Kandi Technologies Group, Inc. (the “Company,”

“we” or “Kandi”) (NASDAQ:KNDI), today announced its financial

results for the first quarter of 2017.

First Quarter Highlights

- Total revenues were $4.3 million for the first quarter of 2017,

a decrease of 91.6% from total revenues of $50.7 million for the

same period in 2016.

- Electric Vehicle (“EV”) parts sales decreased by 94.2% to $2.7

million for the first quarter of 2017, compared with EV parts sales

of $46.2 million for the same period in 2016.

- Off-road vehicles revenues increased by 130.0% to $1.6 million

for the first quarter of 2017, compared with off-road vehicle sales

of $0.7 million for the same period in 2016.

- GAAP net loss for the first quarter of 2017 was $24.2 million,

or a loss of $0.51 per fully diluted share, which was largely due

to $20.8 million for research & development, compared with GAAP

net income of $0.1 million, or $0.00 in income per fully diluted

share for the same period in 2016.

- Non-GAAP adjusted net loss1, which excludes stock award

expenses, was $21.7 million in the first quarter of 2017, compared

with non-GAAP net income of $3.7 million for the same period in

2016. Non-GAAP adjusted loss per share1 was approximately $0.45 per

fully diluted share for the first quarter of 2017, compared with

Non-GAAP adjusted earnings per share1 of $0.07 per fully diluted

share for the same period in 2016;

- Working capital surplus was $65.3 million as of March 31, 2017.

Cash, cash equivalents and restricted cash totaled $16.3 million as

of March 31, 2017.

Mr. Hu Xiaoming, Chairman and Chief Executive

Officer of Kandi, commented, “Due to extended delays in receiving

government subsidy payments, as well as the government’s recent

revisions regarding the new technical standards to the MIIT

directory of recommended new energy vehicle models, or the

Directory, that required re-submission of applications of new

energy vehicles to be included in the Directory, the JV Company was

not able to have normal production in the first quarter. By April 4

of this year, all of the JV Company’s five Geely Global

Hawk EV models (SMA7000BEV05 (Kandi Model K12),

SMA7000BEV06(Kandi Model K10D), SMA7000BEV07(Kandi Model K12A),

SMA7001BEV25 (Kandi Model K17), and JL7001BEV18 (Kandi Model K11))

received MIIT approval and are included in the updated

Directory.”

“The significant drop in overall sales this

quarter was a direct result of reduced EV product sales by the JV

Company. However, now that we have begun receiving subsidy payments

from the Chinese government and capital support from the supply

chain finance program of the National Economic and Technological

Development Zone of Rugao City, our normal production activities

have resumed. We believe that we will regain our sales momentum and

competitive edge in the second half of this year and consequently

will achieve improved business operations.”

“Additionally, we have made significant progress

towards the JV Company's receiving EV manufacturing license

approval. Our application was accepted by the National Development

and Reform Commission, or the Commission on March 20, 2017, and

from April 13, 2017 to April 15, 2017, the project evaluation and

assessment team of experts made an on-site visit to conduct a

comprehensive inspection and evaluation of the JV Company’s

research and development, trial production, and manufacturing

capabilities. The JV Company received top marks from the evaluation

and assessment team’s experts. Pursuant to the application process,

the evaluation and assessment team submitted its appraisal report

to the Commission on May 4, 2017, and we expect we will receive

feedback from the Commission in the near future. Lastly, we note

that we are honored to welcome one of most influential experts in

China’s EV industry, Mr. Yi Lin, to be our independent board

member. Mr. Lin has many years of experience in manufacturing,

research and development, and management in the renewable energy

automotive industry. He is a valuable asset to the Company and we

believe that his involvement will improve the quality of our board

and provide the professional guidance we need to maximize Kandi’s

potential. The efforts we have made this year will lay a solid

foundation for the growth of our business and towards gaining our

leading market position,” Mr. Hu concluded.

