CALCULATION OF REGISTRATION FEE

|

Title

of Each Class Of Securities to be Registered

|

Amount

to be

Registered

(1)

|

Proposed

Maximum

Aggregate

Offering

Price

per

share (2)

|

Proposed

Maximum

Aggregate

Offering

Price (3)

|

Amount

of

Registration

fee(4)

|

|

Class A Common

Stock, no par value

|

110,000,000

|

$

0.0401

|

$

4,411,000

|

$

512.56

|

(1) In

the event of a stock split, stock dividend, or similar transaction

involving the common stock, the number of shares registered shall

automatically be increased to cover the additional shares of common

stock issuable pursuant to Rule 416 under the Securities

Act. The amount of shares to be registered represents

the Company’s good faith estimate of the number of shares

that the registrant may issue pursuant to a Letter Agreement with

the selling security holder.

(2) The

proposed maximum offering price per share and the proposed maximum

aggregate offering price have been estimated solely for the purpose

of calculating the amount of the registration fee in accordance

with Rules 457(c) and 457(h) under the Securities Act of 1933. Our

common stock is quoted under the symbol “KBLB” on

the OTC Markets, Inc. OTCQB. As of October 31, 2014, the

last sale reported price was $0.0401 per share. Accordingly, the

registration fee is $512.56 based on $0.0401 per

share.

(3)

This amount represents the maximum aggregate market value of common

stock which may be put to the selling shareholder by the registrant

pursuant to the terms and conditions of a Letter Agreement between

the selling shareholder and the registrant.

(4)

previously paid.

The registrant hereby amends this registration statement on such

date or dates as may be necessary to delay its effective date until

the registrant shall file a further amendment which specifically

states that this registration statement shall thereafter become

effective in accordance with section 8(a) of the securities act of

1933 or until the registration statement shall become effective on

such date as the commission, acting pursuant to said section 8(a),

may determine.

EXPLANATORY NOTE

We are filing this Amendment No. 9 to our registration

statement on Form S-1 filed on June 2, 2015, (File No. 333-199820)

to conform the disclosure herein to our Annual Report on Form

10-K for the year ending December 31, 2016, which was filed on

March 22, 2017.

Pursuant to Section 84001 of the Fixing America’s Surface

Transportation Act (the “FAST Act”), the Company elects

to incorporate by reference all documents subsequently filed by the

Company pursuant to Sections 13(a), 13(c), 14 or 15(d) of the

Exchange Act. The Company will (i) provide to each

person, including any beneficial owner, to whom a prospectus is

delivered, a copy of any or all of the reports or documents that

have been incorporated by reference in the prospectus contained in

the registration statement but not delivered with the prospectus;

(ii) provide these reports or documents upon written or oral

request; (iii) provide these reports or documents at no cost to the

requester; (iv) state the name, address, telephone number, and

email address, if any, to which the request for these reports or

documents must be made; and (v) state the Company’s Website

address, including the uniform resource locator (URL) where the

incorporated reports and other documents may be

accessed.

The information in this prospectus is not complete and may be

changed. These securities may not be sold by the selling

stockholders publicly until the registration statement filed with

the Securities and Exchange Commission is effective. This

prospectus is not an offer to sell these securities and no offer to

buy these securities is being solicited in any state where the

offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 4, 2017

AMENDMENT NO. 9 TO PRELIMINARY PROSPECTUS

KRAIG BIOCRAFT LABORATORIES, INC.

110,000,000

shares of Class A Common Stock

This

prospectus relates to the resale of up to 110,000,000 shares of the

common stock of Kraig Biocraft Laboratories, Inc., a Wyoming

corporation, which shares will be offered and sold by the selling

shareholder, Calm Seas Capital, LLC, a Nevada limited liability

company (“Calm Seas”), pursuant to a “put

right” under a letter agreement for an equity line financing,

that we entered into with Calm Seas on October 2, 2014 (the

“Letter Agreement”). As of May 4, 2017, of the

110,000,000 shares of common stock initially registered, 38,824,427

shares of common stock remain available for registration. The

Letter Agreement permits us to “put” up to an aggregate

of $7,500,000 in shares of our Class A common stock to Calm Seas

during a two year period ending on the second anniversary of

the effective date of the registration statement covering the

resale of the put shares. We will not receive any

proceeds from the sale of these shares of our Class A common stock.

However, we will receive proceeds from the sale of securities

pursuant to our exercise of the put right offered by Calm Seas

under the Letter Agreement. We will bear all costs

associated with this registration.

Calm

Seas is an “underwriter” within the meaning of the

Securities Act of 1933, as amended (the “Securities

Act”) in connection with the resale of our Class A common

stock sold to it by our exercise of the put right under the Letter

Agreement. Each month we may put up to $200,000 of our

Class A common stock under the Letter Agreement, which will

purchase such shares at a price per share equal to 80% of the

lowest price of our Class A common stock during the five

consecutive trading days immediately following the date the notice

of our election to put shares pursuant to the Letter Agreement is

delivered to Calm Seas (the date of delivery of such notice is

referred to as the “put

date”). Notwithstanding the aggregate $200,000

ceiling for monthly puts under the Letter Agreement, if both we and

Calm Seas agree, we may submit one or more additional puts during

any given month to the extent we need additional capital for our

operations and/or our product development. We can only

submit such additional put(s) if Calm Seas Capital agrees to

it. Furthermore, the additional put is subject to the

aggregate $7,500,000 limitation of this offering. The

additional put allows us to obtain additional capital in the event

that our product development proceeds quicker than we

expect.

We will

automatically withdraw our put notice to Calm Seas if the lowest

price used to determine the purchase price of the put shares is not

at least equal to seventy-five percent (75%) of the average closing

“bid” price for our Class A common stock for the ten

(10) trading days prior to the put date.

Our shares of Class A common stock are traded on the OTC Markets,

Inc. OTCQB under the symbol “KBLB.” On

May 4,

2017

, the closing sale price

of our common stock was $0.07 per share.

This investment involves a high degree of risk. You should purchase

shares only if you can afford a complete loss. See "Risk Factors"

beginning on page 8.

Our

principal executive offices are located at 2723 South State St.,

Suite 150, Ann Arbor, Michigan. Our telephone number is

(734)619-8066.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these

securities or determined if this prospectus is truthful or

complete. Any representation to the contrary is a criminal

offense.

