Highlights for the quarter

ended March 31, 2017

Maiden Holdings, Ltd. (NASDAQ:MHLD) (“Maiden” or “the Company”)

today reported first quarter 2017 net income attributable to Maiden

common shareholders of $20.5 million or $0.23 per diluted common

share compared to net income attributable to Maiden common

shareholders of $27.2 million or $0.35 per diluted common share in

the first quarter of 2016. Non-GAAP operating earnings(1)

were $22.6 million, or $0.26 per diluted common share compared with

non-GAAP operating earnings of $28.3 million, or $0.37 per diluted

common share in the first quarter of 2016.

Commenting on the Company's results, Art

Raschbaum, Chief Executive Officer of Maiden, said:

“Notwithstanding a challenging operating environment, Maiden’s

results improved significantly from the Company’s fourth quarter

2016 underwriting loss. While the aggregate combined ratio for the

quarter was 100.9%, it reflects the impact of more conservative

initial expected loss ratios for the AmTrust master quota share as

well as higher than anticipated losses in the quarter from select

casualty lines. Gross revenues increased by 6.9% across our

two operating segments while investment income also reflected

strong year-on-year growth of 16.1%. We believe that we

are well positioned to continue to further strengthen returns for

the balance of the year while continuing to implement new business

initiatives across the Company.”

Results for the quarter ended March 31,

2017Maiden reported first quarter 2017

net income attributable to Maiden common shareholders of $20.5

million or $0.23 per diluted common share compared to net income

attributable to Maiden common shareholders of $27.2 million or

$0.35 per diluted common share in the first quarter of

2016. The non-GAAP operating earnings(1) were $22.6

million, or $0.26 per diluted common share compared with non-GAAP

operating earnings of $28.3 million, or $0.37 per diluted common

share in the first quarter of 2016.

In the first quarter of 2017, gross premiums

written increased 6.9% to $923.4 million from $864.1 million in the

first quarter of 2016. Gross premiums written in the

Diversified Reinsurance segment totaled $332.0 million, an increase

of 5.1% versus the first quarter of 2016 due to a combination of

new business and growth from existing client relationships.

In the AmTrust Reinsurance segment, gross premiums written

were $591.4 million, an increase of 7.9% compared to $548.3 million

in the first quarter of 2016.

Net premiums written totaled $900.5 million in

the first quarter of 2017, an increase of 13.6% compared to the

first quarter of 2016. Net premiums written increased in the

first quarter due to premium growth in both operating segments, as

well as a lower proportion of premiums ceded compared to the prior

year period.

Net premiums earned were $709.5 million, an

increase of 15.2% compared to the first quarter of 2016. In

the Diversified Reinsurance segment, net premiums earned increased

17.2% to $201.8 million compared to the first quarter of 2016.

The AmTrust Reinsurance segment net premiums earned were

$507.6 million, up 14.4% compared to the first quarter of

2016. Maiden’s year-over-year increase in net premiums earned

was due to a lower utilization of retrocessional capacity.

Net loss and loss adjustment expenses of $480.6

million were up 19.1% compared to the first quarter of 2016.

The loss ratio(8) of 67.4% was higher than the 65.0% reported in

the first quarter of 2016.

Commission and other acquisition expenses,

increased 13.8% to $222.0 million in the first quarter of 2017,

compared to the first quarter of 2016. The expense ratio(11)

decreased to 33.5% for the first quarter of 2017 compared with

33.9% in the same quarter last year. General and

administrative expenses for the first quarter of 2017 totaled $17.4

million, a 12.4% increase compared with $15.5 million in the first

quarter of 2016. The general and administrative expense ratio(10)

was 2.4% in the first quarter of 2017, compared to 2.5% in the

first quarter of 2016.

The combined ratio(12) for the first quarter of

2017 totaled 100.9% compared with 98.9% in the first quarter of

2016. The Diversified Reinsurance segment

combined ratio was 99.9% in the first quarter of 2017 compared to

102.9% in the first quarter of 2016. The Diversified

Reinsurance results in the first quarter last year were impacted by

adverse development of U.S. commercial auto business, which was not

a significant factor in the first quarter of 2017. The AmTrust

Reinsurance segment combined ratio was 99.8% in the first quarter

of 2017 compared to 95.3% in the first quarter of 2016, partially

due to a higher initial loss ratio on the master quota

share.

