First-quarter Financial Highlights

- Net sales were $199.3 million, an

increase of 15.6% compared to 2016. Net sales increased 11.7% as a

result of the Q2 2016 acquisition in AEC (see Tables 1 and 2).

- Net income attributable to the Company

was $10.8 million ($0.34 per share), compared to $13.5 million

($0.42 per share) in Q1 2016.

- Net income attributable to the Company,

excluding adjustments (a non-GAAP measure), was $0.46 per share in

both Q1 2017 and Q1 2016 (see Table 11).

- Adjusted EBITDA (a non-GAAP measure)

was $43.5 million compared to $41.3 million in Q1 2016 (see Tables

7 and 8).

Albany International Corp. (NYSE:AIN) reported that Q1 2017 net

income attributable to the Company was $10.8 million, including a

net charge of $0.8 million for income tax adjustments. Q1 2016 net

income attributable to the Company was $13.5 million, including

favorable income tax adjustments of $1.0 million.

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20170504006383/en/

Q1 2017 income before income taxes was $17.5 million, including

restructuring charges of $2.7 million, and losses from foreign

currency revaluation of $1.9 million. Q1 2017 income before income

taxes also includes $0.6 million of professional fees related to

the integration of the Q2 2016 acquisition of Harris Corporation’s

composite aerostructures division (referred to below as “SLC”). Q1

2016 income before income taxes was $20.4 million, including

restructuring charges of $0.7 million, losses of $1.4 million from

foreign currency revaluation, and $1.6 million of expenses related

to the acquisition.

Table 1 summarizes key financial metrics of SLC, which is

included in the AEC segment:

Table 1

(in thousands)

Three Months endedMarch 31, 2017

Net sales (GAAP) $20,200 Gross profit (GAAP)

2,245 Selling, technical, general and research

expenses(GAAP) 3,172 Restructuring expenses(GAAP)

1,699 Operating (loss) (GAAP) (2,626)

Depreciation and amortization (D&A) (GAAP) 3,850

EBITDA [Operating (loss) + D&A] (Non-GAAP) 1,224

Adjusted EBITDA [Operating (loss)+ Restructuring + D&A]

(Non-GAAP) $2,923

Table 2 summarizes net sales and the effect of changes in

currency translation rates:

Table 2

Net SalesThree Months endedMarch 31,

PercentChange

Impact ofChangesin CurrencyTranslation

Rates

PercentChangeexcludingCurrencyRate

Effect

(in thousands, excluding percentages)

2017

2016

Machine Clothing (MC)

$142,827 $145,264 -1.7%

$(2,122) -0.2% Albany Engineered Composites

(AEC) 56,450 27,067 108.6%

(263) 109.5% Total

$199,277 $172,331 15.6% $(2,385)

17.0%

In comparison to Q1 2016, MC net sales increased in tissue and

packaging grades but that increase was offset by declines in the

publication grades. The increase in AEC net sales was primarily due

to the Q2 2016 acquisition and growth in LEAP.

First-quarter gross profit increased to $75.9 million in 2017

from $72.5 million in 2016. Gross profit margin in Q1 2017 was

38.1% compared to 42.1% in Q1 2016, reflecting the change in the

business mix due to higher AEC sales. MC gross profit was $69.2

million (48.5% of net sales) in Q1 2017, compared to $69.6 million

(47.9% of net sales) in Q1 2016. AEC gross profit increased to $6.8

million (12.1% of net sales) in Q1 2017, compared to $3.1 million

(11.5% of net sales) in Q1 2016.

Q1 2017 selling, technical, general, and research (STG&R)

expenses were $51.2 million, or 25.7% of net sales, including

losses of $1.8 million from the revaluation of

nonfunctional-currency assets and liabilities, and $0.6 million of

professional fees related to the integration of SLC. Q1 2016

STG&R expenses were $49.6 million, or 28.8% of net sales,

including losses of $1.9 million from the revaluation of

nonfunctional-currency assets and liabilities, and $1.6 million of

expenses related to the Q2 2016 acquisition. The reduction in

STG&R expenses as a percentage of net sales in 2017 reflects

the relative growth of AEC which carries lower STG&R expenses

as a percentage of net sales.