The date of this amendment is May 4, 2017

TABLE OF CONTENTS

|

|

|

|

Prospectus

Summary

|

5

|

|

Summary Financial

Data

|

7

|

|

Risk

Factors

|

8

|

|

Use of

Proceeds

|

15

|

|

Selling

Shareholder

|

16

|

|

Plan of

Distribution

|

19

|

|

Description of

Securities

|

20

|

|

Interests of Named

Experts and Counsel

|

21

|

|

Description of

Business

|

21

|

|

Legal

Proceedings

|

27

|

|

Market For Common

Equity and Related Stockholder Matters

|

28

|

|

Available

Information

|

28

|

|

Financial

Statements

|

29

|

|

Management

Discussion and Analysis of Financial Condition and Results of

Operations

|

51

|

|

Changes In and

Disagreements with Accounts on Accounting and Financial

Disclosure

|

52

|

|

Directors,

Executive Officers, Promoters and Control Persons

|

57

|

|

Executive

Compensation

|

58

|

|

Security Ownership

of Certain Beneficial Owners and Management

|

60

|

|

Certain

Relationships and Related Transactions

|

60

|

|

Disclosure of

Commission Position of Indemnification for Securities Act

Liabilities

|

61

|

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this

prospectus. We have not, and the selling security holder

has not, authorized anyone to provide you with different

information. If anyone provides you with different

information, you should not rely on it. We are not, and

the selling security holder is not, making an offer to sell these

securities in any jurisdiction where the offer or sale is not

permitted. You should assume that the information

contained in this prospectus is accurate only as of the date on the

front cover of this prospectus. Our business, financial

condition, results of operations and prospects may have changed

since that date. In this prospectus, “Kraig”,

“Kraig Biocraft” “KBLB”, “the

Company”, “we”, “us” and

“our” refer to Kraig Biocraft Laboratories, Inc., a

Wyoming corporation, unless the context otherwise

requires.

PROSPECTUS SUMMARY

This

summary highlights selected information contained elsewhere in this

prospectus. This summary does not contain all the

information that you should consider before investing in the common

stock. You should carefully read the entire prospectus,

including “Risk Factors,” “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations” and the Condensed Financial Statements, before

making an investment decision

.

About Our Company

We are

Kraig Biocraft Laboratories, Inc., a corporation organized under

the laws of Wyoming on April 25, 2006. We were organized

to develop high strength, protein-based fibers, using recombinant

DNA technology, for commercial applications in both the specialty

fiber and technical textile industries. Specialty fibers

are engineered for specific uses that require exceptional strength,

heat resistance and/or chemical resistance. The

specialty fiber market is dominated by two synthetic fiber

products: aramid fibers and ultra-high molecular weight

polyethylene fiber. Examples of these synthetic fibers

include Kevlar® and Spectra®. The technical

textile industry involves products for both industrial and consumer

products, such as filtration fabrics, medical textiles (e.g.,

sutures and artificial ligaments), safety and protective clothing

and fabrics used in military and aerospace applications (e.g.,

high-strength composite materials).

We

entered into license agreements with University of Notre Dame and

the University of Wyoming that give us the use of certain

intellectual property for developing transgenic silkworms to

produce spider silk fibers in commercially viable

quantities. We are using these genetic engineering

technologies to develop fibers with greater strength, resiliency

and flexibility for use in our target markets, namely the specialty

fiber and technical textile industries.

We are

currently in the research and development stage of our development,

which is to develop a transgenic silkworm that can produce a

recombinant spider silk fiber by inserting genetic sequences into

ordinary silkworms using patented genetic engineering technology

under our license and collaboration agreements with the University

of Norte Dame and the University of Wyoming. The proceeds from

the offering, as described below, will be used to fund this

research and development and to increase the scale of our

production of genetically endeared silks. We anticipate this stage

in our development may be complete by December 31,

2017.

As of

the date of this prospectus, the Company has generated $31,858 from

our development activities. As of December 31, 2016, we

have an accumulated deficit since inception of

$23,385,979. As of December 31, 2016, we had $298,859 in

cash. Our cash balance is not sufficient to advance our

research and development obligations under our agreements with The

Universities of Norte Dame and Wyoming. Both

universities have indicated to us that they desire to continue

their respective collaborative efforts with us, with the

expectation that we will be able to raise capital under the Equity

Line Financing to fund our research and development

efforts. We have also received a going concern opinion

from our independent registered accounting firm in its audit report

dated March 22, 2017, for our fiscal year ended December 31,

2016.

The

proceeds from the equity line financing will be used for working

capital including employee salaries, the costs of our research and

development obligations under the agreement with the University of

Notre Dame, the costs related to our operation as a public company

(primarily, legal and accounting fees) as well as legal fees for

securing our intellectual property, rent and telecommunications

(phone, fax and Internet). Consequently, we believe that

it is highly likely that we will use all $7,500,000 of the proceeds

we expect to raise from the equity line financing under the Letter

Agreement. We believe the results of our research and

development efforts, if successful, will help increase our stock

price and, therefore, reduce the number of shares we will need to

put to Calm Seas in order to raise the full $7,500,000 in gross

proceeds we are seeking to raise under the equity line financing

under the Letter Agreement. In the event that we do not

have positive results from our research and development during the

24 month term of the equity line financing, we believe it will be

unlikely that we will raise the full $7,500,000 in gross proceeds

under the equity line financing. In the event that we

raise substantially less than the maximum proceeds that we expect

to raise under the equity line financing by the expiration of its

24 month term, we will seek to raise additional capital from other

investors.

Where You Can Find Us

Our

principal executive offices are located at 2723 South State St.,

Suite 150, Ann Arbor, Michigan. Our telephone number is

(734)619-8066.

The Offering

This

prospectus relates to the resale of up to 110,000,000 shares of our

Class A common stock that may be issued to Calm Seas pursuant to a

“put right” under the Letter Agreements, that we

entered into with Calm Seas. As of May 4, 2017, of the

110,000,000 shares of common stock initially registered, 38,824,427

shares of common stock remain available for

registration.

For the

purpose of determining the number of shares of common stock to be

offered by this prospectus, we have assumed that we will issue not

more than 110,000,000 shares pursuant to the exercise of our put

right under the Letter Agreement, although the number of shares

that we will actually issue pursuant to that put right may be

significantly less than 110,000,000, depending on the trading price

of our Class A common stock.

The

Letter Agreement with Calm Seas provides that over a 24 month

period we may put to Calm Seas up to an aggregate of $7,500,000 in

shares of our Class A common stock for a purchase price equal to

80% of the lowest price of our Class A common stock during the five

consecutive trading days immediately following the date we deliver

notice to Calm Seas of our election to put shares pursuant to the

Letter Agreement. We may only put shares twice during

each calendar month, unless Calm Seas accepts an additional put (as

described below). The dollar value that we will be

permitted to put each month pursuant to the Letter Agreement will

be the lesser of: (A) the product of (i) 200% of the average daily

volume in the US market of our Class A common stock for the ten

trading days prior to the date we deliver our put notice to Calm

Seas multiplied by (ii) the average of the daily closing prices for

the ten (10) trading days immediately preceding the date we deliver

our put notice to Calm Seas, or (B) $200,000 with regard to the

Letter Agreement. We will automatically withdraw our put

notice to Calm Seas if the lowest price used to determine the

purchase price of the put shares is not at least equal to

seventy-five percent (75%) of the average closing “bid”

price for our Class A common stock for the ten (10) trading days

prior to the date we deliver our put notice to Calm

Seas.

