Current Report Filing (8-k)

May 08 2017 - 2:45PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of the

Securities

Exchange Act of 1934

Date of Report

(Date of earliest event reported): May 3, 2017

SIEBERT FINANCIAL

CORP.

(Exact name of

registrant as specified in its charter)

|

New

York

|

0-5703

|

11-1796714

|

(State

or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS

Employer Identification Number)

|

|

|

|

|

|

120

Wall Street, New York, New York

|

10005

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code:

(212) 644-2400

(Former name

or former address, if changed since last report.)

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

o

Written

communications pursuant to Rule 425 under the Securities Act

o

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act

o

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act

o

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act

Item 8.01 Other Events.

On May 8, 2017,

Siebert Financial Corp. (the “Company), issued a press release announcing that the Company and its wholly owned subsidiary

Muriel Siebert & Co., Inc. (“MSCO”) had entered into a non-binding letter of intent dated May 3, 2017 (the “LOI”)

with StockCross Financial Services, Inc., a registered broker-dealer (“StockCross”) which contemplates the Company

and MSCO acquiring (the “Acquisition”) certain retail broker-dealer assets of StockCross (the “Assets”).

StockCross is a self-clearing discount broker dealer that has many business lines that are similar to MSCO’s. A copy of

the press release is attached hereto as Exhibit 99.1.

The value of

the Assets is currently estimated to be approximately $20 million. The Company has engaged Manorhaven Capital, LLC (“Manorhaven”),

a registered broker-dealer, to provide a fairness opinion regarding the value of the Assets. Manorhaven is under common control

with the Company’s counsel Gusrae Kaplan Nusbaum PLLC who represents all the parties to the LOI. The Company intends to

issue StockCross shares of its restricted common stock as consideration for the Assets. The number of shares of common stock issuable

to StockCross will be determined based upon the average closing price of the common stock during the 15 day period prior to the

date of the LOI. The shares of common stock issued to StockCross as consideration for the Assets will be restricted for a period

of 2 years following the date of issuance.

The Acquisition

will be subject to the terms and conditions of a definitive asset purchase agreement by and among the Company, MSCO and StockCross

to be negotiated by the parties (the “Definitive Agreement”). The Company currently anticipates that the Definitive

Agreement will be executed, and that the closing of the Acquisition will be completed, in 2017. The Company’s expectations

are subject to change, however, based on the parties’ ongoing discussions, changing business conditions and other future

events and uncertainties. Consummation of the Acquisition will be subject to certain customary conditions to closing, including

any required regulatory approvals.

Gloria E. Gebbia,

a member of the Company’s board of directors and the managing member of the Company’s majority shareholder along with

other members of the Gebbia family, control StockCross.

Forward-Looking

Statements.

This Current

Report on Form 8-K contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements typically are identified by use of terms such as “may,” “project,”

“should,” “plan,” “expect,” “anticipate,” “believe,” “estimate”

and similar words. Except as required by law, the Company undertakes no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise. The Company’s actual results could differ

materially from those contained in forward-looking statements due to a number of factors, including the statements under “Risk

Factors” found in the Company’s Annual Reports on Form 10-K’s and its Quarterly Reports on Form 10-Q’s

on file with the SEC.

Item 9.01 Financial Statements

and Exhibits

.

(d) Exhibits

The following exhibit is attached

to this Form 8-K:

Exhibit No. Description

99.1

Press

release dated May 8, 2017

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

Dated: May 8, 2017

|

|

By:

|

/s/ Andrew H. Reich

|

|

|

|

|

Andrew H. Reich

|

|

|

|

|

Executive Vice President, Chief Operating Officer,

Chief Financial

Officer and Secretary

|

|

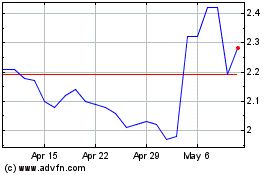

Siebert Financial (NASDAQ:SIEB)

Historical Stock Chart

From Mar 2024 to Apr 2024

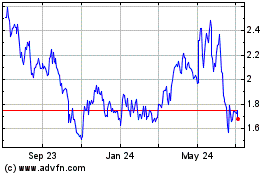

Siebert Financial (NASDAQ:SIEB)

Historical Stock Chart

From Apr 2023 to Apr 2024