Filed Pursuant to Rule 424(b)(5)

Registration No. 333-216845

PROSPECTUS SUPPLEMENT

(To Prospectus dated April 21, 2017)

5,055,555

Shares of

Cannabics

Pharmaceuticals, Inc.

Common

Stock

Pursuant to this

prospectus supplement and the accompanying prospectus, we are offering 4,500,000 shares of our common stock to D-Beta One EQ,

Ltd. ("D-Beta") under a Securities Purchase Agreement entered into on May 8, 2017 (the “Purchase

Agreement”), and the selling stockholder named herein is offering an additional 555,555 shares of our common stock.

The shares offered by

us under the Purchase Agreement include (i) 3,000,000 shares of Common Stock to be issued and sold to D-Beta for a purchase

price of $1.00 per share for an aggregate purchase price of $3,000,000, (the “Purchased Shares”), and (ii) 1,500,000

shares of Common Stock (the “Additional Shares”) which may be purchased by D-Beta from time to time until and including

May 7, 2018 for a purchase price of $2.00 per share.

The price at which the

selling stockholder may sell its shares will be determined by the prevailing market price for the shares or in negotiated transactions.

We will not receive any proceeds from the sale of shares by the selling stockholder.

Our common stock is listed

on the OTCQB tier of the marketplace maintained by OTC Markets Group Inc. under the symbol “CNBX”. On May 5, 2017,

the last reported sales price for our common stock as reported on the OTCQB was $1.61 per share.

Investing in our securities

involves significant risks. See “Risk Factors” beginning on page S-4 of this prospectus supplement and on page

4 of the accompanying prospectus.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this

prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal

offense.

The date of this prospectus supplement

is May 9, 2017.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two

parts. The first part is this prospectus supplement, which describes the terms of this offering of common stock and also adds to

and updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus

supplement and the accompanying prospectus. The second part, the accompanying prospectus dated April 21, 2017, including the documents

incorporated by reference therein, provides more general information. Generally, when we refer to this prospectus, we are referring

to both parts of this document combined. To the extent there is a conflict between the information contained in this prospectus

supplement, on the one hand, and the information contained in the accompanying prospectus or in any document incorporated by reference

that was filed with the Securities and Exchange Commission, or SEC, before the date of this prospectus supplement, on the other

hand, you should rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent

with a statement in another document having a later date — for example, a document incorporated by reference in

the accompanying prospectus — the statement in the document having the later date modifies or supersedes the earlier

statement.

We have not, and the

selling stockholder has not, authorized anyone to provide you with information different from that contained in or incorporated

by reference into this prospectus supplement, the accompanying prospectus and in any free writing prospectus that we have authorized

for use in connection with this offering. If anyone provides you with different or inconsistent information, you should not rely

on it. We are not, and the selling stockholder is not, making an offer to sell these securities in any jurisdiction where the offer

or sale is not permitted. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus,

the documents incorporated by reference in this prospectus supplement and the accompanying prospectus, and in any free writing

prospectus that we have authorized for use in connection with this offering, is accurate only as of the date of those respective

documents. Our business, financial condition, results of operations and prospects may have changed since those dates. You should

read this prospectus supplement, the accompanying prospectus, the documents incorporated by reference in this prospectus supplement

and the accompanying prospectus, and any free writing prospectus that we have authorized for use in connection with this offering,

in their entirety before making an investment decision. You also should read and consider the information in the documents to which

we have referred you in the sections of this prospectus supplement titled “Where You Can Find Additional Information”

and “Incorporation of Certain Information By Reference.”

We, and the selling stockholder,

are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted.

The distribution of this prospectus supplement and the accompanying prospectus and the offering of common stock in certain jurisdictions

may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement and the accompanying

prospectus must inform themselves about, and observe any restrictions relating to, the offering of the common stock and the distribution

of this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying

prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any

securities offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it

is unlawful for such person to make such an offer or solicitation.

This prospectus supplement

and the accompanying prospectus contain summaries of certain provisions contained in some of the documents described herein, but

reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the

actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by

reference as exhibits to the registration statement of which this prospectus supplement and the accompanying prospectus is a part,

and you may obtain copies of those documents as described below under the section titled “Where You Can Find Additional Information.”

Unless otherwise mentioned

or unless the context requires otherwise, all references in this prospectus supplement and the accompanying prospectus to “Cannabics,”

the “Company,” the “Registrant,” “us,” “we” and “our” are to Cannabics

Pharmaceuticals, Inc., a Nevada corporation, and its subsidiary. References to “selling stockholder” refer to the holder

of our common stock listed in this prospectus supplement under the section titled “Selling Stockholder.”

This prospectus supplement,

the accompanying prospectus, and the information incorporated herein and therein by reference include trademarks, service marks

and trade names owned by us or other companies. All trademarks, service marks and trade names included or incorporated by reference

into this prospectus supplement or the accompanying prospectus are the property of their respective owners.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights

selected information appearing elsewhere or incorporated by reference into this prospectus supplement and the accompanying prospectus.

This information is not complete and does not contain all of the information that you should consider before deciding whether to

invest in our common stock. You should read this prospectus supplement, the accompanying prospectus, and any free writing prospectus

that we have authorized for use in connection with this offering carefully, including the information incorporated by reference

in this prospectus supplement and the accompanying prospectus, and including information under the heading “Risk Factors”

in this prospectus supplement on page S-4, and our Quarterly Report on Form 10-Q for the quarterly period ending February

28, 2017.

Company Overview

We are an early stage biotechnology company

engaged in discovering, developing, and commercializing personalized anti-cancer and palliative treatments. Our research and development

is based in Israel, where we have obtained a license from the Israeli Ministry of Health for both scientific and clinical research.

We are focused on harnessing the therapeutic properties of natural cannabinoid formulations and diagnostics. Cannabics engages

in developing individually tailored natural therapies for cancer patients, utilizing advanced screening systems and personalized

bioinformatics tools.

Our business model is solely based on technology

development and out-licensing of our intellectual property to global pharmaceutical and biotechnology companies, in addition to

other suitable strategic partners, but always in accordance with the law of each applicable jurisdiction. Cannabics does not manufacture,

distribute, dispense, or possess any controlled substances, including cannabis or cannabis-based preparations, in the United States.

Cancer Diagnostics

Utilizing novel biological screening technologies,

we monitor the antitumor effects of arrays of botanical extracts on cell lines and biopsies. The data collected propels the development

of proprietary and novel compounds targeted to diverse types of tumors. This technology enables us to perform lab tests that offer

doctors and their patients a profile of personalized treatment with cannabinoids. We believe that our personalized approach minimizes

harmful side effects, with more successful outcomes and lower costs than the traditional “trial-and-error” approach

to treatment. We are presently conducting diagnostic validation studies in collaboration with academic institutes and lab facilities,

and expect to have preliminary results available by March 2018.