Net investment income of $42.2 million in the

first quarter of 2017 increased 16.1% compared to the first quarter

of 2016. As of March 31, 2017, the average yield on the fixed

income portfolio (excluding cash) is 3.29% with an average duration

of 5.06 years. Cash and cash equivalents were $193.2 million

at March 31, 2017 or $43.7 million higher than at year-end

2016.

Total assets increased 4.9% to $6.6 billion at

March 31, 2017 compared to $6.3 billion at year-end

2016. Shareholders' equity was $1.4 billion, up 0.7%

compared to December 31, 2016. Book value per

common share(4) was $12.19 at March 31, 2017 or 0.6% higher

than at December 31, 2016. During the first quarter of

2017, the Board of Directors declared dividends of $0.15 per common

share, $0.515625 per Series A preference share and $0.445313 per

Series C preference share.

(1)(4)(7) Please see the Non-GAAP Financial

Measures table for additional information on these non-GAAP

financial measures and reconciliation of these measures to GAAP

measures.

(8)(10)(11)(12) Loss ratio, general and

administrative expense ratio, expense ratio and combined ratio are

non-GAAP operating metrics. Please see the additional

information on these measures under Non-GAAP Financial Measure

tables.

Conference Call

Maiden’s Chief Executive Officer, Art Raschbaum

and Chief Financial Officer, Karen Schmitt will review these

results tomorrow via teleconference and live audio webcast

beginning at 8:30 a.m. ET.

To participate in the conference call, please

access one of the following at least five minutes prior to the

start time:

U.S. Callers: 1.877.734.5373

Outside U.S. Callers: 1.973.200.3059

Passcode: 11534370

Webcast:

http://www.maiden.bm/news_events

A replay of the conference call will be

available beginning at 11:30 a.m. ET on May 9, 2017 through 11:30

a.m. ET on May 16, 2017. To listen to the replay, please dial toll

free: 1.855.859.2056 (U.S. Callers) or toll: 1.404.537.3406

(callers outside the U.S.) and enter the Passcode: 11534370; or

access http://www.maiden.bm/news_events

About Maiden Holdings, Ltd.

Maiden Holdings, Ltd. is a Bermuda-based holding

company formed in 2007. Through its subsidiaries, which are

each A rated (excellent) by A.M. Best, the Company is focused on

providing non-catastrophic, customized reinsurance products and

services to small and mid-size insurance companies in the United

States and Europe. As of March 31, 2017, Maiden had $6.6

billion in assets and shareholders' equity of $1.4 billion.

The Maiden Holdings, Ltd. logo is available at

http://www.globenewswire.com/newsroom/prs/?pkgid=5006

Forward Looking Statements

This release contains "forward-looking

statements" which are made pursuant to the safe harbor provisions

of the Private Securities Litigation Reform Act of 1995. The

forward-looking statements are based on the Company's current

expectations and beliefs concerning future developments and their

potential effects on the Company. There can be no assurance that

actual developments will be those anticipated by the Company.

Actual results may differ materially from those projected as a

result of significant risks and uncertainties, including

non-receipt of the expected payments, changes in interest rates,

effect of the performance of financial markets on investment income

and fair values of investments, developments of claims and the

effect on loss reserves, accuracy in projecting loss reserves, the

impact of competition and pricing environments, changes in the

demand for the Company's products, the effect of general economic

conditions and unusual frequency of storm activity, adverse state

and federal legislation, regulations and regulatory investigations

into industry practices, developments relating to existing

agreements, heightened competition, changes in pricing

environments, and changes in asset valuations. Additional

information about these risks and uncertainties, as well as others

that may cause actual results to differ materially from those

projected is contained in Item 1A. Risk Factors in the Company's

Annual Report on Form 10-K for the year ended December 31, 2016 as

updated in periodic filings with the SEC. The Company undertakes no

obligation to publicly update any forward-looking statements,

except as may be required by law.

| Maiden Holdings, Ltd. |

| Consolidated Balance Sheets |

| (in thousands (000's), except per share

data) |

| |

| |

|

|

|

|

| |

|

|

March 31, 2017(Unaudited) |

|

|

December 31, 2016(Audited) |

|

Assets |

|

|

|

|

|

|

| Fixed

maturities, available-for-sale, at fair value (Amortized cost 2017:

