UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended

March 31, 2017

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

Commission File Number

001-10346

GALENFEHA, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

46-2283393

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Identification No.)

|

420 Throckmorton Street, Suite 200

Fort Worth,

Texas 76102

(Address of principal executive offices) (Zip code)

(817) 945-6448

(Registrant’s telephone

number, including area code)

N/A

(Former name, former address and former

fiscal year, if changed since last report)

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or

15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or

for such shorter period that registrant was required to file such reports), and

(2) has been subject to such filing requirements for the past 90 days.

Yes

[X] No [ ]

Indicate by check mark whether the registrant submitted

electronically and posted on its corporate web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (section 232.405 of this chapter) during the preceding 12 months (or for

such shorter period that the registrant was required to submit and post such

files).

Yes [X] No [ ]

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer or a smaller

reporting company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

|

Large Accelerated Filer [ ]

|

Accelerated

Filer

[ ]

|

|

Non-Accelerated Filer [ ]

|

Smaller Reporting Company [X]

|

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Exchange Act).

Yes [

] No [X]

As of May 10, 2017, there were 61,250,000 shares of the

registrant’s common stock outstanding, each with a par value of $0.001.

TABLE OF CONTENTS

FORM 10-Q

FOR THE

QUARTERLY PERIOD ENDED MARCH 31, 2017

Galenfeha, Inc.

INDEX TO CONSOLIDATED FINANCIAL

STATEMENTS

(Unaudited)

F-1

Galenfeha, Inc.

CONSOLIDATED

BALANCE

SHEETS

(Unaudited)

|

|

|

March 31, 2017

|

|

|

December 31, 2016

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

CURRENT ASSETS

|

|

|

|

|

|

|

|

Cash

|

$

|

23,699

|

|

$

|

129,973

|

|

|

Accounts receivable from related

parties

|

|

-

|

|

|

14,189

|

|

|

Assets held for

sale

|

|

-

|

|

|

381,041

|

|

|

Total current assets

|

|

23,699

|

|

|

525,203

|

|

|

|

|

|

|

|

|

|

|

OTHER ASSETS

|

|

|

|

|

|

|

|

Deposits

|

|

-

|

|

|

1,000

|

|

|

Total other assets

|

|

-

|

|

|

1,000

|

|

|

TOTAL ASSETS

|

$

|

23,699

|

|

$

|

526,203

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

CURRENT LIABILITIES

|

|

|

|

|

|

|

|

Accounts

payable and accrued liabilities

|

$

|

15,393

|

|

$

|

32,892

|

|

|

Deferred revenue

|

|

-

|

|

|

43,602

|

|

|

Liabilities held for sale

|

|

-

|

|

|

350,000

|

|

|

Due to officer

|

|

35,000

|

|

|

110,000

|

|

|

Total

current liabilities

|

|

50,393

|

|

|

536,494

|

|

|

|

|

|

|

|

|

|

|

Total

liabilities

|

|

50,393

|

|

|

536,494

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY

(DEFICIT)

|

|

|

|

|

|

|

|

Preferred stock

|

|

|

|

|

|

|

Preferred A shares: 20,000,000 authorized, $0.001 par

value, 7,568,537 and 0 issued and outstanding at March

31, 2017 and December 31, 2016, respectively

|

|

7,568

|

|

|

-

|

|

Preferred B shares: 30,000,000 authorized , $0.001 par

value,27,347,563 issued and outstanding at March 31,

2017 and December 31, 2016

|

|

27,348

|

|

|

27,348

|

|

|

Common stock

|

|

|

|

|

|

|

Authorized: 150,000,000 common shares, $0.001 par value,

61,250,000

issued and outstanding at

March 31, 2017 and 69,318,537

issued and

outstanding at December 31, 2016

|

|

61,250

|

|

|

69,318

|

|

|

Additional paid-in capital

|

|

3,424,991

|

|

|

3,384,950

|

|

|

Accumulated deficit

|

|

(3,547,851

|

)

|

|

(3,491,907

|

)

|

|

Total stockholders’ equity(deficit)

|

|

(26,694

|

)

|

|

(10,291

|

)

|

|

TOTAL LIABILITIES AND

STOCKHOLDERS’

EQUITY (DEFICIT)

|

$

|

23,699

|

|

$

|

526,203

|

|

The accompanying notes are an integral part of these unaudited

consolidated financial statements.

F-2

Galenfeha, Inc.