Anti-Cancer Treatments

We are developing botanical cannabinoid formulations

based on our proprietary diagnostic procedures designated for the treatment of cancer and its side-effects. We are presently conducting

preclinical research on the efficacy of our cannabinoid-based formulations in the treatment of cancer and expect to have preliminary

results available by March 2018. If our diagnostic data cross-linked with clinical outcomes demonstrates that our formulations

have therapeutic and commercial potential, we intend to submit an investigational new drug application with the U.S. Food and Drug

Administration to commence clinical trials.

Palliative Therapies

We have developed our non-pharmaceutical capsules

as a treatment to improve cancer related cachexia/anorexia syndrome (“CACS”) in advanced cancer patients. The main

purpose in the treatment of patients with advanced cancer and CACS is to prolong life and to improve quality of life (“QoL”)

as far as possible. We believe that QoL in patients with CACS is inversely related to reduced appetite and weight-loss. We are

currently engaged in a clinical study in Israel to determine the efficacy of our proprietary capsules as a treatment to improve

appetite and stem weight-loss associated with CACS in advanced cancer patients. We expect that preliminary results of our study

will be available by the end of 2017.

Corporate Information

The Company was originally

incorporated as Thrust Energy Corp. on September 15, 2004, under the laws of the State of Nevada, for the purpose of acquiring

oil and gas exploration properties and non-operating interests. In April 2011, the Company expanded its business to include the

acquisition of mineral exploration rights. On May 5, 2011, the name of the Company was changed to American Mining Corporation.

On April 25, 2014, Cannabics Inc., a Delaware corporation, acquired 99.1% voting control of the Company. On June 19, 2014, the

Company changed its name to Cannabics Pharmaceuticals Inc., and redirected its business focus towards its current operations.

All of our research and development in Israel

is conducted by our wholly-owned subsidiary, G.R.I.N. Ultra Ltd., which was incorporated under the laws of Israel on August 25,

2014. We do not have any other subsidiaries.

Our principal executive offices are located

at #3 Bethesda Metro Center, Suite 700, Bethesda, Maryland, 20814, and our telephone number is (877) 424-2429. Our website address

is http://www.cannabics.com. The information on, or that can be accessed through, our website is not incorporated by reference

into this prospectus supplement or the accompanying prospectus and should not be considered to be a part of this prospectus supplement

or the accompanying prospectus. We have included our website address as an inactive textual reference only.

Recent Developments

On May 3, 2017, Cannabics announced that it

had begun a scientific collaboration with a medical laboratory in Europe, a world leader in the field of CTC (circulating

tumor cells) count and drug sensitivity tests for cancer patients.

The Offering

|

Issuer

|

Cannabics Pharmaceuticals, Inc.

|

|

|

|

|

Shares offered by us in this offering

|

4,500,000 shares

|

|

|

|

|

Shares offered by the selling stockholder

|

555,555 shares

|

|

|

|

|

Shares outstanding after this offering

|

119,655,955 shares

(1)

, assuming the sale of all 1,500,000 Additional Shares. Actual shares issued will vary

depending on whether the Additional Shares are sold under this offering.

|

|

|

|

|

Use of proceeds

|

We intend to use the net proceeds from this offering for general corporate purposes, including working capital. See “Use of Proceeds” in this prospectus supplement.

|

|

|

|

|

OTCQB Symbol

|

“CNBX”

|

|

|

|

|

Risk Factors

|

See “Risk Factors” beginning on page S-4 in this prospectus supplement, which incorporates by reference the risk factors in our Quarterly Report on Form 10-Q for the quarterly period ending February 28, 2017, for a discussion of factors that you should carefully consider before deciding to purchase shares of our common stock.

|

|

(1)

|

The number of our shares outstanding is based on shares outstanding as of April 30, 2017.

|

Except as otherwise indicated,

the information contained in this prospectus supplement assumes the sale of all of the shares offered hereby, including the sale

of 1,500,000 Additional Shares at a price of $2.00 per share.

RISK FACTORS

Investing in our common

stock involves risks. Before making an investment decision, you should carefully consider the risks described below, as well as

the information and financial statements contained in the documents incorporated by reference herein, including the risk factors

described in our Quarterly Report on Form 10-Q for the quarterly period ending February 28, 2017. You should consider these risks

in light of your particular investment objectives and financial circumstances. Our business, financial condition or results of

operations could be materially adversely affected by any of these risks. The trading price of our common stock could decline due

to any of these risks, and you may lose all or part of your investment.

Risks Related to this Offering

Management will have broad discretion

as to the use of the proceeds from this offering, and we may not use the proceeds effectively.

Our management will have

broad discretion in the application of the net proceeds from this offering, and could spend the proceeds in ways that do not improve

our results of operations or enhance the value of our common stock. Our failure to apply these funds effectively could have a material

adverse effect on our business and cause the price of our common stock to decline.

Sales of our Common Stock to

D-Beta may cause substantial dilution to our existing stockholders and the sale of the shares of our Common Stock acquired by D-Beta

could cause the price of our Common Stock to decline.

This prospectus

supplement relates to the sale by us of 3,000,000 shares of our Common Stock to D-Beta at a price per share of $1.00 per share,

and to the sale of an additional 1,500,000 shares that D-Beta may purchase from time to time at a price per share of $2.00 per

share. It is anticipated that the Additional Shares offered to D-Beta in this offering will be purchased over a period of up to

12 months from the date of this prospectus supplement. The total number of shares ultimately purchased by D-Beta under this prospectus

supplement is dependent upon the number of Additional Shares that D-Beta elects to purchase under the Purchase Agreement. Depending

upon market liquidity at the time, sales of shares of our Common Stock under the Purchase Agreement may cause the trading price

of our Common Stock to decline.

D-Beta may ultimately

purchase all or some of the 1,500,000 Additional Shares that, together with the 3,000,000 Purchased Shares, is the subject of this

prospectus supplement. After D-Beta has acquired shares under the Purchase Agreement, it may sell all, some, or none of those shares.

Sales to D-Beta by us pursuant to the Purchase Agreement under this prospectus supplement may result in substantial dilution to

the interests of other holders of our Common Stock. The sale of a substantial number of shares of our Common Stock to D-Beta in

this offering, or the anticipation of such sales, could make it more difficult for us to sell equity or equity-related securities

in the future at a time and at a price that we might otherwise wish to effect sales.

Future sales of a significant

number of our shares of Common Stock in the public markets, or the perception that such sales could occur, could depress the market

price of our shares of Common Stock.

Sales of a substantial

number of our shares of Common Stock in the public markets, or the perception that such sales could occur, could depress the market

price of our shares of Common Stock and impair our ability to raise capital through the sale of additional equity securities. A

substantial number of shares of Common Stock are being offered by this prospectus supplement, and we cannot predict if and when

D-Beta may sell such shares in the public markets. In addition, we cannot predict the number of these shares that might be sold

nor the effect that future sales of our shares of Common Stock would have on the market price of our shares of Common Stock.