$3,993,941; 2016: $4,005,642) |

|

$ |

3,967,907 |

|

$ |

3,971,666 |

| Fixed

maturities, held-to-maturity, at amortized cost (Fair value 2017:

$767,657; 2016: $766,135) |

|

|

750,554 |

|

|

752,212 |

| Other

investments, at fair value (Cost 2017: $10,074; 2016: $10,057) |

|

|

13,534 |

|

|

13,060 |

| Total

investments |

|

|

4,731,995 |

|

|

4,736,938 |

| Cash and cash

equivalents |

|

|

83,537 |

|

|

45,747 |

| Restricted cash and

cash equivalents |

|

|

109,697 |

|

|

103,788 |

| Accrued investment

income |

|

|

36,179 |

|

|

36,517 |

| Reinsurance balances

receivable, net |

|

|

615,556 |

|

|

410,166 |

| Reinsurance recoverable

on unpaid losses |

|

|

108,777 |

|

|

99,936 |

| Loan to related

party |

|

|

167,975 |

|

|

167,975 |

| Deferred commission and

other acquisition expenses, net |

|

|

472,459 |

|

|

424,605 |

| Goodwill and intangible

assets, net |

|

|

77,183 |

|

|

77,715 |

| Other assets |

|

|

153,601 |

|

|

148,912 |

|

Total Assets |

|

$ |

6,556,959 |

|

$ |

6,252,299 |

| Liabilities

and Equity |

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

| Reserve for loss and

loss adjustment expenses |

|

$ |

2,991,604 |

|

$ |

2,896,496 |

| Unearned premiums |

|

|

1,670,884 |

|

|

1,475,506 |

| Accrued expenses and

other liabilities |

|

|

172,886 |

|

|

167,736 |

| Senior notes |

|

|

|

|

|

|

| Principal

amount |

|

|

362,500 |

|

|

362,500 |

| Less

unamortized debt issuance costs |

|

|

11,012 |

|

|

11,091 |

| Senior notes, net |

|

|

351,488 |

|

|

351,409 |

|

Total Liabilities |

|

|

5,186,862 |

|

|

4,891,147 |

|

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

| Preference Shares |

|

|

315,000 |

|

|

315,000 |

| Common shares |

|

|

876 |

|

|

873 |

| Additional paid-in

capital |

|

|

750,694 |

|

|

749,256 |

| Accumulated other

comprehensive income |

|

|

15,591 |

|

|

14,997 |

| Retained earnings |

|

|

293,164 |

|

|

285,662 |

| Treasury shares, at

cost |

|

|

(5,566) |

|

|

(4,991) |

| Total Maiden

Shareholders’ Equity |

|

|

1,369,759 |

|

|

1,360,797 |

| Noncontrolling

interest in subsidiaries |

|

|

338 |

|

|

355 |

|

Total Equity |

|

|

1,370,097 |

|

|

1,361,152 |

|

Total Liabilities and

Equity |

|

$ |

6,556,959 |

|

$ |

6,252,299 |

| |

|

|

|

|

|

|

| Book value per

common share(4) |

|

$ |

12.19 |

|

$ |

12.12 |

| |

|

|

|

|

|

|

| Common shares

outstanding |

|

|

86,553,324 |

|

|

86,271,109 |

| |

|

|

|

|

|

|

| Maiden Holdings, Ltd. |

| Consolidated Statements of Income |

| (in thousands (000's), except per share

data) |

| (Unaudited) |

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

For the Three Months EndedMarch

31, |

| |

2017 |

|

2016 |

|

Revenues: |

|

|

|

| Gross premiums

written |

$ |

923,427 |

|

$ |

864,114 |

| |

|

|

|

|

|

| Net premiums

written |

$ |

900,548 |

|

$ |

792,831 |

| Change in unearned

premiums |

|

(191,064) |

|

|

(176,822) |

|

Net premiums earned |

|

709,484 |

|

|

616,009 |

| Other insurance

revenue |

|

3,781 |

|

|

4,826 |

| Net investment

income |

|

42,157 |

|

|

36,302 |

| Net realized gains on

investment |

|

885 |

|

|

2,277 |

| Total

other-than-temporary impairment losses |

|

- |

|

|

- |

| Portion of loss

