By Nicole Friedman

OMAHA, Neb. -- Warren Buffett is quietly installing a new set of

leaders throughout Berkshire Hathaway Inc.

Seven Berkshire subsidiaries that collectively employ more than

46,000 people announced changes in chief executive officers in the

last year, an unusually high amount of turnover at a company that

rarely has top executives leave.

They range from reinsurer General Re Corp. and

specialty-chemicals company Lubrizol Corp. to MiTek Industries

Inc., which supplies equipment and software to the construction

industry. Some of the leadership changes weren't widely

reported.

The moves will test the strength of Berkshire's decentralized

structure. Berkshire's roughly 60 subsidiaries operate

independently, with the CEOs of most Berkshire businesses reporting

directly to Mr. Buffett.

"The performance of these units in transition will each be a

test of succession planning," said Lawrence Cunningham, a law

professor at George Washington University who has written about

Berkshire.

At Berkshire's annual meeting Saturday, Mr. Buffett offered no

new clues about who would eventually succeed him as CEO, though he

did suggest that person could take over while Mr. Buffett is still

alive. The 86-year-old, who has headed Berkshire for 52 years, has

said that Berkshire's board has agreed on a succession plan but

hasn't released the name of his successor.

Mr. Buffett went out of his way Saturday to praise Berkshire's

managers, as he usually does. "We have never had more good managers

than we have now," Mr. Buffett said. But, he quipped, "that's

because we've got more good companies."

Berkshire typically leaves the management team in place when it

buys a business, and Berkshire CEOs rarely leave their jobs to take

other positions. Some have served for decades.

Most Berkshire CEOs report directly to Mr. Buffett, but some

report to one of his investing lieutenants, Ted Weschler or Todd

Combs, or to Tracy Britt Cool, Mr. Buffett's former financial

assistant and current chief executive of the Pampered Chef, a

Berkshire subsidiary.

When Tad Montross announced his retirement from Gen Re last year

Gen Re said his successor would report to Ajit Jain, who runs

Berkshire Hathaway Reinsurance Group, and not to Mr. Buffett as Mr.

Montross had. One month later it announced the new CEO would be

Kara Raiguel.

Berkshire's board routinely discusses succession at the top but

also at the subsidiary level, with a focus on how to maintain

Berkshire's culture, said board member Ron Olson, a partner at

Munger, Tolles & Olson LLP, at a conference Thursday in

Omaha.

Most new managers are hired from within the subsidiaries, he

said, a model that has been successful.

One such example is Eric Schnur, who started reporting to Mr.

Buffett as chief executive of Lubrizol in January, replacing the

retiring James Hambrick. He has worked at the company since he was

a student.

"I know the product lines, the customers. I know a lot of the

challenges, " he said in an interview. "It's clear to me what we

need to do" to expand the business.

Many Berkshire managers spent part of last week networking with

each other in Omaha, sharing experiences and ideas on shared

challenges.

Other recent Berkshire subsidiary CEO turnovers include Cathy

Baron Tamraz, who retired as CEO of press-release distributor

Business Wire Inc., and was succeeded by Geff Scott. At MiTek, Mark

Thom took over as CEO while former CEO Tom Manenti became executive

chairman and continues to report to Mr. Buffett.

In December, Melissa Burgess-Taylor took the helm at Fruit of

the Loom Inc. after Rick Medlin died at age 68. In April,

Texas-based Star Furniture said Chief Executive Bill Kimbrell had

resigned and a successor wasn't announced. A spokesman didn't

provide an immediate comment.

Starting in June, RC Willey Home Furnishings Chief Executive

Scott Hymas is planning to take a three-year religious leave,

during which the company's president will be in charge of the Utah

furniture chain while Mr. Hymas will take more of a board role, he

said.

Berkshire declined to say whether that was a complete list of

CEO transitions since 2016's annual meeting.

Mr. Buffett sends CEOs a letter every two years reminding them

of the company's values and asking them to recommend in writing who

their successors should be, he said in his 2010 shareholder

letter.

Mr. Buffett also occasionally replaces top executives. In 2012,

he wrote a letter to ousted Benjamin Moore & Co. CEO Denis

Abrams explaining his decision to fire him based on "a differing

view about distribution channels and brand strategy."

At the 2016 annual meeting, Mr. Buffett said there is no "grand

design" behind succession planning at the subsidiary level, and

there are no rules about how many executives can report to Mr.

Buffett.

"At Berkshire, every decision that comes up, we just try to

figure out the most logical thing to do at that time," he said.

Write to Nicole Friedman at nicole.friedman@wsj.com

(END) Dow Jones Newswires

May 08, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

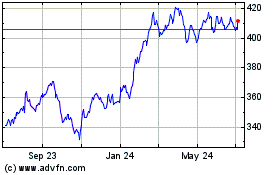

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

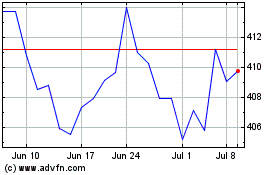

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Apr 2023 to Apr 2024