FONAR Corporation (NASDAQ:FONR), The Inventor of MR Scanning™,

reported today its financial results for Fiscal 2017 3rd Quarter

and nine-month period ended March 31, 2017.

- 96% Increase to $0.88 per share, for 3rd quarter Fiscal 2017,

(versus prior year) of Diluted Net Income per Common Share

available to Common Shareholders, including a $1.1 million impact

of recorded income tax benefits.

- 84% Increase to $7.1 million, for 3rd quarter Fiscal 2017,

(versus same period prior year) of Net Income.

- 46% Increase to $6.0 million, for 3rd quarter Fiscal 2017,

(versus same period prior year) of Income from Operations.

- 7% Increase to $20.0 million, for 3rd quarter Fiscal 2017,

(versus same period prior year) of Total Revenues – Net.

- Company adds additional MRI Center, during 3rd quarter, where

it provides non-medical management services.

- Timothy R. Damadian completes first year as President and

CEO.

Most of FONAR’s recent activity is through its

wholly-owned subsidiary, HMCA (Health Management Company of

America, LLC). HMCA provides non-medical management services for 19

diagnostic imaging centers in New York and 7 in Florida. These 26

centers are collectively equipped with 33 MRI scanners.

FONAR birthed the MRI industry with its

installation of the first commercial whole-body MRI (Magnetic

Resonance Imaging) scanner in 1980. Since then the Company

has manufactured and installed hundreds of MRIs the world

over. FONAR’s premier MRI scanner, the UPRIGHT®

Multi-Position™ MRI, aka Stand-Up® MRI, is the world’s only MRI

scanner that is able to scan patients in normal,

full-weight-bearing positions and to be licensed under FONAR’s

extensive UPRIGHT® Multi-Position™ MRI patent portfolio.

In light of the fact that the majority of MRI

exams are of the spine, FONAR’s UPRIGHT® MRI technology is of great

importance. Diagnosticians are able to view human anatomy in its

normal weight-bearing positions, including sitting, standing and

bending. Certain anatomical regions are very sensitive to

body-position and gravity. For example, patients with lower back

problems are often most uncomfortable when in a particular

weight-bearing position. If diagnosticians can evaluate the spine

in those positions, they can minimize or completely avoid the risks

of mischaracterizing or underestimating the patients’

problems.

Financial Highlights

Income from Operations increased 46%, for the

quarter ended March 31, 2017, to $6.0 million as compared to $4.1

million for the quarter ended March 31, 2016. Income from

Operations, for the nine month period ended March 31, 2017,

increased 29% to $15.4 million as compared to $12.0 million for the

nine-month period ended March 31, 2016.

Net Income increased 84%, for the quarter ended

March 31, 2017, to $7.1 million as compared to $3.9 million for the

quarter ended March 31, 2016. Net Income, for the nine-month

period ended March 31, 2017, increased 45% to $16.6 million as

compared to $11.5 million for the nine-month period ended March 31,

2016.

Total Revenues – Net increased 7%, for the

quarter ended March 31, 2017, to $20.0 million as compared to $18.6

million for the quarter ended March 31, 2016. Total Revenues – Net,

for the nine-month period ended March 31, 2017, increased 5% to

$57.1 million as compared to $54.6 million for the nine-month

period ended March 31, 2016.

Net Income, Available to Common Stockholders,

increased 97%, for the quarter ended March 31, 2017, to $5.5

million as compared to $2.8 million for the quarter ended March 31,

2016. Net Income, Available to Common Stockholders, for the

nine-month period ended March 31, 2017, increased 47% to $12.8

million as compared to $8.8 for the nine-month period ended March

31, 2016.

Diluted Net Income, per Common Share Available

to Common Stockholders, increased 96%, for the quarter ended March

31, 2017, to $0.88 per share as compared to $0.45 per share for the

quarter ended March 31, 2016. Diluted Net Income, per Common Share

Available to Common Stockholders, for the nine-month period ended

March 31, 2017, increased 44% to $2.05 per share as compared to

$1.42 per share for the nine-month period ended March 31, 2016.

Basic Net Income, per Common Share Available to

Common Stockholders, increased 96%, for the quarter ended March 31,

2017, to $0.90 per share as compared to $0.46 per share for the

quarter ended March 31, 2016. Basic Net Income, per Common Share

Available to Common Stockholders, for the nine-month period ended

March 31, 2017, increased 44% to $2.09 per share as compared to

$1.45 per share for the nine-month period ended March 31, 2016.

Total Assets, at March 31, 2017, was $91.8

million, as compared to $84.9 million at June 30, 2016. Total

Current Assets, at March 31, 2017, was $50.8 million, as compared

to $45.6 million at June 30, 2016.

Total Liabilities, at March 31, 2017, was $16.4

million, as compared to $24.1 million at June 30, 2016. Total

Current Liabilities, at March 31, 2017, was $14.5 million, as

compared to $20.6 million at June 30, 2016.

Total Cash and Cash Equivalents, at March 31,

2017, was $7.8 million, as compared to $8.5 million at June 30,

2016.

Management Discussion

Reflecting upon his first year as President and

CEO of FONAR Corporation, Timothy R. Damadian stated: “The

transition has been seamless, we’re successfully executing our

business plan, and earnings are growing steadily. Naturally our

stockholders focus on Diluted Net Income per Common Share Available

to Common Stockholders, which for the quarter ending March 31 was

$0.88. That’s a 96% increase as compared to the corresponding

quarter a year ago. And for the nine-month period ending March 31,

we’re at $2.05 per share, which is up 44% as compared to the

corresponding period a year ago.”

“I am very pleased with Tim’s performance as

President and CEO,” said Raymond V. Damadian, M.D., Chairman of

FONAR Corporation. “We operate in a highly competitive and strictly

regulated business environment. Nevertheless, FONAR revenues have

been growing a brisk rate and, even more notable, our net profit

margin has steadily climbed. We’ve been profitable for 28

consecutive quarters. That’s remarkable.” Table I below shows

revenues and profit margins over the past seven years.

Table I

| PROFIT MARGIN TABLE |

Nine Month Period ending March 31, |

| 2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

|

Net Income (x $ millions) |

$ |

3.0 |

$ |

5.1 |

$ |

5.0 |

$ |

8.8 |

$ |

9.2 |

$ |

11.5 |

$ |

16.6 |

|

Total Revenues – Net (x $ millions) |

$ |

25.4 |

$ |

28.5 |

$ |

30.8 |

$ |

51.5 |

$ |

52.2 |

$ |

54.6 |

$ |

57.1 |

|

NET PROFIT MARGIN[(Net Income / Total Revenues) x 100] |

|

12 |

|

18 |

|

16 |

|

17 |

|

18 |

|

21 |

|

29 |

“As the original MRI company, we are thoroughly

familiar with all aspects of operating MRI centers. Combining that

experience with the diagnostic and patient-friendliness of the

FONAR UPRIGHT® Multi-Position™ MRI has contributed enormously to

our successful management of 26 diagnostic imaging centers,”

concluded Dr. Damadian.

Recent Event

On April 4, 2017, the Company reported it had

purchased all interests and assets of an MRI diagnostic imaging

center located in White Plains, New York, where the Company will

provide non-medical management services. Mr. Tim Damadian

commented, “This very synergistic acquisition provides the Company

with an already up-and-running business strategically located

nearby other HMCA-managed imaging centers. We are always looking

for opportunities such as this one that will add to the success of

our Company.”

About FONAR

FONAR, The Inventor of MR Scanning™, is located

in Melville, NY. Incorporated in 1978, FONAR is the first,

oldest and most experienced MRI company in the industry. FONAR

introduced the world’s first commercial MRI in 1980, and went

public in 1981. FONAR’s signature product is the FONAR UPRIGHT®

Multi-Position™ MRI (also known as the Stand-Up® MRI), the only

whole-body MRI that performs Position™ Imaging (pMRI™) and scans

patients in numerous weight-bearing positions, i.e. standing,

sitting, in flexion and extension, as well as in the conventional

lie-down position. The FONAR UPRIGHT® MRI often detects patient

problems that other MRI scanners cannot because they are “lie-down,

weightless-only” scanners. The patient-friendly UPRIGHT® MRI has a

near-zero patient claustrophobic rejection rate. As one FONAR

customer says, “If patients are claustrophobic in this scanner,

they’ll be claustrophobic in my parking lot.” Approximately 85% of

patients are scanned sitting while watching TV.

FONAR has new works-in-progress technology for

visualizing and quantifying the cerebral hydraulics of the central

nervous system, the flow of cerebrospinal fluid (CSF), which

circulates throughout the brain and vertebral column at the rate of

32 quarts per day. This imaging and quantifying of the

dynamics of this vital life-sustaining physiology of the body’s

neurologic system has been made possible first by FONAR’s

introduction of the MRI and now by this latest works-in-progress

method for quantifying CSF in all the normal positions of the body,

particularly in its upright flow against gravity. Patients

with whiplash or other neck injuries are among those who will

benefit from this new understanding.

FONAR’s substantial list of patents includes

recent patents for its technology enabling full weight-bearing MRI

imaging of all the gravity sensitive regions of the human anatomy,

especially the brain, extremities and spine. It includes its newest

technology for quantifying the Upright cerebral hydraulics of the

central nervous system. FONAR’s UPRIGHT® Multi-Position™ MRI

is the only scanner licensed under these patents.

UPRIGHT® and STAND-UP® are registered trademarks

and The Inventor of MR Scanning™, Full Range of Motion™,

Multi-Position™, Upright Radiology™, The Proof is in the Picture™,

True Flow™, pMRI™, Spondylography™, Dynamic™, Spondylometry™, CSP™,

and Landscape™, are trademarks of FONAR Corporation.

This release may include forward-looking

statements from the company that may or may not materialize.

Additional information on factors that could potentially affect the

company's financial results may be found in the company's filings

with the Securities and Exchange Commission.

| |

| FONAR CORPORATION AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED BALANCE SHEETS |

| (Amounts and shares in thousands, except per share

amounts) |

| (UNAUDITED) |

| |

| ASSETS |

| |

| |

March 31,2017 |

|

June 30,2016 * |

| Cash and cash

equivalents |

$ |

7,750 |

|

$ |

8,528 |

| Accounts receivable –

net |

|

3,614 |

|

|

4,370 |

| Accounts receivable -

related party |

|

30 |

|

|

- |

| Medical receivable –

net |

|

11,332 |

|

|

10,127 |

| Management and other

fees receivable – net |

|

18,480 |

|

|

15,638 |

| Management and other

fees receivable – related medical practices – net |

|

5,255 |

|

|

4,064 |

| Costs and estimated

earnings in excess of billing on uncompleted contracts |

|

649 |

|

|

- |

| Inventories |

|

2,670 |

|

|

2,074 |

| Prepaid expenses and

other current assets |

|

1,059 |

|

|

759 |

| Total Current

Assets |

|

50,839 |

|

|

45,560 |

| Deferred income tax

asset |

|

14,942 |

|

|

13,042 |

| Property and equipment

– net |

|

15,292 |

|

|

14,513 |

| Goodwill |

|

3,322 |

|

|

3,322 |

| Other intangible assets

– net |

|

6,920 |

|

|

7,719 |

| Other assets |

|

509 |

|

|

732 |

| Total Assets |

$ |

91,824 |

|

$ |

84,888 |

* condensed from audited financial statements

| |

| FONAR CORPORATION AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED BALANCE SHEETS |

| (Amounts and shares in thousands, except per share

amounts) |

| (UNAUDITED) |

| |

| LIABILITIES AND STOCKHOLDERS' EQUITY |

| |

|

|

March 31,2017 |

|

June 30,2016 * |

| Current

Liabilities: |

|

|

|

| Current

portion of long-term debt and capital leases |

$ |

727 |

|

$ |

2,448 |

| Accounts

payable |

|

1,183 |

|

|

1,254 |

| Other

current liabilities |

|

7,483 |

|

|

10,827 |

| Unearned

revenue on service contracts |

|

3,987 |

|

|

4,679 |

| Unearned

revenue on service contracts - related party |

|

28 |

|

|

- |

| Customer

advances |

|

1,018 |

|

|

1,199 |

| Billings

in excess of costs and estimated earnings on uncompleted

contracts |

|

25 |

|

|

207 |

| Total

Current Liabilities |

|

14,451 |

|

|

20,614 |

| Long-Term

Liabilities: |

|

|

|

| Deferred

income tax liability |

|

482 |

|

|

482 |

| Due to

related medical practices |

|

228 |

|

|

245 |

| Long-term

debt and capital leases, less current portion |

|

348 |

|

|

2,059 |

| Other

liabilities |

|

890 |

|

|

712 |

| Total

Long-Term Liabilities |

|

1,948 |

|

|

3,498 |

| Total

Liabilities |

|

16,399 |

|

|

24,112 |

* condensed from audited financial statements

| |

| FONAR CORPORATION AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED BALANCE SHEETS |

| (Amounts and shares in thousands, except per share

amounts) |

| (UNAUDITED) |

| |

| LIABILITIES AND STOCKHOLDERS' EQUITY (Continued) |

| |

| |

March 31, 2017 |

|

June 30, 2016 * |

| STOCKHOLDERS'

EQUITY: |

|

|

|

| Class A

non-voting preferred stock $.0001 par value; 453 shares authorized

at March 31, 2017 and June 30, 2016, 313 issued and outstanding at

March 31, 2017 and June 30, 2016 |

$ |

- |

|

|

$ |

- |

|

| Preferred

stock $.001 par value; 567 shares authorized at March 31, 2017 and

June 30, 2016, issued and outstanding – none |

|

- |

|

|

|

- |

|

| Common

Stock $.0001 par value; 8,500 shares authorized at March 31, 2017

and June 30, 2016, 6,214 and 6,062 issued at March 31, 2017 and

June 30, 2016; 6,202 and 6,051 outstanding at March 31, 2017 and

June 30, 2016 |

|

1 |

|

|

|

1 |

|

| Class B

Common Stock (10 votes per share) $ .0001 par value; 227 shares

authorized at March 31, 2017 and June 30, 2016, 146 issued and

outstanding at March 31, 2017 and June 30, 2016 |

|

- |

|

|

|

- |

|

| Class C

Common Stock (25 votes per share) $.0001 par value; 567 shares

authorized at March 31, 2017 and June 30, 2016, 383 issued and

outstanding at March 31, 2017 and June 30, 2016 |

|

- |

|

|

|

- |

|

| Paid-in

capital in excess of par value |

|

176,761 |

|

|

|

173,702 |

|

|

Accumulated deficit |

|

(106,911 |

) |

|

|

(120,624 |

) |

| Notes

receivable from employee stockholders |

|

(19 |

) |

|

|

(24 |

) |

| Treasury

stock, at cost - 12 shares of common stock at March 31, 2017 and

June 30, 2016 |

|

(675 |

) |

|

|

(675 |

) |

| Total

Fonar Corporation Stockholder Equity |

|

69,157 |

|

|

|

52,380 |

|

|

Noncontrolling interests |

|

6,268 |

|

|

|

8,396 |

|

| Total

Stockholders' Equity |

|

75,425 |

|

|

|

60,776 |

|

| Total

Liabilities and Stockholders' Equity |

$ |

91,824 |

|

|

$ |

84,888 |

|

* condensed from audited financial statements

| |

| FONAR CORPORATION AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME |

| (Amounts and shares in thousands, except per share

amounts) |

| (UNAUDITED) |

| |

| |

FOR THE THREE MONTHS ENDED MARCH 31 |

| REVENUES |

|

2017 |

|

|

|

2016 |

|

| Product

sales – net |

$ |

768 |

|

|

$ |

20 |

|

| Service

and repair fees – net |

|

2,366 |

|

|

|

2,406 |

|

| Service

and repair fees – related parties - net |

|

27 |

|

|

|

27 |

|

| Patient

fee revenue, net of contractual allowances and discounts |

|

9,028 |

|

|

|

8,695 |

|

| Provision

for bad debts for patient fee |

|

(3,979 |

) |

|

|

(3,830 |

) |

|

Management and other fees – net |

|

9,592 |

|

|

|

9,394 |

|

|

Management and other fees – related medical practices – net |

|

2,206 |

|

|

|

1,907 |

|

| Total

Revenues – Net |

|

20,008 |

|

|

|

18,619 |

|

| COSTS AND EXPENSES |

|

|

|

| Costs

related to product sales |

|

364 |

|

|

|

263 |

|

| Costs

related to service and repair fees |

|

829 |

|

|

|

552 |

|

| Costs

related to service and repair fees – related parties |

|

10 |

|

|

|

6 |

|

| Costs

related to patient fee revenue |

|

1,744 |

|

|

|

2,549 |

|

| Costs

related to management and other fees |

|

5,122 |

|

|

|

5,649 |

|

| Costs

related to management and other fees – related medical

practices |

|

1,122 |

|

|

|

1,045 |

|

| Research

and development |

|

332 |

|

|

|

395 |

|

| Selling,

general and administrative |

|

4,483 |

|

|

|

4,063 |

|

| Total

Costs and Expenses |

|

14,006 |

|

|

|

14,522 |

|

| Income From

Operations |

|

6,002 |

|

|

|

4,097 |

|

| Interest Expense |

|

(69 |

) |

|

|

(127 |

) |

| Investment Income |

|

47 |

|

|

|

56 |

|

| Other Income |

|

2 |

|

|

|

- |

|

| Income Before Benefit

(Provision) for Income Taxes and Non Controlling Interests |

|

5,982 |

|

|

|

4,026 |

|

| Benefit (Provision) for

Income Taxes |

|

1,140 |

|

|

|

(145 |

) |

| Net Income |

|

7,122 |

|

|

|

3,881 |

|

| Net Income – Non

Controlling Interests |

|

(1,222 |

) |

|

|

(876 |

) |

| Net Income –

Controlling Interests |

$ |

5,900 |

|

|

$ |

3,005 |

|

| Net Income Available to

Common Stockholders |

$ |

5,526 |

|

|

$ |

2,810 |

|

| Net Income Available to

Class A Non-Voting Preferred Stockholders |

$ |

279 |

|

|

$ |

145 |

|

| Net Income Available to

Class C Common Stockholders |

$ |

95 |

|

|

$ |

50 |

|

| Basic Net Income Per

Common Share Available to Common Stockholders |

$ |

0.90 |

|

|

$ |

0.46 |

|

| Diluted Net Income Per

