− Pivotal Phase 3 BOSTON Study Expected to

Commence in May 2017 –

Karyopharm Therapeutics Inc. (Nasdaq:KPTI), a clinical-stage

pharmaceutical company, today reported financial results for the

first quarter 2017 and commented on recent accomplishments and

clinical development plans for its lead, novel, oral Selective

Inhibitor of Nuclear Export (SINE™) compound selinexor (KPT-330),

and other pipeline assets verdinexor (KPT-335), and KPT-9274, its

oral, dual inhibitor of p21-activated kinase 4 (PAK4) and

nicotinamide phosphoribosyltransferase (NAMPT).

“It’s been a highly active early 2017 for

Karyopharm, marked most notably by establishment of a planned

approval path for selinexor in relapsed or refractory diffuse large

B-cell lymphoma (DLBCL), our second lead indication after multiple

myeloma (MM), following the presentation of robust interim data

from the Phase 2b SADAL study at the American Association for

Cancer Research (AACR) 2017 Annual Meeting,” said Michael G.

Kauffman, MD, PhD, Chief Executive Officer of Karyopharm.

“After the observation of a 28.6% overall response rate (ORR)

with over 7 months median duration of response (DOR), we consulted

with the U.S. Food and Drug Administration (FDA) and obtained their

agreement to amend the SADAL study to focus solely on the 60mg

twice weekly treatment cohort, in which we plan to enroll up to 90

more patients. Assuming we continue to see the response rate

and durability observed to date, we plan to use the data from the

SADAL study to support a request for accelerated approval in

DLBCL. Looking ahead, we remain focused on the initiation of

the pivotal Phase 3 BOSTON study where we will evaluate selinexor

in combination with Velcade® (bortezomib) and dexamethasone in

patients with myeloma previously treated with one to three

regimens, moving selinexor into much earlier lines of

treatment.”

Dr. Kauffman continued, “Importantly, during

April 2017, we strengthened our balance sheet by raising net

proceeds of approximately $52.2 million in equity financings,

including approximately $37.8 million in an underwritten public

offering and $14.5 million through our at-the-market (ATM) offering

program. We plan to use these funds to support the continued

clinical development of selinexor in our lead indications,

including in multiple myeloma, DLBCL and other oncology

indications, with a focus on filing for accelerated approvals for

both myeloma and DLBCL during 2018. In addition, we expect

this capital will fund our operations into 2019, while we are

preparing to establish a commercial infrastructure for the

potential launch of selinexor in North America and Western

Europe.”

First Quarter 2017 and Recent Events,

Highlights and Milestones:

Selinexor in Multiple Myeloma (MM)

- Upcoming Initiation of Pivotal Phase 3 BOSTON

Study. Based on the strong combination data recently

reported from the Phase 1b STOMP study, Karyopharm plans to

initiate a pivotal randomized Phase 3 study, known as the BOSTON

(Bortezomib, Selinexor and

dexamethasone) study, which will

evaluate selinexor in combination with Velcade and dexamethasone

(SVd), compared to Velcade and low-dose dexamethasone (Vd) in

patients with MM who have had one to three prior lines of

therapy. The BOSTON study is expected to enroll approximately

360 patients and commence in May 2017.

- Ongoing Phase 2b STORM Study Expansion in Patients with

Penta-refractory MM. The Company has expanded the

Phase 2b STORM study, which is expected to include 122 additional

patients with penta-refractory MM, a growing unmet medical need in

which there are no approved therapies available. Karyopharm

expects to report top-line data from the expanded cohort in early

2018, and, assuming a positive outcome, intends to use the expanded

STORM study data to support a request for accelerated approval for

selinexor in MM.

- Completed Enrollment in Phase 1b/2 STOMP Arm Evaluating

Selinexor in Combination with Velcade. In February

2017, Karyopharm completed enrollment in the Phase 1b/2 STOMP arm

designed to evaluate selinexor in combination with the proteasome

inhibitor Velcade and low-dose dexamethasone (SVd) in heavily

pretreated patients with MM. The SVd arm of the STOMP study

enrolled 42 patients and the Company expects to report updated data

toward the end of 2017.

