Amended Statement of Beneficial Ownership (sc 13d/a)

May 11 2017 - 6:05AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

TELLURIAN

INC.

(Name of Issuer)

Common

Stock, par value $0.01 per share

(Title of Class of Securities)

87968A104

(CUSIP Number)

Isabelle Salhorgne

General Counsel, Gas, Renewables & Power

TOTAL S.A.

2, place Jean

Millier

La Défense 6

92400 Courbevoie

France

011-331-4744-4546

Copies to:

Glen

J. Hettinger

Norton Rose Fulbright US LLP

2200 Ross Avenue, Suite 3600

Dallas, Texas 75201

214-855-8000

(Name, Address and

Telephone Number of Person Authorized to Receive Notices and Communications)

May 10, 2017

(Date of Event

Which Requires Filing of This Statement)

If the filing

person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box. ☐

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other

parties to whom copies are to be sent.

|

*

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter disclosures provided in a prior cover page.

|

The information required on the remainder of this cover page

shall not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the

Act (however, see the Notes).

CUSIP No. 87968A104

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF

REPORTING PERSONS:

TOTAL S.A.

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS):

(a) ☐ (b) ☐

|

|

3

|

|

SEC USE ONLY:

|

|

4

|

|

SOURCE OF FUNDS (SEE

INSTRUCTIONS):

WC

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e): ☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION:

France

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE VOTING POWER:

0

|

|

|

8

|

|

SHARED VOTING POWER:

45,999,999

|

|

|

9

|

|

SOLE DISPOSITIVE POWER:

0

|

|

|

10

|

|

SHARED DISPOSITIVE POWER:

45,999,999

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON:

45,999,999

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS): ☐

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11):

22.7%

|

|

14

|

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS):

CO

|

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF

REPORTING PERSONS:

TOTAL Delaware, Inc.

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (SEE INSTRUCTIONS):

(a) ☐ (b) ☐

|

|

3

|

|

SEC USE ONLY:

|

|

4

|

|

SOURCE OF FUNDS (SEE

INSTRUCTIONS):

OO

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e): ☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION:

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE VOTING POWER:

0

|

|

|

8

|

|

SHARED VOTING POWER:

45,999,999

|

|

|

9

|

|

SOLE DISPOSITIVE POWER:

0

|

|

|

10

|

|

SHARED DISPOSITIVE POWER:

45,999,999

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON:

45,999,999

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS): ☐

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11):

22.7%

|

|

14

|

|

TYPE OF REPORTING PERSON (SEE

INSTRUCTIONS):

CO

|

The Schedule 13D filed on February 27, 2017 (the “

Schedule 13D

”), by

TOTAL S.A., a société anonyme organized under the laws of the Republic of France (“

Total Holdings

”), and TOTAL Delaware, Inc., a Delaware corporation (“

Total Delaware

” and, together with Total

Holdings, the “

Reporting Persons

”), relating to the common stock, par value $0.01 per share (the “

Common Stock

”), of Tellurian Inc., a Delaware corporation (the “

Issuer

”), is hereby

amended and supplemented as set forth below by this Amendment No. 1 to the Schedule 13D.

|

Item 4.

|

Purpose of Transaction

|

Item 4 of the Schedule 13D is hereby amended and

supplemented with the following:

On May 10, 2017, Total Delaware and the Issuer (formerly known as Magellan Petroleum Corporation

“

Magellan

”) entered into a pre-emptive rights agreement (the “

Pre-emptive Rights Agreement

”). The Pre-emptive Rights Agreement was entered into pursuant to the Guaranty and Support Agreement, dated as of

January 3, 2017, by and between Total Delaware and Magellan.

Under the Pre-emptive Rights Agreement, the Issuer agreed to undertake

commercially reasonable efforts to provide Total Delaware with advance written notice of any proposed offering of the Issuer’s equity securities (including any securities or rights convertible into the Issuer’s equity securities,

collectively, “

Securities

”), other than an Excepted Offering (as defined in the Pre-emptive Rights Agreement). Prior to or in connection with the consummation of any offering of Securities (any such offering, an

“

Offering

”), other than an Excepted Offering or an at-the-market offering of Securities (an “

ATM Offering

”), the Issuer will promptly notify Total Delaware of the terms of such Offering (the “

