Net Revenue Growth Drives 1Q Record

Operating Income of $110.1 Million, Record BCF of $188.2 Million,

Adjusted EBITDA of $171.5 Million and Free Cash Flow of $102.2

Million, Before One-Time Transaction Expenses

Nexstar Media Group, Inc. (NASDAQ: NXST) (“Nexstar” or “the

Company”) today reported record financial results for the first

quarter ended March 31, 2017 as summarized below. On January 17,

2017, Nexstar completed its acquisition of Media General, Inc. and

also closed on the divestitures of 13 television stations. All

actual results presented herein reflect the impact of $47.7 million

of one-time transaction expenses incurred in the quarter ended

March 31, 2017. The actual results presented herein for the three

months ended March 31, 2017 reflect the Company’s legacy Nexstar

broadcasting and digital operations (less seventy-three days of

results from six Nexstar station divestitures) and seventy-three

days of results from the Media General stations (net of

divestitures). The comparable three month period ended March 31,

2016 reflects the Company’s legacy Nexstar broadcasting and digital

operations.

Three Months Ended March

31,

($ in thousands)

2017

2016

Change Local Revenue $ 202,430 $ 93,767 +115.9 % National

Revenue $ 77,711 $ 35,450 +119.2 %

Core Advertising Revenue

$ 280,141 $ 129,217 +116.8 %

Political Revenue $ 1,995 $ 11,754 (83.0 )% Retransmission Fee

Revenue $ 231,895 $ 97,313 +138.3 % Digital Revenue $ 46,705 $

22,533 +107.3 % Other $ 4,461 $ 1,605 +177.9 % Trade and Barter

Revenue $ 12,442 $ 11,417 +9.0 %

Gross Revenue $

577,639 $ 273,839 +110.9 % Less: Agency

Commission $ 37,322 $ 18,181 +105.3 %

Net Revenue $

540,317 $ 255,658 +111.3 %

Gross

Revenue Excluding Political $ 575,644 $

262,085 +119.6 %

Income from Operations

$ 110,151 $ 57,929 +90.1 %

Broadcast Cash Flow(1) $ 188,213

$ 98,063 +91.9 %

Broadcast Cash Flow

Margin(2) 34.8 % 38.4 %

Adjusted EBITDA Before One-Time Transaction

Expenses(1) $ 171,490 $

86,765 +97.6 %

Adjusted EBITDA Before One-Time

Transaction Expenses Margin(2) 31.7 %

33.9 % Adjusted EBITDA(1) $

123,814 $ 82,252 +50.5 %

Adjusted EBITDA

Margin(2) 22.9 % 32.2 %

Free Cash Flow Before One-Time Transaction

Expenses(1) $ 102,213 $

56,633 +80.5 %

Free Cash Flow(1) $

54,537 $ 52,120 +4.6 %

_______________

(1) Definitions and disclosures regarding non-GAAP

financial information including reconciliations are included at the

end of the press release. (2) Broadcast cash flow margin is

broadcast cash flow as a percentage of net revenue. Adjusted EBITDA

margin is Adjusted EBITDA as a percentage of net revenue.

CEO Comment

Perry A. Sook, Chairman, President and Chief Executive Officer

of Nexstar Broadcasting Group, Inc. commented, “Nexstar’s record

first quarter results highlight our expanded scale, ongoing

diversification and unwavering commitment to localism, innovation

and growth as we capitalize on the many opportunities to serve

viewers and businesses in our local markets. Our record first

quarter net revenue led to record cash flows before the impact of

$47.7 million of one-time transaction expenses which we disclosed

and estimated at $46.0 million on our fourth quarter conference

call. A partial quarter’s contribution from the Media General

transaction and the continued strength of Nexstar’s legacy

operations led to triple digit growth in all of our non-political

revenue sources and combined with our expense discipline and focus

on managing operations for cash flow, resulted in BCF, Adjusted

EBITDA and free cash flow growth before transaction expenses of

91.9%, 97.6% and 80.5%, respectively. Importantly, the Media

General integration and synergy realization plans are proceeding

ahead of schedule, and to date we have harvested approximately 85%

of the $81 million of year one synergies we previously

identified.