The following table summarizes first-quarter expenses associated

with internally funded research and development by segment:

Table 3

Research and developmentexpenses by

segmentThree Months endedMarch 31,

(in thousands)

2017

2016

Machine Clothing $4,519 $4,337 Albany Engineered

Composites 3,076 2,681 Total $7,595

$7,018

The following table summarizes first-quarter operating income by

segment:

Table 4

Operating Income/(loss)Three Months

endedMarch 31,

(in thousands)

2017

2016

Machine Clothing $38,261 $37,139 Albany

Engineered Composites (5,114) (3,706)

Corporate expenses (11,091) (11,164)

Total $22,056 $22,269

AEC incurred restructuring charges of $2.6 million in the first

quarter of 2017, principally related to a reduction in personnel in

SLC. Table 5 presents the effect on operating income resulting from

restructuring, currency revaluation, and acquisition expenses:

Table 5

Expenses in Q1 2017resulting from

Expenses/(gain) in Q1 2016resulting

from

(in thousands)

Restructuring

Revaluation

Restructuring

Revaluation

Acquisitionexpenses

Machine Clothing $110 $1,663

$698 $1,890 $ - Albany

Engineered Composites 2,571 98

- 5 1,596 Corporate

expenses - 1 (19)

2 - Total $2,681

$1,762 $679 $1,897

$1,596

Q1 2017 Other income/expense, net, was expense of $0.2 million,

including losses related to the revaluation of

nonfunctional-currency balances of $0.1 million. Q1 2016 Other

income/expense, net, was income of $0.3 million, including income

related to the revaluation of nonfunctional-currency balances of

$0.5 million.

The following table summarizes currency revaluation effects on

certain financial metrics:

Table 6

Income/(loss) attributableto currency

revaluationThree Months ended March 31,

(in thousands)

2017

2016

Operating income $(1,762) $(1,897) Other

income/(expense), net (101) 479 Total

$(1,863) $(1,418)

Q1 2017 Interest expense, net, was $4.3 million, compared to

$2.2 million in Q1 2016. The increase was due to higher debt as a

result of the acquisition of SLC in Q2 2016.

The Company’s income tax rate based on income from continuing

operations was 32.6% for Q1 2017, compared to 39.7% for Q1 2016.

The decrease in the rate was due to a shift in the mix of pretax

income in the jurisdictions in which we operate. Discrete tax items

increased income tax expense by $0.8 million in Q1 2017, and

decreased income tax expense by $1.0 million in Q1 2016.

The following tables provide a reconciliation of operating

income and net income to EBITDA and Adjusted EBITDA:

Table 7

Three Months ended March 31,

2017(in thousands)

MachineClothing

AlbanyEngineeredComposites

Corporateexpensesand other

TotalCompany

Operating income/(loss) (GAAP)

$38,261 $(5,114)

$(11,091) $22,056 Interest, taxes,

other income/expense - -

(11,082) (11,082)

Net income (GAAP)

38,261 (5,114)

(22,173) 10,974 Interest

expense, net - -

4,328 4,328 Income tax expense -

- 6,550 6,550

Depreciation and amortization 8,287

7,804 1,202 17,293

EBITDA

(non-GAAP) 46,548

2,690 (10,093)

39,145 Restructuring expenses, net 110

2,571 - 2,681 Foreign

currency revaluation losses 1,663

98 102 1,863 Pretax (income)

attributable to non-controlling interest in ASC

- (171) - (171)

Adjusted EBITDA (non-GAAP)

$48,321 $5,188

$(9,991) $43,518

Table 8

Three Months ended March 31,

2016(in thousands)

MachineClothing

AlbanyEngineeredComposites

Corporateexpensesand other

TotalCompany

Operating income/(loss) (GAAP)

$37,139 $(3,706)

$(11,164) $22,269 Interest, taxes,

other income/expense - -

(8,953) (8,953)

Net income (GAAP)