- Upcoming Initiation of New Phase 1b/2 STOMP Expansion

Arm Evaluating Selinexor in Combination with

Darzalex®

(daratumumab). Karyopharm expects

to dose the first patient in a new Phase 1b/2 STOMP expansion arm

designed to evaluate selinexor in combination with the anti-CD38

monoclonal antibody Darzalex and low-dose dexamethasone (SDd) in

heavily pretreated patients with MM. The SDd arm of the STOMP

study is expected to enroll approximately 44 patients and the

Company expects to report top-line data in late 2017 or early

2018.

- Presented an Overview of Clinical Data Demonstrating

Selinexor Activity in Combination with Proteasome Inhibitors and

Immunomodulatory Agents. In an oral presentation at the

International Myeloma Workshop 2017 annual meeting held March 1-4,

2017 in New Delhi, India, Karyopharm researchers presented an

overview of clinical data demonstrating selinexor’s activity in

combination with proteasome inhibitors and immunomodulatory drugs

for the treatment of relapsed or refractory MM.

Selinexor in Diffuse Large B-Cell Lymphoma

(DLBCL)

- Top-line Data from Phase 2b SADAL Study in DLBCL

Presented in a Late-Breaking Poster at AACR 2017. At

the April AACR 2017 Annual Meeting, a late-breaking poster was

presented that highlighted top-line data from the Company’s ongoing

Phase 2b SADAL study evaluating 60mg and 100mg doses of

single-agent selinexor in patients with relapsed or refractory

DLBCL. The data demonstrated that selinexor achieved an ORR

of 28.6% in the first 63 patients, as adjudicated by an independent

central radiological committee, and a disease control rate (DCR) of

42.9%. The median overall survival (OS) was 8 months for all

patients, consistent with published data in this population.

As of the data cutoff date, median survival for the

responders had not been reached and is over 9 months. The

median DOR across all patients was greater than 7 months with most

responses occurring at the first response evaluation (~2

months). As of the data cutoff date, 9 patients who responded

remained on treatment, including 6 patients with a complete

response (CR). Selinexor showed similar activity against GCB

and non-GCB subtypes of DLBCL: Of the 32 patients with DLBCL of the

GCB-subtype, selinexor achieved an ORR of 25.0% and DCR of

43.8%. Of the 31 patients with DLBCL of the non-GCB-subtype

(ABC), selinexor achieved an ORR of 32.3% and DCR of 41.9%.

Among the 72 patients evaluated for safety, the most common adverse

events (AEs) across both dosing groups were fatigue (65%),

thrombocytopenia (54%), nausea (51%), anorexia (49%), vomiting

(35%) and anemia (32%), and were primarily grades 1 and 2 and were

managed with dose modifications and/or standard supportive

care. As expected, the most common grade 3 and 4 AEs in the

60mg arm were thrombocytopenia (32%), neutropenia (16%), anemia

(14%), and fatigue (11%) and were manageable with dose

modifications and/or standard supportive care.

As a result of these findings, and in

consultation with the FDA, Karyopharm is amending the SADAL study

protocol to become a single-arm study focusing solely on

single-agent selinexor dosed at 60mg twice weekly, eliminating the

100mg arm. The study is also being amended to reduce the

14-week treatment-free period to 8 weeks in patients who achieved

at least a partial response (PR) on their most recent

therapy. Patients whose disease was refractory or did not

achieve at least a PR on their prior therapy will continue with the

14-week treatment-free period. The FDA agreed that the

modification to a single-arm study was reasonable and that the

proposed trial design and indication appear appropriate for

accelerated approval, though eligibility for accelerated approval

will depend on the complete trial results and available therapies

at the time of regulatory action. The Company plans to enroll

up to an additional 90 patients to the 60mg single-arm cohort and

expects to report top-line results from the SADAL study in

mid-2018.

Selinexor in Other Hematologic Malignancies

- Announced Outcome of Phase 2 SOPRA Interim Analysis;

Updated AML Development Strategy. In March 2017,

Karyopharm announced the results of the planned interim analysis of

the Phase 2 SOPRA study evaluating single-agent selinexor in

relapsed or refractory acute myeloid leukemia (AML). In

concert with the study’s independent Data Safety Monitoring Board

(DSMB), the Company determined that the SOPRA study would not reach

statistical significance for showing superiority of OS on selinexor

versus OS on physician’s choice (PC), the study’s primary endpoint.

