EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit

|

|

|

|

No.

|

|

Description

|

|

|

|

|

|

99.1

|

|

Press Release of Maiden Holdings, Ltd., dated May 8, 2017

|

Exhibit 99.1

PRESS RELEASE

Maiden Holdings, Ltd. Announces First Quarter 2017 Financial Results

Highlights for the quarter ended March 31, 2017

|

|

|

|

•

|

Net income attributable to Maiden common shareholders of $20.5 million, or $0.23 per diluted common share compared with net income attributable to Maiden common shareholders of $27.2 million, or $0.35 per diluted common share in the first quarter of 2016;

|

|

|

|

|

•

|

Non-GAAP operating earnings

(1)

of $22.6 million, or $0.26 per diluted common share compared with non-GAAP operating earnings of $28.3 million, or $0.37 per diluted common share in the first quarter of 2016;

|

|

|

|

|

•

|

Annualized return on average common equity of 7.9% compared to 11.9% in the first quarter of 2016;

|

|

|

|

|

•

|

Annualized non-GAAP operating return on average common equity

(7)

of 8.7% compared to 12.3% in the first quarter of 2016;

|

|

|

|

|

•

|

Gross premiums written increased 6.9% to $923.4 million compared to the first quarter of 2016;

|

|

|

|

|

•

|

Net premiums written increased 13.6% to $900.5 million compared to the first quarter of 2016;

|

|

|

|

|

•

|

Combined ratio

(12)

of 100.9% compared to 98.9% in the first quarter of 2016;

|

|

|

|

|

•

|

Net investment income of $42.2 million increased 16.1% compared to $36.3 million in the first quarter of 2016; and

|

|

|

|

|

•

|

Book value per common share

(4)

of $12.19 increased 0.6% compared to year-end 2016.

|

HAMILTON, Bermuda - Maiden Holdings, Ltd. (NASDAQ: MHLD) (“Maiden” or “the Company”) today reported first quarter 2017 net income attributable to Maiden common shareholders of $20.5 million or $0.23 per diluted common share compared to net income attributable to Maiden common shareholders of $27.2 million or $0.35 per diluted common share in the first quarter of 2016. Non-GAAP operating earnings

(1)

were $22.6 million, or $0.26 per diluted common share compared with non-GAAP operating earnings of $28.3 million, or $0.37 per diluted common share in the first quarter of 2016.

Commenting on the Company's results, Art Raschbaum, Chief Executive Officer of Maiden, said: “Notwithstanding a challenging operating environment, Maiden’s results improved significantly from the Company’s fourth quarter 2016 underwriting loss. While the aggregate combined ratio for the quarter was 100.9%, it reflects the impact of more conservative initial expected loss ratios for the AmTrust master quota share as well as higher than anticipated losses in the quarter from select casualty lines. Gross revenues increased by 6.9% across our two operating segments while investment income also reflected strong year-on-year growth of 16.1%. We believe that we are well positioned to continue to further strengthen returns for the balance of the year while continuing to implement new business initiatives across the Company.”

Results for the quarter ended March 31, 2017

Maiden reported first quarter 2017 net income attributable to Maiden common shareholders of $20.5 million or $0.23 per diluted common share compared to net income attributable to Maiden common shareholders of $27.2 million or $0.35 per diluted common share in the first quarter of 2016. The non-GAAP operating earnings

(1)

were $22.6 million, or $0.26 per diluted common share compared with non-GAAP operating earnings of $28.3 million, or $0.37 per diluted common share in the first quarter of 2016.

In the first quarter of 2017, gross premiums written increased 6.9% to $923.4 million from $864.1 million in the first quarter of 2016. Gross premiums written in the Diversified Reinsurance segment totaled $332.0 million, an increase of 5.1% versus the first quarter of 2016 due to a combination of new business and growth from existing client relationships. In the AmTrust Reinsurance segment, gross premiums written were $591.4 million, an increase of 7.9% compared to $548.3 million in the first quarter of 2016.

