All amounts are in US Dollars

Highlights

Company reported on May 1 that ZoptEC Phase 3 clinical study

of ZoptrexTM (zoptarelin doxorubicin) did not achieve

its primary endpoint; further development of product to be

discontinued

Company announced on March 30 that, following its meeting

with the FDA it intends to file a new drug application seeking

approval of MacrilenTM (macimorelin) for the

evaluation of growth hormone deficiency in adults

Adequate liquidity and resources to fund operations through

expected Macrilen™ approval

- $17.8 million of unrestricted cash and

cash equivalents at quarter-end; no third-party debt

- Approximately $4.3 million of gross

proceeds raised from sales of Common Shares pursuant to ATM

programs during and subsequent to the first quarter

- Approximately 14.3 million Common

Shares outstanding as of May 8

Aeterna Zentaris Inc. (NASDAQ: AEZS) (TSX: AEZS) (the

“Company”), a specialty biopharmaceutical company engaged in

developing and commercializing novel pharmaceutical therapies,

today reported financial and operating results for the first

quarter ended March 31, 2017.

Commenting on recent key developments, David A. Dodd, President

and Chief Executive Officer of the Company, stated, “On May 1, we

reported that the ZoptEC (zoptarelin doxorubicin in endometrial

cancer) Phase 3 study of Zoptrex™ in women with locally advanced,

recurrent or metastatic endometrial cancer did not achieve its

primary endpoint of demonstrating a statistically significant

increase in the median period of overall survival of patients

treated with Zoptrex™ as compared to patients treated with

doxorubicin. Therefore, the results of the study do not support

regulatory approval of Zoptrex™. Based on this outcome, we do not

anticipate conducting clinical trials of Zoptrex™ with respect to

any other indications.” Regarding the Company’s plans, Mr. Dodd

continued, “Our focus has now shifted entirely to filing our new

drug application (“NDA”) for Macrilen™ and, if the product is

approved, to its commercial launch as soon as possible. We will

also optimize our resources to be consistent with our focus on

Macrilen™-related efforts. Consequently, we now expect that our

monthly average use of cash in operations during the remainder of

2017 will be between $1.7 million and $1.9 million, a decrease of

approximately 22%, compared to the first quarter. We continue to

believe in the potential that Macrilen™ provides for us to become a

successful specialty pharmaceutical company. Our intention is to

submit the Macrilen™ NDA in the third quarter of 2017 and, if the

product receives approval from the U.S. Food and Drug

Administration (the “FDA”), to commercially launching the product

in the first quarter of 2018.”

First Quarter Financial Highlights

Revenues

Revenues were $261,000 for the three months ended March 31,

2017, as compared to $242,000 for the same period in 2016. The

increase is mainly explained by the amortization of the up-front

payment received in connection with one of the out-licensing

agreements that we entered into in 2016 for ZoptrexTM with respect

to a territory outside our core areas of interest.

Research and Development (“R&D”) costs

R&D costs were $2.5 million for the three months ended March

31, 2017, compared to $3.7 million for the same period in 2016. The

decrease in our R&D costs for the three months ended March 31,

2017, as compared to the same period in 2016, is mainly

attributable to lower third-party costs attributable to Zoptrex™,

which is mainly due to the fact that we completed the clinical

portion of the ZoptEC clinical trial during the first quarter of

2017. Third-party costs attributable to Macrilen™ remained stable

during the three months ended March 31, 2017, as compared to the

same period in 2016.

General and Administrative (“G&A”) Expenses

G&A expenses were $1.9 million for both three-month periods

ended March 31, 2017 and 2016. The G&A expenses remained stable

and were in line with our expectations for the first quarter.

Selling Expenses

Selling expenses were $1.5 million for the three months ended

March 31, 2017, as compared to $1.7 million for the same period in

2016. Selling expenses for the three months ended March 31, 2017

and 2016 represent mainly the costs of our sales force related to

the co-promotion activities as well as our sales management team.

The decrease in selling expenses is explained by the reduction in

the number of sales representatives from 20 to 13 in February

2017.

