BioScrip Reports First Quarter 2017 Financial Results

May 04 2017 - 8:00AM

BioScrip, Inc. (NASDAQ:BIOS) (“BioScrip” or the “Company”) today

announced its first quarter 2017 financial results. For the first

quarter, the Company reported revenue from continuing operations of

$217.8 million, net loss from continuing operations of $19.0

million, and adjusted EBITDA of $5.2 million, in line with the

Company’s plan. For the full-year 2017, the Company continues to

expect to achieve adjusted EBITDA in the range of $45.0 million to

$55.0 million.

First Quarter 2017 Results

- Net revenue was $217.8 million, reflecting a core revenue mix

increase to 72%, up from 60% in the first quarter of 2016, and 70%

in the fourth quarter of 2016;

- Gross profit margin increased to 30.1%, up from 26.9% in the

first quarter of 2016, reflecting the positive impacts from

increased core product mix, Home Solutions synergies, and other

cost reductions;

- The Company remains on track to achieve the previously

announced $17.0 million in Home Solutions synergies and other

incremental annualized cost reductions of $23.0 to $25.0 million,

by the end of 2017;

- Consolidated loss from continuing operations, net of income

taxes, was $19.0 million, an increased loss of $9.2 million from

the first quarter of 2016. The increased loss was primarily driven

by the negative impact of the Cures Act, plus additional

depreciation, amortization and interest expense, offset partially

by higher gross margins resulting from increased core product mix,

Home Solutions synergies, and other cost reductions;

- Consolidated Adjusted EBITDA was $5.2 million, as compared to

$7.4 million in the first quarter of 2016. This expected

decrease was primarily driven by the negative impact of the Cures

Act, offset partially by higher gross margins resulting from

increased core product mix, Home Solutions synergies, and other

cost reductions;

- As of March 31, 2017, the Company had $16.0 million of cash and

it was in full compliance with its bank covenants.

“I am pleased with our Company’s first quarter

performance, which was in line with our plan. Our sales team met

our revenue target for the quarter and continued to increase our

core revenue mix. In addition, our gross profit margin improved 320

basis points year over year and adjusted EBITDA met our

expectations, driven by improved core revenue mix, supply chain

efficiencies and cost-structure improvements,” said Daniel E.

Greenleaf, President and Chief Executive Officer. “We also

successfully completed the integration of the Home Solutions

business and we remain on track to realize the full $17.0 million

of cost synergies and incremental $23.0 million to $25.0 million in

cost savings.”

2017 Guidance

The Company is reiterating its prior guidance of

adjusted EBITDA in the range of $45.0 million to $55.0 million for

full-year 2017. This guidance incorporates the estimated negative

impact of the Cures Act legislation and the Company’s estimates

regarding its contract with UnitedHealthcare. The Company continues

to evaluate the impact of the UnitedHealthcare contract on its 2017

revenue and will provide updated 2017 revenue guidance at the

appropriate time.

Conference Call and

Presentation

BioScrip will host a conference call and live

webcast, May 4, 2017, at 9:00 a.m. Eastern Time, to discuss its

first quarter 2017 financial results. Interested parties may

participate by dialing 888-372-9592 (US) or by accessing a

link on the Company's website at www.bioscrip.com.

A replay of the conference call will be

available for two weeks after the call's completion by dialing

855-859-2056 (US) and entering conference call ID number 8579499.

An audio webcast and archive will also be available for 30

days under the "Investor Relations" section of the Company's

website.

About BioScrip, Inc.

BioScrip, Inc. is the largest independent

national provider of infusion and home care management solutions,

with approximately 2,500 teammates and nearly 80 service locations

across the U.S. BioScrip partners with physicians, hospital

systems, payors, pharmaceutical manufacturers and skilled nursing

facilities to provide patients access to post-acute care services.

BioScrip operates with a commitment to bring customer-focused

pharmacy and related healthcare infusion therapy services into the

home or alternate-site setting. By collaborating with the full

spectrum of healthcare professionals and the patient, BioScrip

provides cost-effective care that is driven by clinical excellence,

customer service, and values that promote positive outcomes and an

enhanced quality of life for those it serves.