You will experience immediate

and substantial dilution.

The offering

price per share in this offering exceeds the net tangible book value per share of our common stock outstanding prior to this offering.

After giving effect to the sale of 4,500,000 shares by us in this offering, and after deducting the estimated offering expenses

payable by us, you will experience immediate dilution of $1.2855 per share, representing the difference between our as adjusted

net tangible book value per share as of February 28, 2017, after giving effect to this offering and the average offering price.

See the section entitled “Dilution” on page S-8 below for a more detailed illustration of the dilution you will incur

if you participate in this offering.

SPECIAL NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus supplement,

the accompanying prospectus, the documents incorporated by reference herein and any free writing prospectus we have authorized

for use in connection with this offering contain forward-looking statements within the meaning of Section 27A of the Securities

Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the Private Securities Litigation

Reform Act of 1995. Also, documents that we incorporate by reference into this prospectus supplement and accompanying prospectus,

including documents that we subsequently file with the SEC, contain or will contain forward-looking statements. Forward-looking

statements are those that predict or describe future events or trends and that do not relate solely to historical matters, including

our cost reduction expectations and business outlook set forth under “Recent Developments” in the “Prospectus

Supplement Summary” section above. You can generally identify forward-looking statements as statements containing the words

“may,” “will,” “could,” “should,” “expect,” “anticipate,”

“intend,” “estimate,” “believe,” “project,” “plan,” “assume”

or other similar expressions, or negatives of those expressions, although not all forward-looking statements contain these identifying

words. All statements contained in or incorporated by reference into this prospectus supplement or the accompanying prospectus

regarding future operating or financial performance, business strategies, technology developments, financing and investment plans,

competitive position, industry and regulatory environment, potential growth opportunities and the effects of competition, and involve

known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be

materially different from any future results, performances or achievements expressed or implied by the forward-looking statements.

You should not place

undue reliance on our forward-looking statements because the matters they describe are subject to certain risks, uncertainties

and assumptions that are difficult to predict. Our forward-looking statements are based on the information currently available

to us and speak only as of the date on the cover of this prospectus supplement, the date of the accompanying prospectus (with respect

to risks described therein), the date of any free writing prospectus we have authorized for use in connection with this offering

with respect to statements made therein, or, in the case of forward-looking statements incorporated by reference, the date of the

filing that includes the statement. Over time, our actual results, performance or achievements may differ from those expressed

or implied by our forward-looking statements, and such difference might be significant and materially adverse to our securityholders.

We undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events

or otherwise.

Factors or events that

could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We

cannot guarantee future results, levels of activity, performance, or achievements. Except as required by applicable law, including

the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements

to actual results

We have identified some

of the important factors that could cause future events to differ from our current expectations and they are described in this

prospectus supplement under the caption “Risk Factors” or are incorporated by reference in this prospectus supplement

from our most recent Quarterly Report on Form 10-Q, including without limitation under the caption “Risk Factors,”

and in other documents that we may file with the SEC, all of which you should review carefully. Please consider our forward-looking

statements in light of those risks as you read this prospectus supplement and the accompanying prospectus.

You should read this

prospectus supplement, the accompanying prospectus, the documents we have filed with the SEC that are incorporated by reference

and any free writing prospectus that we have authorized for use in connection with this offering completely and with the understanding

that our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements

in the foregoing documents by these cautionary statements.

USE OF PROCEEDS

The net proceeds from

the sale of 3,000,000 Purchased Shares and all 1,500,000 Additional Shares (assuming that all of the Additional Shares will be

purchased) will be approximately $5,880,000 million, after deducting the estimated offering expenses payable by us. We estimate

that our offering expenses will be approximately $120,000.

We intend to use the

net proceeds from this offering for general corporate purposes, including the continuation of our research, clinical trials, collaboration

arrangements and general working capital needs. We also may use a portion of the net proceeds from this offering to in-license,

invest in, or acquire businesses, technologies, product candidates, or other intellectual property that we believe are complementary

to our own, although we have no current plans, commitments or agreements to do so as of the date of this prospectus supplement.

The amounts and timing of these expenditures will depend on a number of factors, such as technological advances and the competitive

environment for our products. As of the date of this prospectus supplement, we cannot specify with certainty all of the particular

uses for the net proceeds to us from this offering. Accordingly, our management will have broad discretion in the application of

these proceeds. Pending application of the net proceeds as described above, we intend to temporarily invest the proceeds in short

term, interest-bearing instruments.

We will not receive any

proceeds from the sale of shares of our common stock by the selling stockholder, which are estimated to be approximately $894,000.

PRICE RANGE OF OUR COMMON STOCK

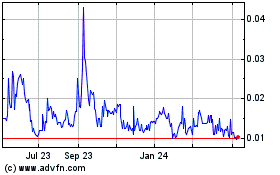

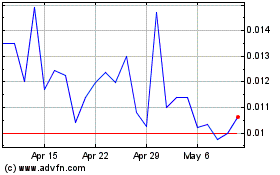

Our common stock is traded

on the OTCQB tier of the marketplace maintained by OTC Markets Group Inc under the symbol of “CNBX”. The following

table sets forth on a per share basis, for the periods indicated, the high and low closing sale prices of our common stock as reported

by OTC Markets Group Inc.

|

|

|

High

|

|

|

Low

|

|

|

2017

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

$

|

6.45

|

|

|

|

0.68

|

|

|

Second Quarter (through May 5, 2017)

|

|

|

2.93

|

|

|

|

1.30

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High

|

|

|

Low

|

|

|

2016

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

$

|

0.11

|

|

|

|

0.04

|

|

|

Second Quarter

|

|

|

0.09

|

|

|

|

0.05

|

|

|

Third Quarter

|

|

|

0.06

|

|

|

|

0.04

|

|

|

Fourth Quarter

|

|

|

1.46

|

|

|

|

0.05

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High

|

|

|

Low

|

|

|

2015

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

$

|

0.30

|

|

|

|

0.18

|

|

|

Second Quarter

|

|

|

0.27

|

|

|

|

0.17

|

|

|

Third Quarter

|

|

|

0.21

|

|

|

|

0.04

|

|

|

Fourth Quarter

|

|

|

0.08

|

|

|

|

0.03

|

|

As of April 30, 2017, there were approximately

60 holders of record of our common stock. On May 5, 2017, the last reported sale price of our common stock was $1.61 per

share.

DIVIDEND POLICY

We have never paid cash

dividends on our common stock and do not anticipate that we will pay any cash dividends on our common stock in the foreseeable

future. We intend to retain our future earnings, if any, to finance the development of our business. Any future dividend policy

will be determined by our board of directors based upon conditions then existing, including our earnings, financial condition,

tax position and capital requirements, as well as such economic and other conditions as our board of directors may deem relevant.