However, the 13% of selinexor-treated patients who achieved a

complete response with or without full hematologic recovery

(CR/CRi) showed a substantial OS benefit as compared to PC.

As a result, patients were permitted to continue on both the

selinexor arm or the PC arm, as applicable, following discussion

with their treating physician. Selinexor demonstrated a

safety profile consistent with previous studies with similar rates

of sepsis and lower rates of febrile neutropenia in the selinexor

arm versus the PC arm. Karyopharm plans to continue to

explore the use of selinexor in combination with novel and standard

agents through investigator-sponsored AML studies.

Selinexor in Solid Tumors

- Completed Enrollment in Phase 2 Portion of the Phase

2/3 SEAL Study. In March 2017, Karyopharm completed

enrollment in the Phase 2 portion of the randomized Phase 2/3 SEAL

study evaluating single-agent selinexor versus placebo in patients

with advanced liposarcoma. Top-line data from the Phase 2

portion of this study are expected in mid-2017. The primary

endpoint of the SEAL study is progression free survival (PFS) and

both the trial design and endpoints have been agreed to by the FDA

and the European Medicines Agency (EMA) as acceptable for

approval.

- Oral Presentation Highlighting Efficacy, Safety and

Intratumoral Pharmacokinetic Data for Selinexor in Glioblastoma at

the 2017 World Federation of Neuro-Oncology Societies

(WFNOS). Clinical data from a Phase 2 study

evaluating selinexor in patients with recurrent glioblastoma will

be highlighted in an oral presentation on May 6, 2017 at WFNOS 2017

by Andrew Lassman, MD, Columbia University Medical Center. These

data demonstrate that oral selinexor achieved responses and

sufficient intratumoral penetration, with a manageable tolerability

profile when accompanied by standard supportive care.

Importantly, disease control rates using selinexor dosed at 80mg

once weekly were as high or higher than those observed with more

intensive dosing, and tolerability was improved. Accrual in

this Phase 2 study utilizing once weekly dosing continues.

Verdinexor

- Signed Global License Agreement with Anivive

Lifesciences for Verdinexor for Animal Health

Applications. Earlier this week, Karyopharm and

Anivive, a privately-held biotech company, announced their entry

into a licensing agreement whereby Anivive licensed from Karyopharm

exclusive worldwide rights to research, develop and commercialize

verdinexor for the treatment of cancer in companion animals.

Under the terms of the agreement, Anivive will make a one-time

upfront payment of $1 million to Karyopharm. Anivive agreed

to pay up to an additional $43.5 million in certain regulatory,

clinical and commercial milestones, assuming approval in both the

United States (US) and the European Union (EU). In addition,

Anivive agreed to pay Karyopharm a low double-digit royalty on

future net sales.

KPT-9274

- Preclinical Efficacy Highlighting KPT-9274’s

Anti-Cancer Activity in Dogs with Spontaneous Lymphomas Presented

as a Late-Breaking Poster at AACR 2017 Annual

Meeting. At the April AACR 2017 Annual Meeting,

Karyopharm collaborator Cheryl London of Tufts University presented

a late-breaking poster highlighting preclinical data demonstrating

the activity and synergy of KPT-9274, the Company’s oral dual

inhibitor of PAK4/NAMPT, with doxorubicin to treat dogs with

lymphoma. KPT-9274 is currently being evaluated in a Phase 1

safety and tolerability study in patients with advanced solid

malignancies (including sarcoma, colon and lung cancer) or

non-Hodgkin's lymphoma (NHL) whose disease has relapsed after

standard therapy(s). Top-line data from this clinical study

are expected in mid-2017.

Other Corporate and Clinical Developments

- Generated $52.2 Million in Equity

Financings. In April 2017, the Company completed the

sale of approximately 3.9 million shares of common stock in an

underwritten public offering at a price to the public of $10.25 per

share, resulting in net proceeds to the Company of approximately

$37.8 million after deducting underwriting discounts and

commissions and other estimated offering expenses, and the sale of

approximately 1.3 million shares under the ATM offering facility

for net proceeds of approximately $14.5 million.

