Phase 3 FORWARD I Trial of Mirvetuximab

Soravtansine Activated in North America and Europe

Data at AACR and SGO Annual Meetings Highlight

Patient Selection Strategy for FORWARD I and Breadth of ADC

Expertise

Mirvetuximab Soravtansine Safety and Efficacy

Data to be Presented at ASCO Annual Meeting

Conference Call to be Held at 8:00am ET

Today

ImmunoGen, Inc. (Nasdaq: IMGN), a

leader in the expanding field of antibody-drug conjugates (ADCs)

for the treatment of cancer, today reviewed recent highlights and

reported financial results for the quarter ended March 31,

2017.

“We have started 2017 with significant progress towards our

strategic priorities of advancing our portfolio, supporting our

partners, and driving continued innovation in ADCs,” said Mark

Enyedy, ImmunoGen’s president and chief executive officer.

“Following enrollment of our first patient in FORWARD I in January,

we have since expanded the study to include additional centers in

North America and Europe, and expect to activate more than 100

sites in these geographies before the end of the year. We presented

data at the SGO Annual Meeting supporting our patient selection

strategy for FORWARD I and delivered nine presentations at the AACR

Annual Meeting highlighting novel ADCs and enhancements to our

platform technologies. For the remainder of the year, we look

forward to a number of additional milestones, including sharing new

efficacy and safety data for mirvetuximab soravtansine at ASCO and

filing an IND for our CD123-targeting ADC, IMGN632, in the third

quarter.”

Recent Highlights

Proprietary Portfolio

- Treated the first patient in FORWARD I

and expanded the study to more than 40 sites in North America and

Europe;

- Presented expanded Phase 1 data from

the biopsy cohort for mirvetuximab soravtansine at the Society for

Gynecologic Oncology (SGO) Annual Meeting on Women’s Cancer

demonstrating that archival tumor tissue can reliably identify

patients with folate receptor alpha (FRα)-positive

platinum-resistant ovarian cancer and supporting the patient

selection strategy for FORWARD I; and

- Delivered nine presentations at the

American Association for Cancer Research (AACR) Annual Meeting

demonstrating improvements to ImmunoGen’s payload and linker

technologies and highlighting data with novel ADCs directed to a

range of tumor targets.

Partner Programs

- Bayer completed enrollment in a

registration-enabling Phase 2 study for anetumab ravtansine in

mesothelioma; and

- Takeda initiated preclinical

development with the first ADC using ImmunoGen’s IGN platform

directed to a solid tumor.

ASCO Presentations

ImmunoGen will report data on mirvetuximab soravtansine in

poster presentations at the 2017 American Society of Clinical

Oncology (ASCO) Annual Meeting on June 3, 2017:

Gynecologic Cancer: General Poster SessionLocation: Hall

ASaturday, June 3, 2017, 1:15 p.m. – 4:45 p.m. CDT

- Title: Mirvetuximab soravtansine

(IMGN853), a folate receptor alpha (FRα)-targeting antibody-drug

conjugate (ADC), in platinum-resistant epithelial ovarian cancer

(EOC) patients (pts): Activity and safety analyses in phase I

pooled expansion cohorts. (Abstract No.: 5547, Poster Board No.:

369)

- Title: Safety findings from FORWARD II:

A phase 1b study evaluating the folate receptor alpha

(FRα)-targeting antibody-drug conjugate (ADC) mirvetuximab

soravtansine (IMGN853) in combination with bevacizumab,

carboplatin, pegylated liposomal doxorubicin (PLD), or

pembrolizumab in patients (pts) with ovarian cancer. (Abstract No.:

5553, Poster Board No.: 375)

- Title: FORWARD I (GOG 3011): A

randomized phase 3 study to evaluate the safety and efficacy of

mirvetuximab soravtansine (IMGN853) versus chemotherapy in adults

with folate receptor alpha (FRα)-positive, platinum-resistant

epithelial ovarian cancer (EOC), primary peritoneal cancer, or

primary fallopian tube cancer. (Abstract No.: TPS5607, Poster Board

No.: 425b)

Additional Upcoming Events

- ImmunoGen expects to present initial

Phase 1 data for IMGN779, a CD33-targeting ADC, for the treatment

of acute myeloid leukemia in mid-2017. These will be the first

clinical data reported with an ADC using ImmunoGen's DNA-alkylating

payload.