On the

seventh business day after we deliver our put notice to it, Calm

Seas will purchase the number of shares set forth in the put notice

at the dollar value set forth in the put notice by delivering such

amount to us by wire transfer.

Notwithstanding

the aggregate $200,000 ceiling for monthly puts under the Letter

Agreement, as described above, we may at any time request Calm Seas

to purchase shares in excess of such ceiling, either as a part of a

monthly put or as an additional put(s) during such

month. If Calm Seas, in its sole discretion, accepts

such request to purchase additional shares, then we may include the

put for additional shares in our monthly put request or submit an

additional put for such additional shares in accordance with the

procedure set forth above.

Calm

Seas has indicated that it will resell those shares in the open

market, resell our shares to other investors through negotiated

transactions, or hold our shares in its portfolio. This

prospectus covers the resale of our stock by Calm Seas either in

the open market or to other investors through negotiated

transactions. Calm Seas’ obligations under the Letter

Agreement are not transferrable and this registration statement

does not cover sales of our common stock by transferees of Calm

Seas.

Except

as described above, there are no other conditions that must be met

in order for Calm Seas to be obligated to purchase the shares set

forth in the put notice.

The

Letter Agreement will terminate when any of the following events

occur:

|

●

|

Calm

Seas has purchased an aggregate of $7,500,000 of our Class A common

stock; or

|

|

●

|

The

second anniversary of the effective date of the registration

statement covering the Equity Line Financing with Calm Seas under

the Letter Agreement.

|

As we

draw down on the Equity Line Financing, shares of our Class A

common stock will be sold into the market by Calm Seas. The

sale of these additional shares could cause our stock price to

decline. In turn, if the stock price declines and we issue

more puts, more shares will come into the market, which could cause

a further drop in the stock price. You should be aware that

there is an inverse relationship between the market price of our

Class A common stock and the number of shares to be issued under

the Equity Line Financing. If our stock price declines, we

will be required to issue a greater number of shares under the

Equity Line Financing. We have no obligation to utilize the

full amount available under the Equity Line Financing.

Terms of the Offering

|

Class A

common stock offered:

|

Up to

110,000,000 shares of Class A common stock, no par value, to be

offered for resale by Calm Seas.

|

|

|

|

|

Class A

common stock outstanding before this offering:

|

676,903,348 shares

|

|

|

|

|

Common

stock to be outstanding after this offering:

|

786,903,348

shares

|

|

|

|

|

Use of

proceeds:

|

We will

not receive any proceeds from the sale of the shares of Class A

common stock. However, we will receive proceeds from the Equity

Line Financing. See “Use of Proceeds”.

|

|

|

|

|

Risk

factors:

|

An

investment in our Class A common stock involves a high degree of

risk. See “Risk Factors” beginning on page 4 of

this prospectus.

|

|

|

|

|

OTC

Markets symbol:

|

“KBLB”

|

As

of the date of this filing there are 783,046,190 outstanding shares

of Class A common stock, which includes 71,175,573 issued share

under this registration. 38,824,427 shares of Class A common

stock remain available for registration under this

offering.

SUMMARY FINANCIAL DATA

The

following table provides summary financial statement data of Kraig

Biocraft Laboratories, Inc. The financial data have been

derived from our audited financial statements. The data set forth

below should be read in conjunction with “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations,” our financial statements and the related notes

included in this prospectus.

|

|

For

the Year

Ended

December

31,

2016

|

For

the Year

Ended

December

31,

2015

|

|

|

|

|

|

|

|

|

|

Revenue

|

$

31,858

|

$

--

|

|

|

|

|

|

Total Operating

Expenses

|

$

2,977,462

|

$

2,054,539

|

|

|

|

|

|

Loss from

Operations

|

$

(2,945,604

)

|

$

(2,054,539

)

|

|

|

|

|

|

Net

loss

|

$

(3,073,843

)

|

$

(2,133,793

)

|

|

|

|

|

|

Loss Per Share

– Basic and Diluted

|

$

(0.00

)

|

$

(0.00

)

|

|

|

|

|

|

BALANCE

SHEET DATA:

|

|

|

|

|

|

|

|

Cash

|

$

298,859

|

$

238,188

|

|

|

|

|

|

Total

assets

|

$

383,659

|

$

304,937

|

|

|

|

|

|

Total Current

liabilities – related party

|

$

2,230,910

|

$

1,732,040

|

|

|

|

|

|

Total Current

Liabilities

|

$

2,744,472

|

$

2,201,873

|

|

|

|

|

|

Stockholders’

Deficit

|

$

(2,360,813

)

|

$

(1,896,936

)

|

RISK FACTORS

An investment in our common stock involves a high degree of risk.

You should carefully consider the risks described below and the

other information in this prospectus before investing in our common

stock. If any of the following risks occur, our business, operating

results and financial condition could be seriously harmed. Please

note that throughout this prospectus, the words “we”,

“our” or “us” refer to the Company and its

subsidiary not to the selling stockholders.

Risk Related to Our Company

The report of the independent registered public accounting firm on

our 2016 and 2015 financial statements contains a going concern

qualification.

The

report of the independent registered public accounting firm

covering our financial statements for the years ended December 31,

2016 and December 31, 2015 stated that certain factors, including

that we have a working capital and shareholder deficit and raised

substantial doubt as to our ability to continue as a going

concern. Because we are not yet producing revenue, we

are dependent upon raising capital to continue our

business. If we are unable to raise capital, we may not

be able to continue as a going concern.

We may be unable to maintain an effective system of internal

controls and accurately report our financial results or prevent

fraud, which may cause our current and potential stockholders to

lose confidence in our financial reporting and adversely impact our

business and our ability to raise additional funds in the

future.

Effective

internal controls are necessary for us to provide reliable

financial statements and effectively prevent fraud. We

have no internal accounting staff. As we noted in our

annual report on Form 10-K for the year ended December 31, 2016, we

reported that our internal control over financial reporting are not

effective for the purposes for which it is intended because we had

material weaknesses, as described below. Though we have

taken some steps to address our material weaknesses in our internal

control over financial reporting, including education of management

of disclosure requirements and financial reporting

controls, we still have not eliminated the material weakness

in our internal controls over financial reporting. If we

cannot provide reliable financial statements or prevent fraud, our

operating results and our reputation could be harmed as a result,

causing stockholders and/or prospective investors to lose

confidence in management and making it more difficult for us to

raise additional capital in the future.