CONSOLIDATED

STATEMENTS OF

OPERATIONS

(Unaudited)

|

|

|

Three Months Ended

|

|

|

Three Months Ended

|

|

|

|

|

March 31, 2017

|

|

|

March 31, 2016

|

|

|

Operating Expenses:

|

|

|

|

|

|

|

|

General and administrative

|

|

1,047

|

|

|

4,312

|

|

|

Payroll expenses

|

|

201

|

|

|

8,074

|

|

|

Professional fees

|

|

27,983

|

|

|

18,295

|

|

|

Total operating

expenses

|

|

29,231

|

|

|

30,681

|

|

|

|

|

|

|

|

|

|

|

Loss from operations

|

|

(29,231

|

)

|

|

(30,681

|

)

|

|

|

|

|

|

|

|

|

|

Other (expense) income

|

|

|

|

|

|

|

|

Interest income

|

|

-

|

|

|

3

|

|

|

Miscellaneous income

|

|

932

|

|

|

-

|

|

|

Interest expense

|

|

-

|

|

|

(7,873

|

)

|

|

Loss on derivative

instruments

|

|

-

|

|

|

(173,580

|

)

|

|

Total other (expense)

|

|

932

|

|

|

( 181,450

|

)

|

|

|

|

|

|

|

|

|

|

Loss from continuing operations

|

|

(28,299

|

)

|

|

(212,131

|

)

|

|

|

|

|

|

|

|

|

|

Loss from discontinued operations

|

|

(27,645

|

)

|

|

(93,732

|

)

|

|

|

|

|

|

|

|

|

|

Net loss

|

$

|

(55,944

|

)

|

$

|

(305,863

|

)

|

|

|

|

|

|

|

|

|

|

Loss per share, basis and diluted

|

|

|

|

|

|

|

|

Continuing operations

|

$

|

(0.00

|

)

|

$

|

(0.00

|

)

|

|

Discontinued operations

|

|

(0.00

|

)

|

|

(0.00

|

)

|

|

Net loss

|

$

|

(0.00

|

)

|

$

|

(0.00

|

)

|

|

|

|

|

|

|

|

|

|

Weighted average number of

common shares outstanding, basic and diluted

|

|

63,481,266

|

|

|

86,126,100

|

|

The accompanying notes are an integral part of these unaudited

consolidated financial statements.

F-3

Galenfeha, Inc.

CONSOLIDATED

STATEMENT OF

CHANGES IN STOCKHOLDERS’ EQUITY (DEFICIT)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock

|

|

|

Common Stock

|

|

|

Paid-in

|

|

|

Accumulated

|

|

|

|

|

|

|

|

Shares

|

|

|

Amount

|

|

|

Shares

|

|

|

Amount

|

|

|

Capital

|

|

|

Deficit

|

|

|

Total

|

|

|

Balance – December 31,

2016

|

|

27,347,563

|

|

$

|

27,348

|

|

|

69,318,537

|

|

$

|

69,318

|

|

$

|

3,384,950

|

|

$

|

(3,491,907

|

)

|

$

|

(10,291

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock returned to Company and

cancelled

|

|

-

|

|

|

-

|

|

|

(500,000

|

)

|

|

(500

|

)

|

|

500

|

|

|

-

|

|

|

-

|

|

|

Forfeiture of of unvested shares issued for service

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

(12,750

|

)

|

|

-

|

|

|

(12,750

|

)

|

|

Related party gain on sale of pump

assets

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

52,291

|

|

|

-

|

|

|

52,291

|

|

|

Common stock converted to

preferred stock

|

|

7,568,537

|

|

$

|

7,568

|

|

|

(7,568,537

|

)

|

|

(7,568

|

)

|

|

-

|

|

|

-

|

|

|

-

|

|

|

Net loss

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

(55,944

|

)

|

|

(55,944

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance –

March 31, 2017

|

|

34,916,100

|

|

$

|

34,916

|

|

|

61,250,000

|

|

$

|

61,250

|

|

$

|

3,424,991

|

|

$

|

(3,547,851

|

)

|

$

|

(26,694

|

)

|

The accompanying notes are an integral part of these unaudited

consolidated financial statements.

F-4

Galenfeha, Inc.

CONSOLIDATED

STATEMENTS OF

CASH FLOWS

(Unaudited)

|

|

|

Three Months

|

|

|

Three Months

|

|

|

|

|

Ended

|

|

|

Ended

|

|

|

|

|

March 31, 2017

|

|

|

March 31, 2016

|

|

|

|

|

|

|

|

|

|

|

OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

Net loss

|

$

|

(55,944

|

)

|

$

|

(305,863

|

)

|

|

Adjustments to

reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

-

|

|

|

6,842

|

|

|

Non-vested

options forfeited

|

|

-

|

|

|

(26,745

|

)

|

|

Common shares issued for

services

|

|

(12,750

|

)

|

|

(22,027

|

)

|

|

Options expense

|

|

-

|

|

|

24,703

|

|

|

Loss on derivative instruments

|

|

-

|

|

|

173,580

|

|

|

Amortization of

debt discounts on convertible notes

|

|

-

|

|

|

7,873

|

|

|

Changes in Operating Assets and

Liabilities:

|

|

|

|

|

|

|

|

(Increase) Decrease in accounts receivable

|

|

14,189

|

|

|

4,653

|

|

|

(Increase)

Decrease in accounts receivable from related party

|

|

-

|

|

|

(8,681

|

)

|

|

(Increase) Decrease in inventory

|

|

6,041

|

|

|

96,327

|

|

|

(Increase)