Net Revenues and Gross Profit

|

|

1Q17 |

1Q16 |

Y-o-Y% |

|

Net Revenues (US$mln) |

$4.3 |

$50.7 |

-91.6% |

|

Gross Profit (US$mln) |

$0.7 |

$6.7 |

-90.1% |

|

Gross Margin |

15.6% |

13.3% |

- |

Net revenues for the first quarter decreased by

91.6% compared to the same period last year. The decrease in net

revenues was mainly due to a significant reduction in EV parts

sales during this quarter. The selling prices of our products for

the three months ended March 31, 2017 decreased slightly on average

from the same period last year. The decrease in revenue was

primarily due to the decrease in sales volume.

Operating Income (Loss)

|

|

1Q17 |

1Q16 |

Y-o-Y% |

|

Operating Expenses (US$mln) |

$29.4 |

$8.3 |

255.4% |

|

Operating (Loss) (US$mln) |

($28.8) |

($1.6) |

- |

|

Operating Margin |

-673.3% |

-3.1% |

- |

|

Operating Income (Loss) (US$mln) (Non-GAAP) |

($26.3) |

$5.3 |

-596.2% |

Total operating expenses in the first quarter

were $29.4 million, compared with $8.3 million in the same quarter

of 2016. The increase in total operating expenses was due to

increased research and development expenses relating to the

development of a new EV model in an effort to prepare the Company

for business growth in the coming years. Research and development

expenses were $20.8 million in this quarter, compared with $0.2

million in the same quarter last year.

GAAP Net Income

|

|

1Q17 |

1Q16 |

Y-o-Y% |

|

Net Income (Loss) (US$mln) |

($24.2) |

$0.1 |

-27416.7% |

|

Earnings per Weighted Average Common Share |

($0.51) |

$0.00 |

- |

|

Earnings per Weighted Average Diluted Share |

($0.51) |

$0.00 |

- |

|

Stock Award Expenses |

$2.5 |

$6.9 |

-63.77% |

|

Change in the Fair Value of Financial Derivatives |

- |

($3.3) |

- |

|

Non-GAAP Net Income (Loss) from Continuing Operations |

($21.7) |

$3.7 |

-687.4% |

Net loss was $24.2 million in the first quarter,

compared with net income of $0.1 million in the same quarter of

2016. The negative change was primarily attributable to

significantly decreased sales and gross profits, JV Company losses,

and significantly increased research and development expenses of

approximately $21 million.

Non-GAAP net loss was $21.7 million, a 687.4%

decrease in the first quarter of 2017 compared to Non-GAAP net

income of $3.7 million in the same quarter of 2016. The

decrease was primarily attributable to decreased revenues and

gross profits, the JV Company’s net losses, and significantly

increased research and development expenses undertaken to prepare

the Company for future business growth.

JV Company Financial Results

As a result of revisions to the MIIT directory

of recommended new energy vehicle models and because of the PRC

government’s new subsidy policies, effective as of January 1, 2017,

as well as extended delays in subsidy payments for EVs manufactured

in previous years resulting from the PRC government’s industry-wide

subsidy review in 2016, the JV Company had no EV product sales in

the first quarter of 2017. The JV Company had no EV product sales

in the same quarter of 2016. This quarter, total revenue was $1.3

million, an increase of $1.8 million over the same quarter of

2016.

The condensed financial income statements of the JV

Company in the first quarter are as set forth below:

|

|

1Q17 |

1Q16 |

Y-o-Y% |

|

Net Revenues (Loss) (US$mln) |

$1.3 |

($0.5) |

360.0% |

|

Gross (Loss) (US$mln) |

($0.3) |

($1.1) |

- |

|

Gross Margin |

- |

- |

- |

|

Net loss |

($10.6) |

($8.1) |

-30.9% |

|

% of Net revenue |

- |

- |

- |

Kandi’s investments in the JV Company are

accounted for under the equity method of accounting, because Kandi

has a 50% ownership interest in the JV Company. As a result, Kandi

recorded 50% of the JV Company’s loss for a total loss of $5.3

million for this quarter. After eliminating intra-entity profits

and losses, Kandi’s share of the JV Company’s after-tax loss was

$5.2 million for the first quarter of 2017.

