Lightbridge Corporation (NASDAQ:LTBR), a U.S.

nuclear fuel technology company, today provided a business update

and reported financial results for the first quarter ended March

31, 2017.

Seth Grae, President & Chief Executive

Officer of Lightbridge Corporation, commented, “We continue to

progress towards commercialization of our proprietary next

generation nuclear fuel for current and future reactors. We are

advancing towards the creation of a formal joint venture agreement

with AREVA to develop, manufacture and commercialize fuel

assemblies based on our fuel technology, which we expect to

finalize in the coming months. We believe AREVA is the ideal

partner, bringing its leading expertise in nuclear fuel assembly

design, licensing and fabrication, as well as an established global

customer base.”

“At the same time, we are advancing our

discussions with a leading U.S. nuclear utility toward an end-user

agreement for the first use of Lightbridge-designed nuclear fuel in

a commercial reactor in the United States. Also, we remain on track

for irradiation testing of our nuclear fuel samples at the Halden

reactor in Norway.”

“Given our recent partnerships, along with other

support we have received from the industry, we expect that our

nuclear fuel technology has the potential to generate hundreds of

millions of dollars in annual profits. We believe that

nuclear power, generated in existing and future reactors utilizing

our advanced metallic fuel technology, will dramatically improve

the safety and enhance the operating economics of nuclear

power.”

Financial Highlights

Balance Sheet Overview At March

31, 2017, we had approximately $5.3 million in cash and restricted

cash compared to approximately $3.7 million in cash and restricted

cash at December 31, 2016. The $1.6 million increase in cash and

equivalents resulted from the sale of approximately $2.8 million of

our common stock during the quarter ended March 31, 2017, offset by

net cash used in operating activities of $1.1 million. We had

approximately $4.9 million in working capital at March 31, 2017 as

compared to working capital of approximately $3.4 million at

December 31, 2016. Stockholders' equity at March 31, 2017 was

approximately $7.0 million compared to stockholders’ equity of

approximately $5.6 million at December 31, 2016.

Operating Results – First Quarter of

Fiscal 2017 Compared to First Quarter of Fiscal 2016For

the first quarter ended March 31, 2017, our net loss attributable

to common shareholders was approximately $1.8 million, or a loss of

$0.20 per share, on revenue of $0.1 million. In the same

quarter of 2016, the net loss available to common shareholders was

$0.3 million, or loss per share of $0.09 per share, on revenue of

$0.2 million. All revenue was generated from consulting services.

Stock-based compensation expense was $0.2 million for the quarter

ended March 31, 2017 compared to $0.2 million for the quarter ended

March 31, 2016. For the three months ended March 31, 2017, the

Company’s cash flows used in operating activities were $1.1 million

versus $1.3 million used in operating activities for the same

period of 2016. This decrease is primarily due to the decrease in

warrant valuation income of approximately $1.3 million offset by

the decrease in our revenue and the increase in our operating

expenses, which include research and development expenses. The

change for the warrant revaluation is due to a change in the

accounting treatment of the outstanding warrants, which were

recorded as derivative liabilities at March 31, 2016 and are now

recorded as equity in 2017.

2017 First Quarter Conference

Call

Lightbridge will host a conference call on

Wednesday, May 10, 2017 at 11:00 a.m. Eastern Time to discuss the

company's financial results for the first quarter ending March 31,

2017, as well as the Company's corporate progress and other

meaningful developments. Interested parties can access the

conference call by calling 866-682-6100 for U.S. callers, or

+1-862-255-5401 for international callers. The call will be

available on the Company’s website via webcast at

http://ir.ltbridge.com/events.cfm. The conference call will be led

by Seth Grae, President and Chief Executive Officer and other

Lightbridge executives will also be available to answer questions.

Questions may also be submitted in writing before or during the

conference call to ir@ltbridge.com.

A webcast will also be archived on the Company’s

website and a telephone replay of the call will be available

approximately one hour following the call, through midnight June

10, 2017, and can be accessed by calling: 877-481-4010 (U.S.

callers) or +1-919-882-2331 (international callers) and entering

conference ID: 10364.