Net premiums written totaled $900.5 million in the first quarter of 2017, an increase of 13.6% compared to the first quarter of 2016. Net premiums written increased in the first quarter due to premium growth in both operating segments, as well as a lower proportion of premiums ceded compared to the prior year period.

Net premiums earned were $709.5 million, an increase of 15.2% compared to the first quarter of 2016. In the Diversified Reinsurance segment, net premiums earned increased 17.2% to $201.8 million compared to the first quarter of 2016. The AmTrust Reinsurance segment net premiums earned were $507.6 million, up 14.4% compared to the first quarter of 2016. Maiden’s year-over-year increase in net premiums earned was due to a lower utilization of retrocessional capacity.

Net loss and loss adjustment expenses of $480.6 million were up 19.1% compared to the first quarter of 2016. The loss ratio

(8)

of 67.4% was higher than the 65.0% reported in the first quarter of 2016.

Commission and other acquisition expenses, increased 13.8% to $222.0 million in the first quarter of 2017, compared to the first quarter of 2016. The expense ratio

(11)

decreased to 33.5% for the first quarter of 2017 compared with 33.9% in the same quarter last year. General and administrative expenses for the first quarter of 2017 totaled $17.4 million, a 12.4% increase compared with $15.5 million in the first quarter of 2016. The general and administrative expense ratio

(10)

was 2.4% in the first quarter of 2017, compared to 2.5% in the first quarter of 2016.

The combined ratio

(12)

for the first quarter of 2017 totaled 100.9% compared with 98.9% in the first quarter of 2016.

The Diversified Reinsurance segment combined ratio was 99.9% in the first quarter of 2017 compared to 102.9% in the first quarter of 2016. The Diversified Reinsurance results in the first quarter last year were impacted by adverse development of U.S. commercial auto business, which was not a significant factor in the first quarter of 2017. The AmTrust Reinsurance segment combined ratio was 99.8% in the first quarter of 2017 compared to 95.3% in the first quarter of 2016, partially due to a higher initial loss ratio on the master quota share.

Net investment income of $42.2 million in the first quarter of 2017 increased 16.1% compared to the first quarter of 2016. As of March 31, 2017, the average yield on the fixed income portfolio (excluding cash) is 3.29% with an average duration of 5.06 years. Cash and cash equivalents were $193.2 million at March 31, 2017 or $43.7 million higher than at year-end 2016.

Total assets increased 4.9% to $6.6 billion at March 31, 2017 compared to $6.3 billion at year-end 2016. Shareholders' equity was $1.4 billion, up 0.7% compared to December 31, 2016. Book value per common share

(4)

was $12.19 at March 31, 2017 or 0.6% higher than at December 31, 2016.

During the first quarter of 2017, the Board of Directors declared dividends of $0.15 per common share, $0.515625 per Series A preference share and $0.445313 per Series C preference share.

(1)(4)(7) Please see the Non-GAAP Financial Measures table for additional information on these non-GAAP financial measures and reconciliation of these measures to GAAP measures.

(8)(10)(11)(12) Loss ratio, general and administrative expense ratio, expense ratio and combined ratio are non-GAAP operating metrics. Please see the additional information on these measures under Non-GAAP Financial Measure tables.

Conference Call

Maiden’s Chief Executive Officer, Art Raschbaum and Chief Financial Officer, Karen Schmitt will review these results tomorrow via teleconference and live audio webcast beginning at 8:30 a.m. ET.

To participate in the conference call, please access one of the following at least five minutes prior to the start time:

U.S. Callers: 1.877.734.5373

Outside U.S. Callers: 1.973.200.3059

Passcode: 11534370

Webcast: http://www.maiden.bm/news_events

A replay of the conference call will be available beginning at 11:30 a.m. ET on May 9, 2017 through 11:30 a.m. ET on May 16, 2017. To listen to the replay, please dial toll free: 1.855.859.2056 (U.S. Callers) or toll: 1.404.537.3406 (callers outside the U.S.) and enter the Passcode: 11534370; or access

http://www.maiden.bm/news_events

About Maiden Holdings, Ltd.