In our

“Management's Annual Report on Internal Control Over

Financial Reporting” that appeared in our annual report on

Form 10-K for the year ended December 31, 2016, we reported that

our internal control over financial reporting was not effective for

the purposes for which it is intended based on the following

material weaknesses:

|

●

|

Lack of internal audit function

. During 2016, the Company,

upon review of the independent auditors, made some adjustments to

its financial statements, including, adjusting salary amounts and

the related tax accruals, allocating the “related party

gain” to be donated capital and adding the liability due to

our attorney that should have been recorded. Management

believes that the foregoing is due to the fact that the Company

lacks qualified resources to perform the internal audit functions

properly and that the scope and effectiveness of the internal audit

function are yet to be developed. Specifically, the reporting

mechanism between the Company’s accounting personnel, the

Board of Directors and the CEO was not effective, therefore

resulting in the delay of recording and reporting.

|

|

|

|

|

●

●

|

No Segregation of Duties Ineffective controls over financial

reporting

: As of December 31, 2016, we had no full-time

employees with the requisite expertise in the key functional areas

of finance and accounting; since inception, we have retained

contract accountants to serve in that role on an as needed basis.

As a result, there is a lack of proper segregation of duties

necessary to insure that all transactions are accounted for

accurately and in a timely manner.

Lack of a functioning audit committee

: Due to a lack of a

majority of independent members and a lack of a majority of outside

directors on our board of directors, and no audit committee has

been elected, the oversight in the establishment and monitoring of

required internal controls and procedures is

inadequate.

Written Policies & Procedures

: Due to lack of written

policies and procedures for accounting and financial reporting, the

Company did not establish a formal process to close our books

monthly and account for all transactions.

|

As

reported in our most recent Annual Report, we had hired a payroll

service firm to manage all payroll functions including tax

withholdings. We will take the following remediation steps to help

address our material weaknesses in our internal control over

financial reporting:

|

|

1.

|

We will

continue to educate our management personnel to increase its

ability to comply with the disclosure requirements and financial

reporting controls;

|

|

|

2.

|

We will

increase management oversight of accounting and reporting functions

in the future; and

|

|

|

3.

|

As soon

as we can raise sufficient capital or our operations generate

sufficient cash flow, we will hire personnel to handle our

accounting and reporting functions.

|

We do

not expect to remediate the weaknesses in our internal controls

over financial reporting until the time when we start to

commercialize a recombinant fiber (and, therefore, may have

sufficient cash flow for hiring personnel to handle our accounting

and reporting functions).

We currently do not have any patent rights in the products we are

seeking to develop and we currently license the genetic sequences

and genetic engineering technology we need to develop our

products. If any third party challenges our claim to

intellectual property rights in the fiber products we are seeking

to develop or the intellectual property rights that we license, our

business may be materially harmed

We have

no patents or design patents on any of the fiber products we are

seeking to develop. It is possible that the fiber

products we are seeking to develop could be imitated or directly

manufactured and sold by a competitor. In addition, some

or all of our research, development ideas and proposed products may

be covered by patent rights held by some other

entity. In that event, we could incur devastating

liability and be forced to cease operations.

We

entered into intellectual property licensing agreements with Notre

Dame and the University of Wyoming. Pursuant to these

licensing agreements, we have obtained certain exclusive rights to

use intellectual property and genetic sequences owned by these

universities. However, we have no guarantee of the

viability of these intellectual property rights or the rights that

we have licensed do not infringe on the legal rights of third

parties. The intellectual property rights that we have

licensed could be challenged or voided or that the licensed

intellectual property is worthless and without

utility. We may also need to license additional

intellectual property from persons or entities in order to

successfully complete our research and development, and we cannot

be certain that we would be able to enter into a license agreement

with such persons or entities. In which event our

operations will be adversely affected and our prospects negatively

affected.

The 110,000,000 shares we are registering for resale hereunder may

not be enough to access the full $7,500,000 available under our

equity line agreement with Calm Seas Capital, LLC

We have

elected to register for resale 110 million shares of our Class A

Common Stock under our equity line agreement with Calm Seas. By

choosing to register this number of shares, we may not be able to

receive the full $7,500,000 available to us under the Calm Seas

agreement unless our stock price were to increase to at

approximately $0.068 per share from its price of $0.04 per share as

of the date of this Registration Statement. In the event

we are not able to receive the full $7,500,000 from Calm Seas, we

may have to seek capital from other sources to fund our operations

which may not be available to us.

Whether

our stock price will reach $0.068 is dependent on a number of

factors such as the progress of our business and commercialization

of our Monster Silk™ and whether sales of our Class A Common

Stock by Calm Seas after we put stock to them have the effect of

depressing our stock price below $0.068 even if there are positive

developments in our business.

Existing stockholders could experience substantial dilution upon

the issuance of Class A common stock pursuant to an equity line we

have with Calm Seas Capital.

Under

the Equity Line Financing set forth in the Letter Agreement with

Calm Seas Capital, we may put up to $200,000 of our Class A common

stock to Calm Seas per month. Notwithstanding the

$200,000 ceiling for monthly puts under the Letter Agreement, if

both we and Calm Seas agree, we may submit one or more additional

puts during any given month to the extent we need additional

capital for our operations and/or our product

development. When we exercise our put Calm Seas will

purchase such shares at a price per share equal to 80% of the

lowest price of our Class A common stock during the five

consecutive trading days immediately following the put date (as

defined on page 2 of this prospectus). Our equity line

with Calm Seas Capital contemplates our future possible issuance of

up to an aggregate 110,000,000 shares of our Class A common stock

as a result of this prospectus, subject to certain

restrictions. As of May 4, 2017, of the 110,000,000

shares of common stock initially registered, 38,824,427 shares of

common stock remain available for registration. Our existing

stockholders will be significantly diluted if the terms and

conditions of the equity line are satisfied, and we choose to

exercise our put rights to the fullest extent permitted and sell

all of the 110,000,000 shares of our common stock to Calm Seas

Capital. Additionally, if we are unable to raise $7,500,000 in

proceeds from the sale of the entire 110,000,000 shares to Calm

Seas Capital under the equity line financing, we will seek funding

from other capital sources. In such cases, we expect

that we would have to issue a significant number of additional

shares that would further dilute existing

shareholders.

We may not successfully manage any growth that we may

experience.

Our

future success will depend upon not only product development but

also on the expansion of our operations and the effective

management of any such growth, which will place a significant

strain on our management and on our administrative, operational,

and financial resources. To manage any such growth, we must expand

our facilities, augment our operational, financial and management

systems, and hire and train additional qualified personnel. If we

are unable to manage our growth effectively, our business would be

harmed as our growth could be adversely affected by such

mismanagement.

Our initial development of recombinant silk fiber from the

transgenic silkworm and other product development programs depend

upon third-party researchers who are outside our

control.

We

depend upon independent researchers and collaborators, such as

universities and their staff, to conduct our development of a

transgenic silkworm and recombinant silk polymers, such as spider

silk. Such researchers and collaborators perform

services under agreements with us. Such agreements are often

standard-form agreements typically not subject to extensive

negotiation. These researchers or collaborators are not

our employees, and in general we cannot control the amount or

timing of resources that they devote to our product development

programs. These researchers and collaborators may not assign

as great a priority to our programs or pursue them as diligently as

we would if we were undertaking such programs ourselves. If outside

collaborators fail to devote sufficient time and resources to our

transgenic silkworm development and our product development

programs, or if their performance is substandard, our introduction

of protein based fiber products will be delayed or may not result

at all. These researchers and collaborators may also

have relationships with other commercial entities, some of whom may

compete with us.