- Partial Clinical Holds Lifted by U.S.

FDA. During late March and early April 2017, the

FDA’s Divisions of Hematology Products, Oncology Products 1 and

Oncology Products 2 lifted their respective partial clinical holds

placed on the Company’s selinexor clinical trials, re-opening

enrollment and dosing of new patients in all of the Company's

clinical trials across both hematological and solid tumor

malignancies. There were no material impacts on development

timelines for any of the ongoing selinexor studies.

- Management Change. In April 2017, Justin

Renz resigned as the Company’s Executive Vice President, Chief

Financial Officer and Treasurer to pursue other

opportunities. Mr. Renz continues to serve the Company in an

advisory capacity in order to ensure a smooth transition.

Karyopharm has begun a search process for the selection and

appointment of a new Chief Financial Officer. In the interim,

Michael Todisco, who serves as the Company's Vice President,

Finance, leads the Company’s internal finance function.

First Quarter 2017 Financial

Results

Cash, cash equivalents and investments as of

March 31, 2017, including restricted cash, totaled $150.6 million,

compared to $175.5 million as of December 31, 2016.

On April 28, 2017, Karyopharm completed an

underwritten public offering of 3,902,439 shares of its common

stock at a price to the public of $10.25 per share. The net

proceeds to Karyopharm from the offering, after deducting the

underwriting discounts and commissions and estimated offering

expenses, were approximately $37.8 million. In addition,

during April 2017, the Company completed the sale of approximately

1.3 million shares under the ATM offering facility for net proceeds

of approximately $14.5 million.

For the quarter ended March 31, 2017, research

and development expense was $24.1 million compared to $21.8 million

for the quarter ended March 31, 2016. For the quarter ended

March 31, 2017, general and administrative expense was $6.3 million

compared to $5.6 million for the quarter ended March 31, 2016.

Karyopharm reported a net loss of $29.9 million,

or $0.71 per share, for the quarter ended March 31, 2017, compared

to a net loss of $27.1 million, or $0.75 per share, for the quarter

ended March 31, 2016. Net loss includes stock-based

compensation expense of $5.9 million and $5.2 million for the

quarters ended March 31, 2017 and March 31, 2016, respectively.

Financial Outlook

Karyopharm expects its operating cash burn,

including research and development and general and administrative

expenses, for the year ending December 31, 2017 to be in the range

of $85 to 90 million. Based on current operating plans,

Karyopharm expects that its existing cash and cash equivalents,

along with the $52.2 million of net proceeds raised in April 2017,

will be sufficient to fund its research and development programs

and operations into 2019, including the continued clinical

development of selinexor in our lead indications with a focus on

filing for accelerated approvals for both MM and DLBCL during 2018,

and preparing a commercial infrastructure for the potential launch

of selinexor in North America and Western Europe.

Conference Call

Information:

Karyopharm will host a conference call today,

Thursday, May 4, 2017, at 8:30 a.m. Eastern Time, to discuss the

first quarter 2017 financial results, recent accomplishments,

clinical developments and business plans. To access the

conference call, please dial (855)

437-4406 (US) or (484) 756-4292 (international) at

least five minutes prior to the start time and refer to conference

ID: 10603764. An audio recording of the call will be

available under “Events & Presentations” in the

“Investor” section of Karyopharm's website,

http://www.karyopharm.com, approximately two hours after the

event.

About Karyopharm

Therapeutics

Karyopharm Therapeutics Inc. (Nasdaq:KPTI) is a

clinical-stage pharmaceutical company focused on the discovery and

development of novel first-in-class drugs directed against nuclear

transport and related targets for the treatment of cancer and other

major diseases. Karyopharm's SINE™ compounds function by binding

with and inhibiting the nuclear export protein XPO1 (or CRM1). The

Company's initial focus is on seeking regulatory approval and

commercialization of its lead drug candidate, oral selinexor

(KPT-330). To date, over 2,000 patients have been treated with

selinexor and it is currently being evaluated in several mid- and

later-phase clinical trials across multiple cancer indications,

including multiple myeloma in combination with low-dose

dexamethasone (STORM) and backbone therapies (STOMP), diffuse large

B-cell lymphoma (SADAL), and liposarcoma (SEAL), among others.

