Additional Proxy Soliciting Materials (definitive) (defa14a)

May 10 2017 - 4:13PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant ☒ Filed by a Party other than the

Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☒

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material Pursuant to §240.14a-12

|

Western

Alliance Bancorporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary material.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount previously paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

Western Alliance Bancorporation

One E. Washington Street Suite 1400

Phoenix, AZ 85004

SUPPLEMENT

TO PROXY STATEMENT FOR THE 2017 ANNUAL MEETING OF STOCKHOLDERS

On May 4, 2017, Western Alliance Bancorporation (the “Company”)

announced that current board member Kenneth Vecchione will return as President of the Company and its wholly-owned subsidiary Western Alliance Bank (the “Bank”), effective July 10, 2017. Mr. Vecchione will report directly to

Robert G. Sarver, Chairman and Chief Executive Officer of the Company. In connection with its long-term succession planning, the Board of Directors anticipates that Mr. Sarver will eventually transition to the role of Executive Chairman of the

Board and Mr. Vecchione will eventually succeed Mr. Sarver as Chief Executive Officer. Mr. Vecchione will continue to serve as a director of the Company and the Bank. As President of the Company, Mr. Vecchione will serve as the

Company’s principal operating officer.

In connection with his appointment, Mr. Vecchione is no longer considered an independent director and

has resigned from his membership on the Nominating and Corporate Governance Committee of the Board of Directors of the Company. As an employee, Mr. Vecchione will not be eligible to receive compensation for his continued service as a director

of the Company and the Bank.

In connection with Mr. Vecchione’s appointment as President, the Company entered into an offer letter with

Mr. Vecchione dated May 1, 2017 (the “Offer Letter”). Pursuant to the Offer Letter, Mr. Vecchione will be paid an annual base salary of $1,000,000 for 2017 (prorated based on his starting date) and an annual base salary of

$1,100,000, $1,150,000 and 1,200,000 for 2018, 2019 and 2020, respectively. Mr. Vecchione will be eligible for an annual cash award pursuant to the Company’s Annual Bonus Plan based on the Company’s annual performance relative to

pre-established

targets that are subject to the Compensation Committee of the Board’s review and approval. Mr. Vecchione’s target bonus will be 100% of his annual base salary, and will not be prorated

for 2017.

Under the Company’s Long Term Incentive Plan, Mr. Vecchione will receive a

one-time

award of

100,000 shares of performance-based restricted stock, vesting 25% on each of the 1st, 2nd, 3rd & 4th anniversaries of the grant date, subject to the Company achieving earnings per share for 2017 of no less than $2.03. Beginning in 2018,

2019 and 2020, Mr. Vecchione will receive annual grants of performance-based stock units and performance-based restricted stock equal to a total dollar amount at the time of the award of $2,200,000, $2,300,000 and $2,400,000, respectively, with

the allocation between stock units and restricted stock to be determined by the Compensation Committee.

Mr. Vecchione will be eligible to

participate in the Company’s Change of Control Severance Plan. The offer letter also provides that, if, prior to July 9, 2019, (i) Mr. Vecchione is terminated by the Company, without cause and not in connection with a change in

control, or (ii) terminates his employment with the Company for good reason, he will be entitled to receive severance upon execution of a release and agreement not to compete with the Company for a period of 24 months. Under those

circumstances, Mr. Vecchione will receive (i) immediate vesting of the unvested portion of the

one-time

award of 100,000 shares of restricted stock described above, (ii) payment, in 24 equal

monthly installments, of two times his annual base salary and target bonus, subject to all applicable withholding, subject to the total value of severance received under such circumstances not exceeding a maximum of $6,000,000.

The Board of Directors has not changed its recommendation that the stockholders vote “FOR” all of the director-nominees, including

Mr. Vecchione. Biographical information about Mr. Vecchione may be found on page 11 of the proxy statement.

Important Information

The Company filed a definitive Proxy Statement dated April 21, 2017 with the Securities and Exchange Commission and furnished to our shareholders that

Proxy Statement in connection with the solicitation of proxies for the 2017 Annual Meeting of Shareholders. Shareholders are urged to read the Proxy Statement dated April 21, 2017 relating to the 2017 Annual Meeting of Shareholders, as

supplemented by this supplement, because it contains important information.

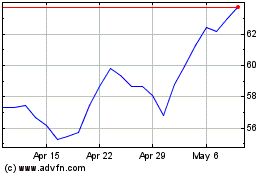

Western Alliance Bancorp... (NYSE:WAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

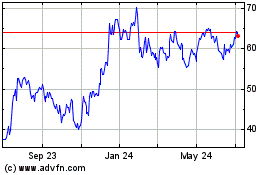

Western Alliance Bancorp... (NYSE:WAL)

Historical Stock Chart

From Apr 2023 to Apr 2024