If conflicts arise with our collaborators, they may act in their

self-interests, which may be adverse to our interests.

Conflicts

may arise in our collaborations we have entered into or may enter

into due to one or more of the following:

|

●

|

disputes

with respect to payments that we believe are due under a

collaboration agreement;

|

|

●

|

disagreements

with respect to ownership of intellectual property

rights;

|

|

●

|

unwillingness

on the part of a collaborator to keep us informed regarding the

progress of its development and commercialization activities, or to

permit public disclosure of these activities;

|

|

●

|

delay

of a collaborator’s development or commercialization efforts

with respect to our product development; or

|

|

●

|

termination

or non-renewal of the collaboration.

|

In

addition, in our collaborations, we may be required to agree not to

conduct independently, or with any third party, any research that

is competitive with the research conducted under our

collaborations. Our collaborations may have the effect of limiting

the areas of research that we may pursue, either alone or with

others. Our collaborators, however, may be able to develop, either

alone or with others, products in related fields that are

competitive with the products or potential products that are the

subject of these collaborations.

If we lose the services of key management personnel, we may not be

able to execute our business strategy effectively.

Our

future success depends in a large part upon the continued service

of our founder and sole officer and director, Kim

Thompson. Mr. Thompson is critical to our overall

management as well as the development of our technology, our

culture and our strategic direction. We do not maintain a

key-person life insurance policy on Mr. Thompson. The

loss of Mr. Thompson would materially harm our

business.

As our business grows, we will need to hire highly skilled

personnel and, if we are unable to retain or motivate hire

additional qualified personnel, we may not be able to grow

effectively.

Our

performance will be largely dependent on the talents and efforts of

highly skilled individuals. Our future success depends on our

continuing ability to identify, hire, develop, motivate, and retain

highly skilled personnel for all areas of our company.

Despite the current economic conditions, competition in our

industry for qualified employees remains intense as the skills we

require in our employees are highly specialized. We

compete with companies in the biotechnology and pharmaceutical

industries that seek to retain scientists with genetic engineering

experience and expertise. Competition for qualified

individuals remains intense despite the current economic

conditions, which have somewhat softened demand for qualified

personnel. However, we expect that over the longer term we

will continue to face stiff competition and may not be able to

successfully recruit or retain such personnel. Attracting and

retaining qualified personnel will be critical to our

success.

If we are unable to establish sales and marketing capabilities or

enter into agreements with third parties to sell and market any

products we may develop, we may not be able to generate product

revenue.

We do

not currently have an organization for the sales, marketing and

distribution of any fiber products that we expect to

develop. In order to market any products that may be

developed, we must build our sales, marketing, managerial and other

non-technical capabilities or make arrangements with third parties

to perform these services. In addition, we have no experience in

developing, training or managing a sales force and will incur

substantial additional expenses in doing so. The cost of

establishing and maintaining a sales force may exceed its cost

effectiveness. Furthermore, we will compete with many

companies that currently have extensive and well-funded marketing

and sales operations. Our marketing and sales efforts

may be unable to compete successfully against these

companies. If we are unable to establish adequate sales,

marketing and distribution capabilities, whether independently or

with third parties, we may not be able to generate product revenue

and may not become profitable.

We may be unable to generate significant revenues and may never

become profitable.

The

Company did not have revenues in 2015 and generated $31,858 in

revenue in 2016, making it difficult to predict when we will

generate significant revenues or be profitable. We expect to incur

significant research and development costs for the foreseeable

future. We may not be able to successfully market fiber

products we produce in the future that will generate significant

revenues. In addition, any revenues that we may generate may

be insufficient for us to become profitable.

In

particular, potential investors should be aware that we have not

proven that we can:

|

●

|

raise

sufficient additional capital in the public and/or private markets

to continue the development of the transgenic silkworm or

demonstrate the ability to produce commercial volumes of

recombinant silk fibers;

|

|

●

|

develop

and manufacture specialty fibers achieve market

acceptance;

|

|

●

|

develop

and maintain relationships with key vendors that will be necessary

to optimize the market value of the fibers we develop;

|

|

●

|

maintain

relationships with strategic partners that will be necessary to

manufacture the fibers we develop or develop relationships with

potential strategic partners which may license or distribute fiber

products that we develop;

|

|

●

|

respond

effectively to competitive pressures; or

|

|

●

|

recruit

and build a management team to accomplish our business

plan.

|

If we

are unable to accomplish these goals, our business is unlikely to

succeed.

As a result of our limited operating history, we may not be able to

correctly estimate our future operating expenses, which could lead

to cash shortfalls.

We have

a limited operating history from which to evaluate our

business. The Company did not have revenues in 2015 and

generated $31,858 in revenue in 2016, making it difficult to

predict when we will generate significant revenues or be

profitable. Our failure to develop a transgenic silkworm

would have a material adverse effect on our ability to continue

operating. Accordingly, our prospects must be considered in

light of the risks, expenses, and difficulties frequently

encountered by companies in an early stage of development. We

may not be successful in addressing such risks, and the failure to

do so could have a material adverse effect on our business,

operating results and financial condition.

Because

of this limited operating history and because of the emerging

nature of our fiber product we are producing, our historical

financial data is of limited value in estimating future operating

expenses. Our budgeted expense levels are based in part on

our expectations concerning future revenues. However, our

ability to generate any revenues depends largely on the market

acceptance of the fibers we develop, which is difficult to forecast

accurately.

Our

operating results may fluctuate as a result of a number of factors,

many of which are outside of our control. For these reasons,

comparing our operating results on a period-to-period basis may not

be meaningful, and you should not rely on our past results as any

indication of our future performance. Our quarterly and

annual expenses are likely to increase substantially over the next

several years depending upon the level of fiber development

activities. Our operating results in future quarters may

fall below expectations. Any of these events could adversely

impact our business prospects and make it more difficult to raise

additional equity capital at an acceptable price per

share.

We have limited intellectual property protection in overseas

markets, which could affect our ability to grow our markets and

increase our revenue.

The

intellectual property that we licensed from Notre Dame and the

University of Wyoming is covered by a series of US patents and US

patent applications with limited or no international patent

protection. Overseas competitors could be using the same

technology that we have licensed, which would affect our ability to

expand our markets beyond the United States. We are

aware that laboratories and potential competitors overseas are

using the “piggyback” gene splicing technology for the

genetic modification of silkworm. Such limited overseas

intellectual property could affect our ability to introduce fiber

products in overseas markets or effectively compete in such

markets.

