Union Bank Expands San Francisco Private Wealth Management Team

May 04 2017 - 5:00PM

Business Wire

Tyler Brasfield and Lawrence Parente Join as Private Wealth

Advisors

Union Bank today announced that Tyler Brasfield and Lawrence

Parente have joined its Private Wealth Management team in San

Francisco, CA as Private Wealth Advisors. Brasfield joins as a Vice

President and Parente joins as a Director. They report to Lisa

Roberts, Head of Private Wealth Management for Northern California

and the Pacific Northwest, who was appointed to her role in the

fall of 2016.

Brasfield and Parente work hand in hand with a team of wealth

management professionals across disciplines and provide customized

wealth management planning to assist clients achieve their

long-term financial goals.

“Union Bank has a 150 year history supporting the families,

business owners and individual visionaries that have made Northern

California the vibrant economy it is today. Building on that

legacy, we continue to make strategic appointments to assist our

Northern California clients through some of the challenges and

opportunities they currently face,” Michael Feldman, Head of Wealth

Markets, said. “Tyler and Larry are well-equipped to deliver

comprehensive wealth planning by bringing together a team of

specialists that can help clients navigate important matters,

including rising interest rates and tax reform preparation.”

Brasfield joined from J.P. Morgan Private Bank where he was a

Private Wealth Advisor. He brings to Union Bank more than 12 years

of experience in the financial services industry. Brasfield began

his career advising executives of financially distressed hospitals

on business and financial strategy. This included serving as a

Manager for Accenture within their Strategy Consulting practice in

New York. Additionally, he co-founded and served as Chief Operating

Officer of Ecure, LLC, a consulting firm that advised private

physician practices on financial management and operational

improvement using smart technology.

Brasfield received his MBA from Columbia Business School and his

B.A. in Economics and Music Performance from Vanderbilt University.

He serves as a Board Member of the New Canaan Society San Francisco

and volunteers with Defy Ventures.

Parente joined Union Bank from Jackson Square Financial, a

registered independent advisory firm in San Francisco, where he was

a Senior Wealth Manager. He brings more than 16 years of experience

as an investment specialist. Parente also served as a Principal and

Senior Wealth Advisor with Bessemer Trust, as a Senior Trust

Specialist at Merrill Lynch, and as Senior Vice President and

Senior Trust Officer at Bank of America’s Private Bank. As part of

Bank of America’s Family Wealth Advisory team, he served families

with $50 million or more in net worth.

Parente is a licensed attorney in the State of California and

practiced for two years at the firm of Brobeck, Phleger and

Harrison in San Francisco. He earned his J.D. from Golden Gate

University School of Law in San Francisco, CA and his B.A. from the

University of Albany, NY.

About The Wealth Markets Group

The Wealth Markets Group at MUFG Union Bank, N.A. includes the

company’s private wealth management, wealth planning, trust and

estate services, as well as its investment advisory and brokerage

subsidiary, UnionBanc Investment Services LLC (member FINRA/SIPC),

its asset management subsidiary, HighMark Capital Management Inc.,

and its insurance division, UnionBanc Insurance Services,

California State Insurance License No. 0817733. Non-deposit

investment products: • Are NOT deposits or other obligations of, or

guaranteed by, the Bank or any Bank affiliate • Are NOT insured by

the FDIC or by any other federal government agency • Are subject to

investment risks, including possible loss of the principal amount

invested • Insurance and annuities are products of the insurance

carriers.

About MUFG Union Bank, N.A.

MUFG Union Bank, N.A., is a full-service bank with offices

across the United States. We provide a wide spectrum of corporate,

commercial and retail banking and wealth management solutions to

meet the needs of customers. We also offer an extensive portfolio

of value-added solutions for customers, including investment

banking, personal and corporate trust, global custody, transaction

banking, capital markets, and other services. With assets of $116.1

billion, as of March 31, 2017, MUFG Union Bank has strong capital

reserves, credit ratings and capital ratios relative to peer banks.

MUFG Union Bank is a proud member of the Mitsubishi UFJ Financial

Group (NYSE: MTU), one of the world’s largest financial

organizations with total assets of approximately ¥302.1 trillion

(JPY) or $2.6 trillion (USD)¹, as of December 31, 2016. The

corporate headquarters (principal executive office) for MUFG

Americas Holdings Corporation, which is the financial holding

company and MUFG Union Bank, is in New York City. The main banking

office of MUFG Union Bank is in San Francisco, California.

1 Exchange rate of 1 USD=¥116.49 (JPY) as of December 31,

2016

©2017 MUFG Union Bank, N.A. All rights reserved. Member

FDIC.Union Bank is a registered trademark and brand name of MUFG

Union Bank, N.A.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170504006745/en/

Union BankJuanita Gutierrez,

213-236-5017Juanita.gutierrez@unionbank.com@UnionBankNews

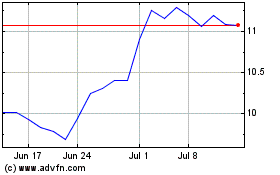

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

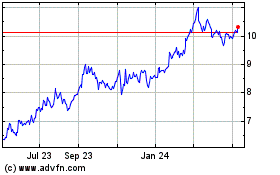

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024