Report of Foreign Issuer (6-k)

May 04 2017 - 6:08AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

May 3, 2017

Commission File Number: 001-32827

MACRO BANK INC.

(Translation of registrant’s name

into English)

Sarmiento 447

Buenos Aires C1 1041

Tel: 54 11 5222 6500

(Address of registrant’s principal

executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information

contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number

assigned to the registrant in connection with Rule 12g3-2(b): 82-

N/A

BANCO MACRO S.A. ANNOUNCES PRICING OF

NOTES OFFERING UNDER MEDIUM-TERM NOTE PROGRAM

City of Buenos Aires, Argentina, May

3, 2017

- Banco Macro S.A. (NYSE:BMA; BCBA:BMA) announced today that it has priced an offering of Peso denominated Notes in

the equivalent amount of US$300 million due 2022 ( the “Notes”). The Notes will accrue interest at a fixed annual rate

equal to 17.50%. The offering is part of a financing program for the issuance by Banco Macro from time to time of up to US$1,000

million aggregate principal amount of debt securities outstanding at any time. The Notes were offered to investors at a price of

100% of the principal amount. Banco Macro intends to use the net proceeds from the offering of the Notes to refinance certain outstanding

debt, to make loans in accordance with Central Bank guidelines and for general working capital in Argentina.

The Notes have not been and will not be

registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”), or any state securities law. The

Notes may not be offered or sold within the U.S. or to U.S. persons, except to qualified institutional buyers in reliance on the

exemption from registration provided by Rule 144A under the Securities Act and to non-U.S. persons in offshore transactions in

reliance on Regulation S under the Securities Act. This announcement is not an offer to sell or a solicitation of an offer to buy

such debt securities and is issued pursuant to Rule 135c of the Securities Act.

This press release is available under the

“Financial Information/Press Releases” section, or, in the Spanish version under “Información Financiera/Comunicados

de Prensa”, of Banco Macro’s Investor Relations web site.

This press release includes forward-looking

statements. We have based these forward-looking statements largely on our current beliefs and expectations. Many important factors

could cause our actual results to differ substantially from those anticipated in our forward-looking statements, including, among

other things: changes in general economic, business, political or legal conditions in Argentina and worldwide; effects of the global

financial markets and economic crisis; deterioration in regional business and economic conditions; changes in interest rates; government

intervention and regulation (including banking and tax regulations) and adverse legal or regulatory disputes or proceedings.

These forward-looking statements can

be identified by words or phrases such as “aim,” “anticipate,” “believe,” “estimate,”

“expect,” “future,” “intend,” “is/are likely to,” “may,” “plan,”

“should,” “will,” “would,” or other similar expressions. Forward-looking statements include

information concerning our possible or assumed future results of operations, business strategies, financing plans, competitive

position, industry environment, potential growth opportunities, and the effects of future regulation and the effects of competition.

Forward-looking statements speak only as of the date they were made, and we undertake no obligation to update publicly or to revise

any forward-looking statements after we distribute this press release because of new information, future events or other factors.

In light of the risks and uncertainties described above, the forward-looking events and circumstances discussed in this press release

might not occur and are not guarantees of future performance.

IR Contact in Buenos Aires:

Jorge Scarinci | Finance & IR Manager

Nicolás A. Torres | Investor Relations

E-mail:

investorelations@macro.com.ar

| Phone: (5411) 5222 6682

About

Banco Macro S.A (NYSE: BMA; Buenos Aires: BMA) is a universal bank, with focus in low & mid-income individuals and small &

mid-sized companies. The Bank started operating in 1985 as non-banking financial institution and today has grown to be the private

local bank with the largest branch network in the country.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

Date: May 3, 2017

|

|

MACRO BANK INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Jorge Scarinci

|

|

|

|

Name: Jorge Scarinci

|

|

|

|

Title: Finance manager

|

|

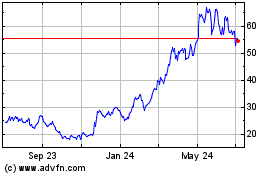

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

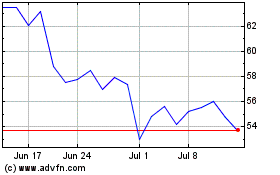

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Apr 2023 to Apr 2024