recognized in other comprehensive income (loss) |

|

- |

|

|

- |

| Net impairment losses

recognized in earnings |

|

- |

|

|

- |

|

Total revenues |

|

756,307 |

|

|

659,414 |

|

Expenses: |

|

|

|

|

|

| Net loss and loss

adjustment expenses ("loss and LAE") |

|

480,569 |

|

|

403,621 |

| Commission and other

acquisition expenses |

|

222,029 |

|

|

195,068 |

| General and

administrative expenses |

|

17,414 |

|

|

15,496 |

|

Total expenses |

|

720,012 |

|

|

614,185 |

| |

|

|

|

|

|

| Non-GAAP income

from operations(2) |

|

36,295 |

|

|

45,229 |

|

|

|

|

|

|

|

| Other

expenses |

|

|

|

|

|

| Interest and

amortization expenses |

|

(6,856) |

|

|

(7,265) |

| Amortization of

intangible assets |

|

(533) |

|

|

(615) |

| Foreign exchange

(losses) gains |

|

(1,921) |

|

|

267 |

|

Total other expenses |

|

(9,310) |

|

|

(7,613) |

| |

|

|

|

|

|

| Income before

income taxes |

|

26,985 |

|

|

37,616 |

| Less: income tax

expense |

|

484 |

|

|

787 |

| |

|

|

|

|

|

| Net

income |

|

26,501 |

|

|

36,829 |

| Add: loss attributable

to noncontrolling interest |

|

22 |

|

|

64 |

| Net income

attributable to Maiden |

|

26,523 |

|

|

36,893 |

| Dividends on preference

shares(6) |

|

(6,033) |

|

|

(9,677) |

| Net income

attributable to Maiden common shareholders |

$ |

20,490 |

|

$ |

27,216 |

| |

|

|

|

|

|

| Basic earnings

per common share attributable to Maiden shareholders |

$ |

0.24 |

|

$ |

0.37 |

| Diluted

earnings per common share

attributable to Maiden shareholders |

$ |

0.23 |

|

$ |

0.35 |

| Dividends

declared per common share |

$ |

0.15 |

|

$ |

0.14 |

| Annualized

return on average common equity |

|

7.9% |

|

|

11.9% |

|

|

|

|

|

|

|

| Weighted

average number of common shares - basic |

|

86,350,850 |

|

|

73,871,277 |

| Adjusted

weighted average number of common shares and assumed conversions -

diluted |

|

87,436,604 |

|

|

85,799,377 |

| |

|

|

|

|

|

| Maiden Holdings, Ltd. |

| Supplemental Financial Data - Segment

Information |

| (in thousands (000's)) |

| (Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended March 31, 2017 |

|

DiversifiedReinsurance |

|

|

AmTrustReinsurance |

|

|

Other |

|

|

Total |

| Gross

premiums written |

|

$ |

332,045 |

|

|

$ |

591,382 |

|

|

$ |

- |

|

|

$ |

923,427 |

| Net premiums

written |

|

$ |

327,496 |

|

|

$ |

573,052 |

|

|

$ |

- |

|

|

$ |

900,548 |

| Net premiums

earned |

|

$ |

201,842 |

|

|

$ |

507,642 |

|

|

$ |

- |

|

|

$ |

709,484 |

| Other insurance

revenue |

|

|

3,781 |

|

|

|

- |

|

|

|

- |

|

|

|

3,781 |

| Net loss and LAE |

|

|

(138,649) |

|

|

|

(341,631) |

|

|

|

(289) |

|

|

|

(480,569) |

| Commissions and other

acquisition expenses |

|

|

(57,945) |

|

|

|

(164,084) |

|

|

|

- |

|

|

|

(222,029) |

| General and

administrative expenses |

|

|

(8,730) |

|

|

|

(805) |

|

|

|

- |

|

|

|

(9,535) |

| Underwriting

income (loss) |

|

$ |

299 |

|

|

$ |

1,122 |

|

|

$ |

(289) |

|

|

$ |

1,132 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation

to net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment income

and realized gains on investment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