Karyopharm plans to initiate a pivotal randomized Phase 3 study of

selinexor in combination with bortezomib (Velcade®) and low-dose

dexamethasone (BOSTON) in patients with multiple myeloma in May

2017. In addition to single-agent and combination activity against

a variety of human cancers, SINE™ compounds have also shown

biological activity in models of neurodegeneration, inflammation,

autoimmune disease, certain viruses and wound-healing. Karyopharm,

which was founded by Dr. Sharon Shacham, currently has five

investigational programs in clinical or preclinical development.

For more information, please visit www.karyopharm.com.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of The Private Securities Litigation

Reform Act of 1995. Such forward-looking statements include those

regarding the therapeutic potential of and potential clinical

development plans for Karyopharm's drug candidates, including the

timing of initiation of certain trials and of the reporting of data

from such trials, and Karyopharm’s financial outlook. Such

statements are subject to numerous important factors, risks and

uncertainties that may cause actual events or results to differ

materially from Karyopharm’s current expectations. For example,

there can be no guarantee that any of Karyopharm's SINE™ compounds,

including selinexor (KPT-330), KPT-8602, Karyopharm's next

generation SINE™ compound, or KPT-9274, Karyopharm's first-in-class

oral dual inhibitor of PAK4 and NAMPT, or any other drug candidate

that Karyopharm is developing, will successfully complete necessary

preclinical and clinical development phases or that development of

any of Karyopharm's drug candidates will continue. Further, there

can be no guarantee that any positive developments in Karyopharm's

drug candidate portfolio will result in stock price appreciation.

Management's expectations and, therefore, any forward-looking

statements in this press release could also be affected by risks

and uncertainties relating to a number of other factors, including

the following: Karyopharm's results of clinical trials and

preclinical studies, including subsequent analysis of existing data

and new data received from ongoing and future studies; the content

and timing of decisions made by the FDA and other regulatory

authorities, investigational review boards at clinical trial sites

and publication review bodies, including with respect to the need

for additional clinical studies; Karyopharm's ability to obtain and

maintain requisite regulatory approvals and to enroll patients in

its clinical trials; unplanned cash requirements and expenditures;

development of drug candidates by Karyopharm's competitors for

diseases in which Karyopharm is currently developing its drug

candidates; and Karyopharm's ability to obtain, maintain and

enforce patent and other intellectual property protection for any

drug candidates it is developing. These and other risks are

described under the caption "Risk Factors" in Karyopharm's Annual

Report on Form 10-K for the year ended December 31, 2016, which was

filed with the Securities and Exchange Commission (SEC) on March

16, 2017, and in other filings that Karyopharm may make with the

SEC in the future. Any forward-looking statements contained in this

press release speak only as of the date hereof, and, except as

required by law, Karyopharm expressly disclaims any obligation to

update any forward-looking statements, whether as a result of new

information, future events or otherwise.

Velcade® is a registered trademark of Takeda

Pharmaceutical Company LimitedDarzalex® is a registered trademark

of Janssen Biotech, Inc.