- The Company anticipates filing an

investigational new drug (IND) application in the third quarter of

2017 to support clinical testing with IMGN632, a CD123-targeting

ADC integrating a more potent DNA-alkylating payload intended to

treat a range of hematological malignancies.

- ImmunoGen also anticipates advancing

the first development candidate under its collaboration with CytomX

into preclinical development in 2017.

Financial Results

Revenues for the quarter ended March 31, 2017 were $28.5

million, compared to $19.7 million for the quarter ended March 31,

2016. License and milestone fees for the first quarter of 2017

included $6 million in partner milestone payments and $12.7 million

in amortization of a non-cash fee related to the Company’s license

agreement with CytomX, compared with $10 million from partner

milestone payments in the same quarter in 2016. Revenues in the

first quarter of 2017 included $7.6 million in non-cash royalty

revenues, compared with $7.4 million in non-cash royalty revenues

for the same quarter in 2016. Revenues for the first quarter of

2017 also included $1.5 million of research and development

(R&D) support fees and $0.7 million of clinical materials

revenue, compared with $1.1 million and $1.2 million, respectively,

for the same quarter in 2016.

Operating expenses for the first quarter of 2017 were $41.4

million, compared to $47.3 million for the same quarter in 2016.

Operating expenses in the first quarter of 2017 include R&D

expenses of $32.9 million, compared to $36.1 million for the same

quarter in 2016. This change is primarily due to a workforce

reduction resulting from the strategic review in September 2016, as

well as decreased costs associated with manufacturing clinical

materials on behalf of ImmunoGen’s partners. Partially offsetting

these decreases, clinical trial costs increased in the first

quarter of 2017 driven primarily by studies of mirvetuximab

soravtansine. Operating expenses include general and administrative

expenses of $8.1 million in the first quarter of 2017, compared to

$11.2 million in the same quarter in 2016. This decrease is

primarily due to a non-cash stock compensation charge in the first

quarter of 2016 resulting from the CEO transition, as well as

decreased personnel expenses in the first quarter of 2017.

ImmunoGen reported a net loss of $17.3 million, or $0.20 per

basic and diluted share, for the first quarter of 2017 compared to

a net loss of $31.9 million, or $0.37 per basic and diluted share,

for the same quarter last year.

ImmunoGen had approximately $126.6 million in cash and cash

equivalents as of March 31, 2017, compared with $160.0 million as

of December 31, 2016, and had $100.0 million of convertible debt

outstanding in each period. Cash used in operations was $33.0

million for the first quarter of 2017, compared with $26.1 million

for the first quarter of 2016. Capital expenditures were $0.4

million and $3.5 million for the quarters ended March 31, 2017 and

2016, respectively.

Financial Guidance

ImmunoGen’s financial guidance for 2017 remains unchanged from

that issued in February 2017. ImmunoGen expects:

- Revenues between $70 million and $75

million, which includes $28 million of expected upfront and

milestone fees from partners;

- Operating expenses between $175 million

and $180 million; and

- Cash and cash equivalents at December

31, 2017 between $35 million and $40 million.

ImmunoGen expects that its current cash plus expected cash

revenues from partners and collaborators will enable the Company to

fund operations into the second quarter of 2018.

Conference Call Information

ImmunoGen will hold a conference call today at 8:00 am ET to

discuss these results. To access the live call by phone, dial

719-325-2452; the conference ID is 5957421. The call may also be

accessed through the Investors section of the Company’s website,

www.immunogen.com. Following the live webcast, a replay of the call

will be available at the same location through May 19, 2017.

About ImmunoGen, Inc.

ImmunoGen is a clinical-stage biotechnology company that

develops targeted cancer therapeutics using its proprietary ADC

technology. ImmunoGen's lead product candidate, mirvetuximab

soravtansine, is in a Phase 3 trial for FRα-positive

platinum-resistant ovarian cancer, and is in Phase 1b/2

testing in combination regimens for earlier-stage disease.