Net Finance Income

Net finance income was $1.5 million for the three months ended

March 31, 2017, as compared to $3.3 million, for the same period in

2016. The decrease in finance income is mainly attributable to the

change in fair value recorded in connection with our warrant

liability. Such change in fair value results from the periodic

"mark-to-market" revaluation, via the application of option pricing

models, of outstanding share purchase warrants. The closing price

of our common shares, which, on the NASDAQ, fluctuated from $2.45

to $3.65 during the three-month period ended March 31, 2017,

compared to $2.67 to $4.40 during the same period in 2016, also had

a direct impact on the change in fair value of warrant

liability.

Net Loss

Net loss for the three months ended March 31, 2017 was $(4.1)

million, or $(0.31) per basic and diluted share, as compared to a

net loss of $(3.7) million, or $(0.37) per basic and diluted share,

for the same period in 2016. The increase in net loss for the three

months ended March 31, 2017, as compared to the same period in

2016, is largely attributable to lower operating expenses offset by

lower net finance income, as described above. The basic and diluted

loss per share decreased because the number of shares outstanding

increased following an offering completed in November 2016 as well

as issuances under our various ATM programs.

Liquidity

Cash and cash equivalents were $17.8 million as at March 31,

2017, as compared to $22.0 million as at December 31, 2016. The

decrease in cash and cash equivalents as at March 31, 2017, as

compared to December 31, 2016, is due to the net cash used in

operating activities and variations in components of our working

capital. The decrease was partially offset by the net proceeds

generated by the issuance of common shares under our various ATM

programs.

Conference Call & Webcast

The Company will host a conference call and live webcast to

discuss these results on Tuesday, May 9, 2017, at 8:30 a.m.,

Eastern Time. Participants may access the live webcast via the

Company's website at www.aezsinc.com

or by telephone using the following dial-in number: 201-689-8029

and Confirmation number 13658332. A replay of the webcast will also

be available on the Company’s website for a period of 30 days.

For reference, the Management’s Discussion and Analysis of

Financial Condition and Results of Operations for the first quarter

ended March 31, 2017, as well as the Company’s interim condensed

consolidated financial statements as at March 31, 2017, can be

found at www.aezsinc.com in the

“Investors” section.

About Aeterna Zentaris Inc.

Aeterna Zentaris is a specialty biopharmaceutical company

engaged in developing and commercializing novel pharmaceutical

therapies. We are engaged in drug development activities and in the

promotion of products for others. We recently completed Phase 3

studies of two internally developed compounds. The focus of our

business development efforts is the acquisition of licenses to

products that are relevant to our therapeutic areas of focus. We

also intend to license out certain commercial rights of internally

developed products to licensees in non-U.S. territories where such

out-licensing would enable us to ensure development, registration

and launch of our product candidates. Our goal is to become a

growth-oriented specialty biopharmaceutical company by pursuing

successful development and commercialization of our product

portfolio, achieving successful commercial presence and growth,

while consistently delivering value to our shareholders, employees

and the medical providers and patients who will benefit from our

products. For more information, visit www.aezsinc.com.

Forward-Looking Statements

This press release contains forward-looking statements made

pursuant to the safe-harbor provision of the U.S. Securities

Litigation Reform Act of 1995, which reflect our current

expectations regarding future events. Forward-looking statements

may include, but are not limited to statements preceded by,

followed by, or that include the words “expects,” “believes,”

“intends,” “anticipates,” and similar terms that relate to future

events, performance, or our results. Forward-looking statements

involve known risks and uncertainties, many of which are discussed

under the caption “Key Information - Risk Factors” in our most

recent Annual Report on Form 20-F filed with the relevant Canadian

securities regulatory authorities in lieu of an annual information

form and with the U.S. Securities and Exchange Commission (“SEC”).