37,139 (3,706)

(20,117) 13,316 Interest

expense, net - -

2,238 2,238 Income tax expense -

- 7,043 7,043

Depreciation and amortization 9,318

3,395 2,107 14,820

EBITDA

(non-GAAP) 46,457

(311) (8,729)

37,417 Restructuring expenses, net 698

- (19) 679 Foreign

currency revaluation (gains)/losses 1,890

5 (477) 1,418 Acquisition

expenses - 1,596 -

1,596 Pretax loss attributable to non-controlling

interest in ASC - 187

- 187

Adjusted EBITDA (non-GAAP)

$49,045 $1,477

$(9,225) $41,297

Payments for capital expenditures increased to $25.1 million in

Q1 2017, compared to $8.1 million in Q1 2016, primarily due to the

ramp in AEC programs. Depreciation and amortization was $17.3

million in Q1 2017, compared to $14.8 million in Q1 2016. As noted

in Table 1, depreciation and amortization for SLC was $3.9 million

in Q1 2017.

CFO Comments

CFO and Treasurer John Cozzolino commented, “As is typical for

the first quarter, cash flow was negatively impacted by incentive

compensation payments, seasonal increases in accounts receivable

and inventory, and high first-quarter income tax payments. In Q1

2017, these typical cash flow effects were compounded by sharp

increases in receivables, inventory, and capital expenditures

associated with multiple program ramps in AEC. For the total

Company, the net effect of higher receivables and inventory,

combined with reductions in accrued liabilities, was a use of cash

of approximately $31 million during the quarter. Payments for

capital expenditures in Q1 were about $25 million and we continue

to estimate full-year spending in 2017 to be $95 million to $105

million. At this rate of spending for capital expenditures, we

expect additional quarterly increases in net debt for the remainder

of the year, but at a considerably lower level than in Q1.

“Total debt decreased a little over $4 million to $480 million

as of the end of the quarter, while cash balances decreased about

$38 million to a total of $143 million. The combined effect of

those two changes resulted in a $34 million increase to net debt

(total debt less cash, see Table 14) to a balance of $337 million

as of the end of the quarter. The Company’s leverage ratio, as

defined in our primary debt agreements, was 2.30 at both the end of

Q1 2017 and Q4 2016, well below our limit of 3.50.

“The Company’s income tax rate based on income from continuing

operations was about 33% in Q1 2017, compared to 35% for the

full-year 2016. We continue to expect the full-year tax rate for

2017 to be similar to the rate in 2016. Cash paid for income taxes

was about $9 million in Q1, and we estimate cash taxes in 2017 to

range from $25 million to $30 million.”

CEO Comments

CEO Joseph Morone said, “In Q1 2017, both businesses continued

to perform well and in line with our short- and long-term

expectations and objectives. MC once again generated strong income

and strong new product performance, while AEC once again generated

strong growth and executed well on each of its key programs, while

continuing to position itself for improved profitability and new

business.

“In MC, sales were essentially flat, both sequentially and in

comparison to Q1 2016. There were no significant deviations from

recent market trends during the quarter. Once again, a significant

decline in publication grade sales was offset by incremental gains

in the other grades, most notably during Q1 in tissue. By the end

of Q1, the publication grades accounted for 23% of total sales,

compared to 25% in Q1 2016, 27% in Q1 2015, and 30% in Q1 2014. Our

new product performance continued to be strong across all product

lines, especially in tissue. Competitive pricing pressure remained

intense, particularly in Europe and Asia, although the topline

impact was offset by volume growth in Asia.

“Profitability was once again strong in Q1 2017 due to

incremental productivity gains and good plant utilization. Gross

margin, segment net income and Adjusted EBITDA were in line with

the excellent performance levels of Q1 2016.

“As for our outlook in MC, the market appears stable and we

enter Q2 with a good order backlog. Although we have been

anticipating and are seeing some inflationary pressures, MC remains

on track toward its full-year objective of annual Adjusted EBITDA

in the middle of that $180 million to $195 million range that we

have discussed on numerous occasions. (See Table 15 for

reconciliation to GAAP net income for this segment.)