43,042 |

| Interest and

amortization expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(6,856) |

| Amortization of

intangible assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(533) |

| Foreign exchange

losses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1,921) |

| Other general and

administrative expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(7,879) |

| Income tax expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(484) |

| Net

income |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

26,501 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss and

LAE(8) |

|

|

67.5% |

|

|

|

67.3% |

|

|

|

|

|

|

|

67.4% |

| Commission and other

acquisition expense ratio(9) |

|

|

28.2% |

|

|

|

32.3% |

|

|

|

|

|

|

|

31.1% |

| General and

administrative expense ratio(10) |

|

|

4.2% |

|

|

|

0.2% |

|

|

|

|

|

|

|

2.4% |

| Expense ratio(11) |

|

|

32.4% |

|

|

|

32.5% |

|

|

|

|

|

|

|

33.5% |

| Combined

ratio(12) |

|

|

99.9% |

|

|

|

99.8% |

|

|

|

|

|

|

|

100.9% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended March 31, 2016 |

|

DiversifiedReinsurance |

|

|

AmTrustReinsurance |

|

|

Other |

|

|

Total |

| Gross

premiums written |

|

$ |

315,804 |

|

|

$ |

548,310 |

|

|

$ |

- |

|

|

$ |

864,114 |

| Net premiums

written |

|

$ |

286,136 |

|

|

$ |

506,695 |

|

|

$ |

- |

|

|

$ |

792,831 |

| Net premiums

earned |

|

$ |

172,256 |

|

|

$ |

443,753 |

|

|

$ |

- |

|

|

$ |

616,009 |

| Other insurance

revenue |

|

|

4,826 |

|

|

|

- |

|

|

|

- |

|

|

|

4,826 |

| Net loss and LAE |

|

|

(119,076) |

|

|

|

(281,774) |

|

|

|

(2,771) |

|

|

|

(403,621) |

| Commissions and other

acquisition expenses |

|

|

(54,531) |

|

|

|

(140,538) |

|

|

|

1 |

|

|

|

(195,068) |

| General and

administrative expenses |

|

|

(8,600) |

|

|

|

(586) |

|

|

|

- |

|

|

|

(9,186) |

| Underwriting

(loss) income |

|

$ |

(5,125) |

|

|

$ |

20,855 |

|

|

$ |

(2,770) |

|

|

$ |

12,960 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation

to net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment income

and realized gains on investment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

38,579 |

| Interest and

amortization expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(7,265) |

| Amortization of

intangible assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(615) |

| Foreign exchange

gains |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

267 |

| Other general and

administrative expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(6,310) |

| Income tax expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(787) |

| Net

income |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

36,829 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss and

LAE(8) |

|

|

67.2% |

|

|

|

63.5% |

|

|

|

|

|

|

|

65.0% |

| Commission and other

acquisition expense ratio(9) |

|

|

30.8% |

|

|

|

31.7% |

|

|

|

|

|

|

|

31.4% |

| General and

administrative expense ratio(10) |

|

|

4.9% |

|

|

|

0.1% |

|

|

|

|

|

|

|

2.5% |

| Expense ratio(11) |

|

|

35.7% |

|

|

|

31.8% |

|

|

|

|

|

|

|

33.9% |

| Combined

ratio(12) |

|

|

102.9% |

|

|

|

95.3% |

|

|

|

|

|

|

|

98.9% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Maiden Holdings, Ltd. |