The patents underlying our license agreements could expire prior to

our commercializing our specialty fibers, which would result in the

loss of our competitive edge and could negatively impact our

revenues and results of operations.

The

patent rights that we license could expire before we are ready to

market or commercialize any fiber product, or while we are still in

research and development of proposed products. In which

event the patents would be worthless and would not protect us from

potential competitors who would then have low barriers to entry and

who would be in a position to compete more effectively with

us.

Our license agreements restrict us from developing products for

certain markets.

Some,

but not all, of the gene sequences that we have licensed from Notre

Dame and the University of Wyoming are covered by restrictions in

the licensing agreement which preclude their use by us for sporting

goods and medical applications.

Our management has no previous experience in developing, marketing

or selling recombinant fiber which may have a negative effect

on our ability to develop or sell our products.

Our

current management has no previous experience in developing,

marketing or selling recombinant fiber and the other products that

we intend to develop and market. Additionally, our

current management has no experience in the business of scientific

research and development, which is critical to our

success. The inexperience of our management may

negatively affect our ability to succeed in developing, marketing

and/or distributing our proposed products.

We are unprepared for technological changes in our industry, which

could result in our products being obsolete or replaced by better

technology

.

The

industry in which we participate

is subject to rapid business and

technological changes. The business, technology,

marketing, legal and regulatory changes that could occur may have a

material adverse impact on us. New inventions and

product innovations may make our proposed products

obsolete. Other researches may develop and patent

technologies which make our line of research

obsolete. We may not have the financial or technical

ability to keep up with its competitors.

Our business is based on unproven scientific research and makes our

business highly risky

.

We are

engaging in research and development of new recombinant silk

fibers. Due to the speculative nature of this scientific

research, our chances of success are speculative and we cannot be

certain that we will succeed in developing new fibers or that our

use of novel transgenic methods will be successful. An

investment in us, therefore, is highly speculative and

risky.

The fibers we develop could expose us to product liability claims

and government regulation, which could have a negative impact on

our results of operations

.

The

fibers we are seeking to develop may subject us to product

liability claims if widely used, including but not limited to

design defect, environmental hazards, quality control, and

durability of product. This potential liability is

increased by virtue of the fact that our products in development

may be used as protective and safety materials. There is

tremendous potential liability to any person who is injured by, or

while using, one of our products. As a manufacturer, we

may be strictly liable for any damage caused by our

products. This liability might not be covered by

insurance, or may exceed any coverage that we may

obtain.

Additionally,

our products, if successfully developed, will be produced by means

of genetic engineering. These transgenic methods may

carry inherent environmental risks and the production of the

products may therefore also be heavily regulated by the

government. We may face changes in governmental

regulation policies and practices which could have a significant

adverse effect on us and our ability to develop, produce and market

any products.

Our operations would be negatively affected by any dispute with our

partner Universities or by labor unrest (such as disputes, strikes

or lockouts) between such Universities and its academic

staff

.

We have

signed intellectual property, sponsored research and collaborative

research agreements with one or more universities. The

continued cooperation of university(s), as well as the cooperation

of other institutions and or universities is essential for our

success of the Company. In the event of a material dispute with the

university(s), such a dispute could create a cessation of

operations for a period of time that could be detrimental to our

operations and survival. Additionally, in the event of a

material dispute between such universities and its employees could

create a cessation of operations for period of time that could be

detrimental to our product development.

Unforeseen circumstances may require us to use the proceeds from

the Equity Line Financing in a manner not set forth in the Use of

Proceeds section of this prospectus

.

Management

intends to use the proceeds from this offering, in part, to pay off

some of unpaid salary we owe to our Chief Executive Officer (which

we have accounted for as an accrued expense and which amount bears

interest at the rate of three percent per annum and is due on

demand by our Chief Executive Officer) and accounts payable,

including contractual obligations associated with this

offering. However, results of our research and

development may not go as we hope and we may have to conduct

further research and development that we currently do not expect

that we will have to do. In such event, the funds used

for these purposes will require us to raise additional

capital.

Our competitors are larger competitors with greater financial

resources than we have and we may face increased competition due to

the low barriers of entry to our industry

.

We

compete directly with numerous other companies with similar product

lines and/or distribution that have extensive capital, resources,

market share, and brand recognition. There are few

barriers to entry on the industry in which we

compete. This creates the strong possibility of new

competitors emerging, and of others succeeding in developing the

same or similar fibers that we are trying to

develop. The effects of this increased competition may

be materially adverse to us and our stockholders.

We may face various governmental regulation, which could increase

our costs and lower our future profitability

.

Governmental

regulation regarding import/export, taxes, transgenic, scientific

research and university based research, biological research;

transgenic product manufacture and distribution, environmental

regulation and packaging requirements may be adverse to our

operations, research and development, revenues, and potential

profit. We are especially at risk from governmental

restriction and regulations related to the development of materials

by use of transgenic organisms. Federal and state

regulations impose strict regulation on the use, storage, and

transportation of such transgenic organisms. Such rules

impose severe penalties on us for any breach of regulations, for

any spill, release, or contamination caused while the substances

are under our direct or indirect ownership or

control. We are not aware of any such breach of

governmental regulation, or of any spill, release, or

contamination. If such a release, or other regulatory

breach does occur in the future, the resulting clean-up costs,

and/or fines and penalties, would cause a material negative effect

on the Company and its financial future. In that event,

investors could expect to lose their entire

investment.

Risks Related to Our Stock

We may need to raise additional capital by sales of our Class A

common stock, which may adversely affect the market price of our

Class A common stock and your rights in us may be

reduced.

We

expect to continue to incur product development and selling,

general and administrative costs, and in order to satisfy our

funding requirements, we will need to sell additional equity

securities, in transactions similar in size and scope to our Equity

Line Financing covered by this prospectus. Such

additional sales of equity securities may be subject to

registration rights. The sale or the proposed sale of

substantial amounts of our Class A common stock in the public

markets may adversely affect the market price of our Class A common

stock and our stock price may decline substantially. Our

stockholders may experience substantial dilution and a reduction in

the price that they are able to obtain upon sale of their shares.

Also, new equity securities issued may have greater rights,

preferences or privileges than our existing Class A common

stock.

There is no assurance of an established public trading

market.

A

regular trading market for our Class A common stock may not be

sustained in the future. FINRA has enacted changes that limit

quotation on the OTCQB to securities of issuers that are current in

their reports filed with the SEC. The OTCQB is an inter-dealer,

over-the-counter quotation medium that provides significantly less

liquidity than a listing on the NASDAQ Stock Markets or other

national securities exchange. Quotes for stocks included on the

OTCQB are not listed in the financial sections of newspapers as are

those for the NASDAQ Stock Market. Therefore, prices for securities

traded solely on the OTCQB may be difficult to obtain and holders

of Class A common stock may be unable to resell their securities at

or near their original offering price or at any price. Market

prices for our Class A common stock will be influenced by a number

of factors, including:

|

●

|

the

issuance of new equity securities pursuant to a future

offering;

|

|

●

|

competitive

developments;

|

|

●

|

variations

in quarterly operating results;

|

|

●

|

change

in financial estimates by securities analysts;

|

|

●

|

the

depth and liquidity of the market for our Class A common

stock;

|

|

●

|

investor

perceptions of our company and the technologies industries

generally; and

|

|

●

|

general

economic and other national conditions.

|

Our Class A common stock is considered “a penny stock”

and, as a result, it may be difficult to trade a significant number

of shares of our Class A common stock.