First Quarter

2017 Conference Call

DetailsThe Company has scheduled a conference call and

live webcast to discuss its financial results at 8:00

A.M. Eastern Time (8:00 P.M. Beijing Time) on May 10,

2017. Mr. Hu Xiaoming, Chief Executive Officer of the Company, and

Mr. Mei Bing, Chief Financial Officer of the Company, will deliver

prepared remarks to be followed by a question and answer

session.

Dial-in details for the conference call are as

follows:

- Toll-free dial-in number: +1-877-407-3982

- International dial-in number: + 1-201-493-6780

- Webcast and replay:

http://public.viavid.com/index.php?id=124320

A live audio webcast of the call can also be

accessed by visiting Kandi's Investor Relations page on

the Company’s website at http://www.kandivehicle.com. An

archive of the webcast will be available on the Company’s website

following the live call.

About Kandi Technologies Group,

Inc. Kandi Technologies Group, Inc. (KNDI), headquartered

in Jinhua, Zhejiang Province, is engaged in the research and

development, manufacturing and sales of various vehicle products.

Kandi has established itself as one of China's leading

manufacturers of pure electric vehicle ("EV") products (through its

joint venture), EV parts and off-road vehicles. More information

can be viewed at the Company's corporate website at

http://www.kandivehicle.com. The Company routinely posts important

information on its website.

Safe Harbor StatementThis press

release contains certain statements that may include

"forward-looking statements." All statements other than statements

of historical fact included herein are "forward-looking

statements." These forward-looking statements are often identified

by the use of forward-looking terminology such as "believes,"

"expects" or similar expressions, involving known and unknown risks

and uncertainties. Although the Company believes that the

expectations reflected in these forward-looking statements are

reasonable, they do involve assumptions, risks and uncertainties,

and these expectations may prove to be incorrect. You should not

place undue reliance on these forward-looking statements, which

speak only as of the date of this press release. The Company's

actual results could differ materially from those anticipated in

these forward-looking statements as a result of a variety of

factors, including the risk factors discussed in the Company's

periodic reports that are filed with the Securities and Exchange

Commission and available on the SEC's website (http://www.sec.gov).

All forward-looking statements attributable to the Company or

persons acting on its behalf are expressly qualified in their

entirety by these risk factors. Other than as required under the

securities laws, the Company does not assume a duty to update these

forward-looking statements.