“We remain confident that significant year-over-year growth in

our non-political revenue sources will continue throughout the

year, and we expect 2017 to mark the Company’s sixth consecutive

year of record financial results. With the operating momentum

across our business and our integration initiatives proceeding

according to plan, we remain confident in Nexstar’s ability to meet

or exceed our targets for average annual free cash flow in the

2017/2018 cycle of approximately $565 million, or approximately

$12.00 per share, per year. Overall, the Media General transaction

is meeting our expectations and will result in excess of 55% growth

in our annual average pro forma 2017/2018 free cash flow per share

relative to the record performance of our legacy operations in

2016.

“For the quarter, net revenue rose 111% as our increased scale

and the ongoing execution of our strategies to leverage our local

content and diversify our revenue sources more than offset the $9.8

million year-over-year decline in political advertising. First

quarter core television ad revenue growth of 117% was complemented

by a 138% rise in retransmission fee revenue and a 107% increase in

digital media revenue both of which benefited from organic growth

as well the addition of the Media General operations. Our strong

local sales teams and focus on managing core ad inventory resulted

in a modest increase in pro forma combined Company same-station

local advertising revenue, despite the absence of political and

soft first quarter GDP trends as the U.S. economy grew during the

period at its weakest pace in three years. Reflecting

transaction-related growth and our historical success in growing

political ad spending during odd-year cycles, we reported first

quarter political revenue of approximately $2 million marking a

454% rise over the comparable 2015 period. Notably, excluding

political, gross revenue grew 120% in the first quarter compared to

the prior year, reflecting Nexstar’s further success in leveraging

the value of our television broadcasting operating model and

content creation capabilities into a diversified platform with

multiple high margin revenue streams.

“Highlighting further success against our diversification

initiatives, combined digital media and retransmission fee revenue

of $278.6 million more than doubled compared to the prior year

period and accounted for 51.6% of net revenue marking the highest

contribution to our quarterly revenue mix for the combined metric

and significant growth over the 2016 first quarter level of 46.9%.

The year-over-year increase in first quarter non-television revenue

reflects new distribution agreements reached in late 2016 with

multichannel video programming distributors covering approximately

10 million subscribers, Media General revenue synergies related to

the after acquired clauses in our retransmission consent contracts,

and our expanded digital operations.

“The rise in first quarter station direct operating expenses

(net of trade expense) and SG&A expense primarily reflects the

operation of acquired stations and digital assets and increases in

network affiliation expense. First quarter corporate expense was in

line with our overall guidance and our prior indication that we

would incur transaction costs related to the completion of the

Media General transaction and certain divestitures.

“With significant and growing free cash flow Nexstar has

excellent visibility to delivering on or exceeding our free cash

flow targets in the current cycle and a clear path for the

continued near- and long-term enhancement of shareholder value. As

always, we remain focused on actively managing our capital

structure to provide the financial flexibility to support our near-

and long-term growth. In this regard, subsequent to the closing of

the Media General transaction, Nexstar made voluntary prepayments

on its Term Loan B amounting to $125.0 million and called the

entire $525 million of the 6.875% senior unsecured notes. As a

result, we reduced our funded debt at March 31, 2017, by [$650]

million relative to the levels at the time we closed the Media

General transaction. We continue to expect Nexstar’s net leverage,

absent additional strategic activity, to be in the high 4x range at

the end of 2017 and to decline to the mid 3x range by the end of

2018.

“To ensure precise execution across our significantly expanded

operating base, during the first quarter we promoted Tim Busch to

serve as President of the Nexstar Broadcasting Inc., announced

three newly-created regional managers and moved quickly to fill

open general manager positions and to date have hired or promoted

22 new station GMs. We also hired our Washington D.C. News Bureau

Chief, CBS News veteran Bill Mondora, who will leverage our

expanded team of journalists and production resources to deliver

local content to communities across Nexstar’s markets. We added

sales resources to the former Media General markets and continue to

transition our stations onto the same operating systems, platforms

and services. We also announced the appointment of technology

venture capital investor and former Rubicon Project president and

board member, Greg Raifman, to President of Nexstar Digital LLC.

