Current Report Filing (8-k)

May 09 2017 - 4:30PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

May 3, 2017

The Hackett Group, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

FLORIDA

|

|

0-24343

|

|

65-0750100

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

1001 Brickell Bay Drive, Suite 3000

Miami, Florida

|

|

33131

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(305) 375-8005

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 2.02

|

Results of Operations and Financial Condition.

|

On May 9, 2017

,

The Hackett Group, Inc. (

the

“

Company

”)

issued a press release setting forth its consolidated financial results for the

first

fiscal quarter

ended March 31, 2017

. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

The information contained in Item 2.02 of this current report on Form 8-K, as well as Exhibit 99.1, is being furnished to the Securities and Exchange Commission and shall not be deemed “filed” with the Securities and Exchange Commission nor incorporated by reference in any registration statement filed by the Company under the Securities Act of 1933, as amended.

Item 5.07

Submission of Matters to a Vote of Security Holders.

The 201

7

Annual Meeting of Shareholders of

the Company

was held on May

3, 2017

. Matters submitted to shareholders at the meeting and the voting results thereof were as follows:

Proposal 1 – Election of Directors.

The shareholders of the Company elected

the director nominee

nam

ed below

to serve until

the 2020

Annual Meeting of Shareholders and unt

il its

successor

is

duly elected and qualified. The following is a breakdown of the voting results:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BROKER

|

|

DIRECTOR

|

|

FOR

|

|

WITHHE

LD

|

|

NON-VOTES

|

|

John R. Harris

|

|

21,464,988

|

|

710,110

|

|

3,555,355

|

Proposal

2

–

Amendment to the Company's 1998 Stock Option and Incentive Plan

.

The shareholders of the Company approved

an amendment to the Company’s 1988 Stock Option and Incentive Plan

(the “Plan”)

to (i) increase the sublimit under the Plan for issuances of restricted stock and restri

cted stock units by 1,200,000

shares

, and (ii)

increase

the total number of shares available for issu

ance under the Plan by 1,200,000

shares

.

The following is a breakdown of

the

voting results:

|

|

|

|

|

|

|

BROKER

|

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

NON-VOTES

|

|

19,155,672

|

|

3,010,950

|

|

8,476

|

|

3,555,355

|

Proposal

3

–

Amendment to the Company's Employee Stock Plan.

The shareholders of the Company approved

an amendment to the Company’s Employee Stock Plan (the “Purchase Plan”)

to

(i) increase the number of shares authorized for issuance under the Purchase Plan by 250,000 shares, and (ii) extend the term of the Purchase Plan

by five years until July 1, 202

3. T

he following is a breakdown of

the

voting results:

|

|

|

|

|

|

|

BROKER

|

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

NON-VOTES

|

|

21,994,031

|

|

179,161

|

|

1,906

|

|

3,555,355

|

Proposal

4

– Advisory Vote on Executive

Officer

Compensation.

The shareholders of the Company approved an advisory vote on executive

officer

compensation. The following is a breakdown of the voting results:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BROKER

|

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

NON-VOTES

|

|

17,073,824

|

|

3,917,676

|

|

1,183,598

|

|

3,555,355

|

Proposal 5 –

Advisory Vote on the Frequency of Future Advisory Votes on Executive Compensation.

The shareholders of the Company voted in favor of a frequency of holding future advisory votes on executive compensation every year. The following is a breakdown of the voting results:

|

|

|

|

|

|

|

|

|

BROKER

|

|

1 YEAR

|

|

2 YEARS

|

|

3 YEARS

|

|

ABSTAIN

|

|

NON-VOTES

|

|

17,862,062

|

|

5,732

|

|

4,269,262

|

|

38,042

|

|

3,555,355

|

In accordance with its own recommendation and the shareholders

’

voting results

on Proposal 4, the Company’s

Board of Directors has determined

to hold an advisory vote on e

xecutive compensation every year at the Company’s Annual Meeting of Shareholders

until the next required vote by

shareholders on the frequency of shareholder

votes on the compensation of executives. Accordingly, the next advisory vote on executive compensation will be held at the 2018 Annual Meeting of Shareholders

.

Proposal

6

– Appointment of

RSM US LLP

as Independent Auditor.

The shareholders of the Company ratified the appointment of

RSM US LLP

as the Company’s independent registered pub

lic accounting firm for the 201

7

fiscal year. The following is a breakdown of the voting results:

|

|

|

|

|

|

|

|

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

NON-VOTES

|

|

25,686,390

|

|

28,087

|

|

15,976

|

|

-

|

Item 9.01

Financial Statements and Exhibits.

See Exhibit Index attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

THE HACKETT GROUP, INC.

|

|

|

|

|

|

|

Date:

May

9

,

2017

|

|

|

|

By:

|

|

/s/ Robert A. Ramirez

|

|

|

|

|

|

|

|

Robert A. Ramirez

|

|

|

|

|

|

|

|

Executive Vice President, Finance and Chief Financial Officer

|

Exhibit Index

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release of The Hackett Group, Inc., dated

May

9

,

201

7

.

|

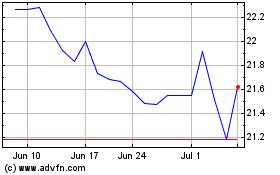

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Mar 2024 to Apr 2024

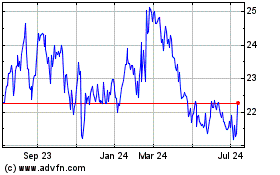

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Apr 2023 to Apr 2024