“AEC continued on its path of accelerating growth. Q1 sales grew

to $56 million, from $27 million in Q1 2016, the last quarter

before we acquired SLC. Excluding SLC, sales grew by $9 million or

34%. The quarter began slowly for AEC, but revenue accelerated as

the quarter progressed, and the business remains on track toward

its full-year target of 25% to 35% revenue growth over 2016.

“The growth was led once again by LEAP. AEC continues to execute

on the very aggressive LEAP ramp schedule, while the LEAP engine

program continues to perform well in the marketplace. The order

backlog for LEAP exceeded 12,000 engines at the end of Q1 with no

signs of market softening, CFM delivered its 100th LEAP engine

during the quarter, and the LEAP engines in service are performing

well and meeting their performance targets.

“Q1 sales in SLC were flat compared to Q4, but as with the rest

of AEC, we expect a sharp increase in SLC sales for the balance of

2017. It has been a full year since our acquisition of SLC, and our

experience to date – particularly our experience with SLC’s

customers – validates our view of the growth potential that

motivated the acquisition. In SLC’s key growth and legacy programs,

the near- and long-term demand outlook is strong and SLC is meeting

customer expectations. Of particular note since our last earnings

call are two recent developments in the CH-53K program. SLC was

informed during Q1 that it was selected by Sikorsky as its supplier

of the year for the CH-53K. And in early April, the CH-53K program

was officially approved by the Department of Defense to enter into

low-rate initial production. At full-rate production next decade

and with no additional content, this program has the potential to

generate as much as $150 million per year of revenue.

“While AEC segment net income declined compared to Q1 2016, due

to increases in depreciation expense and restructuring, Adjusted

EBITDA improved significantly, both in absolute terms and as a

percent of sales. Profitability was held back by a still

substantial effort to complete the integration of SLC into AEC. The

AEC ERP system successfully went live in SLC in February, but the

usual inefficiencies associated with learning a new system and

modifying work processes will continue to be a drag on productivity

well into the second half of the year. Shortly after the end of the

quarter, SLC announced a significant restructuring, which coupled

with continuous improvement in operations, should result in gradual

improvements to profitability by the end of this year.

“Q1 was also marked by a significant increase in new business

development activity in AEC. As previously mentioned, AEC is

pursuing new business opportunities on three fronts: existing

aerospace platforms, new aerospace platforms, and diversification

outside of aerospace. While there were promising developments

during Q1 on all three fronts, the most notable were on existing

aerospace platforms. AEC received a significant number of formal

requests-for-proposal as well as more preliminary expressions of

interest from a broad cross-section of OEMs, largely prompted by

AEC’s execution and emphasis on lean manufacturing in its existing

programs with those OEMs.

“As for our outlook for AEC, we continue to expect full-year

revenue to be 25% to 35% higher than full-year 2016, and Adjusted

EBITDA as a percentage of sales to slowly improve. For the longer

term, the intensity of new business development activity in Q1

suggests that there is more upside than downside risk to our

current estimate of $450 million to $500 million revenue potential

by 2020, as well as potential for substantial growth beyond

2020.

“In sum, this was a good quarter for both businesses, as MC

generated strong Adjusted EBITDA and AEC strong growth. Both

businesses remain firmly on track toward their short- and long-

term goals. For 2017, MC is on track toward full-year Adjusted

EBITDA in the middle of our expected range, and AEC is on track for

full-year revenue growth between 25% and 35% coupled with gradually

improving Adjusted EBITDA as a percentage of sales.”

About Albany International Corp.

Albany International is a global advanced textiles and materials

processing company, with two core businesses. Machine Clothing is

the world’s leading producer of custom-designed fabrics and belts

essential to production in the paper, nonwovens, and other process

industries. Albany Engineered Composites is a rapidly growing

supplier of highly engineered composite parts for the aerospace

industry. Albany International is headquartered in Rochester, New

Hampshire, operates 22 plants in 10 countries, employs 4,400 people

worldwide, and is listed on the New York Stock Exchange (Symbol

AIN). Additional information about the Company and its products and

services can be found at www.albint.com.