CAPITALIZATION

The following tables

set forth our capitalization as of February 28, 2017:

|

|

·

|

On an actual basis; and

|

|

|

·

|

on an as adjusted basis to give effect to

the receipt of the estimated net proceeds of approximately $5,880,000 million from the sale of the common stock in this offering

at the public offering price of $1.00 per share for the Purchased Shares and $2.00 per share for the Additional Shares, after deducting

the estimated offering expenses payable by us as described under “Use of Proceeds.”

|

You should read the data

set forth in the tables below in conjunction with (a) our consolidated financial statements, including the related notes,

and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” from our Annual Report

on Form 10-K for the fiscal year ended August 31, 2016, and (b) our unaudited condensed consolidated financial statements,

including the related notes, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

from our Quarterly Report on Form 10-Q for the quarterly period ended February 28, 2017 which are incorporated by reference

into this prospectus supplement.

The table below sets

forth our total capitalization as of February 28, 2017 on an actual basis:

|

Stockholders' equity (deficit):

|

|

|

|

|

Preferred stock, $.0001 par value, 5,000,000 shares authorized, no shares issued and outstanding

|

|

|

–

|

|

|

Common stock, $.0001 par value, 900,000,000 shares authorized, 114,676,233 shares issued and outstanding

|

|

|

11,467

|

|

|

Additional paid-in capital

|

|

|

1,882,299

|

|

|

Accumulated deficit

|

|

|

(2,171,632

|

)

|

|

Total stockholders' equity (deficit)

|

|

|

(277,866

|

)

|

|

Total capitalization

|

|

$

|

(277,866

|

)

|

The table below sets forth our total capitalization as of February 28, 2017 on an on an as adjusted basis to give effect to the receipt of the estimated net proceeds of approximately $5.9 million from the sale of the common stock in this offering :

|

Stockholders' equity (deficit):

|

|

|

|

|

Preferred stock, $.0001 par value, 5,000,000 shares authorized, no shares issued and outstanding

|

|

|

–

|

|

|

Common stock, $.0001 par value, 900,000,000 shares authorized, 119,176,233 shares issued and outstanding

|

|

|

11,918

|

|

|

Additional paid-in capital

|

|

|

7,761,848

|

|

|

Accumulated deficit

|

|

|

(2,171,632

|

)

|

|

Total stockholders' equity (deficit)

|

|

|

5,602,134

|

|

|

Total capitalization on an as adjusted basis

|

|

$

|

5,602,134

|

|

DILUTION

Our net negative tangible

book value as of February 28, 2017, was approximately $(177,866), or $(0.0016) per share. Net negative tangible book value per

share is determined by dividing our total tangible assets, less total liabilities, by the number of shares of our common stock

outstanding as of February 28, 2017. Dilution with respect to net tangible book value per share represents the difference between

the amount per share paid by purchasers of shares of common stock in this offering, and the net tangible book value per share of

our common stock immediately after this offering.

After giving effect to

the sale by us of 3,000,000 shares of our common stock at the offering price of $1.00 per share and assuming the sale of 1,500,000

shares of our common stock at the offering price of $2.00 per share, and after deducting the estimated offering expenses payable

by us, our as adjusted net tangible book value as of February 28, 2017, would have been approximately $5,702,134, or $0.0478 per

share. This represents an immediate increase in net tangible book value of $0.0494 per share to existing stockholders and immediate

dilution of $1.2855 per share to investors purchasing our common stock in this offering. The following table illustrates this dilution

on a per share basis:

|

Average Public offering price per share

|

|

|

|

|

|

$

|

1.33

|

|

|

Net tangible book value per share as of February 28, 2017

|

|

$

|

(0.0016

|

)

|

|

|

|

|

|

Increase in net tangible book value per share attributable to investors purchasing our common stock in this offering

|

|

$

|

0.0494

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As adjusted net tangible book value per share after this offering

|

|

|

|

|

|

|

5,702,134

|

|

|

|

|

|

|

|

|

|

|

|

|

Dilution per share to investors purchasing our common stock in this offering

|

|

|

|

|

|

$

|

1.2855

|

|

The above discussion

and table are based on 114,676,233 shares outstanding as of February 28, 2017.

To the extent that outstanding

options or warrants have been or may be exercised or other shares issued, investors purchasing our common stock in this offering

may experience further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic considerations

even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is

raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution

to our stockholders.

SELLING STOCKHOLDER

The following table sets

forth information as of April 30, 2017, regarding beneficial ownership of the selling stockholder that is offering shares of our

common stock pursuant to this prospectus supplement and the accompanying prospectus. When we refer to the “selling stockholder”

in this prospectus supplement, we mean the persons listed in the table below.

We have determined beneficial

ownership in accordance with SEC rules. The information does not necessarily indicate beneficial ownership for any other purpose.

Except as indicated in the footnotes to this table and pursuant to state community property laws, we believe, based on the information

furnished to us, that the persons named in the table have sole voting and investment power with respect to all shares reflected

as beneficially owned by them. In computing the number of shares beneficially owned by a person and the percentage ownership of

that person, shares of common stock that could be issued upon the exercise of outstanding options held by that person that are

currently exercisable or exercisable within 60 days of February 28, 2017 are considered outstanding. These shares, however, are

not considered outstanding when computing the percentage ownership of any other person.

Selling Stockholder

name and address

|

|

Number of shares before the Offering

|

|

Percentage beneficially owned before the offering

|

|

Number of shares offered hereby

|

|

Number of shares after the Offering

|

|

Percentage beneficially owned after the

offering

|

|

YAII PN Ltd

1012 Springfield Ave.

Mountainside, NJ 07092

|

|

555,555

|

|

<1%

|

|

555,555

|

|

0

|

|

0%

|

The selling stockholder and D-Beta are affiliated

funds as the members and partners of their respective investment managers and general partners are the same.

Secondary Offering Shares

In January 2017, we entered

into a subscription agreement with the selling stockholder, whereby the selling stockholder purchased 555,555 shares of common

stock at a price per share of 0.45 per share, for an aggregate purchase price of $250,000. The private placement purchase agreement

granted the selling stockholder registration rights.

Material Relationships with Selling Stockholder

The selling stockholder

does not have any material transaction or relationship with us or any of our predecessors or affiliates within the past three years.

D-BETA TRANSACTION

Purchase Agreement

On May 8, 2017,

we entered into a Purchase Agreement with D-Beta, which provides that, upon the terms and subject to the conditions and limitations

set forth therein, D-Beta will purchase an aggregate of 3,000,000 shares of our Common Stock (the “Purchased Shares”)

at a price per share of $1.00 per share, for an aggregate purchase price of $3,000,000. In addition, for a period of one-year from

May 8, 2017, D-Beta may from time to time purchase up to an additional 1,500,000 shares of our Common Stock (the "Additional

Shares") at a price per share of $2.00 per share, for an aggregate purchase price of $3,000,000 assuming the purchase of all

of the Additional Shares.