Decrease in prepaid expenses and other assets

|

|

1,000

|

|

|

(7,441

|

)

|

|

Increase (Decrease) in accounts payable and accrued liabilities

|

|

2,626

|

|

|

(78,886

|

)

|

|

Increase

(Decrease) in accounts payable to related parties

|

|

-

|

|

|

(31,720

|

)

|

|

Increase (Decrease) in deferred revenue

|

|

(11,436

|

)

|

|

-

|

|

|

Net cash used in operating activities

|

|

(56,274

|

)

|

|

(167,385

|

)

|

|

|

|

|

|

|

|

|

|

INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

Cash received for sale

of pump assets

|

|

25,000

|

|

|

-

|

|

|

Net cash provided by financing activities

|

|

25,000

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

Proceeds from line of

credit

|

|

-

|

|

|

71,000

|

|

|

Payments on liabilities due to officer

|

|

(75,000

|

)

|

|

-

|

|

|

Proceeds from

convertible debentures, net of original issue discounts

|

|

-

|

|

|

145,375

|

|

|

Payments on finance contracts

|

|

-

|

|

|

(6,791

|

)

|

|

Net cash (used in) provided

by financing activities

|

|

(75,000

|

)

|

|

209,584

|

|

|

|

|

|

|

|

|

|

|

(DECREASE) INCREASE IN CASH

|

|

(106,274

|

)

|

|

42,199

|

|

|

CASH AT BEGINNING OF PERIOD

|

|

129,973

|

|

|

47,333

|

|

|

CASH AT END OF PERIOD

|

$

|

23,699

|

|

$

|

89,532

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL INFORMATION

|

|

|

|

|

|

|

|

Cash paid for:

|

|

|

|

|

|

|

|

Interest expense

|

$

|

5,789

|

|

$

|

6,901

|

|

|

Income taxes

|

|

-

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

NONCASH INVESTING AND FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

Common stock converted

to preferred stock

|

$

|

7,568

|

|

$

|

-

|

|

|

Gain on sale of pump division to

related party

|

|

52,291

|

|

|

-

|

|

|

Liabilities released

upon sale of pump division

|

|

402,291

|

|

|

-

|

|

|

Debt discount due to derivative

liabilities

|

|

-

|

|

|

145,375

|

|

|

Reclassification of

conversion option from equity to derivative liabilities

|

|

-

|

|

|

6,175

|

|

The accompanying notes are an integral part of these unaudited

consolidated financial statements.

F-5

|

Galenfeha, Inc.

|

|

Notes to Unaudited Consolidated Financial

Statements

|

|

March 31, 2017

|

NOTE 1 - BASIS OF PRESENTATION

The accompanying financial statements have been prepared by the

Company without audit. In the opinion of management, all adjustments (which

include only normal recurring adjustments) necessary to present fairly the

financial position, results of operations, and cash flows at March 31, 2017, and

for all periods presented herein, have been made.

Certain information and footnote disclosures normally included

in financial statements prepared in accordance with accounting principles

generally accepted in the United States of America have been omitted. It is

suggested that these unaudited interim financial statements be read in

conjunction with the financial statements and notes thereto included in the

Company’s December 31, 2016 audited financial statements included in its Form

10-K filed with the Securities and Exchange Commission. The results of

operations for the period ended March 31, 2017 and the same period last year are

not necessarily indicative of the operating results for the full years.

NOTE 2 - GOING CONCERN

The accompanying financial statements have been prepared

assuming that the Company will continue as a going concern. The Company has

incurred net losses and net cash used in operations since inception. These

conditions raise substantial doubt about the Company’s ability to continue as a

going concern. The Company’s ability to continue as a going concern is dependent

upon the Company’s ability to achieve a level of profitability. The Company

intends on financing its future development activities and its working capital

needs largely from the sale of public equity securities with some additional

funding from other traditional financing sources, including term notes until

such time that funds provided by operations are sufficient to fund working

capital requirements. The financial statements of the Company do not include any

adjustments relating to the recoverability and classification of recorded

assets, or the amounts and classifications of liabilities that might be

necessary should the Company be unable to continue as a going concern.

NOTE 3 – NOTES PAYABLE

On August 23, 2016, the Company entered into a Promissory Note

Agreement with Kevin L. Wilson, in the amount of $350,000. The note bears an

interest rate of 11 ½ % per annum from the date until the principal is paid in

full. This note may be prepaid in whole or in part, without penalty. All

outstanding principal, interest and fees shall be due and payable on or before

August 23, 2017. As of December 31, 2016, the principal and interest due on the

note is $364,336 (the accrued interest of $14,336 is presented as accounts

payable in the consolidated balance sheet). This note was assumed by the

purchaser in the sale of the Company’s Daylight Pumps division. It is classified

as liabilities held for sale as of December 31, 2016. This note was assumed by

the purchaser of the pumps division on March 9, 2017. The total amount of

accrued interest due of $20,125 under the note was paid in full by the purchaser

in the sale of the Company’s Daylight Pumps division.

NOTE 4 - SHAREHOLDERS’ EQUITY

PREFERRED STOCK

The authorized stock of the Company consists of 50,000,000

preferred shares with a par value of $0.001.