Follow us on Twitter: @ Kandi_Group

- Tables Below -

| |

| KANDI TECHNOLOGIES GROUP,

INC. |

| AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED BALANCE

SHEET |

| |

| (UNAUDITED) |

| |

|

|

|

March 31, 2017 |

|

|

December 31,

2016 |

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

|

| Cash

and cash equivalents |

|

$ |

2,044,025 |

|

|

$ |

12,235,921 |

|

|

Restricted cash |

|

|

14,222,418 |

|

|

|

12,957,377 |

|

| Short

term investments |

|

|

82,371 |

|

|

|

4,463,097 |

|

|

Accounts receivable |

|

|

34,053,585 |

|

|

|

32,394,613 |

|

|

Inventories (net of provision for slow moving inventory of $464,950

and $415,797 as of March 31, 2017 and December 31, 2016,

respectively |

|

|

14,742,642 |

|

|

|

11,914,110 |

|

| Notes

receivable from JV Company and related party |

|

|

1,329,481 |

|

|

|

400,239 |

|

| Other

receivables |

|

|

576,867 |

|

|

|

66,064 |

|

|

Prepayments and prepaid expense |

|

|

4,011,087 |

|

|

|

4,317,855 |

|

| Due

from employees |

|

|

46,207 |

|

|

|

4,863 |

|

|

Advances to suppliers |

|

|

16,958,367 |

|

|

|

38,250,818 |

|

|

Amount due from JV Company, net |

|

|

130,463,405 |

|

|

|

136,536,159 |

|

|

Amount due from related party |

|

|

10,568,992 |

|

|

|

10,484,816 |

|

|

Deferred taxes assets |

|

|

581,806 |

|

|

|

- |

|

|

Total Current assets |

|

|

229,681,253 |

|

|

|

264,025,932 |

|

|

|

|

|

|

|

|

|

|

|

|

LONG-TERM ASSETS |

|

|

|

|

|

|

|

|

|

Property, plants and equipment, net |

|

|

14,277,542 |

|

|

|

15,194,442 |

|

| Land

use rights, net |

|

|

11,790,750 |

|

|

|

11,775,720 |

|

|

Construction in progress |

|

|

36,779,576 |

|

|

|

27,054,181 |

|

|

Deferred tax assets |

|

|

3,196,909 |

|

|

|

0 |

|

| Long

term investments |

|

|

1,378,704 |

|

|

|

1,367,723 |

|

|

Investment in JV Company |

|

|

72,914,887 |

|

|

|

77,453,014 |

|

|

Goodwill |

|

|

322,591 |

|

|

|

322,591 |

|

|

Intangible assets |

|

|

392,687 |

|

|

|

413,211 |

|

|

Advances to suppliers |

|

|

31,751,164 |

|

|

|

33,819,419 |

|

| Other

long term assets |

|

|

8,045,747 |

|

|

|

8,271,952 |

|

|

Total Long-Term Assets |

|

|

180,850,557 |

|

|

|

175,672,253 |

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

$ |

410,531,810 |

|

|

$ |

439,698,185 |

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

106,672,979 |

|

|

$ |

115,870,051 |

|

| Other

payables and accrued expenses |

|

|

4,338,481 |

|

|

|

4,835,952 |

|

|

Short-term loans |

|

|

32,508,385 |

|

|

|

34,265,065 |

|

|

Customer deposits |

|

|

169,177 |

|

|

|

41,671 |

|

| Notes

payable |

|

|

18,761,779 |

|

|

|

14,797,325 |

|

|

Income tax payable |

|

|

607,699 |

|

|

|

1,364,235 |

|

| Due

to employees |

|

|

16,014 |

|

|

|

21,214 |

|

|

Deferred tax liabilities |

|

|

- |

|

|

|

118,643 |

|

|

Deferred income |

|

|

1,349,098 |

|

|

|

6,363,751 |

|

|

Total Current Liabilities |

|

|

164,423,612 |

|

|

|

177,677,907 |

|

|

|

|

|

|

|

|

|

|

|

|

LONG-TERM LIABILITIES |

|

|

|

|

|

|

|

|

| Long

term bank loans |

|

|

29,025,343 |

|

|

|

28,794,172 |

|

|

Deferred tax liabilities |

|

|

- |

|

|

|

878,639 |

|

|

Total Long-Term Liabilities |

|

|

29,025,343 |

|

|

|

29,672,811 |

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES |

|

|

193,448,955 |

|

|

|

207,350,718 |

|

|

|

|

|

|

|

|

|

|

|

| Loss

contingency-litigation |

|

|

4,620,488 |

|

|

|

0 |

|

|

STOCKHOLDER'S EQUITY |

|

|

|

|

|

|

|

|

|

Common stock, $0.001 par value; 100,000,000 shares authorized;

