Avinger, Inc. (NASDAQ:AVGR) (the “Company”), a leading developer of

innovative treatments for peripheral artery disease (“PAD”), today

reported results for the first quarter ended March 31, 2017.

First Quarter and Recent

Highlights

- Announced an organizational restructuring, which is expected to

reduce net cash use to approximately $7 million per quarter by the

third quarter of 2017, a reduction of 48% from the average

quarterly cash use for 2016

- Revenue of $3.5 million, a 23% decrease compared to the first

quarter of 2016

- Added five Lumivascular™ accounts, expanding the installed base

of the Company's Lumivascular platform to 161 accounts

- Presented positive interim two-year clinical data from the

pivotal VISION study for the Company’s Lumivascular technology,

with the complete data set scheduled for presentation at the New

Cardiovascular Horizons (NCVH) annual conference on May 31,

2017

- Received FDA approval to proceed with an in-stent restenosis

(ISR) pivotal study for Pantheris under an investigational device

exemption (IDE) designation

“We are pleased with how our organization has

responded following our recent restructuring, and are making good

progress on our core strategic initiatives,” said Jeff Soinski,

Avinger’s president and CEO. “Our sales force is focused on driving

utilization in our installed base to improve productivity in the

near term and maintain a strong commercial presence in advance of

our new product offerings. Our R&D and operations teams

continue to implement improvements to our current Pantheris

products and are rapidly advancing our two new Pantheris offerings,

Pantheris 3.0, our next generation atherectomy catheter, and a

lower-profile Pantheris device, toward 510(k) filings later this

year. These two new product offerings are expected to meaningfully

improve product reliability and usability and significantly expand

our addressable market, as we re-position the Company for growth in

2018.

“In addition, we have recently received FDA

approval of our IDE application for an in-stent restenosis trial

for Pantheris. In-stent restenosis is especially challenging for

physicians to treat, and we believe that Pantheris will prove to be

an important new therapy in a segment estimated to represent

approximately 20% of PAD procedures in the U.S. We expect to begin

patient enrollment in the third quarter of this year.”

First Quarter 2017 Financial

ResultsTotal revenue was $3.5 million for the first

quarter ended March 31, 2017, a 23% decrease from the first quarter

of 2016 and a 25% decrease from the fourth quarter of 2016. Revenue

from disposable devices was $2.9 million for the first quarter of

2017, a 12% decrease compared to the first quarter of 2016 and a

22% decrease from the fourth quarter of 2016. Revenue related to

Lightbox imaging consoles was $0.6 million, a 50% decrease compared

to the first quarter of 2016 and a 40% decrease from the fourth

quarter of 2016.

Gross margin for the first quarter of 2017 was a

loss of 17%, down from 26% in the comparable quarter of 2016 and

down from 21% in the fourth quarter of 2016. The decreased gross

margin was primarily attributable to $2.1 million in charges for

excess, obsolete and scrapped inventories. Excluding these

non-recurring expenses would have resulted in a gross margin of

approximately 44%.

Operating expenses for the first quarter of 2017

were $13.2 million, compared to $16.2 million in the first quarter

of 2016. This decrease was primarily attributable to higher sales

and marketing expenses in 2016 as the Company expanded its

commercial organization in conjunction with the commercial launch

of Pantheris. Because the Company’s restructuring activities

occurred after the end of the first quarter, expenses related

thereto will be recognized during the second quarter of 2017.

Loss from operations for the first quarter of 2017

was $13.8 million, compared to $15.0 million for the first quarter

of 2016, and net loss for the first quarter of 2017 was $15.3

million, compared to $16.2 million for the first quarter of 2016.

Loss per share for the first quarter of 2017 was $0.64, compared to

$1.28 for the first quarter of 2016. The decreased loss per share

includes the impact of the issuance of 9.9 million shares in the

Company’s follow-on public offering, which closed on August 16,

2016, and 1.1 million shares issued throughout 2016 under the

Company’s at-the-market (“ATM”) program.

Adjusted EBITDA, a non-GAAP measure, was a loss of

$11.9 million for the first quarter of 2017, compared to a loss of

$12.7 million for the first quarter of 2016.

Cash and cash equivalents totaled $23.0 million as

of March 31, 2017, compared to $36.1 million as of December 31,

2016. Based on the Company’s recent organizational restructuring

and other expense reduction measures, the Company expects cash

utilization to decrease to approximately $7 million per quarter by

the third quarter of 2017, compared to an average of $13.5 million

per quarter in 2016 and $13.1 million in the first quarter of

2017.

Conference Call Avinger will hold

a conference call today, May 4, 2017 at 1:30pm PT/4:30pm ET to

discuss its first quarter 2017 financial results. Individuals may

listen to the call by dialing (844) 776-7820 for domestic callers

or (661) 378-9536 for international callers and referencing

Conference ID: 14503879. To listen to a live webcast, please visit

the investor relations section of Avinger's website at:

www.avinger.com.