About Non-GAAP Financial

Measures

This press release contains non-GAAP financial

measures for earnings that exclude warrant revaluation income. Net

income excluding warrant revaluation income is not a measure of

performance calculated in accordance with generally accepted

accounting principles in the United States (“GAAP”). The Company

believes the presentation of net loss excluding warrant revaluation

income is relevant and useful by enhancing the readers’ ability to

understand the Company’s operating performance. The Company’s

management utilizes net loss excluding warrant revaluation income

as a means to measure operating performance. The table below

reconciles net (loss) excluding revaluation income, a non-GAAP

measure, to net loss for the three months ended March 31, 2017 and

2016.

| (in

millions) |

|

|

|

|

|

|

|

Quarter Ended |

|

Quarter Ended |

|

|

|

March 31, |

|

March 31, |

|

|

|

2017 |

|

2016 |

| Net loss

attributable to common stockholders |

|

$ |

(1.7 |

) |

|

$ |

(0.3 |

) |

|

Adjustments: |

|

|

|

|

| Warrant

revaluation income |

|

|

0 |

|

|

|

1.3 |

|

| Net Loss

attributable to common stockholders, excluding warrant revaluation

income |

|

$ |

(1.7 |

) |

|

$ |

(1.6 |

) |

About Lightbridge Corporation

Lightbridge (NASDAQ: LTBR) is a nuclear fuel

technology company based in Reston, Virginia, USA. The Company

develops proprietary next generation nuclear fuel technologies for

current and future reactors. The technology significantly enhances

the economics and safety of nuclear power, operating about 1000° C

cooler than standard fuel. Lightbridge invented, patented and has

independently validated the technology, including successful

demonstration of the fuel in a research reactor with near-term

plans to demonstrate the fuel under commercial reactor conditions.

The Company has assembled a world class development team including

veterans of leading global fuel manufacturers. Four large electric

utilities that generate about half the nuclear power in the US

already advise Lightbridge on fuel development and deployment. The

Company operates under a licensing and royalty model, independently

validated and based on the increased power generated by

Lightbridge-designed fuel and high ROI for operators of existing

and new reactors. The economic benefits are further enhanced by

anticipated carbon credits available under the Clean Power Plan.

Lightbridge also provides comprehensive advisory services for

established and emerging nuclear programs based on a philosophy of

transparency, non-proliferation, safety and operational excellence.

For more information please visit: www.ltbridge.com.

To receive Lightbridge Corporation updates via e-mail, subscribe

at http://ir.ltbridge.com/alerts.cfm.

Lightbridge is on Twitter. Sign up to follow @LightbridgeCorp at

http://twitter.com/lightbridgecorp.

Forward Looking Statements

With the exception of historical matters, the

matters discussed in this news release are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995, including statements regarding the Company's

competitive position, the timing of demonstration testing and

commercial production, the Company's entry into agreements with

nuclear fuel manufacturers and the timing thereof, the potential

impact of the U.S. Clean Power Plan and similar regulations, the

Company's anticipated financial resources and position, the

Company's product and service offerings, the expected market for

the Company's product and service offerings. These statements

are based on current expectations on the date of this news release

and involve a number of risks and uncertainties that may cause

actual results to differ significantly from such estimates. The

risks include, but are not limited to, the degree of market

adoption of the Company's product and service offerings; market

competition; dependence on strategic partners; demand for fuel for

nuclear reactors; the Company's ability to manage its business

effectively in a rapidly evolving market; as well as other factors

described in Lightbridge's filings with the Securities and Exchange

Commission. Lightbridge does not assume any obligation to

update or revise any such forward-looking statements, whether as

the result of new developments or otherwise. Readers are

cautioned not to put undue reliance on forward-looking

statements.