Such statements include, but are not limited to, statements about

the timing of, and prospects for, regulatory approval and

commercialization of our product candidates, statements about the

status of our efforts to establish a commercial operation and to

obtain the right to promote or sell products that we did not

develop and estimates regarding our capital requirements and our

needs for, and our ability to obtain, additional financing. Known

and unknown risks and uncertainties could cause our actual results

to differ materially from those in forward-looking statements. Such

risks and uncertainties include, among others, our now heavy

dependence on the success of Macrilen™ and the continued

availability of funds and resources to successfully complete the

submission of an NDA without undue delay with respect to Macrilen™

and, in the event the FDA approves Macrilen™, to successfully

launch the product, the rejection or non-acceptance of any new drug

application by one or more regulatory authorities and, more

generally, uncertainties related to the regulatory process, the

ability of the Company to efficiently commercialize one or more of

its products or product candidates (including, in particular,

Macrilen™), the degree of market acceptance once our products are

approved for commercialization (including, in particular,

Macrilen™), our ability to take advantage of business opportunities

in the pharmaceutical industry, our ability to protect our

intellectual property, the potential of liability arising from

shareholder lawsuits and general changes in economic conditions.

Investors should consult the Company’s quarterly and annual filings

with the Canadian and U.S. securities commissions for additional

information on risks and uncertainties. Given these uncertainties

and risk factors, readers are cautioned not to place undue reliance

on these forward-looking statements. We disclaim any obligation to

update any such factors or to publicly announce any revisions to

any of the forward-looking statements contained herein to reflect

future results, events or developments, unless required to do so by

a governmental authority or applicable law.

Consolidated Statements of Comprehensive Loss

Information

(in thousands, except share and per share

data)

(unaudited)

Three months ended March 31, 2017

2016 $ $ Revenues Sales

commission and other

153 181 License fees

108

61

261 242

Operating expenses

Research and development costs

2,455 3,657 General and

administrative expenses

1,881 1,894 Selling expenses

1,542 1,682

5,878

7,233

Loss from operations (5,617 )

(6,991 ) Gain due to changes in foreign currency exchange

rates

65 468 Change in fair value of warrant liability

1,403 2,805 Other finance income

18 42

Net finance income 1,486 3,315

Net

loss (4,131 ) (3,676 )

Other comprehensive

(loss) income: Items that may be reclassified subsequently to

profit or loss: Foreign currency translation adjustments

(133 ) (469 ) Items that will not be reclassified to

profit or loss: Actuarial gain (loss) on defined benefit plans

441 (1,426 )

Comprehensive loss (3,823

) (5,571 )

Net loss per share (basic and diluted)

(0.31 ) (0.37 )

Weighted average number of shares

outstanding: Basic and Diluted

13,175,866

9,928,697

Consolidated Statement of

Financial Position Information

(in thousands)

As at March 31, As at December 31, (unaudited)

2017 2016 $ $ Cash and cash equivalents 1

17,777 21,999 Trade and other receivables and other current

assets

1,185 744 Restricted cash equivalents

500 496

Property, plant and equipment

184 204 Other non-current

assets

8,435 8,216

Total assets 28,081

31,659 Payables and other current liabilities

2,954 3,778 Current portion of deferred revenues

432

426 Warrant liability

5,451 6,854 Non-financial non-current

liabilities 2

13,892 14,389

Total liabilities

22,729 25,447 Shareholders' equity

5,352 6,212

Total liabilities and shareholders'

equity 28,081 31,659

_______________

1.

Approximately $0.9 million and $1.5

million were denominated in EUR as at March 31, 2017 and December

31, 2016, respectively, and approximately $2.5 million and $3.7

million were denominated in Canadian dollars as at March 31, 2017

and December 31, 2016, respectively.

2.

Comprised mainly of employee future

benefits, provisions for onerous contracts and non-current portion

of deferred revenues.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170508006226/en/

Aeterna Zentaris Inc.Philip A. Theodore, 843-900-3211Senior Vice

PresidentIR@aezsinc.com

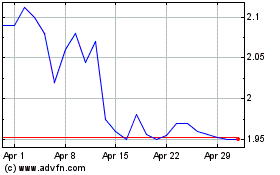

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Mar 2024 to Apr 2024

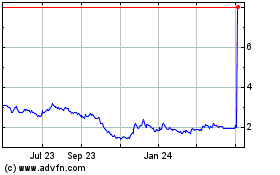

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Apr 2023 to Apr 2024