Forward-Looking Statements – Safe

Harbor

This press release includes statements that may

constitute "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995, including the

statements regarding 2017 guidance, projections of certain measures

of the Company's results of operations, projections of future

levels of certain charges and expenses, expectations of Home

Solutions cost synergies and incremental cost structure

improvements and other statements regarding the Company's financial

improvement plan and strategy and anticipated effects of the Cures

Act and the UnitedHealthcare contract. You can identify these

statements by the fact that they do not relate strictly to

historical or current facts. In some cases, forward-looking

statements can be identified by words such as "may," "should,"

"could," "anticipate," "estimate," "expect," "project," "outlook,"

"aim," "intend," "plan," "believe," "predict," "potential,"

"continue" or comparable terms. Because such statements inherently

involve risks and uncertainties, actual future results may differ

materially from those expressed or implied by such forward-looking

statements. Investors are cautioned that any such forward-looking

statements are not guarantees of future performance and involve

risks and uncertainties, and that actual results may differ

materially from those in the forward-looking statements as a result

of various factors. Important factors that could cause actual

results to differ materially from those in the forward-looking

statement include but are not limited to risks associated with: the

Company’s ability to successfully integrate the Home Solutions

business into its existing businesses; the Company’s ability to

grow its core Infusion revenues; the Company's ability to continue

to execute its financial improvement plan to reduce operating costs

and focus its business on its Infusion Services segment; the

Company’s ability to evaluate opportunities for improvement and

implement solutions as part of its strategic review process; the

Company’s ability to comply with the covenants in its debt

agreements or obtain amendments to such covenants; the

UnitedHealthcare contract termination, including potential

accounting charges and impacts on other contract provisions and

their associated revenue; the success of the Company’s initiatives

to mitigate the impact of the Cures Act on its business; reductions

in federal, state and commercial reimbursement for the Company's

products and services; increased government regulation related to

the health care and insurance industries; as well as the risks

described in the Company's periodic filings with the Securities and

Exchange Commission. The Company does not undertake any duty to

update these forward-looking statements after the date hereof, even

though the Company's situation may change in the future. All of the

forward-looking statements herein are qualified by these cautionary

statements.

Note Regarding Use of Non-GAAP Financial

Measures

In addition to reporting financial information

in accordance with generally accepted accounting principles (GAAP),

the Company is also reporting Adjusted EBITDA, which is a non-GAAP

financial measure. Adjusted EBITDA is not a measurement of

financial performance under GAAP and should not be used in

isolation or as a substitute or alternative to net income,

operating income or any other performance measure derived in

accordance with GAAP, or as a substitute or alternative to cash

flow from operating activities or a measure of the Company’s

liquidity. In addition, the Company's definition of Adjusted EBITDA

may not be comparable to similarly titled non-GAAP financial

measures reported by other companies. Adjusted EBITDA, as defined

by the Company, represents net income before net interest expense,

income tax expense, depreciation and amortization, impairment of

goodwill, stock-based compensation expense, and restructuring,

integration and other expenses. As part of restructuring, the

Company may incur significant charges such as the write down of

certain long−lived assets, temporary redundant expenses, retraining

expenses, potential cash bonus payments and potential accelerated

payments or terminated costs for certain of its contractual

obligations. Management believes that Adjusted EBITDA provides

useful supplemental information regarding the performance of

BioScrip’s business operations and facilitates comparisons to the

Company’s historical operating results. For a full reconciliation

of Adjusted EBITDA to the most comparable GAAP financial measure,

please see the attachment to this earnings release.

