Current Report Filing (8-k)

May 10 2017 - 4:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May 10,

2017 (May 4, 2017)

CRAWFORD & COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Georgia

|

|

1-10356

|

|

58-0506554

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS employer

Identification No.)

|

|

|

|

|

1001 Summit Blvd., Atlanta, Georgia

|

|

30319

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(404) 300-1000

N/A

(Former name or

former address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities

Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment

of Certain Officers; Compensatory Arrangements of Certain Officers

On April 11, 2017, Crawford & Company (the

“Company”) filed a Current Report on Form 8-K reporting that, on April 11, 2017, Ian V. Muress, who was the Company’s Executive Vice President and Chief Executive Officer – International Operations, resigned his

employment. Pursuant to Mr. Muress’ resignation, Crawford & Company EMEA/AP Management Limited, the Company’s subsidiary, and Mr. Muress entered into a Settlement Agreement and Further Waiver of Claims, effective May 4,

2017 (the “Settlement Agreement”) and, in connection with the Settlement Agreement, the Company and Mr. Muress entered into a Stock Purchase and Sale Agreement (the “Stock Repurchase Agreement”).

The Settlement Agreement terminates all obligations of the Group Company (as defined therein) to Mr. Muress under that certain

Contract of Employment for EMEA AP Executive Management, dated April 2014 and effective May 4, 2017, by and between Crawford & Company EMEA/AP Management Limited and Mr. Muress, except as specifically set forth in

the Settlement Agreement. The Settlement Agreement provides (i) that Mr. Muress’ employment will continue to the Termination Date or Early Release (each as defined in the Settlement Agreement), during such time

Mr. Muress will continue to receive his basic salary and contractual benefits, and (ii) for the payment of certain separation benefits to Mr. Muress, including: Payment in Lieu in the amount of £120,830 and £17,911, a

Severance Payment of £95,000 and a Termination Payment of £30,000 (each as defined in the Settlement Agreement). The Settlement Agreement also contains certain customary covenants regarding mutual confidentiality,

non-disparagement and waiver and release of claims provisions. Additionally, Mr. Muress will enter into a second Waiver of Claims in respect of any claims arising from his ongoing employment between May 7, 2017 and December 31, 2017

or the date of Early Release (whichever is sooner). The preceding summary of the Settlement Agreement is qualified in its entirety by reference to the full text of such agreement, a copy of which is attached as Exhibit 10.1 hereto and incorporated

herein by reference.

The Stock Repurchase Agreement is made pursuant to the Company’s board-authorized share repurchase program. The

Company will repurchase 131,320 shares of the Company’s Class A Common Stock, par value $1.00 per share, from Mr. Muress at a price per share equal to the average closing price per share of Class A Common Stock on the New York

Stock Exchange during the period from April 26, 2017 through and including May 9, 2017.

Item 9.01. Financial Statements and Exhibits.

(a) Exhibits.

The following exhibit is filed with this Report:

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

10.1

|

|

Settlement Agreement and Further Waiver of Claims effective May 4, 2017, by and between Crawford & Company EMEA/AP Management Limited and Ian V. Muress

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CRAWFORD & COMPANY

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ R. Eric Powers, III

|

|

|

|

|

|

|

|

|

|

Name:

|

|

R. Eric Powers, III

|

|

|

|

|

|

|

|

|

|

Title:

|

|

Corporate Secretary

|

Date: May 10, 2017

EXHIBIT INDEX

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

10.1

|

|

Settlement Agreement and Further Waiver of Claims effective May 4, 2017, by and between Crawford & Company EMEA/AP Management Limited and Ian V. Muress

|

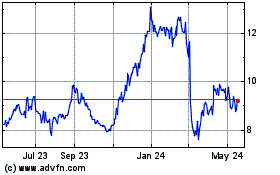

Crawford (NYSE:CRD.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

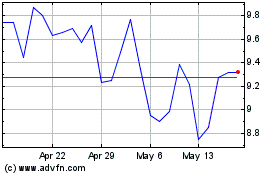

Crawford (NYSE:CRD.B)

Historical Stock Chart

From Apr 2023 to Apr 2024