Maiden Holdings, Ltd. is a Bermuda-based holding company formed in 2007. Through its subsidiaries, which are each A rated (excellent) by A.M. Best, the Company is focused on providing non-catastrophic, customized reinsurance products and services to small and mid-size insurance companies in the United States and Europe. As of March 31, 2017, Maiden had $6.6 billion in assets and shareholders' equity of $1.4 billion.

The Maiden Holdings, Ltd. logo is available at http://www.globenewswire.com/newsroom/prs/?pkgid=5006

Forward Looking Statements

This release contains "forward-looking statements" which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking statements are based on the Company's current expectations and beliefs concerning future developments and their potential effects on the Company. There can be no assurance that actual developments will be those anticipated by the Company. Actual results may differ materially from those projected as a result of significant risks and uncertainties, including non-receipt of the expected payments, changes in interest rates, effect of the performance of financial markets on investment income and fair values of investments, developments of claims and the effect on loss reserves, accuracy in projecting loss reserves, the impact of competition and pricing environments, changes in the demand for the Company's products, the effect of general economic conditions and unusual frequency of storm activity, adverse state and federal legislation, regulations and regulatory investigations into industry practices, developments relating to existing agreements, heightened competition, changes in pricing environments, and changes in asset valuations. Additional information about these risks and uncertainties, as well as others that may cause actual results to differ materially from those projected is contained in Item 1A. Risk Factors in the Company's Annual Report on Form 10-K for the year ended December 31, 2016 as updated in periodic filings with the SEC. The Company undertakes no obligation to publicly update any forward-looking statements, except as may be required by law.

CONTACT:

Noah Fields, Senior Vice President, Investor Relations

Maiden Holdings, Ltd.

Phone: 441.298.4927

E-mail: nfields@maiden.bm

MAIDEN HOLDINGS, LTD.

CONSOLIDATED BALANCE SHEETS

(In thousands of U.S. dollars, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31,

2017

|

|

December 31, 2016

|

|

|

|

(Unaudited)

|

|

(Audited)

|

|

ASSETS

|

|

|

|

|

|

Investments:

|

|

|

|

|

|

Fixed maturities, available-for-sale, at fair value (amortized cost 2017: $3,993,941; 2016: $4,005,642)

|

|

$

|

3,967,907

|

|

|

$

|

3,971,666

|

|

|

Fixed maturities, held to maturity, at amortized cost (fair value 2017: $767,657; 2016: $766,135)

|

|

750,554

|

|

|

752,212

|

|

|

Other investments, at fair value (cost 2017: $10,074; 2016: $10,057)