During 2016, four officers and directors of the Company

exchanged 27,347,563 common shares for 27,347,563 preferred shares. During 2017,

one officer and one director exchanged 7,568,537 common shares for 7,568,537

preferred shares.

As of March 31, 2017, 7,568,537 shares of the Company’s

preferred stock Series A were issued and outstanding. As of December 31, 2016,

zero shares of the Company’s preferred stock Series A were issued and

outstanding.

As of March 31, 2017 and December 31, 2016, 27,347,563 shares

of the Company’s preferred stock Series B were issued and outstanding.

As of March 31, 2017, 34,916,100 shares of the Company’s

preferred stock were issued and outstanding.

On December 20, 2016, shareholders of the company approved an

amendment to the Bylaws for the creation of preferred stock. The preferred class

of stock will consist of two (2) series, Series A, and Series B. All affiliates

of the company who purchased stock during the formation of the company and who

purchased stock for financing activities at prices below market will move their

common shares into the Series B preferred stock, effective immediately. The

Series B votes 1:1; is subject to all splits the same as common; converts back

to common 1:1; and cannot be converted back to common for resale in the open

market until a 30 day VWAP (volume weighted average price) of $.45 cents has

been met in the Company’s public trading market. All future sales of company

securities by affiliates will adhere to rules and regulations of the Commission.

F-6

Affiliates who purchased stock at offering prices that were

current at the time of purchase, and affiliates who make open market purchases

and are directly responsible for a merger/acquisition that brings retained

earnings to the company, can convert these common shares 1:1 into Series A

preferred stock. Series A votes 1:1; converts back to common 1:1; is not subject

to splits in order to facilitate mergers, acquisitions, or meeting the

requirements of a listed exchange; and cannot be converted back to common for

resale in the open market until a 30 day VWAP of $3.50 per share has been met in

the Company’s public trading market. All future sales of company securities by

affiliates will adhere to rules and regulations of the Commission.

COMMON STOCK

The authorized stock of the Company consists of 150,000,000

common shares with a par value of $0.001.

As of March 31, 2017 61,250,000 shares of the Company’s common

stock were issued and outstanding. As of December 31, 2016, 69,318,537 shares of

the Company’s common stock were issued and outstanding.

In July 2016, the Company entered into an agreement for the

issuance of 1,000,000 common shares for consulting services. The shares are to

be transferred in four quarterly installments of two hundred fifty thousand

shares on or before the fifth day of the following months: August 2016, October

2016, January 2017, and April 2017. On August 5, 2016, the Company issued

250,000 shares under this award. On October 5, 2016, the Company issued another

250,000 shares under this award. Since inception through December 31, 2016,

$17,530 was expensed under this award.

On January 18, 2017 the company extinguished the remainder of

the Consulting Agreement with Asher Oil & Gas Exploration in Natchez,

Mississippi; and Lane Murray, of Jackson, Mississippi. The Company issued a

one-time payment to the consultants of $40,000, which included the cancellation

of any additional stock issuance, and the return of the 500,000 shares of

Galenfeha common stock previously issued in Quarters 3 and 4 of 2016. The terms

of this agreement previously included a $50,000 non-refundable retainer, as well

as 1,000,000 shares of Galenfeha, Inc. (GLFH) common stock, to be issued in four

quarterly installments. As of December 31, 2016, the consultants had received

the retainer and a total of 500,000 shares of Galenfeha, Inc. common stock, per

the agreement. The 500,000 shares of Galenfeha, Inc. common stock have been

returned and cancelled; and no further stock will be issued pursuant to this

agreement. Due to the forfeiture of the unvested shares, total $12,750 expense was reversed during the three months ended March 31, 2017. The consultants will keep their initial $50,000 non-refundable

retainer.

NOTE 5 - OPTIONS

During the year ended December 31, 2015, the Company granted an

aggregate of 2,050,000 options to a military sales representative and three

employees. Col. Ashton Naylor (Ret) received 100,000 options exercisable at

$0.25 per share, Chris Watkins received 750,000 options exercisable at $0.25 per

share, Jeff Roach received 1,000,000 options exercisable at $0.20 per share, and

Brian Nallin received 200,000 options exercisable at $0.20 per share. These

options expire on April 1, 2016; June 11, 2020, February 1, 2017, and December

31, 2017 respectively. The options granted to Brian Nallin vest immediately and

the other options vest in equal tranches over periods ranging from 2 to 5 years.

The aggregate fair value of the option grants was determined to be $430,839

using the Black-Scholes Option Pricing Model and the following assumptions:

volatilities between 218% and 396%, risk free rates between .27% and 1.74%,

expected terms between 1 and 5 years and zero expected dividends. The fair value

of the award is being expensed over the vesting periods. $65,360 and $295,553

was expensed during the year ended December 31, 2016 and December 31, 2015,

respectively, $91,519 was reversed from option expense due to non-vested options

forfeited for the year ended December 31, 2016, and $0 remains to be expensed

over the remaining vesting period.