Pursuant to the

Purchase Agreement, we are required to register all shares previously acquired by D-Beta or its affiliates, the Purchased Shares,

and the Additional Shares.

We are filing

this prospectus supplement with regard to the offering of our Common Stock consisting of (i) the Purchased Shares, and the

(ii) Additional Shares. In addition, the selling stockholder is an affiliate of D-Beta, and therefore we are registering the

selling stockholder's shares as well.

Pursuant to the

Purchase Agreement, we shall use the net proceeds from the sale of the shares for working capital purposes and capital expenditures.

For 60 days from the effective date of the Purchase Agreement we may not sell shares of Common Stock that are freely tradable at

a price below $1.00 per share. There are no other restrictions on future financing transactions. The Purchase Agreement does not

contain any right of first refusal, participation rights, penalties or liquidated damages. We did not pay any additional amounts

to reimburse or otherwise compensate D-Beta in connection with the transaction.

Termination

The

Purchase Agreement shall terminate automatically on the one-year anniversary of the effective date of the Purchase Agreement.

No Short-Selling or Hedging by D-Beta

D-Beta has agreed

that neither it nor any of its affiliates shall engage in any short-selling or hedging of our Common Stock during any time prior

to the public disclosure of the Purchase Agreement.

Effect of Performance of the Purchase

Agreement on Our Stockholders

The Purchase

Agreement does not limit the ability of D-Beta to sell any or all of the shares it receives in this offering. The subsequent

resale by D-Beta of a significant amount of shares sold to D-Beta in this offering at any given time could cause the market price

of our Common Stock to decline or to be highly volatile. D-Beta may ultimately purchase all, some or none of the Additional Shares

under this prospectus supplement. D-Beta may resell all, some or none of the Purchased Shares and the Additional hares it

acquires. Therefore, sales to D-Beta by us pursuant to the Purchase Agreement and this prospectus supplement also may result

in substantial dilution to the interests of other holders of our Common Stock.

Information With Respect to D-Beta

Delta Beta Advisors,

LLC, the investment manager of D-Beta, has voting and investment power over the shares owned by D-Beta. D-Beta is not a licensed

broker dealer or an affiliate of a licensed broker dealer.

LEGAL MATTERS

The validity of the shares

of common stock offered by this prospectus supplement and accompanying prospectus will be passed upon for us by SRK Kronengold

Law Offices.

EXPERTS

The consolidated financial

statements incorporated in this prospectus supplement by reference from our Annual Report on Form 10-K for the year ended August

31, 2016 have been audited by Weinberg & Baer LLC, an independent registered public accounting firm, as stated in their report,

which is incorporated herein by reference. Such consolidated financial statements have been so incorporated in reliance upon

the report of such firm given upon their authority as experts in accounting and auditing.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

This prospectus supplement

is part of the registration statement on Form S-3 we filed with the SEC under the Securities Act and does not contain all the information

set forth in the registration statement. Whenever a reference is made in this prospectus supplement or the accompanying prospectus

to any of our contracts, agreements or other documents, the reference may not be complete and you should refer to the exhibits

that are a part of the registration statement or the exhibits to the reports or other documents incorporated by reference into

this prospectus supplement and the accompanying prospectus for a copy of such contract, agreement or other document. Because we

are subject to the information and reporting requirements of the Exchange Act, we file annual, quarterly and current reports, proxy

statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s

website at http://www.sec.gov. You may also read and copy any document we file at the SEC’s Public Reference Room at 100

F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the Public

Reference Room.

INCORPORATION OF CERTAIN INFORMATION

BY REFERENCE

The SEC allows us to

“incorporate by reference” information from other documents that we file with it, which means that we can disclose

important information to you by referring you to those documents. The information incorporated by reference is considered to be

part of this prospectus supplement and the accompanying prospectus. Information in this prospectus supplement and the accompanying

prospectus supersedes information incorporated by reference that we filed with the SEC prior to the date of this prospectus supplement

and the accompanying prospectus, while information that we file later with the SEC will automatically update and supersede the

information in this prospectus supplement and the accompanying prospectus. We incorporate by reference into this prospectus supplement,

the accompanying prospectus and the registration statement of which this prospectus is a part the information or documents listed

below that we have filed with the SEC (Commission File No. 001-35480), excluding any portions of any Form 8-K that are not

deemed “filed” pursuant to the General Instructions of Form 8-K:

|

|

·

|

our Annual Report on Form 10-K for the fiscal year ended August 31, 2016, filed with the SEC on December 13, 2016;

|

|

|

·

|

the amendment to our Annual Report on Form 10-K for the fiscal year ended August 31, 2016, filed with the SEC on March 15,

2017;

|

|

|

·

|

our Quarterly Reports on Form 10-Q for the three months ended November 30, 2016, and for the three months ended February 28,

2017, filed with the SEC on January 17, 2017, and on April 14, 2017, respectively;

|

|

|

|

|

|

|

·

|

our Periodic Report on Form 8-K, filed with the SEC on May 9, 2017;

|

|

|

·

|

our Periodic Report on Form 8-K, filed with the SEC on December 13, 2016; and

|

|

|

·

|

the description of our common stock contained in our registration statement on Form 8-A, dated January 12, 2007, filed with

the SEC on January 16, 2007, and any amendment or report filed with the SEC for the purpose of updating the description.

|

We also incorporate by

reference any future filings (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits

filed on such form that are related to such items unless such Form 8-K expressly provides to the contrary) made with the SEC pursuant

to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act. Information in such future filings updates and supplements the

information provided in this prospectus supplement and the accompanying prospectus. Any statements in any such future filings will

automatically be deemed to modify and supersede any information in any document we previously filed with the SEC that is incorporated

or deemed to be incorporated herein by reference to the extent that statements in the later filed document modify or replace such

earlier statements.

You can request a copy

of these filings, at no cost, by writing or telephoning us at the following address or telephone number:

Cannabics Pharmaceuticals Inc.

# 3 Bethesda Metro Center

Suite 700

Bethesda, MD 20814

Attention: General Counsel

Telephone: (877) 424-2429

SUBJECT TO COMPLETION, DATED APRIL 7,

2017

PROSPECTUS

$80,000,000

CANNABICS

PHARMACEUTICALS INC.

Common

Stock

Preferred

Stock

Warrants

Units

and

7,966,444

Shares of Common Stock Offered by Selling Stockholders

We may from time to time, in one or more

offerings, at prices and on terms that we will determine at the time of each offering, sell common stock, preferred stock, warrants,

or a combination of these securities, or units, for an aggregate initial offering price of up to $80,000,000. In addition, selling

stockholders to be named in a prospectus supplement may from time to time offer and sell up to 7,966,444 shares of our common stock.