ImmunoGen's ADC technology is used in Roche's marketed product,

Kadcyla®, in three other clinical-stage ImmunoGen product

candidates, and in programs in development by partners Amgen,

Bayer, Biotest, CytomX, Lilly, Novartis, Sanofi and Takeda. More

information about the Company can be found at

www.immunogen.com.

Kadcyla® is a registered trademark of Genentech, a member of the

Roche Group.

This press release includes forward-looking statements based on

management's current expectations. These statements include, but

are not limited to, ImmunoGen's expectations related to: the

Company's revenues, operating expenses, net loss, cash used in

operations and capital expenditures for the twelve months ending

December 31, 2017; its cash and marketable securities as of

December 31, 2017; the occurrence, timing and outcome of potential

pre-clinical, clinical and regulatory events related to the

Company's and its collaboration partners' product programs; and the

presentation of preclinical and clinical data on the Company’s and

collaboration partners’ product candidates. For these statements,

ImmunoGen claims the protection of the safe harbor for

forward-looking statements provided by the Private Securities

Litigation Reform Act of 1995. Various factors could cause

ImmunoGen's actual results to differ materially from those

discussed or implied in the forward-looking statements, and you are

cautioned not to place undue reliance on these forward-looking

statements, which are current only as of the date of this release.

Factors that could cause future results to differ materially from

such expectations include, but are not limited to: the timing and

outcome of ImmunoGen's and the Company's collaboration partners'

research and clinical development processes; the difficulties

inherent in the development of novel pharmaceuticals, including

uncertainties as to the timing, expense and results of preclinical

studies, clinical trials and regulatory processes; ImmunoGen's

ability to financially support its product programs; ImmunoGen's

dependence on collaborative partners; industry merger and

acquisition activity; and other factors more fully described in

ImmunoGen's Annual Report on Form 10-K for the fiscal year ended

June 30, 2016 and other reports filed with the Securities and

Exchange Commission.

-Financials Follow-

IMMUNOGEN, INC.

SELECTED FINANCIAL INFORMATION

(in thousands, except per share

amounts)

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited) March 31, December 31,

2017 2016 ASSETS Cash and cash equivalents $

126,568 $ 159,964 Other assets 36,753 38,900

Total assets $ 163,321 $ 198,864 LIABILITIES AND

SHAREHOLDERS' DEFICIT Current liabilities $ 40,367 $ 55,776

Long-term portion of deferred revenue and other long-term

liabilities 290,484 295,938 Shareholders' deficit (167,530)

(152,850) Total liabilities and shareholders' deficit

$ 163,321 $ 198,864

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (Unaudited) Three Months

Ended March 31, 2017 2016

Revenues: License and milestone fees $ 18,730 $ 10,077

Non-cash royalty revenue 7,613 7,380 Research and development

support 1,665 1,059 Clinical materials revenue 678

1,198 Total revenues 28,686 19,714

Expenses: Research and development 33,070 36,094 General and

administrative 8,119 11,235 Restructuring charge 386

- Total operating expenses 41,575 47,329

Loss from operations (12,889) (27,615) Non-cash

interest expense on liability related to sale of future royalty

& convertible bonds (3,575) (4,972) Interest expense on

convertible bonds (1,125) - Other income, net 249 659

Net loss $ (17,340) $ (31,928)

Net loss per common

share, basic and diluted $ (0.20) $

(0.37) Weighted average common shares

outstanding, basic and diluted 87,160

87,035

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170505005126/en/

For InvestorsThrust IRMonique Allaire,

617-895-9511monique@thrustir.comorFor MediaFTI Consulting,

Inc.Robert Stanislaro,

212-850-5657robert.stanislaro@fticonsulting.com

ImmunoGen (NASDAQ:IMGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

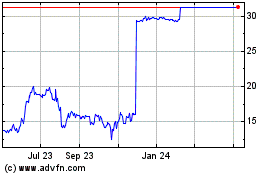

ImmunoGen (NASDAQ:IMGN)

Historical Stock Chart

From Apr 2023 to Apr 2024