| Non - GAAP Financial Measure |

| (in thousands (000's), except per share

data) |

| (Unaudited) |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

For the Three Months EndedMarch

31, |

|

| |

2017 |

|

2016 |

|

|

|

|

|

|

|

|

Non-GAAP operating earnings attributable to Maiden common

shareholders(1) |

$ |

22,638 |

|

$ |

28,347 |

|

|

Non-GAAP basic operating earnings per common share

attributable to Maiden shareholders |

$ |

0.26 |

|

$ |

0.38 |

|

|

Non-GAAP diluted operating earnings per common share

attributable to Maiden shareholders |

$ |

0.26 |

|

$ |

0.37 |

|

|

Annualized non-GAAP operating return on average common

equity(7) |

|

8.7% |

|

|

12.3% |

|

| |

|

|

|

|

|

|

|

Reconciliation of net income attributable to Maiden common

shareholders to non-GAAP operating earnings attributable to Maiden

common shareholders: |

|

|

|

|

|

|

| Net income attributable

to Maiden common shareholders |

$ |

20,490 |

|

$ |

27,216 |

|

| Add (subtract) |

|

|

|

|

|

|

| Net

realized gains on investment |

|

(885) |

|

|

(2,277) |

|

| Foreign

exchange losses (gains) |

|

1,921 |

|

|

(267) |

|

|

Amortization of intangible assets |

|

533 |

|

|

615 |

|

| Divested

excess and surplus "E&S" business and NGHC run-off |

|

289 |

|

|

2,770 |

|

| Non-cash

deferred tax expense |

|

290 |

|

|

290 |

|

| Non-GAAP

operating earnings attributable to Maiden common

shareholders(1) |

$ |

22,638 |

|

$ |

28,347 |

|

| |

|

|

|

|

|

|

|

Reconciliation of diluted earnings per common share

attributable to Maiden shareholders to non-GAAP diluted operating

earnings per common share attributable to Maiden

shareholders: |

|

|

|

|

|

|

| Diluted earnings per

common share attributable to Maiden shareholders |

$ |

0.23 |

|

$ |

0.35 |

|

| Add (subtract) |

|

|

|

|

|

|

| Net

realized gains on investment |

|

(0.01) |

|

|

(0.03) |

|

| Foreign

exchange losses |

|

0.02 |

|

|

- |

|

|

Amortization of intangible assets |

|

0.01 |

|

|

0.01 |

|

| Divested

excess and surplus "E&S" business and NGHC run-off |

|

- |

|

|

0.03 |

|

| Non-cash

deferred tax expense |

|

0.01 |

|

|

0.01 |

|

|

Non-GAAP diluted operating earnings per common share

attributable to Maiden shareholders |

$ |

0.26 |

|

$ |

0.37 |

|

| |

|

|

|

|

|

|

|

Reconciliation of net income attributable to Maiden to

non-GAAP income from operations: |

|

|

|

|

|

|

| Net income attributable

to Maiden |

$ |

26,523 |

|

$ |

36,893 |

|

| Add (subtract) |

|

|

|

|

|

|

| Foreign

exchange losses (gains) |

|

1,921 |

|

|

(267) |

|

|

Amortization of intangible assets |

|

533 |

|

|

615 |

|

| Interest

and amortization expenses |

|

6,856 |

|

|

7,265 |

|

| Income

tax expense |

|

484 |

|

|

787 |

|

| Loss

attributable to noncontrolling interest |

|

(22) |

|

|

(64) |

|

| Non-GAAP income

from operations(2) |

$ |

36,295 |

|

$ |

45,229 |

|

| |

|

|

|

|

|

|

| Maiden Holdings, Ltd. |

| Non - GAAP Financial Measure |

| (in thousands (000's), except per share

data) |

| (Unaudited) |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

March 31, 2017 |

|

December 31, 2016 |

|

Investable assets: |

|

|

|

|

|

| Total

investments |

$ |

4,731,995 |

|

$ |

4,736,938 |

| Cash and

cash equivalents |

|

83,537 |

|

|

45,747 |

| Restricted

cash and cash equivalents |

|

109,697 |

|

|

103,788 |

| Loan to

related party |

|

167,975 |

|

|

167,975 |

| Total

investable assets(3) |

$ |

5,093,204 |

|

$ |

5,054,448 |

| |

|

|

|

|

|

|

| |

|

March 31, 2017 |

|

December 31, 2016 |

|

Capital: |

|

|

|

|

|

| Preference

shares |

$ |

315,000 |

|

$ |

315,000 |

| Common

shareholders' equity |

|

1,054,759 |

|

|

1,045,797 |

|

Total Maiden shareholders' equity |

|

1,369,759 |

|

|

1,360,797 |

| 2016 Senior

Notes |

|

110,000 |

|

|

110,000 |

| 2013 Senior

Notes |

|

152,500 |

|

|

152,500 |

| 2012 Senior

Notes |

|

100,000 |

|

|

100,000 |

|

Total capital resources(5) |

$ |

1,732,259 |

|

$ |

1,723,297 |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| (1) Non-GAAP operating earnings is a non-GAAP financial

measure defined by the Company as net income attributable to Maiden

common shareholders excluding realized and unrealized investment

gains and losses, foreign exchange and other gains and losses,

amortization of intangible assets, divested excess and surplus

business and NGHC run-off and non-cash deferred tax expense and

should not be considered as an alternative to net income. The

Company's management believes that non-GAAP operating earnings is a

useful indicator of trends in the Company's underlying operations.