| Schedule 1 |

| BIOSCRIP, INC. AND SUBSIDIARIES |

| CONSOLIDATED BALANCE SHEETS |

| (in thousands, except for share amounts) |

|

|

|

|

|

|

| |

|

March 31, 2017 |

|

December 31, 2016 |

| |

|

|

|

|

|

ASSETS |

|

|

|

|

| Current

assets |

|

|

|

|

| Cash and

cash equivalents |

|

$ |

15,969 |

|

|

$ |

9,569 |

|

|

Restricted cash |

|

|

5,132 |

|

|

|

- |

|

|

Receivables, less allowance for doubtful accounts of $44,061 and

$44,730 |

|

|

|

|

| as of

March 31, 2017 and December 31, 2016, respectively |

|

|

109,477 |

|

|

|

111,811 |

|

|

Inventory |

|

|

30,549 |

|

|

|

36,165 |

|

| Prepaid

expenses and other current assets |

|

|

14,896 |

|

|

|

18,507 |

|

|

Total current assets |

|

|

176,023 |

|

|

|

176,052 |

|

| Property and equipment,

net |

|

|

30,416 |

|

|

|

32,535 |

|

| Goodwill |

|

|

365,947 |

|

|

|

365,947 |

|

| Intangible assets,

net |

|

|

27,858 |

|

|

|

31,043 |

|

| Other non-current

assets |

|

|

2,173 |

|

|

|

2,163 |

|

|

Total assets |

|

$ |

602,417 |

|

|

$ |

607,740 |

|

| LIABILITIES AND

STOCKHOLDERS' DEFICIT |

|

|

|

|

| Current

liabilities |

|

|

|

|

| Current

portion of long-term debt |

|

$ |

22,426 |

|

|

$ |

18,521 |

|

| Accounts

payable |

|

|

47,446 |

|

|

|

59,134 |

|

| Amounts

due to plan sponsors |

|

|

4,444 |

|

|

|

3,799 |

|

| Accrued

interest |

|

|

5,549 |

|

|

|

6,705 |

|

| Accrued

expenses and other current liabilities |

|

|

41,867 |

|

|

|

42,191 |

|

|

Total current liabilities |

|

|

121,732 |

|

|

|

130,350 |

|

| Long-term debt, net of

current portion |

|

|

450,072 |

|

|

|

433,413 |

|

| Deferred taxes |

|

|

2,900 |

|

|

|

2,281 |

|

| Other non-current

liabilities |

|

|

1,180 |

|

|

|

1,257 |

|

|

Total liabilities |

|

|

575,884 |

|

|

|

567,301 |

|

|

|

|

|

|

|

| Series A

convertible preferred stock, $.0001 par value; 825,000 shares

authorized; |

|

|

|

|

| 21,645

shares issued and outstanding as of March 31, 2017 and December 31,

2016; |

|

|

|

|

| and,

$2,677 and $2,603 liquidation preference as of March 31, 2017

and |

|

|

|

|

| December

31, 2016, respectively |

|

|

2,549 |

|

|

|

2,462 |

|

| Series C

convertible preferred stock, $.0001 par value; 625,000 shares

authorized; |

|

|

|

|

| 614,177

shares issued and outstanding as of March 31, 2017 and December 31,

2016; |

|

|

|

|

| and

$77,632 and $75,491 liquidation preference as of March 31, 2017

and |

|

|

|

|

| December

31, 2016, respectively |

|

|

71,842 |

|

|

|

69,540 |

|

| Stockholders'

