Current Report Filing (8-k)

May 04 2017 - 4:18PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant To Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 28, 2017

Gevo, Inc.

(Exact name

of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-35073

|

|

87-0747704

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

345 Inverness Drive South, Building C, Suite 301

Englewood, CO 80112

(Address of principal executive offices)(Zip Code)

Registrant’s telephone number, including area code: (303)

858-8358

N/A

(Former name or

former address, if changed since last report)

Check the appropriate box below

if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of

this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On April 28, 2017, Gevo, Inc. (the

“Company”) entered into a Supply Agreement (the “Agreement”) with HCS Holding GmbH (“HCS”), pursuant to which the Company agreed to supply isooctane to HCS under a five-year offtake agreement that will be completed in

two phases. In the first phase of the Agreement, HCS will purchase isooctane produced at the Company’s demonstration hydrocarbons plant located in Silsbee, Texas (the “Demo Facility”), commencing in May 2017, with fixed pricing

over the first phase of the Agreement. In the second phase of the Agreement, HCS has agreed to purchase approximately 300,000 gallons of isooctane per year, with an option to purchase approximately 100,000 additional gallons of isooctane per year,

with pricing based on a formula intended to provide the Company with a fixed margin. The Company expects to supply the isooctane under the second phase from its first commercial hydrocarbons facility, which is expected to be built at the

Company’s current isobutanol production facility located in Luverne, Minnesota (the “Luverne Facility”). There is no assurance that the Company will be able to finance and successfully complete the build out of a commercial

hydrocarbons facility.

The first phase of the Agreement will commence in May 2017 and will expire at the earlier of (i) the commencement of shipping

of isooctane from the Luverne Facility (“Luverne Shipping Date”), or (ii) the shutdown of operations at the Demo Facility, but in each case no longer than the fifth anniversary of the Agreement. The second phase of the Agreement will

commence on the Luverne Shipping Date and will expire on the fifth anniversary of such Luverne Shipping Date.

The parties agreed to mutual termination

rights under the Agreement under certain circumstances, including the material breach of the Agreement or insolvency of the other party. The Agreement also contains customary representations, warranties, covenants and confidentiality provisions, and

also contains mutual indemnification obligations.

The foregoing description of the Supply Agreement does not purport to be complete and is subject to, and

qualified in its entirety by, the full text of such agreement, a copy of which is attached hereto as Exhibit 10.1 to this Current Report

on Form 8-K, and

is incorporated herein by

reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

10.1†

|

|

Supply Agreement, effective May 15, 2017, by and between Gevo, Inc. and HCS Holding GmbH.

|

|

†

|

Certain portions of the exhibit have been omitted pursuant to a confidential treatment request. Omitted information has been filed separately with the SEC.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

GEVO, INC.

|

|

|

|

|

|

|

Dated: May 4, 2017

|

|

|

|

By:

|

|

/s/ Geoffrey T. Williams, Jr.

|

|

|

|

|

|

|

|

Geoffrey T. Williams, Jr.

|

|

|

|

|

|

|

|

General Counsel and Secretary

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

10.1†

|

|

Supply Agreement, effective May 15, 2017, by and between Gevo, Inc. and HCS Holding GmbH.

|

|

†

|

Certain portions of the exhibit have been omitted pursuant to a confidential treatment request. Omitted information has been filed separately with the SEC.

|

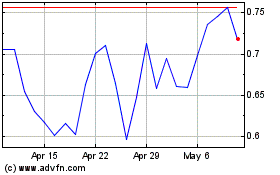

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

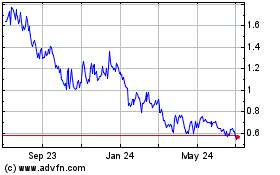

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Apr 2023 to Apr 2024