We will not receive any of the proceeds from the sale of our common stock by the selling stockholders.

This prospectus provides a general description

of the securities we may offer. Each time we or any of the selling stockholders offer and sell securities, we or such selling stockholders

will provide specific terms of the securities offered and, if applicable, the selling stockholders, in a supplement to this prospectus.

We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings. A prospectus

supplement and any free writing prospectus may also add, update, or change information contained in this prospectus. You should

carefully read this prospectus, the applicable prospectus supplement, and any related free writing prospectus, as well as the documents

incorporated or deemed to be incorporated by reference in this prospectus, before you invest in any of our securities offered hereby.

This prospectus may not be used to offer

and sell securities unless accompanied by a prospectus supplement.

Our common stock is quoted on the OTCQB

tier of the marketplace maintained by OTC Markets Group Inc., under the symbol “CNBX.” On March 20, 2017, the last

reported sales price for our common stock as reported on the OTCQB on was $2.7199.

We or the selling stockholders may offer

and sell the securities described in this prospectus and any prospectus supplement to or through one or more underwriters, broker-dealers,

agents, directly to purchasers, or through any other means described in this prospectus under “Plan of Distribution”

and in supplements to this prospectus in connection with a particular offering of securities. If any underwriters, dealers or agents

are involved in the sale of any of these securities, their names and any applicable purchase price, fee, commission or discount

arrangement between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus

supplement. The price to the public of such securities and the net proceeds we expect to receive from such sale will also be set

forth in a prospectus supplement.

You should carefully read this prospectus

and any prospectus supplement, together with additional information described in the sections of this prospectus titled “Incorporation

of Certain Information by Reference” and “Where You Can Find More Information,” before you invest in any of our

securities.

An investment in our stock is extremely

speculative and involves a high degree of risk. Please refer to the section of this prospectus titled “Risk Factors”

beginning on page 4, in addition to Risk Factors contained in the applicable prospectus supplement before making an investment

decision.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy

of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is April 21,

2017

Table

of Contents

About

This Prospectus

This prospectus is part of a registration

statement on Form S-3 that we filed with the United States Securities and Exchange Commission (“SEC”), using a “shelf”

registration process. Under this shelf process, we may, from time to time, sell any combination of the securities described in

this prospectus in one or more offerings up to an aggregate dollar amount of $80,000,000. In addition, the selling stockholders

may from time to time sell up to an aggregate amount of 7,966,444 shares of our common stock in one or more offerings. This prospectus

provides you with a general description of the securities we or the selling stockholders may offer.

Each time we or the selling stockholders sell

securities, we will provide a prospectus supplement that will contain specific information about the terms of that offering. We

may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to

these offerings, hereinafter referred to as a free writing prospectus. The prospectus supplement and any free writing prospectus

may also add to, update, or change information contained in the prospectus, and, accordingly, to the extent inconsistent, information

in this prospectus will be superseded by the information in the prospectus supplement or the free writing prospectus, as applicable.

You should carefully read this prospectus, any prospectus supplement, and any free writing prospectus, together with the additional

information described under the heading “Information Incorporated by Reference.”

The prospectus supplement to be attached to

the front of this prospectus may describe, as applicable, the terms of the securities offered, the initial public offering price,

the price paid for the securities, net proceeds, and the other specific terms related to the offering of the securities.

This prospectus may not be used to offer

and sell securities unless accompanied by a prospectus supplement.

You should only rely on the information contained

or incorporated by reference in this prospectus and any prospectus supplement or free writing prospectus relating to a particular

offering. No person has been authorized to give any information or make any representations in connection with this offering other

than those contained or incorporated by reference in this prospectus, any accompanying prospectus supplement, and any related free

writing prospectus in connection with the offering described herein and therein, and, if given or made, such information or representations

must not be relied upon as having been authorized by us. Neither this prospectus nor any prospectus supplement nor any related

free writing prospectus shall constitute an offer to sell or a solicitation of an offer to buy offered securities in any jurisdiction

in which it is unlawful for such person to make such an offering or solicitation. This prospectus does not contain all of the information

included in the registration statement. For a more complete understanding of the offering of the securities, you should refer to

the registration statement, including its exhibits.

You should read the entire prospectus and

any prospectus supplement and any related free writing prospectus, as well as the documents incorporated by reference into this

prospectus or any prospectus supplement or any related free writing prospectus, before making an investment decision. Neither the

delivery of this prospectus or any prospectus supplement or any free writing prospectus nor any sale made hereunder shall under

any circumstances imply that the information contained or incorporated by reference herein or in any prospectus supplement or free

writing prospectus is correct as of any date subsequent to the date hereof or of such prospectus supplement or free writing prospectus,

as applicable. You should assume that the information appearing in this prospectus, any prospectus supplement, any free writing

prospectus, or any document incorporated by reference is accurate only as of the date of the applicable documents, regardless of

the time of delivery of this prospectus or any sale of securities. Our business, financial condition, results of operations and

prospects may have changed since that date.

As used in this prospectus, references to

“Cannabics,” the “Company,” “we,” “our” and “us” refer to Cannabics

Pharmaceuticals Inc. and its consolidated subsidiaries, unless otherwise indicated.

Prospectus

summary

This summary description about Cannabics and

its business highlights selected information contained elsewhere in this prospectus or incorporated in this prospectus by reference.

This summary does not contain all of the information you should consider before deciding to invest in our securities. You should

carefully read this entire prospectus and any applicable prospectus supplement, including each of the documents incorporated herein

or therein by reference, before making an investment decision. Investors should carefully consider the information set forth under

“Risk Factors” on page 4 and incorporated by reference to our annual report on Form 10-K and our quarterly reports

on Form 10-Q, and any amendments thereto.

Overview

We are an early stage biotechnology company

engaged in discovering, developing, and commercializing personalized anti-cancer and palliative treatments. Our research and development

is based in Israel, where we have obtained a license from the Ministry of Health for both scientific and clinical research. We

are focused on harnessing the therapeutic properties of natural cannabinoid formulations and diagnostics. Cannabics engages in

developing individually tailored natural therapies for cancer patients, utilizing advanced screening systems and personalized bioinformatics

tools.

Our business model is solely based on technology

development and out-licensing of our intellectual property to global pharmaceutical and biotechnology companies, in addition to

other suitable strategic partners, but always in accordance with the law of each applicable jurisdiction. Cannabics does not manufacture,

distribute, dispense, or possess any controlled substances, including cannabis or cannabis-based preparations, in the United States.