(deficit) equity |

|

|

|

|

|

Preferred stock, $.0001 par value; 5,000,000 shares

authorized; no shares issued and |

|

|

|

|

|

outstanding as of March 31, 2017 and December 31, 2016,

respectively |

|

|

- |

|

|

|

- |

|

| Common

stock, $.0001 par value; 250,000,000 shares authorized; 120,982,543

and |

|

|

|

|

|

117,682,543 shares issued and outstanding as of March 31, 2017

and |

|

|

|

|

| December

31, 2016, respectively |

|

|

12 |

|

|

|

12 |

|

|

Additional paid-in capital |

|

|

614,977 |

|

|

|

611,844 |

|

|

Accumulated deficit |

|

|

(662,847 |

) |

|

|

(643,419 |

) |

|

Total stockholders' deficit |

|

|

(47,858 |

) |

|

|

(31,563 |

) |

|

Total liabilities and stockholders' deficit |

|

$ |

602,417 |

|

|

$ |

607,740 |

|

| |

|

|

|

|

| Schedule 2 |

| BIOSCRIP, INC. AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF

OPERATIONS |

| (in thousands, except per share amounts) |

|

|

|

|

|

|

| |

|

Three Months Ending March

31, |

| |

|

2017 |

|

2016 |

| |

|

|

|

|

| Net

revenue |

|

$ |

217,810 |

|

|

$ |

238,462 |

|

| Cost of revenue

(excluding depreciation expense) |

|

|

152,226 |

|

|

|

174,230 |

|

| Gross

profit |

|

|

65,584 |

|

|

|

64,232 |

|

| %

of revenues |

|

|

30.1 |

% |

|

|

26.9 |

% |

| |

|

|

|

|

| Other operating

expenses |

|

|

44,358 |

|

|

|

39,658 |

|

| Bad debt expense |

|

|

7,164 |

|

|

|

7,592 |

|

| General and

administrative expenses |

|

|

9,479 |

|

|

|

11,051 |

|

| Restructuring,

acquisition, integration, and other expenses, net |

|

|

3,223 |

|

|

|

2,667 |

|

| Depreciation and

amortization expense |

|

|

6,988 |

|

|

|

4,538 |

|

| Interest expense |

|

|

12,744 |

|

|

|

9,412 |

|

| Gain on

dispositions |

|

|

- |

|

|

|

(939 |

) |

|

Loss from continuing

operations, before income

taxes |

|

|

(18,372 |

) |

|

|

(9,747 |

) |

| Income

tax expense |

|

|

619 |

|

|

|

23 |

|

|

Loss from continuing operations, net of income

taxes |

|

|

(18,991 |

) |

|

|

(9,770 |

) |

| Income

(loss) from discontinued operations, net of income taxes |

|

|

(437 |

) |

|

|

233 |

|

|

Net loss |

|

$ |

(19,428 |

) |

|

$ |

(9,537 |

) |

| Accrued dividends on

preferred stock |

|

|

(2,214 |

) |

|

|

(1,998 |

) |

| Deemed dividend on

preferred stock |

|

|

(174 |

) |

|

|

(172 |

) |

| Loss

attributable to common stockholders |

|

$ |

(21,816 |

) |

|

$ |

(11,707 |

) |

| |

|

|

|

|

|

Denominator - Basic and

Diluted: |

|

|

|

|

| Weighted

average number of common shares outstanding |

|

|

118,783 |

|

|

|

68,771 |

|

| |

|

|

|

|

| Loss from

continuing operations, basic and diluted |

|

$ |

(0.18 |

) |

|

$ |

(0.17 |

) |

| Income from

discontinued operations, basic and diluted |

|

|

- |

|

|

|

- |

|

| Loss per common

share, basic and diluted |

|

$ |

(0.18 |

) |

|

$ |

(0.17 |

) |

| |

|

|

|

|

| Schedule 3 |

| BIOSCRIP, INC. AND SUBSIDIARIES |

| QUARTERLY RECONCILIATION BETWEEN

GAAP AND NON-GAAP MEASURES |

| (in thousands) |

|

|

|

|

|

|

| |

|

Three Months Ended |

| |

|

3/31/2017 |

|

3/31/2016 |

| Adjusted EBITDA

by Segment: |

|

|

|

|

| Infusion Services

Adjusted EBITDA |

|

$ |

14,062 |

|

|

$ |

16,982 |

|

| Adjusted

EBITDA margin % |

|

|

6.5 |

% |

|

|

7.1 |

% |

| Corporate Overhead

Adjusted EBITDA |

|

|

(8,885 |

) |

|

|

(9,577 |

) |

| Adjusted

EBITDA margin % |

|

|

(4.1 |

%) |

|

|

(4.0 |

%) |

| |

|

|

|

|

| Consolidated

Adjusted EBITDA |

|

|

5,177 |

|

|

|

7,405 |

|

| Adjusted

EBITDA margin % |

|

|

2.4 |

% |

|

|

3.1 |

% |

| |

|

|

|

|

| Interest expense |

|

|

(12,744 |

) |

|

|

(9,412 |

) |

| Gain on

dispositions |

|

|

- |

|

|

|

939 |

|

| Income tax expense |

|

|

(619 |

) |

|

|

(23 |

) |

| Depreciation and

amortization expense |

|

|

(6,988 |

) |

|

|

(4,538 |

) |

| Stock-based