47,772,138 and 47,699,638 shares issued and outstanding at March

31, 2017 and December 31, 2016, respectively |

|

|

47,772 |

|

|

|

47,700 |

|

|

Additional paid-in capital |

|

|

230,387,924 |

|

|

|

227,911,477 |

|

|

Retained earnings (restricted portions were $4,217,753 and

$4,219,808 at March 31, 2017 and December 31, 2016,

respectively) |

|

|

391,728 |

|

|

|

24,545,163 |

|

|

Accumulated other comprehensive income (loss) |

|

|

(18,365,057 |

) |

|

|

(20,156,873 |

) |

|

TOTAL STOCKHOLDERS' EQUITY |

|

|

212,462,367 |

|

|

|

232,347,467 |

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

|

$ |

410,531,810 |

|

|

$ |

439,698,185 |

|

| |

| |

| KANDI TECHNOLOGIES GROUP,

INC. |

| AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(LOSS) AND |

| COMPREHENSIVE INCOME (LOSS) |

| (UNAUDITED) |

| |

|

|

|

Three Months Ended |

|

|

|

|

March 31, 2017 |

|

|

March 31, 2016 |

|

|

|

|

|

|

|

|

|

|

REVENUES FROM UNRELATED PARTIES, NET |

|

|

2,962,931 |

|

|

|

33,974,416 |

|

|

REVENUES FROM THE JV COMPANY AND RELATED PARTIES, NET |

|

|

1,311,642 |

|

|

|

16,683,477 |

|

|

|

|

|

|

|

|

|

|

|

|

REVENUES, NET |

|

|

4,274,573 |

|

|

|

50,657,893 |

|

|

|

|

|

|

|

|

|

|

|

| COST

OF GOODS SOLD |

|

|

3,607,241 |

|

|

|

43,939,795 |

|

|

|

|

|

|

|

|

|

|

|

|

GROSS PROFIT |

|

|

667,332 |

|

|

|

6,718,098 |

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

Research and development |

|

|

20,769,732 |

|

|

|

205,968 |

|

|

Selling and marketing |

|

|

358,309 |

|

|

|

46,335 |

|

|

General and administrative |

|

|

8,319,294 |

|

|

|

8,032,882 |

|

|

Total Operating Expenses |

|

|

29,447,335 |

|

|

|

8,285,185 |

|

|

|

|

|

|

|

|

|

|

|

|

(LOSS) FROM OPERATIONS |

|

|

(28,780,003 |

) |

|

|

(1,567,087 |

) |

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSE): |

|

|

|

|

|

|

|

|

|

Interest income |

|

|

530,642 |

|

|

|

780,181 |

|

|

Interest expense |

|

|

(614,453 |

) |

|

|

(442,079 |

) |

|

Change in fair value of financial instruments |

|

|

0 |

|

|

|

3,286,340 |

|

|

Government grants |

|

|

5,067,474 |

|

|

|

194,473 |

|

| Share

of loss after tax of JV |

|

|

(5,161,713 |

) |

|

|

(4,822,470 |

) |

| Other

income (expense), net |

|

|

28,621 |

|

|

|

22,387 |

|

|

Total other expense, net |

|

|

(149,429 |

) |

|

|

(981,168 |

) |

|

|

|

|

|

|

|

|

|

|

|

(LOSS) BEFORE INCOME TAXES |

|

|

(28,929,432 |

) |

|

|

(2,548,255 |

) |

|

|

|

|

|

|

|

|

|

|

|

INCOME TAX BENEFIT |

|

|

4,775,997 |

|

|

|

2,636,675 |

|

|

|

|

|

|

|

|

|

|

|

|

NET (LOSS) INCOME |

|

|

(24,153,435 |

) |

|

|

88,420 |

|

|

|

|

|

|

|

|

|

|

|

| OTHER

COMPREHENSIVE INCOME (LOSS) |

|

|

|

|

|

|

|

|

|

Foreign currency translation |

|

|

1,791,816 |

|

|

|

1,524,639 |

|

|

|

|

|

|

|

|

|

|

|

|

COMPREHENSIVE (LOSS) INCOME |

|

$ |

(22,361,619 |

) |

|

$ |

1,613,059 |

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE SHARES OUTSTANDING BASIC |

