted EBITDA, which excludes certain

charges and credits that are required by generally accepted

accounting principles (“GAAP”). Adjusted EBITDA provides useful

information to both management and investors by excluding the

effect of certain non-cash expenses and items that Luna believes

may not be indicative of its operating performance, because either

they are unusual and Luna does not expect them to recur in the

ordinary course of its business or they are unrelated to the

ongoing operation of the business in the ordinary course. Adjusted

EBITDA should be considered in addition to results prepared in

accordance with GAAP, but should not be considered a substitute

for, or superior to, GAAP results. Adjusted EBITDA has been

reconciled to the nearest GAAP measure in the table following the

financial statements attached to this press release.

Conference Call

Information

As previously announced, Luna will conduct an investor

conference call at 5:00 p.m. (EDT) today to discuss its financial

results for the three months ended March 31, 2017, and recent

business developments. The call can be accessed by dialing

844.578.9643 domestically or 270.823.1522 internationally prior to

the start of the call. The participant access code is 18890708.

Investors are advised to dial in at least five minutes prior to the

call to register. The conference call will also be webcast live

over the Internet. The webcast can be accessed by logging on to the

“Investor Relations” section of the Luna website, www.lunainc.com, prior to the event. The webcast

will be archived under the “Webcasts and Presentations” section of

the Luna website for at least 30 days following the conference

call.

About Luna

Luna Innovations Incorporated (www.lunainc.com) is a leader in

optical technology, providing unique capabilities in high speed

optoelectronics and high performance fiber optic test products for

the telecommunications industry and distributed fiber optic sensing

for the aerospace and automotive industries. Luna is organized into

two business segments, which work closely together to turn ideas

into products: a Technology Development segment and a Products and

Licensing segment. Luna's business model is designed to accelerate

the process of bringing new and innovative technologies to

market.

Forward-Looking

Statements

The statements in this release that are not historical facts

constitute “forward-looking statements” made pursuant to the safe

harbor provision of the Private Securities Litigation Reform Act of

1995 that involve risks and uncertainties. These statements include

Luna's expectations regarding Luna’s future financial performance,

the significant growth of the market for Luna's 100G products in

the second half of 2017, the adoption of Luna's second generation

100G integrated coherent receivers, and additional potential growth

opportunities. Management cautions the reader that these

forward-looking statements are only predictions and are subject to

a number of both known and unknown risks and uncertainties, and

actual results, performance, and/or achievements of Luna may differ

materially from the future results, performance, and/or

achievements expressed or implied by these forward-looking

statements as a result of a number of factors. These factors

include, without limitation, failure of demand for Luna's products

and services to meet expectations, technological challenges and

those risks and uncertainties set forth in Luna’s periodic reports

and other filings with the Securities and Exchange Commission

("SEC"). Such filings are available on the SEC’s website at

www.sec.gov and on Luna’s website at www.lunainc.com. The

statements made in this release are based on information available

to Luna as of the date of this release and Luna undertakes no

obligation to update any of the forward-looking statements after

the date of this release.

Luna Innovations Incorporated

Consolidated Statements of

Operations

Three Months Ended March 31, 2017

2016 (unaudited) Revenues: Technology

development $ 4,276,448 $ 3,723,262 Products and licensing

8,841,936 10,263,753 Total revenues 13,118,384

13,987,015 Cost of revenues: Technology development

3,222,354 2,846,723 Products and licensing 5,220,775

6,296,685 Total cost of revenues 8,443,129 9,143,408

Gross profit 4,675,255 4,843,607 Operating

expense: Selling, general and administrative 4,495,701 4,645,282

Research, development and engineering 1,444,828 1,550,491

Total operating expense 5,940,529 6,195,773

Operating loss (1,265,274 ) (1,352,166 ) Other income (expense):

Other income, net 351 3,940 Interest expense (64,374 ) (86,173 )