| CONDENSED CONSOLIDATED

BALANCE SHEETS |

| (unaudited) |

| (in thousands, except share and per share

amounts) |

| |

| |

|

|

|

|

|

|

March 31, 2017 |

|

December 31, 2016 |

|

Assets |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

25,577 |

|

|

$ |

49,663 |

|

|

Short-term investments |

|

|

84,307 |

|

|

|

79,889 |

|

|

Restricted cash |

|

|

200 |

|

|

|

— |

|

| Prepaid

expenses and other current assets |

|

|

2,146 |

|

|

|

2,084 |

|

| Total

current assets |

|

|

112,230 |

|

|

|

131,636 |

|

| Property and equipment,

net |

|

|

2,654 |

|

|

|

2,836 |

|

| Long-term

investments |

|

|

40,257 |

|

|

|

45,434 |

|

| Restricted cash |

|

|

279 |

|

|

|

479 |

|

| Other assets |

|

|

15 |

|

|

|

— |

|

| Total

assets |

|

$ |

155,435 |

|

|

$ |

180,385 |

|

|

|

|

|

|

| Liabilities and

stockholders’ equity |

|

|

|

| Current

liabilities: |

|

|

|

| Accounts

payable |

|

$ |

4,245 |

|

|

$ |

4,751 |

|

| Accrued

expenses |

|

|

10,740 |

|

|

|

11,362 |

|

| Deferred

rent |

|

|

286 |

|

|

|

280 |

|

| Other

current liabilities |

|

|

210 |

|

|

|

83 |

|

| Total

current liabilities |

|

|

15,481 |

|

|

|

16,476 |

|

| Deferred rent, net of

current portion |

|

|

1,591 |

|

|

|

1,666 |

|

| Total

liabilities |

|

|

17,072 |

|

|

|

18,142 |

|

| Stockholders’

equity: |

|

|

|

| Preferred

stock, $0.0001 par value; 5,000,000 shares authorized; none issued

and outstanding |

|

|

— |

|

|

|

— |

|

| Common

stock, $0.0001 par value; 100,000,000 shares authorized; 41,902,255

and 41,887,829 shares issued and outstanding at March 31, 2017 and

December 31, 2016, respectively |

|

|

4 |

|

|

|

4 |

|

|

Additional paid-in capital |

|

|

534,838 |

|

|

|

528,617 |

|

|

Accumulated other comprehensive loss |

|

|

(204 |

) |

|

|

(274 |

) |

|

Accumulated deficit |

|

|

(396,275 |

) |

|

|

(366,104 |

) |

| Total

stockholders’ equity |

|

|

138,363 |

|

|

|

162,243 |

|

| Total

liabilities and stockholders’ equity |

|

$ |

155,435 |

|

|

$ |

180,385 |

|

| Karyopharm Therapeutics Inc. |

| CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

| (unaudited) |

| (in thousands, except share and per share

amounts) |

| |

|

|

|

Three Months Ended,

March 31, |

|

|

|

|

2017 |

|

|

|

2016 |

|

| Contract and grant

revenue |

|

$ |

68 |

|

|

$ |

— |

|

| Operating

expenses: |

|

|

|

| Research

and development |

|

|

24,083 |

|

|

|

21,795 |

|

| General

and administrative |

|

|

6,264 |

|

|

|

5,554 |

|

| Total

operating expenses |

|

|

30,347 |

|

|

|

27,349 |

|

|

|

|

|

|

| Loss from

operations |

|

|

(30,279 |

) |

|

|

(27,349 |

) |

| Other income

(expense): |

|

|

|

| Interest

income |

|

|

400 |

|

|

|

286 |

|

| Other

income (expense) |

|

|

(15 |

) |

|

|

4 |

|

| Total

other income (expense), net. |

|

|

385 |

|

|

|

290 |

|

|

|

|

|

|

| Loss before income

taxes |

|

|

(29,894 |

) |

|

|

(27,059 |

) |

| Provision for income

taxes |

|

|

(23 |

) |

|

|

— |

|

| Net loss |

|

$ |

(29,917 |

) |

|

$ |

(27,059 |

) |

| Net loss per

share—basic and diluted |

|

$ |

(0.71 |

) |

|

$ |

(0.75 |

) |

| Weighted-average number

of common shares outstanding used in net loss per share—basic and

diluted |

|

|

41,894,796 |

|

|

|

35,878,502 |

|

Contacts:

Michelle Carroll

(212) 600-1902

michelle@argotpartners.com

Media:

Eliza Schleifstein

(917) 763-8106

eliza@argotpartners.com

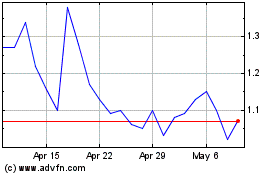

Karyopharm Therapeutics (NASDAQ:KPTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

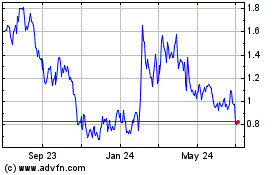

Karyopharm Therapeutics (NASDAQ:KPTI)

Historical Stock Chart

From Apr 2023 to Apr 2024