Current Report Filing (8-k)

May 10 2017 - 8:12AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

May 10, 2017

Vericel Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Michigan

|

|

001-35280

|

|

94-3096597

|

|

(State or other jurisdiction of

|

|

(Commission File Number)

|

|

(l.R.S. Employer Identification No.)

|

|

incorporation)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

64 Sidney Street

|

|

|

|

|

|

Cambridge, MA

|

|

02139

|

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Registrant's telephone number, including area code:

(800) 556-0311

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by a checkmark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§240.12b-2 of this chapter). Emerging Growth Company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 1.01. Entry into a Material Definitive Agreement.

On May 9, 2017, Vericel Corporation (the “Company”), a Michigan corporation, entered into a Second Loan Modification Agreement (the “Loan Modification Agreement”) between the Company, as borrower, and Silicon Valley Bank, in its capacity as Administrative Agent (“Agent”), and Silicon Valley Bank, MidCap Funding IV Trust, MidCap Funding III Trust, and ELM 2016-1 Trust as lenders (“Lenders”). The Loan Modification Agreement modifies certain sections of the Loan and Security Agreement dated as of September 9, 2016, by and between the Company, Agent and Silicon Valley Bank, MidCap Financial Trust, MidCap Funding III Trust and other lenders listed therein as lenders, as amended by that certain First Loan Modification Agreement, dated as of December 30, 2016.

The Loan Modification Agreement modifies (i) certain financial covenants; (ii) the terms of the final payment of the Term Loan Advances (as defined in the Loan Modification Agreement) to an amount equal to the aggregate original principal amount of the Term Loan Advances, multiplied by seven percent (7%); and (iii) the terms of the Availability Amount (as defined in the Loan Modification Agreement) to exclude from the Revolving Line or the Borrowing Base (each as defined in the Loan Modification Agreement) a specified amount until the Company has complied with the minimum financial covenants for two consecutive quarters.

The foregoing description of the Loan Modification Agreement is qualified in its entirety by reference to the full text of the Loan Modification Agreement.

Item 2.

02. Results of Operations and Financial Condition

On May 10, 2017, the Registrant issued a press release, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Report on Form 8-K and Exhibit 99.1 attached hereto is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in response to Item 1.01 of Form 8-K above regarding the Loan Modification Agreement is incorporated by reference in response to this Item 2.03 of Form 8-K.

Item 9.01. Financial Statements and Exhibits.

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

99.1

|

|

Press Release of Vericel Corporation, “Vericel Reports First-Quarter 2017 Financial Results” dated May 10, 2017.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934

,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

Vericel Corporation

|

|

|

|

|

|

|

|

Date: May 10, 2017

|

|

|

By:

|

/s/ Gerard Michel

|

|

|

|

|

|

Name: Gerard Michel

|

|

|

|

|

|

Title: Chief Financial Officer and Vice President Corporate Development

|

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

99.1

|

|

Press Release of Vericel Corporation, “Vericel Reports First-Quarter 2017 Financial Results” dated May 10, 2017.

|

Vericel (NASDAQ:VCEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

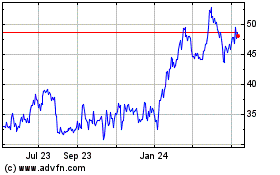

Vericel (NASDAQ:VCEL)

Historical Stock Chart

From Apr 2023 to Apr 2024