Total other expense (64,023 ) (82,233 ) Loss before income taxes

(1,329,297 ) (1,434,399 ) Income tax expense 26,690 25,175

Net loss (1,355,987 ) (1,459,574 ) Preferred stock dividend

34,096 21,210 Net loss attributable to common

stockholders $ (1,390,083 ) $ (1,480,784 ) Net loss per share

attributable to common stockholders: Basic and diluted $ (0.05 ) $

(0.05 ) Weighted average common shares and common equivalent shares

outstanding: Basic and diluted 27,541,356 27,477,181

Luna Innovations Incorporated

Consolidated Balance Sheets

March 31, 2017 December 31, 2016

(unaudited) Assets Current assets: Cash and cash

equivalents $ 12,105,934 $ 12,802,458 Accounts receivable, net

12,256,152 14,297,725 Inventory 8,722,670 8,370,235 Prepaid

expenses and other current assets 1,536,003 1,627,175

Total current assets 34,620,759 37,097,593 Property and equipment,

net 6,575,200 6,780,838 Intangible assets, net 8,280,903 8,681,263

Goodwill 2,348,331 2,348,331 Other assets 68,778 88,948

Total assets $ 51,893,971 $ 54,996,973

Liabilities and stockholders’ equity Liabilities: Current

Liabilities: Current portion of long-term debt obligations $

1,833,333 $ 1,833,333 Current portion of capital lease obligations

53,043 52,128 Accounts payable 3,147,754 4,466,192 Accrued

liabilities 8,672,431 8,667,100 Deferred revenue 843,345

949,603 Total current liabilities 14,549,906 15,968,356

Long-term deferred rent 1,372,356 1,403,957 Long-term debt

obligations 1,965,776 2,420,032 Long-term capital lease obligations

101,328 114,940

Total liabilities 17,989,366

19,907,285 Commitments and contingencies

Stockholders’ equity: Preferred stock, par value $0.001, 1,321,514

shares authorized, issued and outstanding at March 31, 2017 and

December 31, 2016 1,322 1,322 Common stock, par value $0.001,

100,000,000 shares authorized, 27,989,104 and 27,988,104 shares

issued, 27,542,277 and 27,541,277 shares outstanding at March 31,

2017 and December 31, 2016 28,621 28,600 Treasury stock at cost,

446,827 shares at March 31, 2017 and December 31, 2016 (517,987 )

(517,987 ) Additional paid-in capital 82,656,937 82,451,958

Accumulated deficit (48,264,288 ) (46,874,205 )

Total

stockholders’ equity 33,904,605 35,089,688

Total liabilities and stockholders’ equity $ 51,893,971

$ 54,996,973

Luna Innovations Incorporated

Consolidated Statements of Cash

Flows

Three Months Ended March 31, 2017

2016 (unaudited) Cash flows provided by/(used in)

operating activities Net loss $ (1,355,987 ) $ (1,459,574 )

Adjustments to reconcile net loss to net cash provided by/(used in)

operating activities Depreciation and amortization 956,687 939,799

Share-based compensation 170,084 258,803 Bad debt expense 29,671 —

Change in assets and liabilities Accounts receivable 2,011,902

(298,309 ) Inventory (352,435 ) 20,375 Other current assets 55,092

(376,642 ) Accounts payable and accrued expenses (1,313,107 )

(721,289 ) Deferred revenue (137,859 ) 92,259 Net cash

provided by/(used in) operating activities 64,048 (1,544,578

)

Cash flows used in investing activities Acquisition of

property and equipment (157,308 ) (138,099 ) Intangible property

costs (133,054 ) (101,467 ) Net cash used in investing activities

(290,362 ) (239,566 )

Cash flows used in financing

activities Payments on capital lease obligations (12,697 )

(20,106 ) Payments of debt obligations (458,333 ) (458,334 )

Proceeds from the exercise of options 820 — Net cash

used in financing activities (470,210 ) (478,440 )

Net decrease

in cash or cash equivalents (696,524 ) (2,262,584 ) Cash and

cash equivalents-beginning of period 12,802,458 17,464,040

Cash and cash equivalents-end of period $ 12,105,934

$ 15,201,456

Luna Innovations Incorporated

Reconciliation of Net Loss to EBITDA

and Adjusted EBITDA

Three Months Ended March 31, 2017

2016 (unaudited) Net loss $ (1,355,987 ) $

(1,459,574 ) Interest expense 64,374 86,173 Tax expense 26,690

25,175 Depreciation and amortization 956,687 939,799

EBITDA (308,236 ) (408,427 ) Share-based compensation 170,084

258,803 Non-recurring merger-related charges — —

Adjusted EBITDA $ (138,152 ) $ (149,624 )

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170511006214/en/

Investor Contact:Luna Innovations IncorporatedDale

Messick, CFO, 1 540-769-8400IR@lunainc.com

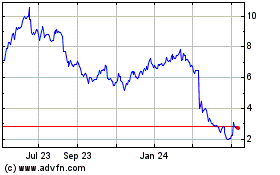

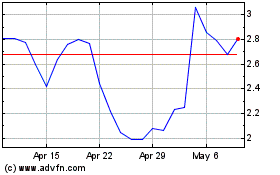

Luna Innovations (NASDAQ:LUNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Luna Innovations (NASDAQ:LUNA)

Historical Stock Chart

From Apr 2023 to Apr 2024