*** tables follow ***

| Lightbridge Corporation |

| Condensed Consolidated Balance

Sheets |

| |

| |

|

March 31, |

|

|

| |

|

2017 |

|

December 31, |

| |

|

(Unaudited) |

|

2016 |

|

ASSETS |

|

|

|

|

| Current

Assets |

|

|

|

|

| Cash and

cash equivalents |

$ |

5,215,035 |

|

$ |

3,584,877 |

|

|

Restricted cash |

|

114,036 |

|

|

114,012 |

|

| Accounts

receivable - project revenue and reimbursable project costs |

|

87,614 |

|

|

388,434 |

|

| Prepaid

expenses and other current assets |

|

165,067 |

|

|

80,933 |

|

| Deferred

financing costs, net |

|

491,168 |

|

|

491,168 |

|

|

Total Current Assets |

|

6,072,920 |

|

|

4,659,424 |

|

| |

|

|

|

|

| Other

Assets |

|

|

|

|

| Patent

costs |

|

1,203,354 |

|

|

1,160,465 |

|

| Deferred

financing costs, net |

|

859,682 |

|

|

982,486 |

|

| Total

Other Assets |

|

2,063,036 |

|

|

2,142,951 |

|

|

Total Assets |

$ |

8,135,956 |

|

$ |

6,802,375 |

|

| |

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

| Current

Liabilities |

|

|

|

|

| Accounts

payable and accrued liabilities |

$ |

1,159,163 |

|

$ |

1,216,321 |

|

| Total

Current Liabilities |

|

1,159,163 |

|

|

1,216,321 |

|

| |

|

|

|

|

| Long-Term

Liabilities |

|

|

|

|

| Deferred

lease abandonment liability |

|

- |

|

|

28,464 |

|

|

Total Liabilities |

|

1,159,163 |

|

|

1,244,785 |

|

| |

|

|

|

|

| Commitments and

contingencies – Note 4 |

|

|

|

|

| |

|

|

|

|

| Stockholders'