Greg brings outstanding leadership and entrepreneurial skills to

Nexstar and a record of success in efficiently scaling advertising

technology and services companies to a position of market

leadership while accelerating revenue growth. He will continue the

progress we have made integrating our digital products under the

Nexstar Digital brand, while evaluating new potential complementary

capabilities that maximize results for our customers and create

revenue opportunities for the Company’s shareholders.

“As the nation’s leading local media company with a portfolio of

premiere stations and digital assets, a strong balance sheet, an

attractive weighted average cost of capital, and prodigious annual

free cash growth, we continue to have the financial flexibility to

reduce leverage, evaluate additional accretive strategic growth

investments and expand our return of capital to shareholders. In

summary, Nexstar is executing very well on all functions including

our operations, integration, synergy realization, capital

structure, and service to our local communities. Our disciplines in

these areas have driven significant growth as well as consistency

and visibility to our results. We look forward to realizing the

significant strategic and economic benefits from the Media General

transaction in 2017 and remain confident that our ongoing

initiatives to drive distribution, digital and odd-year political

revenue growth across our platform combined with prudent management

of our capital structure are a proven formula for sustained long

term financial growth.”

The consolidated debt of Nexstar, its wholly owned subsidiaries

and its variable interest entities (“VIEs”) (collectively, the

“Company”) at March 31, 2017, was $4,501.9 million including senior

secured debt of $2,934.4 million. The Company’s total net leverage

ratio at March 31, 2017 was 4.7x.

The table below summarizes the Company’s debt obligations (net

of financing costs and discounts):

($ in millions)

3/31/2017

12/31/2016 Revolving Credit Facilities $ 3.0 $ 2.0

First Lien Term Loans $ 2,931.4 $ 662.2 6.875% Senior Unsecured

Notes $ - $ 520.7 6.125% Senior Unsecured Notes $ 272.7 $ 272.6

5.875% Senior Unsecured Notes $ 409.6 $ - 5.625% Senior Unsecured

Notes $ 885.2 $ 884.9

Total Debt $ 4,501.9

$ 2,342.4 Cash on Hand $

72.9 $ 87.7

Media General Contingent Value Right

In connection with Nexstar’s merger with Media General, one

Contingent Value Right (“CVR”) was issued for each of Media

General’s outstanding common shares, stock options and other

stock-based awards. The CVR entitles the holder to receive a pro

rata share of the net proceeds from the disposition of Media

General’s spectrum in the Federal Communications Commission’s

spectrum auction. The CVRs are not transferable, except in limited

circumstances. Later this month, Nexstar will be notifying the CVR

Rights Agent, American Stock Transfer, of our estimate of

“Distributable Company Proceeds” and “Estimate Holdback” amounts as

required under the Contingent Value Rights Agreement. While exact

timing is not certain, we anticipate the first payments being made

to CVR holders this summer and continuing thereafter until all of

the spectrum proceeds have been received. Please refer to the

Contingent Value Rights Agreement for additional details.

First Quarter Conference Call

Nexstar will host a conference call at 10:00 a.m. ET today.

Senior management will discuss the financial results and host a

question and answer session. The dial in number for the audio

conference call is 719/325-4940, conference ID 1598799 (domestic

and international callers). In addition, a live audio webcast of

the call will be accessible to the public on Nexstar’s web site,

http://www.nexstar.tv and a recording of the webcast will be

archived on the site for 90 days following the live event.

Definitions and Disclosures Regarding non-GAAP Financial

Information

Broadcast cash flow is calculated as income from operations,

plus corporate expenses (including one-time transaction expenses),

depreciation, amortization of intangible assets and broadcast

rights (excluding barter), (gain) loss on asset disposal, non-cash

representation contract termination fee and change in the fair

value of contingent consideration, minus broadcast rights

payments.