compensation (expense) benefit |

|

|

(594 |

) |

|

|

(1,474 |

) |

| Restructuring,

acquisition, integration, and other expenses, net (1) |

|

|

(3,223 |

) |

|

|

(2,667 |

) |

| Loss from

continuing operations, net of income taxes |

|

$ |

(18,991 |

) |

|

$ |

(9,770 |

) |

| |

|

|

|

|

| |

|

|

|

|

| General and

Administrative Expenses on Face of Income Statement: |

|

|

|

|

| Corporate overhead

adjusted EBITDA |

|

$ |

(8,885 |

) |

|

$ |

(9,577 |

) |

| Stock-based

compensation (expense) |

|

|

(594 |

) |

|

|

(1,474 |

) |

| General

and administrative expenses |

|

$ |

(9,479 |

) |

|

$ |

(11,051 |

) |

| |

|

|

|

|

| (1) Restructuring, acquisition, integration and other expenses,

net include costs associated with restructuring, acquisition, and

integration initiatives such as employee severance costs, certain

legal and professional fees, redundant wage costs, impacts recorded

from the change in contingent consideration obligations, and other

costs related to contract terminations and closed locations. |

| |

| |

|

|

Schedule 4 |

| BIOSCRIP, INC AND SUBSIDIARIES |

| CONSOLIDATED CONDENSED CASH FLOWS |

| (in thousands) |

| |

|

|

|

| |

Three Months Ended |

| |

3/31/2017 |

|

3/31/2016 |

| Cash flows from

operating activities: |

|

|

|

| Net loss from

continuing operations |

$ |

(18,991 |

) |

|

$ |

(9,770 |

) |

|

Receivables, net of bad debt expense |

|

2,333 |

|

|

|

(4,417 |

) |

|

Inventory |

|

5,616 |

|

|

|

13,867 |

|

| Prepaid

expenses and other assets |

|

3,601 |

|

|

|

7,897 |

|

| Accounts

payable |

|

(11,688 |

) |

|

|

(11,995 |

) |

| Accrued

interest |

|

(1,157 |

) |

|

|

(4,630 |

) |

| Accrued

expenses and other liabilities |

|

244 |

|

|

|

(2,227 |

) |

|

Non-Cash Adjustments: |

|

|

|

|

Depreciation and amortization |

|

6,988 |

|

|

|

4,538 |

|

| Deferred

taxes |

|

619 |

|

|

|

174 |

|

| Other

Non-Cash |

|

1,839 |

|

|

|

1,589 |

|

| Operating Cash

Flow (Use) |

|

(10,596 |

) |

|

|

(4,974 |

) |

|

Discontinued operations |

|

(437 |

) |

|

|

(5,989 |

) |

| Capital

expenditures |

|

(1,684 |

) |

|

|

(2,429 |

) |

|

Investment in restricted cash |

|

(5,132 |

) |

|

|

- |

|

| Proceeds

from dispositions |

|

- |

|

|

|

1,105 |

|

| Proceeds

from priming credit agreement, net |

|

23,060 |

|

|

|

- |

|

| Proceeds

from private placement, net |

|

5,052 |

|

|

|

- |

|

| Term note

(repayments) |

|

(3,137 |

) |

|

|

(3,137 |

) |

| Revolver

(repayments) |

|

(437 |

) |

|

|

8,000 |

|

| Deferred

financing costs and other |

|

(289 |

) |

|

|

(104 |

) |

| Total All Cash

Flow |

$ |

6,400 |

|

|

$ |

(7,528 |

) |

| |

|

|

|

| Schedule

5 |

|

|

|

|

|

|

| BIOSCRIP, INC AND SUBSIDIARIES |

| FULL YEAR 2017

GUIDANCE |

| (dollars in millions, except EPS) |

| |

| |

|

Low

End |

|

High

End |

| |

|

of

Range |

|

of

Range |

| |

|

|

|

|

| Adjusted EBITDA |

|

$ |

45.0 |

|

|

$ |

55.0 |

|

| |

|

|

|

|

| Stock Compensation |

|

|

3.0 |

|

|

|

2.5 |

|

| Depreciation &

Amortization |

|

|

27.0 |

|

|

|

25.0 |

|

| Interest Expense,

net |

|

|

52.0 |

|

|

|

49.0 |

|

| Restructuring

Costs |

|

|

4.0 |

|

|

|

3.0 |

|

| Income Tax Expense |

|

|

3.0 |

|

|

|

2.0 |

|

| Preferred Stock

Dividends |

|

|

9.4 |

|

|

|

9.4 |

|

| Net Loss

- Continuing Ops |

|

$ |

(53.4 |

) |

|

$ |

(35.9 |

) |

| |

|

|

|

|

|

Diluted Loss Per Common

Share |

|

$ |

(0.45 |

) |

|

$ |

(0.30 |

) |

| |

|

|

|

|

| weighted-average

diluted shares |

|

|

118,000 |

|

|

|

118,000 |

|

| |

|

|

|

|

|

|

|

|

Investor Contacts:

Stephen Deitsch

Chief Financial Officer & Treasurer

T: (720) 697-5200

stephen.deitsch@bioscrip.com

David Clair

ICR, Inc.

T: (646) 277-1266

david.clair@icrinc.com

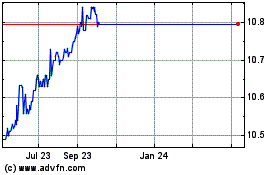

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Apr 2023 to Apr 2024