Report of Foreign Issuer (6-k)

May 04 2017 - 7:44AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2017

Commission File Number 1-15250

BANCO BRADESCO S.A.

(Exact name of registrant as specified in its charter)

BANK BRADESCO

(Translation of Registrant's name into English)

Cidade de Deus, s/n, Vila Yara

06029-900 - Osasco - SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

.

Publicly Traded Company

Corporate Taxpayers’ ID

60.746.948/0001-12

Osasco, SP, May 3, 2017

To

Comissão de Valores Mobiliários

–

CVM

Rua Sete de Setembro, 111

–

26º Andar

Rio de Janeiro

–

RJ

To: Nilza Maria Silva de Oliveira

Business Assistance Manager - 1

Subject: Official Letter No. 182/2017/CVM/SEP/GEA-1

Banco Bradesco S.A.

(“Bradesco” or “Company”) hereby presents its

clarifications regarding the aforementioned Official

Letter (“

Official

Letter 182/2017”), which

refers to the article entitled

“BB Company purchases BRL 4 billion in ‘rotten’ credit from Bradesco”,

published on April 28, 2017, in the Valor Econômico newspaper.

Bradesco understands that the transaction carried out does

not

have the necessary requirements for the disclosure of a material fact under CVM Instruction No. 358/2002.

It further clarifies that the amount of BRL 4 billion refers only to the nominal value of the portfolio, since they were loans written-off for impairment, whose value in trade

and consequent effect on Bradesco’s income was not relevant in its financial statements. The

main goal of the operation is to make internal processes more efficient in the management of overdue loans.

Bradesco disposed of overdue loans in normal operations that are widely used by participants of the financial market. In the case of Bradesco, the operation was also disclosed in explanatory notes to its financial statements for the year that ended on December 31, 2016 and the quarter that ended on March 31, 2017.

The operation followed all applicable governance procedures, including the assistance of independent auditing in the process, and carried out through a bid with the participation of the major

“players”

of the overdue loans acquisition market. It should be noted that the potential purchasers had access to the same information and conditions.

The Company remains at your disposal for any further clarification required.

Yours sincerely,

Banco Bradesco S.A.

Alexandre da Silva Glüher

Executive Vice-President and

Investor Relations Officer

BRAZILIAN SECURITIES AND EXCHANGE COMMISSION

Rua Sete de Setembro, 111 33º andar - Bairro Centro - Rio de Janeiro/RJ - CEP 20050-901

Phone Number: +55 21 3554-8347 - www.cvm.gov.br

Letter No. 182/2017/CVM/SEP/GEA-1

Rio de Janeiro, April 28, 2017.

To Mr.

Alexandre da Silva Glüher

Investor Relations Officer, Banco Bradesco S.A.

E-mail:

alexandre.gluher@bradesco.com.br

Tel: (11) 3681-4011

Núcleo Cidade de Deus, Prédio Vermelho, 4

o

andar

Vila Yara, Osasco, SP

CEP 06029-900

c/c: emissores@bvmf.com.br

Subject: Article entitled “BB Company purchases BRL 4 billion in 'rotten' credit from Bradesco”, published on April 28, 2017, in the Valor Econômico newspaper.

Mr. Officer,

|

1.

|

|

I refer to the article ent

itled “BB Company purchases BRL 4 billion in „rotten credit from Bradesco”, published on April 28, 2017, in the Valor Econômico newspaper.

|

|

2.

|

|

In this regard, I request clarification on the veracity of the article, and, if confirmed, on the reasons said fact was not disclosed to the market.

|

|

3.

|

|

I hereby inform that the requested statement must be sent by means of the Periodic and Occasional Information Submission System, in the category “notice to the market”, type “clarifications on CVM/Bovespa inquiries” including reference to this letter.

|

|

4.

|

|

It should be noted that, pursuant to CVM Instruction 358/2002, Article 3, the investor relations officer is responsible for disclosing and communicating to the CVM material facts that have occurred or are related to its business, as well as ensuring its widespread and immediate dissemination.

|

|

5.

|

|

At the request of the Superintendence of Corporate Relations, in the use of its legal attributions, and based on Law 6,385/1976, Article 9, paragraph II, and on CVM Instruction 452/2007, I hereby warn that the superintendence shall determine the application of a punitive fine, in the amount of BRL

1

,000.00 (one thousand reais), without prejudice to other administrative sanctions for failure to comply with the requirements of this letter, within a period of 1 (one) business day, upon acknowledgement of the contents of this letter.

|

Yours sincerely,

Document electronically signed by

Nilza Maria Silva de Oliveira

,

Manager

, on May 2, 2017, at 4:07 p.m., pursuant to art. 1, III, "b", of Act 11,419/2006.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 03, 2017

|

BANCO BRADESCO S.A.

|

|

|

|

By:

|

|

/S/

Alexandre da Silva Glüher

|

|

|

|

Alexandre da Silva Glüher

Executive Vice President and

Investor Relations Officer.

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

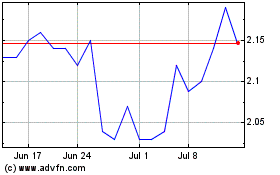

Banco Bradesco (NYSE:BBDO)

Historical Stock Chart

From Mar 2024 to Apr 2024

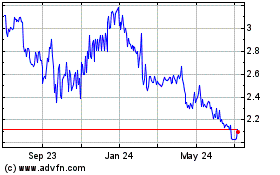

Banco Bradesco (NYSE:BBDO)

Historical Stock Chart

From Apr 2023 to Apr 2024