A replay of the call will be available beginning

May 4, 2017 at 4:30pm PT/7:30pm ET through 4:30pm PT/7:30pm ET on

May 5, 2017. To access the replay, dial (855) 859-2056 or (404)

537-3406 and reference Conference ID: 14503879. The webcast will

also be available on Avinger's website for one year following the

completion of the call.

About Avinger, Inc. Avinger, Inc.

is a commercial-stage medical device company that designs,

manufactures and sells image-guided, catheter-based systems for the

treatment of patients with peripheral artery disease (PAD). PAD is

characterized by a build-up of plaque in the arteries that supply

blood to the legs and feet. The Company’s mission is to

dramatically improve the treatment of vascular disease through the

introduction of products based on its Lumivascular platform, the

only intravascular image-guided system of therapeutic catheters

available in this market. Avinger’s current Lumivascular products

include the Lightbox imaging console, the Ocelot family of

catheters, which are designed to penetrate total arterial

blockages, known as chronic total occlusions, or CTOs, and

Pantheris, the first-ever image-guided atherectomy device, designed

to precisely remove arterial plaque in PAD patients. For more

information, please visit www.avinger.com.

Forward-Looking StatementsThis

news release contains forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934 and the Private Securities

Litigation Reform Act of 1995. These forward-looking statements

include statements regarding the expected impact of the Company’s

recent organizational restructuring and other expense reduction

measures, expectations regarding future 510(k) filings for new

product offerings, the commercial introduction of new versions of

Pantheris, the effect of these products on reliability and

usability and the size of our addressable market, the future

availability and presentation of clinical data, the timing of

enrollment in future clinical studies and financial and operating

guidance for 2017. Such statements are based on current assumptions

that involve risks and uncertainties that could cause actual

outcomes and results to differ materially. These risks and

uncertainties, many of which are beyond our control, include our

dependency on a limited number of products; our ability to

demonstrate the benefits of our Lumivascular platform; the resource

requirements related to Pantheris; the outcome of clinical trial

results; potential exposure to third-party product liability and

intellectual property litigation; lack of long-term data

demonstrating the safety and efficacy of our Lumivascular platform

products; reliance on third-party vendors; dependency on physician

adoption; reliance on key personnel; and requirements to obtain

regulatory approval to commercialize our products; as well as the

other risks described in the section entitled “Risk Factors” and

elsewhere in our annual Form 10-K filing made with the Securities

and Exchange Commission on March 15, 2017. These forward-looking

statements speak only as of the date hereof and should not be

unduly relied upon. Avinger disclaims any obligation to update

these forward-looking statements.

Non-GAAP Financial Measures

Avinger has provided in this press release financial information

that has not been prepared in accordance with generally accepted

accounting principles in the United States (GAAP). The Company uses

these non-GAAP financial measures internally in analyzing its

financial results and believes that the use of these non-GAAP

financial measures is useful to investors as an additional tool to

evaluate ongoing operating results and trends and in comparing the

Company’s financial results with other companies in its industry,

many of which present similar non-GAAP financial measures.

The presentation of these non-GAAP financial

measures are not meant to be considered in isolation or as a

substitute for comparable GAAP financial measures, and should be

read only in conjunction with the Company’s financial statements

prepared in accordance with GAAP. A reconciliation of the Company’s

non-GAAP financial measures to their most directly comparable GAAP

measures has been provided in the financial statement tables

included in this press release, and investors are encouraged to

review these reconciliations.

Adjusted EBITDA. Avinger defines Adjusted EBITDA as

Loss from Operations plus Stock-based Compensation expense plus

Depreciation and Amortization expense.

Investors are cautioned that there are a number of

limitations associated with the use of non-GAAP financial measures

as analytical tools. Furthermore, these non-GAAP financial measures

are not based on any standardized methodology prescribed by GAAP,

and the components that Avinger excludes in its calculation of

non-GAAP financial measures may differ from the components that its

peer companies exclude when they report their non-GAAP results of

operations. Avinger compensates for these limitations by providing

specific information regarding the GAAP amounts excluded from these

non-GAAP financial measures. In the future, the Company may also

exclude non-recurring expenses and other expenses that do not

reflect the Company’s core business operating results.