Cancer Diagnostics

Utilizing novel biological screening technologies,

we monitor the antitumor effects of arrays of botanical extracts on cell lines and biopsies. The data collected propels the development

of proprietary and novel compounds targeted to diverse types of tumors. This technology enables us to perform lab tests that offer

doctors and their patients a profile of personalized treatment with cannabinoids. We believe that our personalized approach minimizes

harmful side effects, with more successful outcomes and lower costs than the traditional “trial-and-error” approach

to treatment. We are presently conducting diagnostic validation studies in collaboration with academic institutes and lab facilities,

and expect to have preliminary results available by March 2018.

Anti-Cancer Treatments

We are developing botanical cannabinoid formulations

based on our proprietary diagnostic procedures designated for the treatment of cancer and its side-effects. We are presently conducting

preclinical research on the efficacy of our cannabinoid-based formulations in the treatment of cancer and expect to have preliminary

results available by March 2018. If our diagnostic data cross-linked with clinical outcomes demonstrates that our formulations

have therapeutic and commercial potential, we intend to submit an investigational new drug application with the U.S. Food and Drug

Administration to commence clinical trials.

Palliative Therapies

We have developed our non-pharmaceutical capsules

as a treatment to improve cancer related cachexia/anorexia syndrome (“CACS”) in advanced cancer patients. The main

purpose in the treatment of patients with advanced cancer and CACS is to prolong life and to improve quality of life (“QoL”)

as far as possible. We believe that QoL in patients with CACS is inversely related to reduced appetite and weight-loss. We are

currently engaged in a clinical study in Israel to determine the efficacy of our proprietary capsules as a treatment to improve

appetite and stem weight-loss associated with CACS in advanced cancer patients. We expect that preliminary results of our study

will be available in July 2017.

Corporate

Information

The Company was originally

incorporated as Thrust Energy Corp. on September 15, 2004, under the laws of the State of Nevada, for the purpose of acquiring

oil and gas exploration properties and non-operating interests. In April 2011, the Company expanded its business to include the

acquisition of mineral exploration rights. On May 5, 2011, the name of the Company was changed to American Mining Corporation.

On April 25, 2014, Cannabics Inc., a Delaware corporation, acquired 99.1% voting control of the Company. On June 19, 2014, the

Company changed its name to Cannabics Pharmaceuticals Inc., and redirected its business focus towards its current operations.

All of our research and development in Israel

is conducted by our wholly-owned subsidiary, G.R.I.N. Ultra Ltd., which was incorporated under the laws of Israel on August 25,

2014. We do not have any other subsidiaries.

Our principal executive offices are located

at #3 Bethesda Metro Center, Suite 700, Bethesda, Maryland, 20814, and our telephone number is (877) 424-2429. Our website address

is http://www.cannabics.com. The information on, or that can be accessed through, our website is not incorporated by reference

into this prospectus and should not be considered to be a part of this prospectus. We have included our website address as an inactive

textual reference only.

“Cannabics,” the Cannabics logo,

and any other trademarks or service marks of Cannabics appearing in this prospectus are trademarked and are the property of Cannabis

Pharmaceuticals Inc. All other trademarks, service marks and trade names referred to in this prospectus are the property of their

respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork

and other visual displays, may appear without the ® or ™ symbols, but such references are not intended to indicate in

any way that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor

to these trademarks and trade names.

The

Securities We May Offer

We may offer up to $80,000,000 of common stock,

preferred stock, warrants, and units in one or more offerings and in any combination. In addition, the selling stockholders may

sell up to 7,966,444 shares of our common stock from time to time in one or more offerings. This prospectus provides you with a

general description of the securities we and the selling stockholders may offer. A prospectus supplement, which we will provide

each time we or the selling stockholders offer securities, will describe the specific amounts, prices, and terms of these securities.

Common Stock

Each holder of our common stock is entitled

to one vote for each share of common stock held on all matters submitted to a vote of the stockholders, including the election

of directors. There are no cumulative voting rights. Subject to preferences that may be applicable to any then outstanding preferred

stock, holders of common stock are entitled to receive ratably those dividends, if any, as may be declared from time to time by

our board of directors out of legally available funds. In the event of our liquidation, dissolution, or winding up, holders of

common stock will be entitled to share ratably in the net assets legally available for distribution to stockholders after the payment

of all of our debts and other liabilities and the satisfaction of any liquidation preference granted to the holders of any then

outstanding preferred stock.

Preferred Stock

Our board of directors has the authority,

without further action by the stockholders, to issue an unlimited number of series of preferred stock. Our board of directors has

the discretion to determine the rights, preferences, privileges, restrictions, and conditions, including, among others, dividend

rights, conversion rights, voting rights, redemption rights, and liquidation preferences of each series of preferred stock.

Each series of preferred stock will be more

fully described in the particular prospectus supplement that will accompany this prospectus, including redemption provisions, rights

in the event of our liquidation, dissolution or winding up, dividend and voting rights, and rights to convert into common stock.

There is currently no preferred stock outstanding.

Warrants

We may issue warrants for the purchase of

common stock or preferred stock. We may issue warrants independently or together with other securities.

Units

We may issue units comprised of one or more

of the other classes of securities issued by us as described in this prospectus in any combination. Each unit will be issued so

that the holder of the unit is also the holder of each security included in the unit.

Risk

Factors

Investing in our securities involves a high

degree of risk. You should consider carefully the risks and uncertainties described in the sections titled “Risk Factors”

contained in the applicable prospectus supplement and any related free writing prospectus, and under similar headings in our most

recent and any of our subsequent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K,

which are incorporated in this prospectus by reference in their entirety, before deciding whether to purchase any of the securities

being registered pursuant to the registration statement of which this prospectus is a part. These risks and uncertainties are not

the only risks and uncertainties we face. Additional risks and uncertainties not currently known to us, or that we currently view

as immaterial, may also impair our business. If any of the risks or uncertainties described in our SEC filings or any additional

risks and uncertainties actually occur, our business, financial condition, results of operations, and cash flow could be materially

and adversely affected. In that case, the trading price of our common stock could decline and you might lose all or part of your

investment.

Special

Note Regarding Forward Looking Statements

This prospectus, each prospectus supplement,

and the information incorporated by reference in this prospectus and each prospectus supplement contain certain statements that

may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. The words “aim,” “anticipate,” “assume,”

“believe,” “contemplate,” “continue,” “could,” “due,” “estimate,”

“expect,” “goal,” “intend,” “may,” “objective,” “plan,”

“predict,” “positioned,” “potential,” “seek,” “should,” “target,”

“will,” “would” and similar expressions and variations thereof are intended to identify forward-looking

statements, but are not the exclusive means of identifying such statements. Those statements may appear in this prospectus, any

accompanying prospectus supplement, and the documents incorporated herein and therein by reference, particularly in the sections

titled “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial

Condition and Results of Operations,” and “Business,” and include statements regarding the intent, belief, or

current expectations of Cannabics and our management that are subject to known and unknown risks, uncertainties, and assumptions.

