Current Report Filing (8-k)

May 05 2017 - 4:18PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 5, 2017

Glaukos Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-37463

|

|

33-0945406

|

|

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(I.R.S. Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

229 Avenida Fabricante

San Clemente, California

|

|

92672

|

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (949) 367-9600

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company

☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☒

Item 5.02.

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers.

(c) Effective May 5, 2017, Richard L. Harrison retired as Glaukos Corporation’s (the “Company’s”) Chief Financial Officer, and Joseph E. Gilliam became the Company’s Chief Financial Officer and Senior Vice President, Corporate Development. Mr. Harrison’s planned retirement had been announced by the Company in a Current Report on Form 8-K filed with the Securities and Exchange Commission (the “Commission”) on July 14, 2016. Mr. Gilliam’s expected appointment to this role was previously announced by the Company in a Current Report on Form 8-K filed with the Commission on February 6, 2017.

Mr. Gilliam previously entered into an Offer Letter with the Company, a summary of the terms of which was included in, and a copy of which was attached as Exhibit 99.2 to the Current Report on Form 8-K filed with the Commission on February 6, 2017. In connection with his appointment, Mr. Gilliam entered into an Executive Severance and Change in Control Agreement with the Company, dated May 5, 2017 (the “Severance Agreement”), a copy of which is attached to this Current Report as Exhibit 10.1. Pursuant to the terms of the Severance Agreement, if Mr. Gilliam is terminated as a result of (i) an involuntary termination without “cause” or (ii) a resignation for “good reason” (each as defined in the Severance Agreement), then he will receive an amount equal to nine months of his base salary amount in effect at the time of such termination, paid in a lump sum on the 60th day following the date of such termination. Mr. Gilliam (and his spouse and dependents) will also receive medical and dental benefits provided by the Company at least equal to the levels of benefits provided to our similarly situated active employees until the earlier of (i) the nine‑month anniversary of the date of such termination or (ii) the date that he becomes covered under a subsequent employer’s medical and dental benefits plans. Mr. Gilliam will also vest in all equity and equity‑based awards that would otherwise have vested during the 12 months following the date of such termination.

If Mr. Gilliam is terminated as a result of (i) an involuntary termination without cause or (ii) a resignation for good reason, in either case within three months prior or 12 months following a “change in control” (as defined in the Severance Agreement), then he will receive an amount equal to the sum of (i) 12 months of his base salary amount in effect at the time of such termination, and (ii) 1.0 times his target annual bonus for the year in which the change in control occurs, paid in a lump sum on the 60th day following the date of such termination. Mr. Gilliam (and his spouse and dependents) will also receive medical and dental benefits provided by the Company at least equal to the levels of benefits provided to our similarly situated active employees until the earlier of (i) the 12‑month anniversary of the date of such termination or (ii) the date that he becomes covered under a subsequent employer’s medical and dental benefits plans. Mr. Gilliam will also vest in all equity and equity‑based awards outstanding on the date of termination.

In the event that Mr. Gilliam would be subject to the excise tax imposed by Section 4999 of the Internal Revenue Code of 1986, as amended (the “Code”) and the net after‑tax benefit that he would receive by reducing such payments to the threshold level as determined by Section 280G of the Code is greater than the net after‑tax benefit he would receive if the full amount of such payments were made, then such payments will be reduced so that such payments do not exceed the threshold level as determined by Section 280G of the Code.

All of the above benefits are subject to the executive’s execution of a general release of claims in the Company’s favor, and this description of the terms of Mr. Gilliam’s Severance Agreement is subject in all respects to the terms of the Severance Agreement.

Item 9.01.

Financial Statements and Exhibits.

(d)

Exhibits

.

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

Joseph E. Gilliam Executive Severance and Change in Control Agreement dated May 5, 2017.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

GLAUKOS CORPORATION

(Registrant)

|

|

|

By:

|

/s/ Robert L. Davis

|

|

|

|

Name:

|

Robert L. Davis

|

|

|

|

Title:

|

Senior Vice President, General Counsel

|

|

|

|

|

and Corporate Secretary

|

Date: May 5, 2017

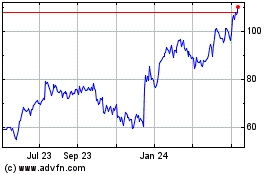

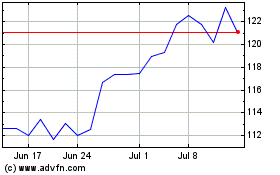

Glaukos (NYSE:GKOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Glaukos (NYSE:GKOS)

Historical Stock Chart

From Apr 2023 to Apr 2024