During 2016, 1,750,000 of these options were forfeited. As of

December 31, 2016, there were 300,000 options outstanding which were

exercisable.

The exercise price and remaining weighted average life of the

options outstanding at December 31, 2016 were $0.25 and 0.08 years,

respectively. The aggregate intrinsic value of the outstanding options at

December 31, 2016 was $0. All options mentioned above are for employees that are

no longer with the company, by either termination because of discontinued

operations, or leaving the company of their own accord. At the time of this

filing, there were no options outstanding which are exercisable.

NOTE 6 - COMMITMENTS AND CONTINGENCIES

The Company leases space in Fort Worth, Texas for corporate

facilities for $99 monthly or $1,188 per year. The terms of this lease are month

to month.

|

Year Ended

|

|

Amount

|

|

|

2017

|

$

|

-

|

|

|

2018

|

|

-

|

|

|

2019

|

|

-

|

|

|

2020

|

|

-

|

|

|

2021

|

|

-

|

|

|

|

$

|

-

|

|

F-7

From time to time the Company may be a party to litigation matters involving claims against the Company. Management believes that there are no current matters that would have a material effect on the Company’s financial position or results of

operations.

The Company received a letter on May 17, 2016 from the Caddo-Shreveport Sales and Use Tax Commission informing them of a parish sales and use tax audit scheduled to begin on June 28, 2016. The audit period covered is January 1, 2013 through May 31,

2016. The audit is currently under way and no judgments or assessments have been issued. Management is of the opinion that this audit will not result in any material change in the Company’s financial results.

NOTE 7 – RELATED PARTY TRANSACTIONS

On November 16, 2016, the Company entered into an agreement with Fleaux Services, LLC for the sale of the company’s battery and stored energy division, which includes, but is not limited to, all inventory, support equipment, and office

operations located at 9204 Linwood Avenue, Suite 104 and 105, Shreveport, LA 71106. Mr. Trey Moore is the President/CEO of Fleaux Services, and also is a Director of Galenfeha, Inc. The sale is for a cash consideration of $350,000 USD; plus a 3%

royalty on all Galenfeha-style batteries sold over the course of the next two years from the date this purchase agreement was executed. The cash consideration was for $175,000 in inventory and $175,000 for business good-will and was provided

directly by Fleaux Services in cash. The sale includes all future sales, future purchase orders resulting from previous negotiations, and all intellectual property related to Galenfeha, Inc. battery manufacturing and distribution. Fleaux Services,

LLC will assume responsibility for expenses related to the Galenfeha, Inc. battery division that includes previous expenses incurred for sales meetings that secured future purchase orders. All contractual agreements between the Galenfeha Inc.

battery division and outside parties, including, but not limited to, consultants, suppliers, distributors, and sales representatives, become the responsibility of Fleaux Services, LLC. This includes all suppliers’ outstanding invoices for

materials not yet delivered and support equipment that will be relinquished to Fleaux Services, LLC upon the execution of this agreement. Galenfeha, Inc. will retain payments on all current outstanding purchase orders invoiced before the date of

this purchase agreement. A gain on the sale of the battery and stored energy division of $15,008 was recognized as a capital transaction.

On November 4, 2016, Mr. James Ketner, Galenfeha’s Chairman and CEO made a cash contribution to the Company in the amount of $100,000 in exchange for a note that has a fixed repayment of $110,000. The note bears no interest, and can be

repaid by the Company when the funds become available. The note can be renegotiated between Galenfeha and Mr. Ketner if both parties agree to the terms. There were no principal repayments on the note for the twelve months ending December 31, 2016,

and the principal balance due under the note as of December 31, 2016 was $110,000. Principal repayments made under the note for the three months ending March 31, 2017 totaled $75,000, and the principal balance due under the note as of March

31, 2017 was $35,000.

On March 9, 2017, the Company entered into an agreement with Fleaux Services, LLC for the sale of the Company’s Daylight Pumps division, which includes, but in not limited to, all inventory located at 9204 Linwood Avenue, Suite 104 and 105,

Shreveport, LA 7116, as well as all usage rights for the name “Daylight Pump.” The sale is for cash consideration of $25,000, and Fleaux Services, LLC will assume the responsibility of a promissory note held by Kevin L. Wilson in the

amount of $350,000 and all accrued interest due since the date of issuance on August 23, 2016. The sale will include all future pump sales, future purchase orders resulting from previous negotiations, and all intellectual property related to

Daylight Pumps.