You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties,

and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors.

Forward-looking statements are subject to

certain risks and uncertainties that could cause actual results to differ materially from those anticipated in the forward-looking

statements. Factors that might cause such a difference include, but are not limited to, those described in “Risk Factors”,

elsewhere in this prospectus or any applicable prospectus supplement, and the documents incorporated by reference in this prospectus.

Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to

our management. These statements, like all statements in this prospectus, speak only as of their date, and we undertake no obligation

to update or revise these statements in light of future developments, except as required by law.

This prospectus, any accompanying prospectus

supplement, and the documents incorporated herein and therein by reference may also contain estimates and other information concerning

our industry that are based on government and industry publications. This information involves a number of assumptions and limitations,

and you are cautioned not to give undue weight to these estimates. These government and industry publications generally indicate

that their information has been obtained from sources believed to be reliable.

RATIO

OF EARNINGS TO FIXED CHARGES AND PREFERENCE DIVIDENDS

Any time preferred shares are offered pursuant

to this prospectus, we will provide a table setting forth our ratio of earnings to fixed charges and preference dividends on a

historical basis in the applicable prospectus supplement, if required.

Use

of Proceeds

Unless otherwise indicated in a prospectus

supplement, we currently intend to use the net proceeds from the sale of the securities under this prospectus for working capital

to support our research and development, including clinical trials, and general corporate purposes.

We may also use a portion of the net proceeds

in connection with any exercise of co-development or co-promotion rights under our collaborations; however, no such rights are

currently exercisable. In addition, we may also use a portion of the net proceeds to acquire, license, and invest in complementary

products, technologies, or businesses; however, we currently have no agreements or commitments to complete any such transactions.

The amounts and timing of our actual expenditures

may vary significantly depending on numerous factors, including cash flows from operations, the anticipated growth of our business,

the progress of our development and commercialization efforts, and the status and results of our clinical trials, as well as results

from any ongoing collaborations and additional collaborations that we may enter into with third parties, and any unforeseen cash

needs. As a result, unless otherwise indicated in the prospectus supplement, our management will have broad discretion to allocate

the net proceeds of the offerings. More detailed information regarding use of proceeds will be described in the applicable prospectus

supplement.

We will not receive any proceeds from the

sale of our common stock by the selling stockholders.

Selling

Stockholders

This prospectus also relates to the possible

resale by certain of our stockholders, who we refer to in this prospectus as the “selling stockholders,” of up to an

aggregate maximum amount of 7,966,444 shares of our common stock that were issued and outstanding prior to the original filing

date of the registration statement of which this prospectus forms a part. The shares of common stock being offered by the selling

stockholders were either originally acquired through several private placements of our common stock, or are issuable to the selling

stockholders upon the exercise of warrants. We are registering the shares of common stock in order to permit the selling stockholders

to offer the shares for resale from time to time.

Information about the selling stockholders,

where applicable, including the amount of shares of common stock owned by each selling stockholder prior to the offering, the number

of shares of our common stock to be offered by each selling stockholder, and the amount of common stock to be owned by each selling

stockholder after completion of the offering, will be set forth in an applicable prospectus supplement, documents incorporated

by reference, or in a free writing prospectus we file with the SEC. The applicable prospectus supplement will also disclose whether

any of the selling stockholders has held any position or office with, has been employed by, or otherwise has had a material relationship

with us during the three years prior to the date of the prospectus supplement.

The selling stockholders will not sell any

common stock pursuant to this prospectus until we have identified such selling stockholders and the shares being offered for resale

by such selling stockholders in a prospectus supplement. However, the selling stockholders may sell or transfer all or a portion

of their common stock pursuant to any available exemption from the registration requirements of the Securities Act of 1933, as

amended (“Securities Act”).

Description

of capital stock

The following summary describes our capital

stock and the material provisions of our amended and restated articles of incorporation (the “Articles of Incorporation”)

and our amended and restated bylaws (“Bylaws”), and of Chapter 78 of the Nevada Revised Statutes (“NRS”).

Because the following is only a summary, it does not contain all of the information that may be important to you. For a complete

description, you should refer to our Articles of Incorporation, and our Bylaws, copies of which are incorporated by reference as

exhibits to the registration statement of which this prospectus is a part.

General

Our

authorized capital stock consists of 900,000,000 shares of common stock, par value $0.0001, and 100,000,000 shares of preferred

stock, par value $0.0001. As of March 20, 2017, there were 114,676,233 shares of our common stock issued and outstanding, 555,555

shares of our common stock subject to outstanding warrants, and no shares of preferred stock issued or outstanding.

As of

March 20, 2017, there were approximately 60 holders of record of our common stock. This number does not include beneficial owners

whose shares are held by nominees in street name.

Common

Stock

Voting Rights

Each outstanding share of our common stock

entitles the holder thereof to one vote per share on all matters submitted to a stockholder vote. Our common stock does not carry

any cumulative voting rights. As a result, holders of a majority of the shares of our common stock voting for the election of directors

can elect all of our directors. At all meetings of stockholders, except where otherwise provided by statute or by our Articles

of Incorporation or our Bylaws, the presence in person or by proxy duly authorized by holders of not less than a majority of the

stockholding voting power shall constitute a quorum for the transaction of business. A vote by the holders of a majority of our

outstanding shares is required to effect certain fundamental corporate changes such as liquidation, merger, or an amendment to

our Articles of Incorporation.

Dividends

Holders of our common stock are entitled to

share in all dividends that our board of directors, in its discretion, declares from legally available funds.

Liquidation

In the event of liquidation, dissolution or

winding up, each outstanding share entitles its holder to participate

pro rata

in all assets that remain after payment of

liabilities and after providing for each class of stock, if any, having preference over our common stock.

Other Rights and Preferences

Holders of our common stock have no pre-emptive,

subscription, or conversion rights, and there are no redemption or sinking fund provisions applicable to our common stock. The

rights, preferences, and privileges of holders of common stock are subject to, and may be adversely affected by, the rights of

the holders of shares of any series of preferred stock that we may designate and issue in the future.

Quotation

Our common stock is quoted on the OTCQB

tier of the marketplace maintained by OTC Markets Group Inc., under the symbol “CNBX.”

Indemnification

Our Articles of Incorporation limits the liability

of our directors and officers to the full extent permitted by the NRS and provides that we will indemnify each of our directors

and officers to the full extent permitted by the NRS. Insofar as indemnification for liabilities arising under the Securities Act

may be permitted to directors, officers, or persons controlling us under the foregoing provisions, we have been informed that in

the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Transfer Agent and Registrar

The transfer agent and registrar for our common

stock is ClearTrust, LLC, whose address is 16540 Pointe Village Dr., Suite 210, Lutz, Florida 33558 (telephone: 813-235-4490; e-mail: