Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

May 09 2017 - 5:30PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus

Filed Pursuant to Rule 433

Relating

to Preliminary Prospectus Supplement dated May 9, 2017

to Prospectus Dated October 14, 2015

Registration Statement No. 333-207417

COSTCO WHOLESALE CORPORATION

PRICING TERM SHEET

May 9, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

4-Year Tranche

(the “2021 Notes”)

|

|

5-Year Tranche

(the “2022 Notes”)

|

|

7-Year Tranche

(the “2024 Notes”)

|

|

10-Year Tranche

(the “2027 Notes”)

|

|

Issuer:

|

|

Costco Wholesale Corporation

|

|

|

|

|

Expected Ratings*:

|

|

A1 (positive) / A+ (stable) / A+ (stable) (Moody’s / S&P / Fitch)

|

|

|

|

|

Trade Date:

|

|

May 9, 2017

|

|

|

|

|

Settlement Date:

|

|

May 18, 2017 (T+7)

|

|

|

|

|

|

|

|

Aggregate Principal Amount:

|

|

$1,000,000,000

|

|

$800,000,000

|

|

$1,000,000,000

|

|

$1,000,000,000

|

|

|

|

|

|

|

|

Maturity Date:

|

|

May 18, 2021

|

|

May 18, 2022

|

|

May 18, 2024

|

|

May 18, 2027

|

|

|

|

|

|

|

|

Interest Payment Dates:

|

|

May 18 and November 18,

beginning November 18, 2017

|

|

May 18 and November 18,

beginning November 18, 2017

|

|

May 18 and November 18,

beginning November 18, 2017

|

|

May 18 and November 18,

beginning November 18, 2017

|

|

|

|

|

|

|

|

Coupon (Interest Rate):

|

|

2.150%

|

|

2.300%

|

|

2.750%

|

|

3.000%

|

|

|

|

|

|

|

|

Price to Public:

|

|

99.825%

|

|

99.625%

|

|

99.596%

|

|

99.137%

|

|

|

|

|

|

|

|

Net Proceeds to Issuer

(before

expenses):

|

|

$995,250,000

|

|

$794,200,000

|

|

$991,960,000

|

|

$986,870,000

|

|

|

|

|

|

|

|

Benchmark Treasury:

|

|

1.500% U.S. Treasury due

April 15, 2020

|

|

1.875% U.S. Treasury due

April 30, 2022

|

|

2.000% U.S. Treasury due

April 30, 2024

|

|

2.250% U.S. Treasury due

February 15, 2027

|

|

|

|

|

|

|

|

Benchmark Treasury Price / Yield:

|

|

99-27

3

⁄

4

/ 1.546%

|

|

99-23

3

⁄

4

/ 1.930%

|

|

98-20 / 2.214%

|

|

98-22 / 2.401%

|

|

|

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

U.S. Treasury + 65 bps

|

|

U.S. Treasury + 45 bps

|

|

U.S. Treasury + 60 bps

|

|

U.S. Treasury + 70 bps

|

|

|

|

|

|

|

|

Yield to Maturity:

|

|

2.196%

|

|

2.380%

|

|

2.814%

|

|

3.101%

|

|

|

|

|

|

|

|

Optional Redemption:

|

|

Callable (i) at any time prior to April 18, 2021 at a make-whole price of comparable maturity U.S. Treasury + 10 bps, and (ii) at par on or after April 18, 2021

|

|

Callable (i) at any time prior to April 18, 2022 at a make-whole price of comparable maturity U.S. Treasury + 10 bps, and (ii) at par on or after April 18, 2022

|

|

Callable (i) at any time prior to March 18, 2024 at a make-whole price of comparable maturity U.S. Treasury + 10 bps, and (ii) at par on or after March 18, 2024

|

|

Callable (i) at any time prior to February 18, 2027 at a make-whole price of comparable maturity U.S. Treasury + 15 bps, and (ii) at par on or after February 18, 2027

|

|

|

|

|

|

|

|

CUSIP / ISIN:

|

|

22160K AJ4 / US22160KAJ43

|

|

22160K AK1 / US22160KAK16

|

|

22160K AL9 / US22160KAL98

|

|

22160K AM7 / US22160KAM71

|

|

|

|

|

Joint Book-Running Managers:

|

|

Citigroup Global Markets Inc.

Guggenheim Securities, LLC

______________________

|

|

|

Wells Fargo Securities, LLC

U.S. Bancorp Investments, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

Changes to the Preliminary Prospectus Supplement:

|

|

Use of Proceeds

[

Delete the second sentence and replace with the language below.

]

We intend to use the net proceeds of this offering and existing cash for the following purposes:

• to fund a special

cash dividend on our common stock of $7.00 per share, which was declared by our board of directors on April 25, 2017, payable on May 26, 2017, to shareholders of record at the close of business on May 10, 2017, and we estimate to aggregate

approximately $3.1 billion; and

• to repay at or prior to maturity all of our 1.125% Senior Notes due December 15, 2017,

$1.1 billion aggregate principal amount.

Underwriting

[

Insert the following immediately after the heading “Selling

Restrictions.”

]

Notice to Prospective Investors in Canada

The notes may be sold only to purchasers purchasing, or deemed to be purchasing, as

principal that are accredited investors, as defined in National Instrument 45-106 Prospectus Exemptions or subsection 73.3(1) of the Securities Act (Ontario), and are permitted clients, as defined in National Instrument 31-103 Registration

Requirements, Exemptions and Ongoing Registrant Obligations. Any resale of the notes must be made in accordance with an exemption from, or in a transaction not subject to, the prospectus requirements of applicable securities laws.

Securities legislation in certain provinces or territories of Canada may provide a

purchaser with remedies for rescission or damages if this prospectus supplement (including any amendment thereto) contains a misrepresentation, provided that the remedies for rescission or damages are exercised by the purchaser within the time limit

prescribed by the securities legislation of the purchaser’s province or territory. The purchaser should refer to any applicable provisions of the securities legislation of the purchaser’s province or territory for particulars of these

rights or consult with a legal advisor.

Pursuant to section 3A.3 of National

Instrument 33-105 Underwriting Conflicts (NI 33-105), the underwriters are not required to comply with the disclosure requirements of NI 33-105 regarding underwriter conflicts of interest in connection with this offering.

|

*Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or

withdrawal at any time.

The Issuer has filed a registration statement including a prospectus and a prospectus supplement with the SEC for the

offering to which this communication relates. Before you invest, you should read the prospectus and prospectus supplement in that registration statement and other documents the Issuer has filed with the SEC for more complete information about the

Issuer and this offering. You may obtain these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus

and the prospectus supplement if you request them by calling Citigroup Global Markets Inc. at 1-800-831-9146 and Guggenheim Securities, LLC at 1-212-739-0700.

Any disclaimer or other notice that may appear below is not applicable to this communication and should be disregarded. Such disclaimer or notice was

automatically generated as a result of this communication being sent by Bloomberg or another email system.

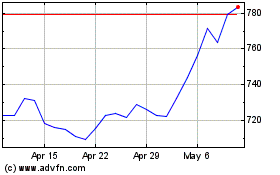

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Mar 2024 to Apr 2024

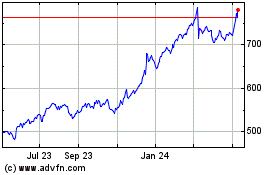

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Apr 2023 to Apr 2024