NOTE 8 – DISCONTINUED OPERATIONS – STORED ENERGY AND DAYLIGHT PUMP DIVISIONS

On November 16, 2016, the Company entered into an agreement with Fleaux Services, LLC for the sale of the Company’s battery and stored energy division, which includes, but is not limited to, all inventory, support equipment, and office

operations located at 9204 Linwood Avenue, Suite 104 and 105, Shreveport, LA 71106. The sale is for a cash consideration of $350,000 USD; plus a 3% royalty on all Galenfeha-style batteries sold over the course of the next two years from the date

this purchase agreement was executed. The cash consideration was for $175,000 in inventory and $175,000 for business good-will and was provided directly by Fleaux Services in cash. The sale includes all future sales, future purchase orders

resulting from previous negotiations, and all intellectual property related to Galenfeha, Inc. battery manufacturing and distribution. Fleaux Services, LLC will assume responsibility for expenses related to the Galenfeha, Inc. battery division that

includes previous expenses incurred for sales meetings that secured future purchase orders. All contractual agreements between the Galenfeha Inc. battery division and outside parties, including, but not limited to, consultants, suppliers,

distributors, and sales representatives, become the responsibility of Fleaux Services, LLC. This includes all suppliers’ outstanding invoices for materials not yet delivered and support equipment that will be relinquished to Fleaux Services,

LLC upon the execution of this agreement. Galenfeha, Inc. will retain payments on all current outstanding purchase orders invoiced before the date of this purchase agreement. A gain on the sale of the battery and stored energy division of

$15,008 was recognized as a capital transaction.

On March 9, 2017, the Company entered into an agreement with Fleaux Services, LLC for the sale of the Company’s Daylight Pumps division, which includes, but in not limited to, all inventory located at 9204 Linwood Avenue, Suite 104 and 105,

Shreveport, LA 7116, as well as all usage rights for the name “Daylight Pump.” The sale is for cash consideration of $25,000, and Fleaux Services, LLC will assume the responsibility of a promissory note held by Kevin L. Wilson in the

amount of $350,000 and all accrued interest due since the date of issuance on August 23, 2016. The sale will include all future pump sales, future purchase orders resulting from previous negotiations, and all intellectual property related to

Daylight Pumps. During 2016, the Company recognized an aggregate impairment loss on this asset group of $443,935 to recognize the asset group at the lower of fair value or carrying value.

The Company recognized the sale of its stored energy division and Daylight Pumps division as a discontinued operation, in accordance with ASU 2014-08,

“Reporting Discontinued

Operations and Disclosures of Disposals of Components of an Entity.”

F-8

Assets and Liabilities of Discontinued Operations

The following table provides the details of the assets and

liabilities of our discontinued stored energy division:

|

Assets sold:

|

|

November 16, 2016

|

|

|

Inventory assets

|

$

|

180,681

|

|

|

Prepaid expenses

|

|

13,830

|

|

|

Property and equipment, net of

accumulated depreciation

|

|

169,275

|

|

|

Total assets of discontinued

operations

|

|

363,786

|

|

|

|

|

|

|

|

Consideration received:

|

|

|

|

|

Cash proceeds

|

|

350,000

|

|

|

Liabilities assumed

|

|

28,794

|

|

|

Total

liabilities of discontinued operations

|

|

378,794

|

|

|

|

|

|

|

|

Net assets sold

|

|

363,786

|

|

|

Consideration received

|

|

378,794

|

|

|

Related party gain recognized

as a capital transaction

|

|

15,008

|

|

The following table provides the details of the assets and

liabilities held for sale of our discontinued Daylight Pump division:

|

Assets sold:

|

|

March 9, 2017

|

|

|

Inventory assets

|

$

|

375,000

|

|

|

Prepaid expenses

|

|

-

|

|

|

Property and equipment, net of

accumulated depreciation

|

|

-

|

|

|

Total assets of discontinued

operations

|

|

375,000

|

|

|

|

|

|

|

|

Consideration received:

|

|

|

|

|

Cash proceeds

|

|

25,000

|

|

|

Liabilities assumed

|

|

402,291

|

|

|

Total

liabilities of discontinued operations

|

|

427,291

|

|

|

|

|

|

|

|

Net assets sold

|

|

375,000

|

|

|

Consideration received

|

|

427,291

|

|

|

Related party gain recognized

as a capital transaction

|

|

52,291

|

|

Income and Expenses of Discontinued Operations

The following table provides income and expenses of

discontinued operations for the three months ended March 31, 2017 and 2016,

respectively.

|

|

|

March

31, 2017

|

|

|

March

31, 2016

|

|

|

Revenue – Third Parties

|

$

|

11,435

|

|

|

286,039

|

|

|

Revenue – Related Parties

|

|

-

|

|

|

17,382

|

|

|

Less: Cost of Goods Sold

|

|

6,041

|

|

|

219,582

|

|

|

Gross Profit

|

|

5,394

|

|

|

83,839

|

|

|

|

|

|

|

|

|

|

|

Other expenses

|

|

|

|

|

|

|

|

General and administrative

|

|

27,250

|

|

|

75,871

|

|

|

Payroll expenses

|

|

-

|

|

|

100,956

|

|

|

Professional fees

|

|

-

|

|

|

13,125

|

|

|

Engineering research and development

|

|

-

|

|

|

(21,174

|

)

|

|

Depreciation and amortization

expense

|

|

-

|

|

|

6,842

|

|

|

Interest expense

|

|

5,789

|

|

|

1,951

|

|

|

Income (loss) from

discontinued operations

|

|

(27,645

|

)

|

|

(93,732

|

)

|

NOTE 9 – SUBSEQUENT EVENTS

On January 21, 2017, Galenfeha entered into a non-binding Letter of Intent to purchase Additive Manufacturing, LLC for a cash purchase of $14,000,000. On May 3, 2017, negotiations for this acquisition were terminated, as both parties could not

reach an agreement on a price of the acquisition or the payment terms.