|

|

13,534

|

|

|

13,060

|

|

|

Total investments

|

|

4,731,995

|

|

|

4,736,938

|

|

|

Cash and cash equivalents

|

|

83,537

|

|

|

45,747

|

|

|

Restricted cash and cash equivalents

|

|

109,697

|

|

|

103,788

|

|

|

Accrued investment income

|

|

36,179

|

|

|

36,517

|

|

|

Reinsurance balances receivable, net

|

|

615,556

|

|

|

410,166

|

|

|

Reinsurance recoverable on unpaid losses

|

|

108,777

|

|

|

99,936

|

|

|

Loan to related party

|

|

167,975

|

|

|

167,975

|

|

|

Deferred commission and other acquisition expenses, net

|

|

472,459

|

|

|

424,605

|

|

|

Goodwill and intangible assets, net

|

|

77,183

|

|

|

77,715

|

|

|

Other assets

|

|

153,601

|

|

|

148,912

|

|

|

Total assets

|

|

$

|

6,556,959

|

|

|

$

|

6,252,299

|

|

|

LIABILITIES

|

|

|

|

|

|

Reserve for loss and loss adjustment expenses

|

|

$

|

2,991,604

|

|

|

$

|

2,896,496

|

|

|

Unearned premiums

|

|

1,670,884

|

|

|

1,475,506

|

|

|

Accrued expenses and other liabilities

|

|

172,886

|

|

|

167,736

|

|

|

Senior notes - principal amount

|

|

362,500

|

|

|

362,500

|

|

|

Less unamortized issuance costs

|

|

11,012

|

|

|

11,091

|

|

|

Senior notes, net

|

|

351,488

|

|

|

351,409

|

|

|

Total liabilities

|

|

5,186,862

|

|

|

4,891,147

|

|

|

Commitments and Contingencies

|

|

|

|

|

|

EQUITY

|

|

|

|

|

|

Preference shares

|

|

315,000

|

|

|

315,000

|

|

|

Common shares

|

|

876

|

|

|

873

|

|

|

Additional paid-in capital

|

|

750,694

|

|

|

749,256

|

|

|

Accumulated other comprehensive income

|

|

15,591

|

|

|

14,997

|

|

|

Retained earnings

|

|

293,164

|

|

|

285,662

|

|

|

Treasury shares, at cost

|

|

(5,566

|

)

|

|

(4,991

|

)

|

|

Total Maiden Shareholders’ Equity

|

|

1,369,759

|

|

|

1,360,797

|

|

|

Noncontrolling interest in subsidiaries

|

|

338

|

|

|

355

|

|

|

Total Equity

|

|

1,370,097

|

|

|

1,361,152

|

|

|

Total Liabilities and Equity

|

|

$

|

6,556,959

|

|

|

$

|

6,252,299

|

|

|

|

|

|

|

|

|

Book value per common share

(4)

|

|

$

|

12.19

|

|

|

$

|

12.12

|

|

|

|

|

|

|

|

|

Common shares outstanding

|

|

86,553,324

|

|

|

86,271,109

|

|

MAIDEN HOLDINGS, LTD.

CONSOLIDATED STATEMENTS OF INCOME

(In thousands of U.S. dollars, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended March 31,

|

|

|

|

2017

|

|

2016

|

|

|

|

(Unaudited)

|

|

(Unaudited)

|

|

Revenues:

|

|

|

|

|

|

Gross premiums written

|

|

$

|

923,427

|

|

|

$

|

864,114

|

|

|

Net premiums written

|

|

$

|

900,548

|

|

|

$

|

792,831

|

|

|

Change in unearned premiums

|

|

(191,064

|

)

|

|

(176,822

|

)

|

|

Net premiums earned

|

|

709,484

|

|

|

616,009

|

|

|

Other insurance revenue

|

|

3,781

|

|

|

4,826

|

|

|

Net investment income

|

|

42,157

|

|

|

36,302

|

|

|

Net realized gains on investment

|

|

885

|

|

|

2,277

|

|

|

Total other-than-temporary impairment losses

|

|

—

|

|

|

—

|

|

|

Portion of loss recognized in other comprehensive income (loss)

|

|

—

|

|

|

—

|

|

|

Net impairment losses recognized in earnings

|

|

—

|

|

|

—

|

|

|

Total revenues

|

|

756,307

|

|

|

659,414

|

|

|

Expenses:

|

|

|

|

|

|

Net loss and loss adjustment expenses ("loss and LAE")

|

|

480,569

|

|

|

403,621

|

|

|

Commission and other acquisition expenses

|

|

222,029

|

|

|

195,068

|

|

|

General and administrative expenses

|

|

17,414

|

|

|

15,496

|

|

|

Total expenses

|

|

720,012

|

|

|

614,185

|

|

|

Non-GAAP income from operations

(2)

|

|

36,295

|

|

|

45,229

|

|

|

Other expenses

|

|

|

|

|

|

Interest and amortization expenses

|

|

(6,856

|

)

|

|

(7,265

|

)

|

|

Amortization of intangible assets

|

|

(533

|

)

|

|

(615

|

)

|

|

Foreign exchange (losses) gains

|

|

(1,921

|

)

|

|

267

|

|

|

Total other expenses

|

|

(9,310

|

)

|

|

(7,613

|

)

