Europe Stocks Quiet Ahead of BOE Update -- 2nd Update

May 11 2017 - 7:08AM

Dow Jones News

By Riva Gold

Stocks were off to a quiet start Thursday as investors parsed

mixed corporate results ahead of an update from the Bank of

England.

The Stoxx Europe 600 edged down 0.1% late morning, brushing off

modest gains across Asia. Futures suggested the S&P 500 would

pull back 0.2% from a record high.

Later Thursday, the Bank of England is expected to leave its

rates unchanged before a U.K. national election in June. The BOE's

inflation report, vote, and comments will be closely watched,

however, for any hints at a change in projections for growth and

inflation, as investors assess the chance of an interest rate rise

next year.

"I think there is a huge divergence in inflation outlooks at the

moment, " said Markus Stadlmann, chief investment officer at Lloyds

Private Bank, who expects the committee to remain in wait-and-see

mode for now.

The European Commission on Thursday raised its U.K. growth

forecasts for the second time in six months, but the British pound

was last down 0.2% at $1.2913 following disappointing industrial

production figures.

In European stocks, the telecom and utilities sectors led

declines in morning trading, with shares of Spanish

telecommunications giant Telefónica and the U.K.'s BT Group PLC

lower after releasing earnings figures. Shares of UniCredit SpA

climbed 4.7%, however, after the Italian lender posted a

first-quarter net profit after a large fourth-quarter loss.

Miners and oil and gas companies outperformed the rest of the

market as oil and metals prices recovered. Crude prices logged

their biggest daily gains since December on Wednesday, and Brent

crude oil added another 1.5% to $50.98 a barrel on Thursday. Copper

futures climbed 1.6% to $5,600 a ton, while gold rose 0.3% to

$1,222 an ounce.

In the U.S., stock futures indicated modest losses on Wall

Street following a raft of earnings reports. Shares of Snap Inc.

tumbled after Wednesday's close after its first quarterly report as

a public company showed it struggled to maintain user growth.

Shares of technology companies had led gains in U.S. stocks so far

this year by a wide margin.

"Its results weren't dramatically worse than people were

expecting... if companies like Snap don't deliver on growth

expectations, these stocks get punished very quickly and hard,"

said Mr. Stadlmann.

"I think tech stocks will continue to be a sector rich in

opportunity, but you probably have to be more selective than

anywhere else," he said.

Shares of Whole Foods Market, Inc. climbed meanwhile ahead of

the market open, after the grocery chain said it would dramatically

reshape its board.

Major U.S. stock indexes have barely moved in recent sessions,

hovering around all-time highs just as implied and realized

volatility have collapsed. Shares have been supported by a mostly

upbeat first-quarter earnings season and continued signs of

strength in the U.S. and global economy.

"Right now, there's a sense that things are pretty good

economically and from an earnings perspective, and that should

continue" said Brad McMillan, chief investment officer at

Commonwealth Financial Network. "Investors are more willing to move

into the market, and less skittish to downturns."

Among clients, "we're starting to see retail investors wanting

to take more risk," he added.

Earlier, Japan's Nikkei Stock Average rose 0.3%, Hong Kong's

Hang Seng Index added 0.4%, Australia's S&P/ASX 200 added 0.1%

and South Korea's Kospi was on track for a fresh record.

The Shanghai Composite rose 0.3%, recovering from earlier losses

that sent it to a seven-month low. In China, a note was posted on

an official WeChat account run by the state-owned Securities Times,

saying the country's stock regulator summoned brokers with large

capital pools for a meeting on Monday to ease concerns about a

crackdown in the shadow-banking sector. The regulator clarified

that the crackdown is targeted at nonstandard assets and doesn't

include bonds.

In currencies, the New Zealand dollar fell sharply against the

greenback after a central-bank policy statement was interpreted as

dovish. The euro was flat at $1.0872 as the European Union raised

this year's growth forecast for the European economy.

The WSJ Dollar Index, which tracks the dollar against a basket

of 16 currencies, was otherwise flat, while 10-year U.S. Treasury

yields dipped to 2.394% from 2.414%. Yields move inversely to

prices.

Kenan Machado,

Yifan Xie

, Paul Hannon, Georgia Wells and P.R. Venkat contributed to this

article.

Write to Riva Gold at riva.gold@wsj.com

(END) Dow Jones Newswires

May 11, 2017 06:53 ET (10:53 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

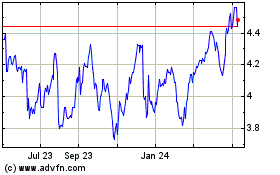

Telefonica (NYSE:TEF)

Historical Stock Chart

From Mar 2024 to Apr 2024

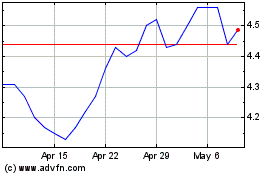

Telefonica (NYSE:TEF)

Historical Stock Chart

From Apr 2023 to Apr 2024