On January 21, 2017, Mr. Ron Barranco joined the Company as Chief Technology Officer. On April 18, 2017, the Company received notice that Mr. Barranco was declining our employment offer and resigning as Chief Technology Officer. Management agreed to

Mr. Barranco’s resignation terms on May 1, 2017.

The Company is currently exploring other options to acquire and merge a profitable private company into ours.

F-9

Item 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis should be read in

conjunction with the consolidated financial statements and related notes

included in this report and those in our Form 10-K filed with the Securities and

Exchange Commission on March 31, 2017. This discussion contains forward-looking

statements that involve risks and uncertainties. Our actual results may differ

materially from those anticipated in such forward-looking statements as a result

of certain factors, including but not limited to, those described under “Risk

Factors” included in Part II, Item IA of this report.

Background Overview

Galenfeha was incorporated on March 14, 2013 in the state of

Nevada. Our corporate office is located at 420 Throckmorton Street, Suite 200,

Ft. Worth Texas 76102, and our telephone number is 1-817-945-6448. Our website

is www.galenfeha.com.

We are an engineering, product development, and manufacturing

company that generates revenue by receiving royalties from products we

developed, providing engineering, regulatory, and business consulting services

across numerous disciplines, such as aerospace, automotive, and medical, and by

making investments in companies that our management team feels to be

undervalued.

With the recent sale of our stored energy division, and our oil

and gas equipment division, we have moved the Company in the direction our

founder originally envisioned. Our objective is to be a vehicle that assembles a

team and finances the development of groundbreaking new technology that is

resistant to adverse economic and market fluctuations.

A condensed version of our 2017 Statement of Work is as

follows:

|

|

1.

|

Acquire or merge a profitable private company into our

public company.

|

|

|

2.

|

Explore investments both private and public.

|

|

|

3.

|

Develop new technologies for engineering, manufacturers,

and product life cycles.

|

|

|

4.

|

Formulate applications for new or recently developed

technologies.

|

|

|

5.

|

Commercialize new technology and

products.

|

Although information for this item is not required, the company

chooses to provide the following disclosures:

CAUTIONARY NOTE TO INVESTORS:

Investing in our

securities, whether open market purchases or private transactions, comes with

the high risk that you could lose your entire investment

.

Our independent

registered public accountant has issued an audit opinion which includes a

statement expressing substantial doubt as to our ability to continue as a going

concern. We have a limited history of operations, and have to date incurred

losses since the company’s inception. We recently sold all divisions of our

commercialized products, but retain royalties from some of these product

lines.

On December 21, 2016, Mr. James Ketner was formally elected by

the shareholders to assume the role of Chief Executive Officer beginning January

1, 2017. Since his reinstatement, Mr. Ketner has led the company back in the

direction he originally intended; to be a vehicle that assembles a team and

finances the development of new technology that is resistant to adverse economic

and market fluctuations.

As of the date of this filing, Galenfeha has zero options that

convert into common or preferred stock, no other notes or off balance sheet

arrangements that convert into common or preferred stock, and zero debt other

than to an affiliate.

The company has two classes of preferred stock. The preferred

class of stock consists of two (2) series, Series A, and Series B. All

affiliates of the company who purchased stock during the formation of the

company and who purchased stock for financing activities at prices below market

moved their common shares into the Series B preferred stock. The Series B votes

1:1; is subject to all splits the same as common; converts back to common 1:1;

and cannot be converted back to common for resale in the open market until a 30

day VWAP (volume weighted average price) of $.45 cents has been met in

Galenfeha’s public trading market. All future sales of company securities by

affiliates will adhere to rules and regulations of the Commission.

Affiliates who purchased stock at offering prices that were

current at the time of purchase, and affiliates who make open market purchases

and are directly responsible for a merger/acquisition that brings retained

earnings to the company, can convert these common shares 1:1 into Series A

preferred stock. Series A votes 1:1; converts back to common 1:1; is not subject

to splits in order to facilitate mergers, acquisitions, or meeting the

requirements of a listed exchange; and cannot be converted back to common for

resale in the open market until a 30 day VWAP of $3.50 per share has been met in

Galenfeha’s public trading market. All future sales of company securities by

affiliates will adhere to rules and regulations of the Commission.

On January 23, 2017, the Company announced on Form 8-K filed

with the commission that the company entered into an agreement to sell its

entire Daylight Pump inventory to SouthVest BDC, LLC for a cash selling price of

$400,000. A majority of the proceeds of this sale were to be used to repay a

note secured by the pump inventory with Kevin L. Wilson on August 23, 2016, for

$350,000 plus accrued interest.