| Avinger, Inc. |

| Statements of Operations Data |

| (in thousands, except per share

data) |

| (unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

March 31, |

| |

|

|

|

2017 |

|

2016 |

|

Revenues |

|

$ |

3,491 |

|

|

$ |

4,539 |

|

| Cost of

revenues |

|

|

4,075 |

|

|

|

3,360 |

|

| |

Gross

profit |

|

|

(584 |

) |

|

|

1,179 |

|

| |

|

|

|

|

-17 |

% |

|

|

26 |

% |

| Operating

expenses: |

|

|

|

|

|

|

|

|

| |

Research and development |

|

|

3,923 |

|

|

|

4,047 |

|

| |

Selling, general and administrative |

|

|

9,318 |

|

|

|

12,161 |

|

| |

|

Total

operating expenses |

|

|

13,241 |

|

|

|

16,208 |

|

| Loss from

operations |

|

|

(13,825 |

) |

|

|

(15,029 |

) |

| |

|

|

|

|

|

|

|

|

|

|

| Interest

income |

|

|

32 |

|

|

|

33 |

|

| Interest

expense |

|

|

(1,550 |

) |

|

|

(1,172 |

) |

| Other

income (expense), net |

|

|

3 |

|

|

|

1 |

|

| Net loss

and comprehensive loss |

|

$ |

(15,340 |

) |

|

$ |

(16,167 |

) |

| |

|

|

|

|

|

|

|

|

|

|

| Net loss

per share, basic and diluted |

|

$ |

(0.64 |

) |

|

$ |

(1.28 |

) |

| |

|

|

|

|

|

|

|

|

|

|

| Weighted

average common shares used to |

|

|

|

|

|

|

|

|

| |

compute net

loss per share, basic and diluted |

|

|

23,820 |

|

|

|

12,669 |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Avinger, Inc. |

|

| Balance Sheets Data |

|

| (in thousands) |

|

| (unaudited) |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

March

31, |

|

December

31, |

|

| |

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

Assets |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

| |

|

Cash and

cash equivalents |

|

$ |

23,034 |

|

|

$ |

36,096 |

|

|

| |

|

Accounts

receivable, net |

|

|

2,089 |

|

|

|

3,570 |

|

|

| |

|

Inventories |

|

|

8,352 |

|

|

|

8,462 |

|

|

| |

|

Prepaid

expenses and other current assets |

|

|

1,359 |

|

|

|

662 |

|

|

| |

|

Total

current assets |

|

|

34,834 |

|

|

|

48,790 |

|

|

| |

|

|

|

|

|

|

|

| Property and equipment, net |

|

|

4,175 |

|

|

|

4,555 |

|

|

| Other assets |

|

|

211 |

|

|

|

212 |

|

|

| |

|

Total

assets |

|

$ |

39,220 |

|

|

$ |

53,557 |

|

|

| |

|

|

|

|

|

|

|

|

Liabilities and stockholders’ equity

(deficit) |

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

| |

|

Accounts

payable |

|

$ |

1,161 |

|

|

$ |

1,607 |

|

|

| |

|

Accrued

compensation |

|

|

2,188 |

|

|

|

2,807 |

|

|

| |

|

Accrued

expenses and other current liabilities |

|

|

3,053 |

|

|

|

3,067 |

|

|

| |

|

Borrowings, current portion |

|

|

41,882 |

|

|

|

41,289 |

|

|

| |

|

Total

current liabilities |

|

|

48,284 |

|

|

|

48,770 |

|

|

| |

|

|

|

|

|

|

|

| Other long-term liabilities |

|

|

257 |

|

|

|

546 |

|

|

| |

|

Total

liabilities |

|

|

48,541 |

|

|

|

49,316 |

|

|

| |

|

|

|

|

|

|

|

|

Stockholders’ equity (deficit): |

|

|

|

|

|

| |

Preferred

stock |

|

|

- |

|

|

|

- |

|

|

| |

Common

stock |

|

|

24 |

|

|

|

24 |

|

|

| |

Additional

paid-in capital |

|

|

258,590 |

|

|

|

256,606 |

|

|

| |

Accumulated

deficit |

|

|

(267,935 |

) |

|

|

(252,389 |

) |

|

| |

|

Total stockholders’

equity (deficit) |

|

|

(9,321 |

) |

|

|

4,241 |

|

|

| |

|

Total liabilities and

stockholders’ equity (deficit) |

|

$ |

39,220 |

|

|

$ |

53,557 |

|

|

| |

|

|

|

|

|

|

|

| Avinger, Inc. |

| Adjusted EBITDA |

| (in thousands) |

| (unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

March 31, |

| |

|

|

|

|

2017 |

|

|

|

2016 |

|

| Loss from

operations |

$ |

(13,825 |

) |

|

$ |

(15,029 |

) |

| Add:

Stock-based compensation |

|

1,542 |

|

|

|

1,978 |

|

| Add:

Depreciation and amortization |

|

428 |

|

|

|

336 |

|

| |

Adjusted

EBITDA |

$ |

(11,855 |

) |

|

$ |

(12,715 |

) |

| |

|

|

INVESTOR CONTACT

Matt Ferguson

Avinger, Inc.

(650) 241-7917

ir@avinger.com

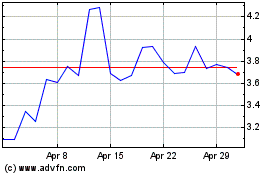

Avinger (NASDAQ:AVGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

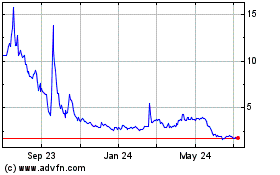

Avinger (NASDAQ:AVGR)

Historical Stock Chart

From Apr 2023 to Apr 2024