This release contains certain non-GAAP metrics, including:

percent change in net sales excluding currency rate effects (for

each segment and the Company as a whole); EBITDA and Adjusted

EBITDA (for each segment and the Company as a whole, represented in

dollars or as a percentage of net sales); net debt; and net income

per share attributable to the Company, excluding adjustments. Such

items are provided because management believes that, when

reconciled from the GAAP items to which they relate, they provide

additional useful information to investors regarding the Company’s

operational performance.

Presenting increases or decreases in sales, after currency

effects are excluded, can give management and investors insight

into underlying sales trends. EBITDA, or net income with interest,

taxes, depreciation, and amortization added back, is a common

indicator of financial performance used, among other things, to

analyze and compare core profitability between companies and

industries because it eliminates effects due to differences in

financing, asset bases and taxes. An understanding of the impact in

a particular quarter of specific restructuring costs, acquisition

expenses, currency revaluation, or other gains and losses, on net

income (absolute as well as on a per-share basis), operating income

or EBITDA can give management and investors additional insight into

core financial performance, especially when compared to quarters in

which such items had a greater or lesser effect, or no effect.

Restructuring expenses in the MC segment, while frequent in recent

years, are reflective of significant reductions in manufacturing

capacity and associated headcount in response to shifting markets,

and not of the profitability of the business going forward as

restructured. Net debt is, in the opinion of the Company, helpful

to investors wishing to understand what the Company’s debt position

would be if all available cash were applied to pay down

indebtedness. EBITDA, Adjusted EBITDA and net income per share

attributable to the Company, excluding adjustments, are performance

measures that relate to the Company’s continuing operations.

Percent changes in net sales, excluding currency rate effects,

are calculated by converting amounts reported in local currencies

into U.S. dollars at the exchange rate of a prior period. That

amount is then compared to the U.S. dollar amount reported in the

current period. The Company calculates EBITDA by removing the

following from Net income: Interest expense net, Income tax

expense, Depreciation and amortization. Adjusted EBITDA is

calculated by: adding to EBITDA costs associated with restructuring

and pension settlement charges; adding (or subtracting) revaluation

losses (or gains); subtracting (or adding) gains (or losses) from

the sale of buildings or investments; subtracting insurance

recovery gains; subtracting (or adding) Income (or loss)

attributable to the non-controlling interest in Albany Safran

Composites (ASC); and adding expenses related to the Company’s

acquisition of Harris Corporation’s composite aerostructures

division. Adjusted EBITDA may also be presented as a percentage of

net sales by dividing it by net sales. Net income per share

attributable to the Company, excluding adjustments, is calculated

by adding to (or subtracting from) net income attributable to the

Company per share, on an after-tax basis: restructuring charges;

discrete tax charges (or gains) and the effect of changes in the

income tax rate; foreign currency revaluation losses (or gains);

acquisition expenses; and losses (or gains) from the sale of

investments.

EBITDA, Adjusted EBITDA, and net income per share attributable

to the Company, excluding adjustments, as defined by the Company,

may not be similar to EBITDA measures of other companies. Such

measures are not considered measurements under GAAP, and should be

considered in addition to, but not as substitutes for, the

information contained in the Company’s statements of income.

The Company discloses certain income and expense items on a

per-share basis. The Company believes that such disclosures provide

important insight into underlying quarterly earnings and are

financial performance metrics commonly used by investors. The

Company calculates the quarterly per-share amount for items

included in continuing operations by using the income tax rate

based on income from continuing operations and the weighted-average

number of shares outstanding for each period. Year-to-date earnings

per-share effects are determined by adding the amounts calculated

at each reporting period.