The

Securities and Exchange Commission (“SEC”) has adopted

regulations that generally define “penny stock” to be

an equity security that has a market price of less than $5.00 per

share, subject to specific exemptions. Since our Class A common

stock has been eligible for quotation on the OTCQB, the market

price of our Class A common stock has been less than $5.00 per

share. As a result of our prior private placements, we will

have increased the number of shares outstanding by almost

ten-fold. Consequently, it is likely that the market price

for our Class A common stock will remain less than $5.00 per share

for the foreseeable future and therefore may be a “penny

stock” according to SEC rules. This designation requires any

broker or dealer selling these securities to disclose certain

information concerning the transaction, obtain a written agreement

from the purchaser and determine that the purchaser is reasonably

suitable to purchase the securities. These rules may restrict

the ability of brokers or dealers to sell our Class A common stock

and may affect the ability of investors hereunder to sell their

shares. In addition, because our Class A common stock is traded on

the OTC Markets, investors may find it difficult to obtain accurate

quotations of the stock and may experience a lack of buyers to

purchase such stock or a lack of market makers to support the stock

price.

We do not intend to pay dividends.

We have

never declared or paid any cash dividends on our securities. We

currently intend to retain our earnings for funding growth and,

therefore, do not expect to pay any dividends in the foreseeable

future.

Risk Factors Related to the Equity Line Financing and this

Offering

We are registering an aggregate of 110,000,000 shares of Class A

Common Stock to be issued under the Equity Line

Financing. The sale of such shares could depress the

market price of our Class A common stock.

We are

registering an aggregate of 110,000,000 shares of our Class A

common stock under the registration statement of which this

prospectus forms a part for issuance pursuant to the Equity Line

Financing. The sale of these shares into the public market by Calm

Seas could depress the market price of our common stock. As of

May, 2017, of the 110,000,000 shares of common stock initially

registered, 38,824,427 shares of common stock remain available for

registration. As of May 4, 2017there were 783,046,190 shares

of our common stock issued and outstanding.

We may not have access to the full amount under the Equity

Line.

As of

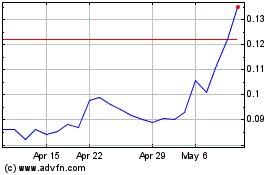

May 4, 2017, the closing market price of our common stock was

$0.07. There is no assurance that the market price of our Class A

common stock will increase substantially in the near future. The

entire commitment under the Equity Line Financing is $7,500,000 as

of the date of this prospectus. We would need to

maintain the market price of our Class A common stock at

approximately $0.172 in order to have access to the full amount

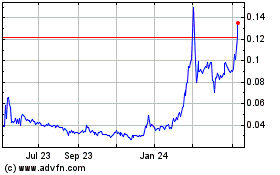

under the Equity Line Financing. Since January 1,

2012, the lowest and the highest prices at which our Class A common

stock has been trading were $0.017 and $0.13 per share,

respectively. We expect that, initially, the resale by Calm

Seas Capital of the shares of our Class A common stock that we will

sell to them under our Equity Line Financing will cause our stock

to decrease. However, if we are able to report positive

developments in our research and development efforts, we expect

that such announcements will cause our stock price to increase

sufficiently to a price per share above the price we need to allow

us to obtain $7,500,000 gross proceeds under the Equity Line

Financing. If we achieve our research and development

goals, we expect that the announcement of such achievements will

have a significant positive impact on the price of our Class A

common stock. Technology research and development is

very risky. We cannot be certain that we will achieve

our research and development goals. Any setbacks in our

research and development activities may cause our stock price to

drop, in which event we would probably not be able to raise

$7,500,000 under our Equity Line Financing. In the event

that we raise substantially less than the maximum proceeds we

expect to raise under the Equity Line Financing by the expiration

of their respective terms, we will seek to raise funds from other

capital sources. Alternatively, if our research yields

some promising or positive results, we may seek a corporate partner

in a joint venture or licensing arrangement in which we would seek

to negotiation an upfront licensing fee and/or capital investment

from such corporate partner. We have not yet

identified any corporate partners for any such joint venture or

licensing arrangement.

Calm Seas will pay less than the then-prevailing market price for

our Class A common stock.

The

Class A common stock to be issued to Calm Seas pursuant to the

Letter Agreement will be purchased at a twenty percent discount to

the lowest price of our Class A common stock during the five

consecutive trading days immediately following the date we deliver

to Calm Seas a notice of our election to put shares to it pursuant

to the Letter Agreement. Calm Seas has a financial incentive to

sell our Class A common stock immediately upon receiving the shares

to realize the profit equal to the difference between the

discounted price and the market price. If Calm Seas sells the

shares, the price of our Class A common stock could decrease. If

our stock price decreases, Calm Seas may have a further incentive

to sell the shares of our Class A common stock that it holds. These

sales may have a further impact on our stock price.

There may not be sufficient trading volume in our Class A common

stock to permit us to generate adequate funds from the exercise of

our put.

The

Letter Agreement provides that the dollar value that we will be

permitted to put to Calm Seas at each drawdown will be the lesser

of: (A) 200% of the average daily volume in the OTCQB of the Class

A common stock for the ten trading days prior to the date we

deliver to Calm Seas a notice of our put, multiplied by the average

of the ten daily closing prices immediately preceding the date we

deliver a put notice to Calm Seas, or (B) $100,000.

We will automatically

withdraw our put notice to Calm Seas if the lowest price used to

determine the purchase price of the put shares is not at least

equal to seventy-five percent (75%) of the average closing bid

price for our Class A common stock for the ten (10) trading days

prior to the put date. If the average daily trading

volume in our Class A common stock is too low, it is possible that

we would exercise a put for less than $100,000, which may not

provide adequate funding for our planned operations.

The selling shareholder may engage in hedging transactions, other

than short sales, which may result in broker-dealers or other

financial institutions engaging in short sales for their own

account and not for the benefit of the selling security holder,

which may cause a steep decline of our share price.