Offering

Notice

”), and Total Delaware will have a right to purchase Securities of the kind offered in such Offering on the following terms:

|

|

(a)

|

Total Delaware will be entitled to purchase such Securities up to such aggregate amount as would permit Total Delaware to maintain the same pro rata equity ownership percentage in the Issuer it had immediately prior to

the consummation of such Offering (based upon Total Delaware’s fully diluted equity ownership percentage in the Issuer immediately prior to the consummation of such Offering).

|

|

|

(b)

|

In the event the Offering is conducted as a registered public offering, Total Delaware will be entitled to purchase such Securities at the public offering price for such Offering. In the event the Offering is conducted

as a private placement, Total Delaware will be entitled to purchase such Securities at the same price that was paid by the purchasers of Securities in such Offering.

|

|

|

(c)

|

Total Delaware will have seven calendar days from the date of its receipt of the Offering Notice to elect to purchase, and to fully fund the purchase, of any such Securities. If Total Delaware does not elect to purchase

any Securities and/or does not provide immediately available funds for the purchase of such Securities to the Issuer within such seven calendar day period, Total Delaware’s rights to purchase such Securities will terminate.

|

Notwithstanding the foregoing, if the Issuer conducts an ATM Offering, the Issuer will not be required to provide Total Delaware with advance

notice of any such offering;

provided

,

however

, that the Issuer will be required to offer (an “

ATM Offer

”) Total Delaware the opportunity to purchase Securities of the kind offered in such ATM Offering on a quarterly

basis up to such aggregate amount as would enable Total Delaware to maintain the same pro rata equity ownership percentage in the Issuer it had immediately prior to the later of (i) the commencement of such ATM Offering, and (ii) the

completion or expiration of the last ATM Offer made by the Issuer to Total Delaware in connection with such ATM Offering, on the following terms:

|

|

(a)

|

The ATM Offer will be made in writing to Total Delaware promptly (and no later than ten business days) following the end of each calendar quarter during which any Securities were sold pursuant to an ATM Offering.

|

|

|

(b)

|

Total Delaware will be entitled to purchase such Securities at price equal to the volume weighted average price at which Securities were sold pursuant to such ATM Offering over the immediately preceding three month

period.

|

|

|

(c)

|

Total Delaware will have seven calendar days from the date of its receipt of the ATM Offer to elect to purchase, and to fully fund the purchase, of any such Securities. If Total Delaware does not elect to purchase any

Securities and/or does not provide immediately available funds for the purchase of such Securities to the Issuer within such seven calendar day period, Total Delaware’s rights to purchase such Securities will terminate.

|

Total Delaware’s rights and the Issuer’s obligations under the Pre-emptive Rights

Agreement will terminate on such date that Total Delaware’s pro rata fully diluted equity ownership percentage in the Issuer is less than 10%.

The description of the Pre-emptive Rights Agreement set forth above does not purport to be complete and is qualified in its entirety by

reference to the Pre-emptive Rights Agreement, a copy of which is attached hereto as Exhibit 99.1 and incorporated herein by reference.

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

|

Item 6 of the Schedule 13D is hereby amended and supplemented with the following:

The information set forth above in Item 4 is incorporated herein by reference.

|

Item 7.

|

Materials to be Filed as Exhibits

|

Item 7 of the Schedule 13D is hereby amended and

supplemented with the following:

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

99.1

|

|

Pre-emptive Rights Agreement, dated as of May 10, 2017, by and between Tellurian Inc. and TOTAL Delaware, Inc.

|

Signatures

After reasonable inquiry and to the best knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

|

|

|

|

|

|

|

Date: May 10, 2017

|

|

|

|

|

|

TOTAL S.A.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Jean-Pierre Sbraire

|

|

|

|

|

|

Name:

|

|

Jean-Pierre Sbraire

|

|

|

|

|

|

Title:

|

|

Treasurer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL DELAWARE, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Isabelle Kieffer

|

|

|

|

|

|

Name:

|

|

Isabelle Kieffer

|

|

|

|

|

|

Title:

|

|

Vice President

|

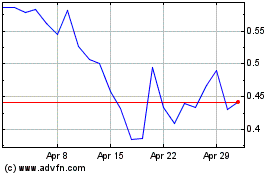

Tellurian (AMEX:TELL)

Historical Stock Chart

From Mar 2024 to Apr 2024

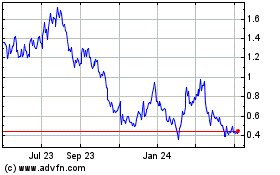

Tellurian (AMEX:TELL)

Historical Stock Chart

From Apr 2023 to Apr 2024