Common Share Available to Common Stockholders |

$ |

0.88 |

|

|

$ |

0.45 |

|

| Basic and Diluted

Income Per Share-Class C Common |

$ |

0.25 |

|

|

$ |

0.13 |

|

| Weighted Average Basic

Shares Outstanding-Common Stockholders |

|

6,166 |

|

|

|

6,050 |

|

| Weighted Average

Diluted Shares Outstanding – Common Stockholders |

|

6,294 |

|

|

|

6,178 |

|

| Weighted Average Basic

Shares Outstanding – Class C Common |

|

383 |

|

|

|

383 |

|

| Weighted Average

Diluted Shares Outstanding – Class C Common |

|

383 |

|

|

|

383 |

|

| |

| FONAR CORPORATION AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME |

| (Amounts and shares in thousands, except per share

amounts) |

| (UNAUDITED) |

| |

|

|

FOR THE NINE MONTHS ENDED MARCH 31, |

| REVENUES |

|

2017 |

|

|

|

2016 |

|

|

| Product

sales – net |

$ |

1,103 |

|

|

$ |

780 |

|

|

| Service

and repair fees – net |

|

7,074 |

|

|

|

6,970 |

|

|

| Service

and repair fees – related parties - net |

|

83 |

|

|

|

83 |

|

|

| Patient

fee revenue, net of contractual allowances and discounts |

|

26,509 |

|

|

|

24,596 |

|

|

| Provision

for bad debts for patient fee |

|

(11,859 |

) |

|

|

(10,608 |

) |

|

|

Management and other fees – net |

|

28,216 |

|

|

|

27,180 |

|

|

|

Management and other fees – related medical practices – net |

|

6,020 |

|

|

|

5,598 |

|

|

| Total

Revenues – Net |

|

57,146 |

|

|

|

54,599 |

|

|

| COSTS AND EXPENSES |

|

|

|

|

| Costs

related to product sales |

|

543 |

|

|

|

939 |

|

|

| Costs

related to service and repair fees |

|

2,168 |

|

|

|

1,542 |

|

|

| Costs

related to service and repair fees – related parties |

|

25 |

|

|

|

18 |

|

|

| Costs

related to patient fee revenue |

|

6,481 |

|

|

|

7,015 |

|

|

| Costs

related to management and other fees |

|

15,641 |

|

|

|

16,664 |

|

|

| Costs

related to management and other fees – related medical

practices |

|

3,202 |

|

|

|

3,116 |

|

|

| Research

and development |

|

1,105 |

|

|

|

1,243 |

|

|

| Selling,

general and administrative |

|

12,617 |

|

|

|

12,125 |

|

|

| Total

Costs and Expenses |

|

41,782 |

|

|

|

42,662 |

|

|

| Income From

Operations |

|

15,364 |

|

|

|

11,937 |

|

|

| Interest Expense |

|

(244 |

) |

|

|

(416 |

) |

|

| Investment Income |

|

145 |

|

|

|

164 |

|

|

| Other (Expense)

Income |

|

(1 |

) |

|

|

1 |

|

|

| Income Before Benefit

(Provision) for Income Taxes and Non Controlling Interests |

|

15,264 |

|

|

|

11,686 |

|

|

| Benefit (Provision) for

Income Taxes |

|

1,293 |

|

|

|

(235 |

) |

|

| Net Income |

|

16,557 |

|

|

|

11,451 |

|

|

| Net Income – Non

Controlling Interests |

|

(2,844 |

) |

|

|

(2,091 |

) |

|

| Net Income –

Controlling Interests |

$ |

13,713 |

|

|

$ |

9,360 |

|

|

| Net Income Available to

Common Stockholders |

$ |

12,842 |

|

|

$ |

8,752 |

|

|

| Net Income Available to

Class A Non-Voting Preferred Stockholders |

$ |

649 |

|

|

$ |

453 |

|

|

| Net Income Available to

Class C Common Stockholders |

$ |

222 |

|

|

$ |

155 |

|

|

| Basic Net Income Per

Common Share Available to Common Stockholders |

$ |

2.09 |

|

|

$ |

1.45 |

|

|

| Diluted Net Income Per

Common Share Available to Common Stockholders |

$ |

2.05 |

|

|

$ |

1.42 |

|

|

| Basic and Diluted

Income Per Share – Class C Common |

$ |

0.58 |

|

|

$ |

0.40 |

|

|

| Weighted Average Basic

Shares Outstanding – Common Stockholders |

|

6,143 |

|

|

|

6,050 |

|

|

| Weighted Average

Diluted Shares Outstanding – Common Stockholders |

|

6,271 |

|

|

|

6,178 |

|

|

| Weighted Average Basic

Shares Outstanding – Class C Common |

|

383 |

|

|

|

383 |

|

|

| Weighted Average

Diluted Shares Outstanding – Class C Common |

|

383 |

|

|

|

383 |

|

|

| |

|

|

| |

|

The Inventor of MR

Scanning™ |

| Contact: Daniel

Culver |

|

An ISO 9001

Company |

| Director of

Communications |

|

Melville, New York

11747 |

| E-mail:

investor@fonar.com |

|

Phone: (631)

694-2929 |

| www.fonar.com |

|

Fax: (631)

390-1772 |

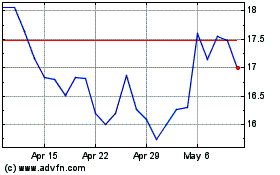

Fonar (NASDAQ:FONR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fonar (NASDAQ:FONR)

Historical Stock Chart

From Apr 2023 to Apr 2024