|

|

Income before income taxes

|

|

26,985

|

|

|

37,616

|

|

|

Less: Income tax expense

|

|

484

|

|

|

787

|

|

|

Net income

|

|

26,501

|

|

|

36,829

|

|

|

Add: loss attributable to noncontrolling interest

|

|

22

|

|

|

64

|

|

|

Net income attributable to Maiden

|

|

26,523

|

|

|

36,893

|

|

|

Dividends on preference shares

(6)

|

|

(6,033

|

)

|

|

(9,677

|

)

|

|

Net income attributable to Maiden common shareholders

|

|

$

|

20,490

|

|

|

$

|

27,216

|

|

|

Basic earnings per common share attributable to Maiden shareholders

|

|

$

|

0.24

|

|

|

$

|

0.37

|

|

|

Diluted earnings per common share attributable to Maiden shareholders

|

|

$

|

0.23

|

|

|

$

|

0.35

|

|

|

Dividends declared per common share

|

|

$

|

0.15

|

|

|

$

|

0.14

|

|

|

Annualized return on average common equity

|

|

7.9

|

%

|

|

11.9

|

%

|

|

Weighted average number of common shares - basic

|

|

86,350,850

|

|

|

73,871,277

|

|

|

Adjusted weighted average number of common shares and assumed conversions - diluted

|

|

87,436,604

|

|

|

85,799,377

|

|

MAIDEN HOLDINGS, LTD.

SUPPLEMENTAL FINANCIAL DATA - SEGMENT INFORMATION

(in thousands of U.S. dollars)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended March 31, 2017

|

|

Diversified Reinsurance

|

|

AmTrust Reinsurance

|

|

Other

|

|

Total

|

|

Gross premiums written

|

|

$

|

332,045

|

|

|

$

|

591,382

|

|

|

$

|

—

|

|

|

$

|

923,427

|

|

|

Net premiums written

|

|

$

|

327,496

|

|

|

$

|

573,052

|

|

|

$

|

—

|

|

|

$

|

900,548

|

|

|

Net premiums earned

|

|

$

|

201,842

|

|

|

$

|

507,642

|

|

|

$

|

—

|

|

|

$

|

709,484

|

|

|

Other insurance revenue

|

|

3,781

|

|

|

—

|

|

|

—

|

|

|

3,781

|

|

|

Net loss and LAE

|

|

(138,649

|

)

|

|

(341,631

|

)

|

|

(289

|

)

|

|

(480,569

|

)

|

|

Commission and other acquisition expenses

|

|

(57,945

|

)

|

|

(164,084

|

)

|

|

—

|

|

|

(222,029

|

)

|

|

General and administrative expenses

|

|

(8,730

|

)

|

|

(805

|

)

|

|

—

|

|

|

(9,535

|

)

|

|

Underwriting income (loss)

|

|

$

|

299

|

|

|

$

|

1,122

|

|

|

$

|

(289

|

)

|

|

$

|

1,132

|

|

|

Reconciliation to net income

|

|

|

|

|

|

|

|

|

|

Net investment income and realized gains on investment

|

|

|

|

|

|

|

|

43,042

|

|

|

Interest and amortization expenses

|

|

|

|

|

|

|

|

(6,856

|

)

|

|

Amortization of intangible assets

|

|

|

|

|

|

|

|

(533

|

)

|

|

Foreign exchange losses

|

|

|

|

|

|

|

|

(1,921

|

)

|

|

Other general and administrative expenses

|

|

|

|

|

|

|

|

(7,879

|

)

|

|

Income tax expense

|

|

|

|

|

|

|

|

(484

|

)

|

|

Net income

|

|

|

|

|

|

|

|

$

|

26,501

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss and LAE ratio

(8)

|

|

67.5

|

%

|

|

67.3

|

%

|

|

|

|

67.4

|

%

|

|

Commission and other acquisition expense ratio

(9)

|

|

28.2

|

%

|

|

32.3

|

%

|

|

|

|

31.1

|

%

|

|

General and administrative expense ratio

(10)

|

|

4.2

|

%

|

|

0.2

|

%

|

|

|

|

2.4

|

%

|

|

Expense Ratio

(11)

|

|

32.4

|

%

|

|

32.5

|

%

|

|

|

|

33.5

|

%

|

|

Combined ratio

(12)

|

|

99.9

|

%

|

|

99.8

|

%

|

|

|

|

100.9

|

%

|

MAIDEN HOLDINGS, LTD.