The Company's measure of non-GAAP operating earnings may not be

comparable to similarly titled measures used by other

companies. |

|

|

|

|

|

|

|

|

| (2) Non-GAAP income from operations is a non-GAAP

financial measure defined by the Company as net income attributable

to Maiden excluding foreign exchange and other gains and losses,

amortization of intangible assets, interest and amortization

expenses, income tax expense and income or loss attributable to

noncontrolling interest and should not be considered as an

alternative to net income. The Company’s management believes

that non-GAAP income from operations is a useful measure of the

Company’s underlying earnings fundamentals based on its

underwriting and investment income before financing costs. This

income from operations enables readers of this information to more

clearly understand the essential operating results of the Company.

The Company’s measure of non-GAAP income from operations may not be

comparable to similarly titled measures used by other

companies. |

| |

|

|

|

|

|

|

| (3) Investable assets is the total of the Company's

investments, cash and cash equivalents and loan to a related

party. |

| |

|

|

|

|

|

|

| (4) Book value per common share is calculated using

Maiden common shareholders’ equity (shareholders' equity excluding

the aggregate liquidation value of our preference shares) divided

by the number of common shares outstanding. |

| |

|

|

|

|

|

|

| (5) Total capital resources is the sum of the Company's

principal amount of debt and Maiden shareholders' equity. |

| |

|

|

|

|

|

|

| (6) Dividends on preference shares consist of $3,094

paid to Preference shares - Series A for the three months ended

March 31, 2017 and 2016 and $2,939 and $3,593 paid to Preference

shares - Series C for the three months ended March 31, 2017 and

2016, respectively. It also includes $2,990 paid to Preference

Shares - Series B during the three months ended March 31, 2016. On

September 15, 2016, each of then outstanding Preference share

- Series B were automatically converted into 12,069,090 of the

Company's common shares at a conversion rate of 3.6573 per

preference share. |

| |

|

|

|

|

|

|

| (7) Non-GAAP operating return on average common equity

is a non-GAAP financial measure. Management uses non-GAAP operating

return on average common shareholders' equity as a measure of

profitability that focuses on the return to Maiden common

shareholders. It is calculated using non-GAAP operating earnings

attributable to Maiden common shareholders divided by average

Maiden common shareholders' equity. |

| |

|

|

|

|

|

|

| (8) Calculated by dividing net loss and LAE by the sum

of net premiums earned and other insurance revenue. |

|

|

|

|

|

|

|

|

| (9) Calculated by dividing commission and other

acquisition expenses by the sum of net premiums earned and other

insurance revenue. |

|

|

|

|

|

|

|

|

| (10) Calculated by dividing general and administrative

expenses by the sum of net premiums earned and other insurance

revenue. |

|

|

|

|

|

|

|

|

| (11) Calculated by adding together the commission and

other acquisition expense ratio and general and administrative

expense ratio. |

|

|

|

|

|

|

|

|

| (12) Calculated by adding together the net loss and LAE

ratio and the expense ratio. |

CONTACT:

Noah Fields, Senior Vice President, Investor Relations

Maiden Holdings, Ltd.

Phone: 441.298.4927

E-mail: nfields@maiden.bm

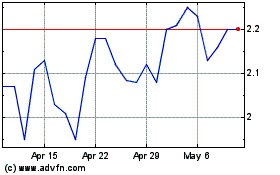

Maiden (NASDAQ:MHLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

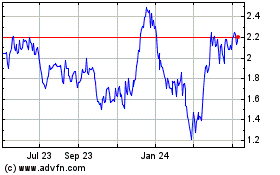

Maiden (NASDAQ:MHLD)

Historical Stock Chart

From Apr 2023 to Apr 2024