|

|

47,732,388 |

|

|

|

47,009,834 |

|

|

WEIGHTED AVERAGE SHARES OUTSTANDING DILUTED |

|

|

47,732,388 |

|

|

|

47,027,744 |

|

|

|

|

|

|

|

|

|

|

|

| NET

(LOSS) INCOME PER SHARE, BASIC |

|

$ |

(0.51 |

) |

|

$ |

0.00 |

|

| NET

(LOSS) INCOME PER SHARE, DILUTED |

|

$ |

(0.51 |

) |

|

$ |

0.00 |

|

| |

| |

| KANDI TECHNOLOGIES GROUP,

INC. |

| AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

| (UNAUDITED) |

|

|

|

Three months Ended |

|

|

|

|

March 31, 2017 |

|

|

March 31, 2016 |

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

| Net

income |

|

$ |

(24,153,435 |

) |

|

$ |

88,420 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

1,162,795 |

|

|

|

1,223,243 |

|

| Asset

impairments |

|

|

45,831 |

|

|

|

0 |

|

|

Deferred taxes |

|

|

(4,775,997 |

) |

|

|

(4,397,828 |

) |

|

Change in fair value of financial instruments |

|

|

0 |

|

|

|

(3,286,340 |

) |

| Share

of loss after tax of the JV Company |

|

|

5,161,713 |

|

|

|

4,822,470 |

|

| Stock

compensation costs |

|

|

2,476,519 |

|

|

|

6,887,892 |

|

|

|

|

|

|

|

|

|

|

|

|

Changes in operating assets and liabilities, net of effects

of acquisitions: |

|

|

|

|

|

|

|

|

|

(Increase) Decrease in: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(1,399,372 |

) |

|

|

(42,638,900 |

) |

| Notes

receivable from the JV Company and related parties |

|

|

3,704,957 |

|

|

|

0 |

|

|

Inventories |

|

|

(2,779,644 |

) |

|

|

(7,815,491 |

) |

| Other

receivables and other assets |

|

|

(210,503 |

) |

|

|

(144,118 |

) |

| Due

from employees |

|

|

(46,692 |

) |

|

|

(67,798 |

) |

|

Advances to suppliers and prepayments and prepaid expenses |

|

|

21,948,470 |

|

|

|

(441,602 |

) |

|

Advances to suppliers-Long term |

|

|

(5,682,460 |

) |

|

|

0 |

|

|

Amounts due from the JV Company |

|

|

(15,542,072 |

) |

|

|

(47,249,577 |

) |

| Due

from related parties |

|

|

(300,000 |

) |

|

|

34,781,767 |

|

|

|

|

|

|

|

|

|

|

|

|

Increase (Decrease) In: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

|

9,986,016 |

|

|

|

59,895,019 |

|

| Other

payables and accrued liabilities |

|

|

(297,408 |

) |

|

|

(7,875,311 |

) |

| Notes

payable |

|

|

(1,855,353 |

) |

|

|

0 |

|

|

Customer deposits |

|

|

127,216 |

|

|

|

54,289 |

|

|

Income tax payable |

|

|

(789,661 |

) |

|

|

1,165,635 |

|

|

Deferred income |

|

|

(5,067,474 |

) |

|

|

0 |

|

| Loss

contingency-litigation |

|

|

4,622,066 |

|

|

|

0 |

|

|

Net cash used in operating activities |

|

$ |

(13,664,488 |

) |

|

$ |

(4,998,230 |

) |

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Purchases of plants and equipment, net |