SUPPLEMENTAL FINANCIAL DATA - SEGMENT INFORMATION

(in thousands of U.S. dollars)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended March 31, 2016

|

|

Diversified Reinsurance

|

|

AmTrust Reinsurance

|

|

Other

|

|

Total

|

|

Gross premiums written

|

|

$

|

315,804

|

|

|

$

|

548,310

|

|

|

$

|

—

|

|

|

$

|

864,114

|

|

|

Net premiums written

|

|

$

|

286,136

|

|

|

$

|

506,695

|

|

|

$

|

—

|

|

|

$

|

792,831

|

|

|

Net premiums earned

|

|

$

|

172,256

|

|

|

$

|

443,753

|

|

|

$

|

—

|

|

|

$

|

616,009

|

|

|

Other insurance revenue

|

|

4,826

|

|

|

—

|

|

|

—

|

|

|

4,826

|

|

|

Net loss and LAE

|

|

(119,076

|

)

|

|

(281,774

|

)

|

|

(2,771

|

)

|

|

(403,621

|

)

|

|

Commission and other acquisition expenses

|

|

(54,531

|

)

|

|

(140,538

|

)

|

|

1

|

|

|

(195,068

|

)

|

|

General and administrative expenses

|

|

(8,600

|

)

|

|

(586

|

)

|

|

—

|

|

|

(9,186

|

)

|

|

Underwriting (loss) income

|

|

$

|

(5,125

|

)

|

|

$

|

20,855

|

|

|

$

|

(2,770

|

)

|

|

$

|

12,960

|

|

|

Reconciliation to net income

|

|

|

|

|

|

|

|

|

|

Net investment income and realized gains on investment

|

|

|

|

|

|

|

|

38,579

|

|

|

Interest and amortization expenses

|

|

|

|

|

|

|

|

(7,265

|

)

|

|

Amortization of intangible assets

|

|

|

|

|

|

|

|

(615

|

)

|

|

Foreign exchange gains

|

|

|

|

|

|

|

|

267

|

|

|

Other general and administrative expenses

|

|

|

|

|

|

|

|

(6,310

|

)

|

|

Income tax expense

|

|

|

|

|

|

|

|

(787

|

)

|

|

Net income

|

|

|

|

|

|

|

|

$

|

36,829

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss and LAE ratio

(8)

|

|

67.2

|

%

|

|

63.5

|

%

|

|

|

|

65.0

|

%

|

|

Commission and other acquisition expense ratio

(9)

|

|

30.8

|

%

|

|

31.7

|

%

|

|

|

|

31.4

|

%

|

|

General and administrative expense ratio

(10)

|

|

4.9

|

%

|

|

0.1

|

%

|

|

|

|

2.5

|

%

|

|

Expense Ratio

(11)

|

|

35.7

|

%

|

|

31.8

|

%

|

|

|

|

33.9

|

%

|

|

Combined ratio

(12)

|

|

102.9

|

%

|

|

95.3

|

%

|

|

|

|

98.9

|

%

|

MAIDEN HOLDINGS, LTD.

NON-GAAP FINANCIAL MEASURES

(In thousands of U.S. dollars, except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended March 31,

|

|

|

|

2017

|

|

2016

|

|

Non-GAAP operating earnings attributable to Maiden common shareholders

(1)

|

|

$

|

22,638

|

|

|

$

|

28,347

|

|

|

Non-GAAP basic operating earnings per common share attributable to Maiden shareholders

|

|

$

|

0.26

|

|

|

$

|

0.38

|

|

|

Non-GAAP diluted operating earnings per common share attributable to Maiden shareholders

|

|

$

|

0.26

|

|

|

$

|

0.37

|

|

|

Annualized non-GAAP operating return on average common equity

(7)