3

On March 9, 2017, the company sold its entire Daylight Pump inventory to Fleaux Services, LLC. The sale was for a cash consideration of $25,000 USD; and Fleaux Services, LLC will assume responsibility of a promissory note held by Kevin L. Wilson

in the amount of $350,000 and all accrued interest this note had accumulated since issuance on August 23, 2016.

The Company is currently exploring other options to acquire and merge a profitable private company into ours.

Liquidity

Assets

At March 31, 2017, we had total assets of $23,699, of which $23,699 was in cash.

Results of Operations for the Three Months ending March 31, 2017

Revenues – Discontinued Operations

Revenues for the three months ended March 31, 2017 and 2016 were $11,435, and $303,421, respectively. Of the $303,421; $286,039 were to third parties and $17,382 were to related parties. All of the sales attributable to the

$11,435 were to third parties. The decrease is from the Company selling its battery and Daylight Pump division. The one sale during the quarter of $11,435 was related to fulfillment of a prior customer’s prepayment with respect to a

battery order.

Cost of Revenues – Discontinued Operations

Cost of Revenues for the three months ended March 31, 2017 and 2016 were $6,041 and $219,582, respectively. Costs were cost of materials and manufacturing supplies with the decrease due to the sale of the Company’s battery and Daylight

Pump division. The $6,041 was related to the one sale that occurred during the quarter.

Operating Expense – Continuing Operations

Total operating expenses for the three months ended March 31, 2017 and 2016 were $29,231 and $30,681, respectively.

Net Operating Loss and Net Loss

Net operating loss for the three months ended March 31, 2017 and 2016 was $28,299 and $212,131 respectively. The Company realized a lower net operating loss because the Company paid off all convertible debenture agreements prior to 2017.

Net loss for the three months ended March 31, 2017 and 2016 was $55,944 and $305,863 respectively. The Company realized a lower net loss because the Company paid off all convertible debenture agreements prior to 2017.

Equity Distribution

Since our incorporation, we have raised capital through private sales of our common equity. As of March 31, 2017 we have issued 61,250,000 shares of our common stock to various shareholders,.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital

expenditures or capital resources that is material to investors.

Item 3. Quantitative & Qualitative Disclosures about Market Risks

Not applicable.

Item 4. CONTROLS AND PROCEDURES

(a) Evaluation of Disclosure Controls and Procedures

As of the end of period covered by this report, the Company carried out an evaluation, with the participation of the Company's Chief Executive Officer and Principal Financial Officer, of the effectiveness of the Company's disclosure controls and

procedures pursuant to Securities Exchange Act Rule 13a-15. Based upon that evaluation, the Company's Chief Executive Officer and Principal Financial Officer concluded that the Company's disclosure controls and procedures were not effective in

ensuring that information required to be disclosed by the Company in the reports that it files or

submits under the Securities Exchange Act is recorded, processed, summarized and

reported, within the time periods specified in the SEC's rules and forms.

4

(b) Changes in internal controls over financial reporting.

No changes were made to the Company's internal controls in the

quarterly period covered by this report that have materially affected, or are

reasonably likely materially to affect, the Company’s internal control over

financial reporting.

PART II. OTHER INFORMATION Item 1. LEGAL PROCEEDINGS

None

Item 1A. Risk Factors

A description of the risks associated with our business,

financial condition and results of operations is set forth in our Annual Report

on Form 10-K for the fiscal year ended December 31, 2016, filed with the SEC on

March 31, 2017. These factors continue to be meaningful for your evaluation of

the Company and we urge you to review and consider the risk factors presented in

the Annual Report on Form 10-K. We believe there have been no changes that

constitute material changes from these risk factors.

Item 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF

PROCEEDS

None

Item 3. DEFAULTS UPON SENIOR SECURITEIES

None

Item 4. MINE SAFETY DISCLOSURES

Not applicable

Item 5. OTHER INFORMATION

None

Item 6. EXHIBITS

(a) Exhibits:

** XBRL (Extensible Business Reporting Language) information is

furnished and not filed or a part of a registration statement or prospectus for

purposes of Sections 11 or 12 of the Securities Act of 1933, as amended, is

deemed not filed for purposes of Section 18 of the Securities Exchange Act of

1934, as amended, and otherwise is not subject to liability under these

sections.

5

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of

1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

Galenfeha, Inc.

|

Date: May 10, 2017

|

By:

|

/s/ James Ketner

|

|

|

Name:

|

James Ketner

|

|

|

|

President and Chief Executive

Officer

|

|

|

|

(Principal Financial Officer,

Principal

|

|

|

|

Accounting Officer)

|

6

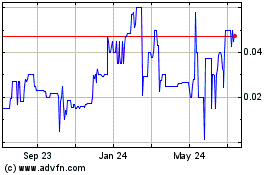

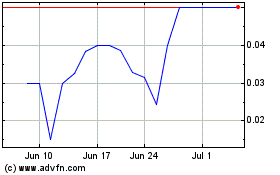

Galenfeha (PK) (USOTC:GLFH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Galenfeha (PK) (USOTC:GLFH)

Historical Stock Chart

From Apr 2023 to Apr 2024