Equity |

|

|

|

|

| Preferred

stock, $0.001 par value, 10,000,000 authorized

shares, convertible Series A preferred shares, 1,020,000

shares issued and outstanding at March 31, 2017 and December 31,

2016 |

|

1,020 |

|

|

1,020 |

|

| Common

stock, $0.001 par value, 100,000,000 authorized, 9,716,004

shares and 7,112,143 shares issued and outstanding as of March 31,

2017 and December 31, 2016, respectively |

|

9,716 |

|

|

7,112 |

|

|

Additional paid-in capital |

|

89,427,982 |

|

|

86,266,075 |

|

|

Accumulated deficit |

|

(82,461,925 |

) |

|

(80,716,617 |

) |

|

Total Stockholders' Equity |

|

6,976,793 |

|

|

5,557,590 |

|

| Total

Liabilities and Stockholders' Equity |

$ |

8,135,956 |

|

$ |

6,802,375 |

|

| |

|

|

|

|

| Lightbridge Corporation |

| Unaudited Condensed Consolidated Statements of

Operations |

| |

|

|

| |

|

Three Months Ended |

| |

|

March 31, |

| |

|

2017 |

|

2016 |

| Revenue: |

|

|

|

|

| |

|

|

|

|

| Consulting Revenue |

$ |

135,485 |

|

$ |

166,546 |

|

| |

|

|

|

|

| Cost of Consulting

Services Provided |

|

85,363 |

|

|

68,225 |

|

| |

|

|

|

|

| Gross Margin |

|

50,122 |

|

|

98,321 |

|

| |

|

|

|

|

| Operating Expenses |

|

|

|

|

|

General and administrative |

|

1,208,303 |

|

|

1,096,109 |

|

|

Research and development |

|

464,343 |

|

|

586,250 |

|

| Total Operating

Expenses |

|

1,672,646 |

|

|

1,682,359 |

|

| |

|

|

|

|

| Operating Loss |

|

(1,622,524 |

) |

|

(1,584,038 |

) |

| |

|

|

|

|

| Other Income and

(Expenses) |

|

|

|

|

|

Warrant revaluation |

|

- |

|

|

1,253,854 |

|

|

Financing costs |

|

(122,804 |

) |

|

- |

|

|

Other income (expenses) |

|

20 |

|

|

(4,521 |

) |

| Total Other Income and

(Expenses) |

|

(122,784 |

) |

|

1,249,333 |

|

| |

|

|

|

|

| Net loss before income

taxes |

|

(1,745,308 |

) |

|

(334,705 |

) |

| |

|

|

|

|

| Income taxes |

|

- |

|

|

- |

|

| |

|

|

|

|

| Net loss |

$ |

(1,745,308 |

) |

$ |

(334,705 |

) |

| |

|

|

|

|

|

Accumulated preferred stock dividend |

|

(49,000 |

) |

|

- |

|

|

|

|

|

|

|

|

Net loss attributable to common stockholders |

|

(1,794,308 |

) |

|

(334,705 |

) |

| |

|

|

|

|

| Net Loss Per Common

Share, |

|

|

|

|

|

Basic and Diluted |

$ |

(0.20 |

) |

$ |

(0.09 |

) |

| |

|

|

|

|

| Weighted Average Number

of Common Shares Outstanding |

|

9,138,014 |

|

|

3,931,506 |

|

| |

|

|

|

|

| Lightbridge Corporation |

| Unaudited Condensed Consolidated Statements of

Cash Flows |

| |

| |

|

Three Months Ended |

| |

|

March 31, |

| |

|

2017 |

|

2016 |

| Operating

Activities: |

|

|

|

|

|

Net Loss |

$ |

(1,745,308 |

) |

$ |

(334,705 |

) |

| Adjustments to

reconcile net loss from operations to net cash used in operating

activities: |

|

|

|

|

|

Stock-based compensation |

|

229,631 |

|

|

185,456 |

|

|

Amortization of deferred financing costs |

|

122,804 |

|

|

- |

|

|

Warrant revaluation |

|

- |

|

|

(1,253,854 |

) |

| Changes in operating

working capital items: |

|

|

|

|

|

Accounts receivable - fees and reimbursable project costs |

|

300,820 |

|

|

(13,822 |

) |

|

Prepaid expenses and other assets |

|

(84,134 |

) |

|

(308,438 |

) |

|

Accounts payable and accrued liabilities |

|

78,262 |

|

|

505,498 |

|

|

Deferred lease abandonment liability |

|

(42,164 |

) |

|

(95,008 |

) |

| Net Cash Used In

Operating Activities |

|

(1,140,089 |

) |

|

(1,314,873 |

) |

| |

|

|

|

|

| Investing

Activities: |

|

|

|

|

|

Patent costs |

|

(42,889 |

) |

|

(61,599 |

) |

| Net Cash Used In

Investing Activities |

|

(42,889 |

) |

|

(61,599 |

) |

| |

|

|

|

|

| Financing

Activities: |

|

|

|

|

|

Net proceeds from the issuance of common stock |

|

2,813,160 |

|

|

1,396,339 |

|

|

Proceeds from the issuance of note payable |

|

- |

|

|

135,000 |

|

|

Repayment of note payable |

|

- |

|

|

(26,786 |

) |

|

Restricted cash |

|

(24 |

) |

|

- |

|

| Net Cash Provided by

Financing Activities |

|

2,813,136 |

|

|

1,504,553 |

|

| |

|

|

|

|

| Net Increase In Cash

and Cash Equivalents |

|

1,630,158 |

|

|

128,081 |

|

| |

|

|

|

|

| Cash and Cash

Equivalents, Beginning of Period |

|

3,584,877 |

|

|

623,184 |

|

| |

|

|

|

|

| Cash and Cash

Equivalents, End of Period |

$ |

5,215,035 |

|

$ |

751,265 |

|

| |

|

|

|

|

| Supplemental Disclosure

of Cash Flow Information: |

|

|

|

|

|

Cash paid during the period: |

|

|

|

|

| Interest

paid |

$ |

- |

|

$ |

484 |

|

| Income

taxes paid |

$ |

- |

|

$ |

- |

|

|

Non-Cash Financing Activity: |

|

|

|

|

|

Decrease in accrued liabilities – stock-based compensation |

$ |

121,720 |

|

$ |

- |

|

|

Accumulated preferred stock dividend |

$ |

49,000 |

|

$ |

- |

|

| |

|

|

|

|

Investor Relations Contact:

David Waldman/Natalya Rudman

Crescendo Communications, LLC

Tel. +1 855-379-9900

ltbr@crescendo-ir.com

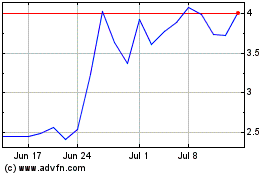

Lightbridge (NASDAQ:LTBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

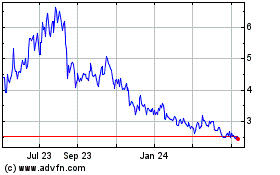

Lightbridge (NASDAQ:LTBR)

Historical Stock Chart

From Apr 2023 to Apr 2024