|

|

8.7

|

%

|

|

12.3

|

%

|

|

Reconciliation of net income attributable to Maiden common shareholders to non-GAAP operating earnings attributable to Maiden common shareholders:

|

|

|

|

|

|

Net income attributable to Maiden common shareholders

|

|

$

|

20,490

|

|

|

$

|

27,216

|

|

|

Add (subtract)

|

|

|

|

|

|

Net realized gains on investment

|

|

(885

|

)

|

|

(2,277

|

)

|

|

Foreign exchange losses (gains)

|

|

1,921

|

|

|

(267

|

)

|

|

Amortization of intangible assets

|

|

533

|

|

|

615

|

|

|

Divested excess and surplus ("E&S") business and NGHC run-off

|

|

289

|

|

|

2,770

|

|

|

Non-cash deferred tax expense

|

|

290

|

|

|

290

|

|

|

Non-GAAP operating earnings attributable to Maiden common shareholders

(1)

|

|

$

|

22,638

|

|

|

$

|

28,347

|

|

|

|

|

|

|

|

|

Reconciliation of diluted earnings per common share attributable to Maiden shareholders to non-GAAP diluted operating earnings per common share attributable to Maiden shareholders:

|

|

|

|

|

|

Diluted earnings per common share attributable to Maiden shareholders

|

|

$

|

0.23

|

|

|

$

|

0.35

|

|

|

Add (subtract)

|

|

|

|

|

|

Net realized gains on investment

|

|

(0.01

|

)

|

|

(0.03

|

)

|

|

Foreign exchange losses

|

|

0.02

|

|

|

—

|

|

|

Amortization of intangible assets

|

|

0.01

|

|

|

0.01

|

|

|

Divested excess and surplus "E&S" business and NGHC run-off

|

|

—

|

|

|

0.03

|

|

|

Non-cash deferred tax expense

|

|

0.01

|

|

|

0.01

|

|

|

Non-GAAP diluted operating earnings per common share attributable to Maiden shareholders

|

|

$

|

0.26

|

|

|

$

|

0.37

|

|

|

|

|

|

|

|

|

Reconciliation of net income attributable to Maiden to non-GAAP income from operations:

|

|

|

|

|

|

Net income attributable to Maiden

|

|

$

|

26,523

|

|

|

$

|

36,893

|

|

|

Add (subtract)

|

|

|

|

|

|

Foreign exchange losses (gains)

|

|

1,921

|

|

|

(267

|

)

|

|

Amortization of intangible assets

|

|

533

|

|

|

615

|

|

|

Interest and amortization expenses

|

|

6,856

|

|

|

7,265

|

|

|

Income tax expense

|

|

484

|

|

|

787

|

|

|

Loss attributable to noncontrolling interest

|

|

(22

|

)

|

|

(64

|

)

|

|

Non-GAAP income from operations

(2)

|

|

$

|

36,295

|

|

|

$

|

45,229

|

|

MAIDEN HOLDINGS, LTD.

NON-GAAP FINANCIAL MEASURES

(In thousands of U.S. dollars, except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2017

|

|

December 31, 2016

|

|

Investable assets:

|

|

|

|

|

Total investments

|

$

|

4,731,995

|

|

|

$

|

4,736,938

|

|

|

Cash and cash equivalents

|

83,537

|

|

|

45,747

|

|

|

Restricted cash and cash equivalents

|

109,697

|

|

|

103,788

|

|

|

Loan to related party

|

167,975

|

|

|

167,975

|

|

|

Total investable assets

(3)

|

$

|

5,093,204

|

|

|

$

|

5,054,448

|

|

|

|

|

|

|

|

|

March 31, 2017

|

|

December 31, 2016

|

|

Capital:

|

|

|

|

|

Preference shares

|

$

|

315,000

|

|

|

$

|

315,000

|

|

|

Common shareholders' equity

|

1,054,759

|

|

|

1,045,797

|

|

|

Total Maiden shareholders' equity

|

1,369,759

|

|

|

1,360,797

|

|

|

2016 Senior Notes

|

110,000

|

|

|

110,000

|

|

|

2013 Senior Notes

|

152,500

|

|

|

152,500

|

|

|

2012 Senior Notes

|

100,000

|

|

|

100,000

|

|

|

Total capital resources

(5)

