Bank of America Survey Highlights Rapid Growth

of Person-to-Person Payments, Reveals Real-Time Speed, Peer

Influence and Rise of Offerings Driving Usage

It appears Americans have run out of excuses for not paying

their friends back in a timely manner, whether it’s for a $5 latte

or $2,500 vacation. A new survey released today finds 36 percent of

adults currently use a person-to-person payments service (P2P),

with millennials leading the charge at nearly double that rate (62

percent). What’s more, 45 percent of non-users say they plan to

start using the service within the next year, foreshadowing

exponential growth in the coming months.

These findings are from the latest Bank of America Trends in

Consumer Mobility Report, exploring emerging payments trends –

specifically P2P technologies that allow consumers to send money to

others via their mobile device – and forward-looking behaviors

among adult consumers who own a smartphone and have an existing

banking relationship at any financial institution. The release of

the survey follows the bank’s recent introduction of aspects of the

Zelle℠ experience into its mobile banking app.

“Technology is developing faster today than at any time in

history, and our newest report demonstrates how consumers are

embracing emerging technologies to make sense of their financial

lives,” said Michelle Moore, head of digital banking at Bank of

America. “We were among the first institutions to integrate the

features of Zelle this year, and we look forward to developing new

innovations that anticipate our customers’ ever-changing needs in

the payments space.”

Timing is top of mind

In a world where mobile technology is ubiquitous, most users say

they started using P2P due to convenience and time savings (68

percent). This motivation is closely followed by peer influence (48

percent), new offerings from banks (30 percent) and a desire to no

longer use cash or checks (16 percent).

Users are also in agreement that time is of the essence when

paying each other back. The majority (69 percent) of respondents

say they pay others back within the same day, and one-third say in

under an hour. Similarly, 53 percent expect others to pay them back

within 24 hours, and 22 percent within the hour.

Minding payments p’s and q’s

When it comes to what people are paying each other back for,

just about anything goes. Practicality tops the list with shared

bills (45 percent), including utilities and rent, being the most

popular reason to use P2P, which is closely followed by shared

expenses for gifts (42 percent), travel (37 percent) and dining (35

percent).

And the dollar amount doesn’t seem to matter much either.

Fifty-one percent believe requesting a payment from others for $5

or less is socially acceptable, and 36 percent claim no amount is

“too low.” The same mentality applies to sending funds, as 44

percent say they would be comfortable sending $1,000 or more to

others using P2P, with 26 percent saying no amount is “too

high.”

Imagining a world without physical currency

In sharing opinions about others’ payments faux pas, it appears

that checks cause the most headaches. People are most annoyed by

others paying via check in store (51 percent), followed by a delay

in cashing checks (38 percent) and ignoring payment requests (24

percent).

As emerging payments continue to rival traditional methods,

Americans increasingly question whether today’s youngest

generations will ever use cash, checks or credit cards in their

traditional forms. When asked what they believe to be true about

children under the age of 10, many respondents agree they won’t

know how to write a check (71 percent) and won’t use physical

credit cards (42 percent). One in seven think the youngest members

of Generation Z won’t even know what cash is.

Bank of America’s focus on mobile bankingWith more than 22

million active mobile users and growing, Bank of America’s mobile

banking platform is an evolving source of increased customer

engagement and satisfaction. During the first quarter of 2017,

mobile banking customers logged into their accounts 980 million

times, or approximately 44 times per user. During that same period,

customers made more than 29 million mobile bill payments and nearly

9 million P2P transfers, a growth of 76 percent over 2016.

Customers also used their mobile devices to deposit more than

315,000 checks daily and redeem over 1 million credit card cash and

travel rewards. More customers are opening new accounts through

mobile, with sales increasing by 36 percent over the past year.

About the Bank of America Trends in Consumer Mobility Report

Convergys (an independent market research company) conducted a

nationally representative, panel sample online survey on behalf of

Bank of America March 20-April 1, 2017. Convergys surveyed 1,005

respondents throughout the U.S., comprised of adults 18+ with a

current banking relationship (checking or savings), and who own a

smartphone. An additional 407 panelists were surveyed who also use

a person-to-person payments service. The margin of error for the

national sample of n=1,005 is +/- 3.1 percent, and the margin of

error for the person-to-person payments oversample where n=407 is

+/- 4.9 percent, with each reported at a 95 percent confidence

level.

Bank of AmericaBank of America is one of the world’s leading

financial institutions, serving individual consumers, small and

middle-market businesses and large corporations with a full range

of banking, investing, asset management and other financial and

risk management products and services. The company provides

unmatched convenience in the United States, serving approximately

47 million consumer and small business relationships with

approximately 4,600 retail financial centers, approximately 15,900

ATMs, and award-winning digital banking with approximately 35

million active users and more than 22 million mobile users. Bank of

America is a global leader in wealth management, corporate and

investment banking and trading across a broad range of asset

classes, serving corporations, governments, institutions and

individuals around the world. Bank of America offers

industry-leading support to approximately 3 million small business

owners through a suite of innovative, easy-to-use online products

and services. The company serves clients through operations in all

50 states, the District of Columbia, the U.S. Virgin Islands,

Puerto Rico and more than 35 countries. Bank of America Corporation

stock (NYSE: BAC) is listed on the New York Stock Exchange.

Visit the Bank of America newsroom for more Bank of America

news, and click here to register for news email alerts.

www.bankofamerica.com

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170511005006/en/

Reporters May Contact:Betty Riess, Bank of America,

1.415.913.4416betty.riess@bankofamerica.com

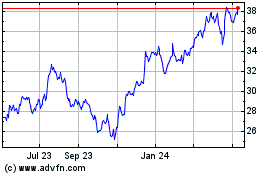

Bank of America (NYSE:BAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

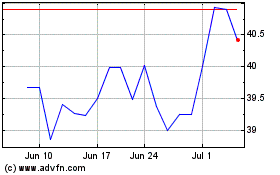

Bank of America (NYSE:BAC)

Historical Stock Chart

From Apr 2023 to Apr 2024