Adjusted EBITDA before one-time transaction expenses is

calculated as broadcast cash flow less corporate expenses,

excluding one-time transaction expenses. Adjusted EBITDA is

calculated as Adjusted EBITDA before one-time transaction expenses

less corporate one-time transaction expenses.

Free cash flow is calculated as income from operations plus

depreciation, amortization of intangible assets and broadcast

rights (excluding barter), (gain) loss on asset disposal, non-cash

compensation expense, non-cash representation contract termination

fee and change in the fair value of contingent consideration, less

payments for broadcast rights, cash interest expense, capital

expenditures and net operating cash income taxes.

Broadcast cash flow, Adjusted EBITDA before one-time transaction

expenses, Adjusted EBITDA and free cash flow results are non-GAAP

financial measures. Nexstar believes the presentation of these

non-GAAP measures are useful to investors because they are used by

lenders to measure the Company’s ability to service debt; by

industry analysts to determine the market value of stations and

their operating performance; by management to identify the cash

available to service debt, make strategic acquisitions and

investments, maintain capital assets and fund ongoing operations

and working capital needs; and, because they reflect the most

up-to-date operating results of the stations inclusive of TBAs or

LMAs. Management believes they also provide an additional basis

from which investors can establish forecasts and valuations for the

Company’s business.

For a reconciliation of these non-GAAP financial measurements to

the GAAP financial results cited in this news announcement, please

see the supplemental tables at the end of this release.

About Nexstar Media Group, Inc.

Nexstar Media Group is a leading diversified media company that

leverages localism to bring new services and value to consumers and

advertisers through its traditional media, digital and mobile media

platforms. Nexstar owns, operates, programs or provides sales and

other services to 170 television stations and related digital

multicast signals reaching 100 markets or nearly 39% of all U.S.

television households. Nexstar’s portfolio includes primary

affiliates of NBC, CBS, ABC, FOX, MyNetworkTV and The CW. Nexstar’s

community portal websites offer additional hyper-local content and

verticals for consumers and advertisers, allowing audiences to

choose where, when and how they access content while creating new

revenue opportunities. For more information please visit

www.nexstar.tv.

Forward-Looking Statements

This communication includes forward-looking statements. We have

based these forward-looking statements on our current expectations

and projections about future events. Forward-looking statements

include information preceded by, followed by, or that includes the

words "guidance," "believes," "expects," "anticipates," "could," or

similar expressions. For these statements, Nexstar claims the

protection of the safe harbor for forward-looking statements

contained in the Private Securities Litigation Reform Act of 1995.

The forward-looking statements contained in this communication,

concerning, among other things, future financial performance,

including changes in net revenue, cash flow and operating expenses,

involve risks and uncertainties, and are subject to change based on

various important factors, including the impact of changes in

national and regional economies, the ability to service and

refinance our outstanding debt, successful integration of acquired

television stations and digital businesses (including achievement

of synergies and cost reductions), pricing fluctuations in local

and national advertising, future regulatory actions and conditions

in the television stations' operating areas, competition from

others in the broadcast television markets, volatility in

programming costs, the effects of governmental regulation of

broadcasting, industry consolidation, technological developments

and major world news events. Nexstar undertakes no obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise. In light of

these risks, uncertainties and assumptions, the forward-looking

events discussed in this communication might not occur. You should

not place undue reliance on these forward-looking statements, which

speak only as of the date of this release. For more details on

factors that could affect these expectations, please see Nexstar’s

other filings with the SEC.

Nexstar Media Group, Inc.