|

$

|

1,732,259

|

|

|

$

|

1,723,297

|

|

|

|

|

|

(1)

|

Non-GAAP operating earnings is a non-GAAP financial measure defined by the Company as net income attributable to Maiden common shareholders excluding realized and unrealized investment gains and losses, foreign exchange and other gains and losses, amortization of intangible assets, divested excess and surplus business and NGHC run-off and non-cash deferred tax expense and should not be considered as an alternative to net income. The Company's management believes that non-GAAP operating earnings is a useful indicator of trends in the Company's underlying operations. The Company's measure of non-GAAP operating earnings may not be comparable to similarly titled measures used by other companies.

|

|

|

|

|

(2)

|

Non-GAAP income from operations is a non-GAAP financial measure defined by the Company as net income attributable to Maiden excluding foreign exchange and other gains and losses, amortization of intangible assets, interest and amortization expenses, income tax expense and income or loss attributable to noncontrolling interest and should not be considered as an alternative to net income. The Company’s management believes that non-GAAP income from operations is a useful measure of the Company’s underlying earnings fundamentals based on its underwriting and investment income before financing costs. This income from operations enables readers of this information to more clearly understand the essential operating results of the Company. The Company’s measure of non-GAAP income from operations may not be comparable to similarly titled measures used by other companies.

|

|

|

|

|

(3)

|

Investable assets is the total of the Company's investments, cash and cash equivalents and loan to a related party.

|

|

|

|

|

(4)

|

Book value per common share is calculated using Maiden common shareholders’ equity (shareholders' equity excluding the aggregate liquidation value of our preference shares) divided by the number of common shares outstanding.

|

|

|

|

|

(5)

|

Total capital resources is the sum of the Company's principal amount of debt and Maiden shareholders' equity.

|

|

|

|

|

(6)

|

Dividends on preference shares consist of

$3,094

paid to Preference shares - Series A for the three months ended March 31, 2017 and 2016 and

$2,939

and

$3,593

paid to Preference shares - Series C for the

three months ended

March 31, 2017

and 2016, respectively. It also includes

$2,990

paid to Preference Shares - Series B during the three months ended March 31, 2016. On

September 15, 2016

, each of then outstanding Preference share - Series B were automatically converted into

12,069,090

of the Company's common shares at a conversion rate of

3.6573

per preference share.

|

|

|

|

|

(7)

|

Non-GAAP operating return on average common equity is a non-GAAP financial measures. Management uses non-GAAP operating return on average common shareholders' equity as a measure of profitability that focuses on the return to Maiden common shareholders. It is calculated using non-GAAP operating earnings attributable to Maiden common shareholders divided by average Maiden common shareholders' equity.

|

|

|

|

|

(8)

|

Calculated by dividing net loss and LAE by the sum of net premiums earned and other insurance revenue.

|

|

|

|

|

(9)

|

Calculated by dividing commission and other acquisition expenses by the sum of net premiums earned and other insurance revenue.

|

|

|

|

|

(10)

|

Calculated by dividing general and administrative expenses by the sum of net premiums earned and other insurance revenue.

|

|

|

|

|

(11)

|

Calculated by adding together the commission and other acquisition expense ratio and the general and administrative expense ratio.

|

|

|

|

|

(12)

|

Calculated by adding together the net loss and LAE ratio and the expense ratio.

|

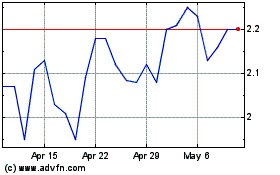

Maiden (NASDAQ:MHLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

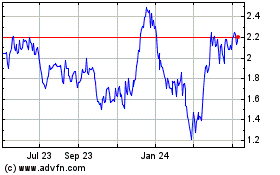

Maiden (NASDAQ:MHLD)

Historical Stock Chart

From Apr 2023 to Apr 2024