Table 9

Three Months ended March 31,

2017(in thousands, except per share amounts)

Pretaxamounts

Tax Effect After-tax Effect

Per ShareEffect

Restructuring expenses, net $2,681

$979 $1,702 $0.05 Foreign

currency revaluation losses 1,863

680 1,183 0.04 Expenses related

to integration of acquired business 589

224 365 0.01 Net discrete income

tax charge - 831

831 0.03

Table 10

Three Months ended March 31,

2016(in thousands, except per share amounts)

Pretaxamounts

Tax Effect

After-taxEffect

Per Share Effect

Restructuring expenses, net $679

$270 $409 $0.01 Foreign currency

revaluation losses 1,418 563

855 0.03 Acquisition expenses

1,596 575 1,021

0.03 Net discrete income tax benefit -

1,033 1,033 0.03

The following table contains the calculation of net income per

share attributable to the Company, excluding adjustments:

Table 11

Three Months endedMarch 31,

Per share amounts (Basic)

2017

2016

Net income attributable to the Company, reported (GAAP)

$0.34 $0.42 Adjustments:

Restructuring expenses, net 0.05 0.01

Discrete tax adjustments 0.03 (0.03) Foreign

currency revaluation losses 0.04 0.03

Acquisition expenses - 0.03 Net income

attributable to the Company, excluding adjustments (non-GAAP)

$0.46 $0.46

Table 12

AEC Adjusted EBITDA as a percentage of

salesThree Months endedMarch 31,

(in thousands)

2017

2016

Adjusted EBITDA (see Tables 6 and 7) (non-GAAP)

$5,188

$1,477

Net sales (see Table 1) (GAAP) $56,450 $27,067

Adjusted EBITDA as a percentage of net sales 9.2%

5.5%

Table 13

Three Months ended December 31,

2016(in thousands)

AEC

Net income/(loss) (GAAP)

$(1,280) Interest expense, net - Income

tax expense - Depreciation and amortization

6,433

EBITDA (non-GAAP)

5,153 Restructuring expenses, net

526 Foreign currency revaluation (gains)/losses

11 Pretax (income) attributable to non-controlling

interest in ASC (160)

Adjusted EBITDA

(non-GAAP) $5,530 Net Sales (GAAP)

$68,302 Adjusted EBITDA as a percentage of net

sales 8.1%

The following table contains the calculation of net debt:

Table 14

(in thousands)

March 31,2017

December 31,2016

September30, 2016

June 30,2016

March 31, 2016

Notes and loans payable $274 $312

$343 $531 $590 Current

maturities of long-term debt 51,699

51,666 1,462 566 16

Long-term debt 428,477 432,918

490,003 485,215 255,076

Total

debt 480,450 484,896

491,808 486,312

255,682 Cash and cash equivalents

143,333 181,742 196,170

176,025 169,615

Net debt

$337,117 $303,154

$295,638 $310,287

$86,067

The following table contains the reconciliation of MC 2017

projected Adjusted EBITDA to MC 2017 projected net income:

Table 15

Machine Clothing Full-Year 2017 Outlook

(in millions)

Actual, threemonthsendedMarch 31,2017

Results forlast threequarters ofyear to

meetlow end ofrange

Results forlast threequarters ofyear to

meethigh end ofrange

Estimatedrange for full-year

Net income (non-GAAP) $38

$108 $117 $146 -

$155 Depreciation and amortization 8

24 30 (32-38)

EBITDA

(non-GAAP) $46 $132

$147 $178 - $193

Restructuring expenses - *

* * Foreign currency revaluation losses

2 * * *

Adjusted EBITDA (non-GAAP) $48

$132 $147 $180

- $195

* Due to the uncertainty of these items, management is currently

unable to project restructuring expenses and foreign currency

revaluation gains/losses for the remainder of the year.

This press release may contain statements, estimates, or

projections that constitute “forward-looking statements” as defined

under U.S. federal securities laws. Generally, the words “believe,”

“expect,” “intend,” “estimate,” “anticipate,” “project,” “will,”

“should,” “look for,” and similar expressions identify

forward-looking statements, which generally are not historical in

nature. Forward-looking statements are subject to certain risks and

uncertainties (including, without limitation, those set forth in

the Company’s most recent Annual Report on Form 10-K or Quarterly

Report on Form 10-Q) that could cause actual results to differ

materially from the Company’s historical experience and our present

expectations or projections.