Condensed Consolidated Statements of

Operations

(in thousands, except per share amounts,

unaudited)

Three Months Ended March 31,

2017 2016 Net revenue $ 540,317 $ 255,658

Operating expenses: Corporate expenses 64,399 15,811 Direct

operating expenses, net of trade 216,060 87,946 Selling, general

and administrative expenses, excluding corporate 109,903 52,354

Trade and barter expense 12,900 11,344 Depreciation 22,226 12,558

Amortization of intangible assets 48,158 12,079 Amortization of

broadcast rights, excluding barter 14,236 5,637 Gain on disposal of

stations, net (57,716 ) - Total operating expenses

430,166 197,729 Income from operations 110,151 57,929

Interest expense, net (79,237 ) (20,654 ) Loss on debt

extinguishment (31,804 ) - Other expenses (107 ) (136

) (Loss) income before income taxes (997 ) 37,139 Income tax

benefit (expense) 5,941 (14,865 ) Net income 4,944

22,274 Net loss (income) attributable to noncontrolling interests

1,105 (547 ) Net income attributable to Nexstar $

6,049 $ 21,727 Basic net income per common share

attributable to Nexstar $ 0.14 $ 0.71 Basic weighted average number

of common shares outstanding 44,200 30,658 Diluted net

income per common share attributable to Nexstar $ 0.13 $ 0.69

Diluted weighted average number of common shares outstanding 45,419

31,538

Nexstar Media Group, Inc.

Reconciliation of Broadcast Cash Flow

and Adjusted EBITDA (Non-GAAP Measures)

UNAUDITED (in thousands)

Three Months Ended March 31,

Broadcast Cash Flow and Adjusted EBITDA: 2017

2016 Income from operations $ 110,151 $ 57,929

Add: Depreciation 22,226 12,558 Amortization of intangible

assets 48,158 12,079 Amortization of broadcast rights, excluding

barter 14,236 5,637 Gain on asset disposal, net (57,622 ) (97 )

Corporate expenses 64,399 15,811 Change in the fair value of

contingent consideration - 404 Less: Payments for broadcast

rights 13,335 6,258 Broadcast cash flow

188,213 98,063 Margin % 34.8 % 38.4 % Less: Corporate

expenses, excluding one-time transaction expenses 16,723

11,298 Adjusted EBITDA before one-time transaction

expenses 171,490 86,765 Margin % 31.7 % 33.9 % Less:

Corporate one-time transaction expenses 47,676 4,513

Adjusted EBITDA $ 123,814 $ 82,252 Margin % 22.9 % 32.2 %

Nexstar Media Group, Inc.

Reconciliation of Free Cash Flow

(Non-GAAP Measure)

UNAUDITED (in thousands)

Three Months Ended March 31,

Free Cash Flow: 2017 2016

Income from operations $ 110,151 $ 57,929 Add: Depreciation

22,226 12,558 Amortization of intangible assets 48,158 12,079

Amortization of broadcast rights, excluding barter 14,236 5,637

Gain on asset disposal, net (57,622 ) (97 ) Non-cash compensation

expense 4,810 3,134 Change in the fair value of contingent

consideration - 404 Corporate one-time transaction expenses 47,676

4,513 Less: Payments for broadcast rights 13,335 6,258 Cash

interest expense(1) 56,972 19,707 Capital expenditures 13,510 7,581

Operating cash income taxes, net of refunds 3,605

5,978 Free cash flow before one-time transaction expenses

102,213 56,633 Less: Corporate one-time transaction expenses

47,676 4,513 Free cash flow $ 54,537 $ 52,120

_______________

(1) Excludes payments of $19.6 million in one-time

fees during Q1 2017 associated with the financing of the Company’s

merger with Media General.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170509005434/en/

Nexstar Media Group, Inc.Thomas E. Carter, 972-373-8800Chief

Financial OfficerorJCIRJoseph Jaffoni / Jennifer Neuman,

212-835-8500nxst@jcir.com

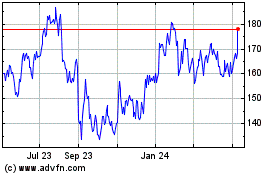

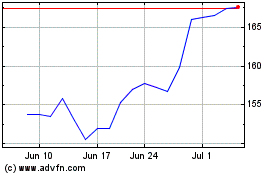

Nexstar Media (NASDAQ:NXST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nexstar Media (NASDAQ:NXST)

Historical Stock Chart

From Apr 2023 to Apr 2024