|

|

(23,492 |

) |

|

|

(29,696 |

) |

|

Disposal of land use rights and other intangible assets |

|

|

0 |

|

|

|

13,767 |

|

|

Purchases of construction in progress |

|

|

(1,488,409 |

) |

|

|

(28,140 |

) |

|

Repayment of notes receivable |

|

|

- |

|

|

|

2,724,443 |

|

| Short

term investments |

|

|

4,418,065 |

|

|

|

(1,455,727 |

) |

|

Net cash provided by investing activities |

|

$ |

2,906,164 |

|

|

$ |

1,224,647 |

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Restricted cash |

|

|

(1,161,410 |

) |

|

|

0 |

|

|

Proceeds from short-term bank loans |

|

|

3,629,407 |

|

|

|

- |

|

|

Repayments of short-term bank loans |

|

|

(5,661,875 |

) |

|

|

0 |

|

|

Proceeds from notes payable |

|

|

3,669,853 |

|

|

|

- |

|

|

Warrant exercises |

|

|

- |

|

|

|

434,666 |

|

|

Net cash provided by financing

activities |

|

$ |

475,975 |

|

|

$ |

434,666 |

|

|

|

|

|

|

|

|

|

|

|

|

NET INCREASE IN CASH AND CASH EQUIVALENTS |

|

|

(10,282,349 |

) |

|

|

(3,338,917 |

) |

|

Effect of exchange rate changes on cash |

|

|

90,453 |

|

|

|

48,024 |

|

| Cash

and cash equivalents at beginning of year |

|

|

12,235,921 |

|

|

|

16,738,559 |

|

|

|

|

|

|

|

|

|

|

|

|

CASH AND CASH EQUIVALENTS AT END OF PERIOD |

|

|

2,044,025 |

|

|

|

13,447,666 |

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTARY CASH FLOW INFORMATION |

|

|

|

|

|

|

|

|

|

Income taxes paid |

|

|

786,172 |

|

|

|

595,518 |

|

|

Interest paid |

|

|

386,973 |

|

|

|

445,176 |

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL NON-CASH DISCLOSURES: |

|

|

|

|

|

|

|

|

|

Prepayments transferred to construction in progress |

|

|

8,023,030 |

|

|

|

0 |

|

|

Accounts payable transferred to construction in progress |

|

|

980,292 |

|

|

|

0 |

|

|

Settlement of accounts due from the JV Company and related parties

with notes receivable |

|

|

22,713,442 |

|

|

|

31,350,559 |

|

|

Settlement of accounts receivables with notes receivable from

unrelated parties |

|

|

- |

|

|

|

10,413,273 |

|

|

Assignment of notes receivable to suppliers to settle accounts

payable |

|

|

18,082,140 |

|

|

|

40,855,454 |

|

|

Settlement of accounts payable with notes payables |

|

|

2,032,468 |

|

|

|

2,063,766 |

|

| |

1 Non-GAAP measures, including Non-GAAP net income and

Non-GAAP EPS are defined as the financial measures excluding the

change of fair value of financial derivatives and the effects of

stock award expenses. We supply non-GAAP information because we

believe it allows our investors to obtain a clearer understanding

of our operations. Any non-GAAP measure should not be considered as

a substitute for, and should only be read in conjunction with,

measures of financial performance prepared in accordance with

GAAP.

Company Contact:

Ms. Kewa Luo

Kandi Technologies Group, Inc.

Phone: 1-212-551-3610

Email: IR@kandigroup.com

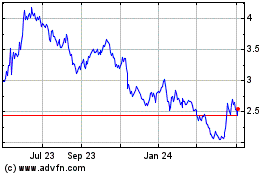

Kandi Technolgies (NASDAQ:KNDI)

Historical Stock Chart

From Mar 2024 to Apr 2024

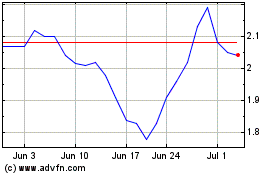

Kandi Technolgies (NASDAQ:KNDI)

Historical Stock Chart

From Apr 2023 to Apr 2024