Forward-looking statements in this release or in the webcast

include, without limitation, statements about macroeconomic,

geopolitical and paper-industry trends and conditions during 2016

and in future years; expectations in 2017 and in future periods of

sales, EBITDA, Adjusted EBITDA (both in dollars and as a percentage

of net sales), income, gross profit, gross margin, cash flows and

other financial items in each of the Company’s businesses,

including the acquired composite aerostructures business, and for

the Company as a whole; the timing and impact of production and

development programs in the Company’s AEC business segment and the

sales growth potential of key AEC programs, as well as AEC as a

whole; the amount and timing of capital expenditures, future tax

rates and cash paid for taxes, depreciation and amortization;

future debt and net debt levels and debt covenant ratios; and

changes in currency rates and their impact on future revaluation

gains and losses. Furthermore, a change in any one or more of the

foregoing factors could have a material effect on the Company’s

financial results in any period. Such statements are based on

current expectations, and the Company undertakes no obligation to

publicly update or revise any forward-looking statements.

Statements expressing management’s assessments of the growth

potential of its businesses, or referring to earlier assessments of

such potential, are not intended as forecasts of actual future

growth, and should not be relied on as such. While management

believes such assessments to have a reasonable basis, such

assessments are, by their nature, inherently uncertain. This

release and earlier releases set forth a number of assumptions

regarding these assessments, including historical results,

independent forecasts regarding the markets in which these

businesses operate, and the timing and magnitude of orders for our

customers’ products.

Historical growth rates are no guarantee of future growth, and

such independent forecasts and assumptions could prove materially

incorrect in some cases.

ALBANY INTERNATIONAL CORP. CONSOLIDATED STATEMENTS OF INCOME

(in thousands, except per share amounts) (unaudited)

Three Months EndedMarch 31,

2017 2016 Net sales $ 199,277 $ 172,331 Cost of goods sold

123,372 99,830 Gross profit 75,905

72,501 Selling, general, and administrative expenses 40,906 39,421

Technical and research expenses 10,262 10,132 Restructuring

expenses, net 2,681 679 Operating

income 22,056 22,269 Interest expense, net 4,328 2,238 Other

expense/(income), net 204 (328 ) Income before

income taxes 17,524 20,359 Income tax expense 6,550

7,043 Net income 10,974 13,316 Net income/(loss)

attributable to the noncontrolling interest 135 (185

) Net income attributable to the Company $ 10,839 $ 13,501

Earnings per share attributable to Company shareholders -

Basic $ 0.34 $ 0.42 Earnings per share attributable to

Company shareholders - Diluted $ 0.34 $ 0.42 Shares of the

Company used in computing earnings per share: Basic 32,128 32,041

Diluted 32,164 32,081 Dividends declared per share,

Class A and Class B $ 0.17 $ 0.17 ALBANY INTERNATIONAL CORP.

CONSOLIDATED BALANCE SHEETS (in thousands, except share data)

(unaudited) March 31, December 31, 2017

2016 ASSETS Cash and cash equivalents $ 143,333 $ 181,742 Accounts

receivable, net 174,339 171,193 Inventories 150,481 133,906 Income

taxes prepaid and receivable 5,224 5,213 Prepaid expenses and other

current assets 11,245 9,251 Total

current assets 484,622 501,305 Property, plant and

equipment, net 432,465 422,564 Intangibles, net 64,685 66,454

Goodwill 161,089 160,375 Income taxes receivable and deferred

69,505 68,865 Contract receivables 17,960 14,045 Other assets

31,799 29,825 Total assets $ 1,262,125

$ 1,263,433 LIABILITIES AND SHAREHOLDERS'