In

connection with the distribution of the Class A common stock or

otherwise, the selling shareholder may enter into hedging

transactions, other than short sales, with broker-dealers or other

financial institutions. In connection with such hedging

transactions, broker-dealers or other financial institutions may,

for their own account and not for the benefit of Calm Seas

Capital, engage in short sales of shares in the course of

hedging the positions they assume with the selling

shareholder. If there are significant short sales of our

stock by such broker-dealers or other financial institutions, the

price decline that would result from this activity will cause our

share price to decline which in turn may cause long holders of our

stock to sell their shares thereby contributing to sales of stock

in the market. If there is an imbalance on the sell side

of the market our stock the price will decline. It is not possible

to predict if the circumstances where by a short sales could

materialize or to what our share price could drop. In some

companies that have been subjected to short sales their stock price

has dropped to near zero. We cannot provide any assurances that

this situation will not happen to us.

Shares eligible for future sale by our current shareholders may

adversely affect our stock price.

Sales

of substantial amounts of Class A common stock, including shares

issued upon the exercise of outstanding options and warrants, under

Securities and Exchange Commission Rule 144 or otherwise could

adversely affect the prevailing market price of our common stock

and could impair our ability to raise capital at that time through

the sale of our securities.

If we fail to remain current on our reporting requirements, we

could be removed from the OTCQB, which would limit the ability of

Broker-Dealers to sell our securities and the ability of

shareholders to sell their securities in the secondary

market.

Companies

trading on the OTCQB, such as Kraig Biocraft Laboratories, must be

current in their reports under Section 13 of the Exchange Act, in

order to maintain price quotation privileges on the OTCQB. If

we fail to remain current on our reporting requirements, we could

be removed from the OTCQB. As a result, the market liquidity

for our securities could be adversely affected by limiting the

ability of broker-dealers to sell our securities and the ability of

shareholders to sell their securities in the secondary

market.

USE OF PROCEEDS

We will

not receive any proceeds from the sale of common stock offered by

Calm Seas. However, we will receive proceeds from the sale of

our common stock to Calm Seas pursuant to the put right under the

Letter Agreement. We intend to use the proceeds from our exercise

of the put options pursuant to the Letter Agreement for working

capital.

The

proceeds from the Equity Line Financing will be used for working

capital including employee salaries, the costs of our research and

development obligations under the agreement with the University of

Notre Dame, the cost of increasing our production, the costs

relating to commercializing our products, the costs related to

our operation as a public company (primarily, legal and accounting

fees) as well legal fees for securing our intellectual property,

rent and telecommunications (phone, fax and

Internet). Consequently, we believe that it is highly

likely that we will use all $7,500,000 of the proceeds we expect to

raise from the equity line financing. We also expect to

be able to raise the full $7,500,000 from the Equity Line

Financing. We believe that positive results of our

research and development efforts under our arrangement with the

University of Notre Dame will help increase our stock price and,

therefore, reduce the number of shares we will need to put to Calm

Seas in order to raise the full $7,500,000 in gross proceeds we are

seeking to raise under the equity line financing.

In the

event we are unable to raise the full $7,500,000 from the equity

line financing, we would use the proceeds in the following

priority: (i) research and development expenses, (ii) employee

salaries, cost of benefits and payroll taxes, (iii) rent and

telecommunications, (iv) legal expenses (both SEC and intellectual

property) and accounting expenses, press release and EDGAR filing

services and transfer agent expenses, (v) postage/shipping, office

equipment and office supplies, (vi) auto and travel expenses, (vii)

increasing production and commercialization of our products, (viii)

payments for a portion of the amount owed by the Company to its CEO

for the transfer of intellectual property to the Company, which has

been recorded in the financial statements as royalty payments due

to a related party, and (ix) reserves to cover expenses due to

contingent events.

In the

event that we raise substantially less than the maximum proceeds we

expect to raise under the equity line financing by the expiration

of their respective terms, we will seek to raise additional capital

from other investors.

SELLING SHAREHOLDER

Other than as described below, none of the Selling Stockholders nor

any of their affiliates has held any position or office with, been

employed by or otherwise has had any material relationship with us

or our affiliates during the three years prior to the date of this

prospectus. Unless otherwise indicated below, none of the Selling

Stockholders are broker-dealers or affiliates of a broker-dealer

within the meaning of Section 3 of the Securities Exchange

Act.

This prospectus relates to the offering and sale, from time to

time, of up to 110,000,000 shares of our common stock held by the

stockholders named in the table below. As of

May 4,

2017

, of the 110,000,000 shares of

common stock initially registered, 38,824,427 shares of common

stock remain available for registration.

The

table below lists the selling stockholders and other information

regarding the beneficial ownership (as determined under Section

13(d) of the Securities Exchange Act of 1934, as amended, and the

rules and regulations thereunder) of our common stock with respect

to the securities held by each of the selling stockholders. The

second column lists the number of shares of common stock

beneficially owned by each of the selling stockholders as of May 4,

2017. The third column lists the shares of common stock being

offered by this prospectus by the selling stockholders and does not

take into account any ownership caps or limitations. The fourth

column assumes the sale of all of the shares offered by the selling

stockholders pursuant to this prospectus. However, the selling

stockholders may sell all, some or none of their shares in this

offering. See “Plan of Distribution.”

We estimate that our costs and expenses of registering the shares

listed herein for resale will be approximately

$

23,873.91.

On

September 14, 2009, we entered into the Amended Letter Agreement

with Calm Seas to raise up to $1,000,000 through an equity line

financing. On June 28, 2011 we entered into the Letter

Agreement with Calm Seas to raise up to $1,500,000 through an

equity line financing. On April 30, 2013, we entered

into the Letter Agreement with Calm Seas to raise up to $2,500,000

through an equity line financing. On October 2, 2014, we entered

into the Letter Agreement with Calm Seas to raise up to $7,500,000

through an equity line financing. Except as described above, to our

knowledge Calm Seas has not had a material relationship with us

during the last three years, other than as an owner of our common

stock or other securities.

During

the fiscal year 2016, the Company exercised a total of nine puts

under the Calm Seas equity line for an aggregate amount of

$1,025,000. For seven puts, the Company’s stock price

declined in the five-week price declined by approximately 3.6% to

34.9%. For two puts, the Company’s stock price

increased in the five-week period by approximately 5.1% to

65%.

During

fiscal year 2015, the Company exercised a total of seven puts under

the Calm Seas equity line for an aggregate amount of $750,000 and

the Company’s stock price in year 2015 ranged from $0.024 to

$0.052. For the seven puts, the Company’s stock price

declined in the five-week price declined by approximately 8.2% to

40.3%.

During

fiscal year 2014, the Company exercised a total of ten puts under

the Calm Seas equity line for an aggregate amount of $1,150,000 and

the Company’s stock price in year 2014 ranged from $0.037 to

$0.067. Of the ten puts, the Company’s stock price remained

stable in the five-week period following one put, our stock price

declined by approximately 2.6% to 19.8% in the five-week period

following five puts, and our stock price increased by approximately

1.2% to 9.1% during the five-week period following four

puts.

During

fiscal year 2013, the Company exercised a total of twelve puts

under the Calm Seas equity line for an aggregate amount of