EQUITY Notes and loans payable $ 274 $ 312 Accounts payable 43,756

43,305 Accrued liabilities 85,151 95,195 Current maturities of

long-term debt 51,699 51,666 Income taxes payable 7,199

9,531 Total current liabilities 188,079

200,009 Long-term debt 428,477 432,918 Other noncurrent

liabilities 104,262 106,827 Deferred taxes and other liabilities

12,714 12,389 Total liabilities

733,532 752,143 SHAREHOLDERS' EQUITY

Preferred stock, par value $5.00 per share; authorized 2,000,000

shares; none issued - - Class A Common Stock, par value $.001 per

share; authorized 100,000,000 shares; issued 37,368,649 in 2017 and

37,319,266 in 2016 37 37 Class B Common Stock, par value $.001 per

share; authorized 25,000,000 shares; issued and outstanding

3,233,998 in 2017 and 2016 3 3 Additional paid in capital 427,017

425,953 Retained earnings 528,227 522,855 Accumulated items of

other comprehensive income: Translation adjustments (123,172 )

(133,298 ) Pension and postretirement liability adjustments (51,748

) (51,719 ) Derivative valuation adjustment 1,458 828 Treasury

stock (Class A), at cost 8,443,444 shares in 2017 and 2016

(257,136 ) (257,136 ) Total Company shareholders' equity

524,686 507,523 Noncontrolling interest 3,907

3,767 Total equity 528,593 511,290

Total liabilities and shareholders' equity $ 1,262,125

$ 1,263,433 ALBANY INTERNATIONAL CORP.

CONSOLIDATED STATEMENTS OF CASH FLOW (in thousands) (unaudited)

Three Months endedMarch 31,

2017 2016 OPERATING ACTIVITIES Net income $ 10,974 $ 13,316

Adjustments to reconcile net income to net cash (used in)/provided

by operating activities:

Depreciation

14,644 13,124

Amortization

2,649 1,696

Change in other noncurrent liabilities

(1,596 ) (1,364 )

Change in deferred taxes and other

liabilities

(612 ) 2,529

Provision for write-off of property, plant

and equipment

296 592

Non-cash interest expense

211 -

Compensation and benefits paid or payable

in Class A Common Stock

989 864 Changes in operating assets and liabilities that

provide/(use) cash:

Accounts receivable

(741 ) (902 )

Inventories

(14,921 ) (1,348 )

Prepaid expenses and other current

assets

(1,917 ) (5,382 )

Income taxes prepaid and receivable

- (1,895 )

vAccounts payable

3,524 1,632

Accrued liabilities

(10,971 ) (8,843 )

Income taxes payable

(2,486 ) (3,836 )

Contract receivables

(3,915 ) -

Other, net

(700 ) (4,801 )

Net cash (used in)/provided by operating

activities

(4,572 ) 5,382 INVESTING ACTIVITIES

Purchases of property, plant and

equipment

(25,045 ) (7,993 )

Purchased software

(38 ) (82 )

Net cash used in investing activities

(25,083 ) (8,075 ) FINANCING ACTIVITIES

Proceeds from borrowings

16,145 12,396

Principal payments on debt

(20,602 ) (22,398 )

Debt acquisition costs

- (200 )

Taxes paid in lieu of share issuance

(1,364 ) (1,272 )

Proceeds from options exercised

75 205

Dividends paid

(5,459 ) (5,443 )

Net cash used in financing activities

(11,205 ) (16,712 ) Effect of exchange rate

changes on cash and cash equivalents 2,451

3,907 Decrease in cash and cash equivalents (38,409 )

(15,498 ) Cash and cash equivalents at beginning of period

181,742 185,113 Cash and cash equivalents at

end of period $ 143,333 $ 169,615

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170504006383/en/

Albany International Corp.InvestorsJohn Cozzolino,

518-445-2281john.cozzolino@albint.comorMediaHeather Kralik,

801-505-7001heather.kralik@albint.com

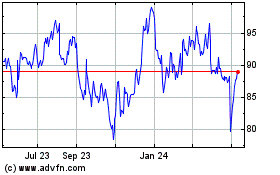

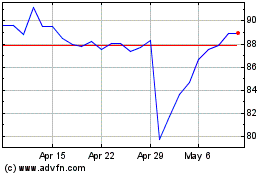

Albany (NYSE:AIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Albany (NYSE:AIN)

Historical Stock Chart

From Apr 2023 to Apr 2024