Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-214318

Prospectus

Supplement dated May 1, 2017

(to Prospectus

dated November 14, 2016)

Cadiz

Inc.

Warrants

to Purchase Common Stock and shares of Common Stock underlying the Warrants

We

and Cadiz Real Estate LLC, as borrowers, are parties to that certain Credit Agreement dated as of May 1, 2017 (which we refer

to as the “Credit Agreement”) along with Apollo Special Situations Fund, L.P. and other lenders from time to time

party to the Credit Agreement (which we refer to collectively as the “Investors”) and Wells Fargo Bank, National Association,

as agent (which we refer to as the “Agent”).

Pursuant

to this prospectus supplement and the accompanying prospectus, we are offering warrants (which we refer to as the “warrants”)

for the purchase of an aggregate 357,500 shares of our common stock, par value $0.01 per share (which we refer to as the “common

stock”), to the Investors in connection with the incurrence of senior secured term loans under the Credit Agreement. This

prospectus also relates to the offering of shares of common stock issuable upon exercise of the warrants. The number of shares

of common stock subject to the warrants may be increased to 362,500 shares of common stock by agreement between us and the Investors.

We will allocate a value to the warrants upon the closing date under the Credit Agreement in accordance with its terms. We will

receive no proceeds from the offering of the warrants. If the warrants are exercised for cash, we would receive the warrant exercise

price.

The

warrants are not and will not be listed for trading on The NASDAQ Global Market or any other securities exchange or nationally

recognized trading system. There is no market through which the warrants may be sold, and the Investors may not be able to resell

the warrants purchased under this prospectus supplement. This may affect the pricing of the warrants in the secondary market,

the transparency and availability of trading prices, and the liquidity of the warrants.

You

should read carefully this prospectus supplement and the accompanying prospectus, as well as the documents incorporated by reference

herein and therein, before you invest in our securities.

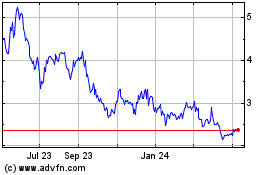

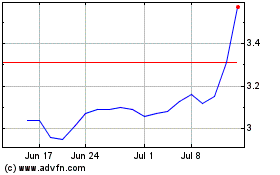

Our

common stock is traded on the NASDAQ Global Market under the symbol “CDZI.” On May 1, 2017, the closing price of our

common stock was $15.00.

Investing

in our common stock involves risks that are described in the “Risk Factors” section beginning on page S-3 of this

prospectus supplement and on page 2 of the prospectus. You should carefully read and consider those risks before making an investment

decision.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the adequacy or accuracy of this prospectus supplement. Any representation to the contrary is a criminal offense.

We

currently anticipate that the final settlement of the offering will take place on or prior to June 15, 2017. See “Plan of

Distribution.” The warrants offered hereby are being sold directly by us without the use of underwriters or agents.

The

date of this prospectus supplement is May 1, 2017.

TABLE

OF CONTENTS

PROSPECTUS

SUPPLEMENT

ABOUT

THIS PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING PROSPECTUS

This

prospectus supplement and the accompanying prospectus form part of a registration statement on Form S-3 that we filed with the

Securities and Exchange Commission (or the “Commission”) using a “shelf” registration process. This document

consists of two parts. The first part is this prospectus supplement, which describes the specific terms of this offering. The

second part is the accompanying prospectus, which contains more general information. Before you invest in our warrants, you should

read both this prospectus supplement and the accompanying prospectus, together with additional information described below under

the caption “Where You Can Find More Information.”

If

the description of this offering varies between this prospectus supplement and the accompanying prospectus, you should rely upon

the information in this prospectus supplement. Any statement made in the accompanying prospectus or in a document incorporated

or deemed to be incorporated by reference therein will be deemed to be modified or superseded for purposes of this prospectus

supplement to the extent that a statement contained in this prospectus supplement or in any other subsequently filed document

that is also incorporated or deemed to be incorporated by reference in this prospectus supplement modifies or supersedes that

statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part

of this prospectus supplement.

We

are responsible for the information contained in or incorporated by reference in this prospectus supplement, the accompanying

prospectus and any related free writing prospectus we have authorized for use in connection with this offering. This prospectus

supplement may be used only for the purpose for which it has been prepared. Neither we nor any other person has authorized anyone

to provide information different from the information contained in this prospectus supplement, the accompanying prospectus and

any related free writing prospectus and the documents incorporated by reference herein and therein.

We

are not making an offer to sell our securities in any jurisdiction where the offer or sale is not permitted. You should not assume

that the information appearing in this prospectus supplement, the accompanying prospectus or any free writing prospectus we have

authorized for use in connection with this offering is accurate as of any date other than the date of the applicable document.

Neither this prospectus supplement nor the accompanying prospectus constitutes an offer or an invitation to subscribe for and

purchase any of our securities, and may not be used for or in connection with an offer or solicitation by any person, in any jurisdiction

in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation.

In

this prospectus supplement and the accompanying prospectus, unless expressly noted or the content indicates otherwise, the words

“we,” “us,” “our,” “Cadiz,” “the Company” and similar references mean

Cadiz Inc. and its subsidiaries.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

All

statements in this prospectus supplement and the documents incorporated by reference herein that are not historical facts should

be considered “forward looking statements” within the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that

may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements

expressed or implied by the forward-looking statements. Some of the forward-looking statements can be identified by the use of

words such as “believe,” “expect,” “may,” “will,” “should,” “seek,”

“approximately,” “intend,” “plan,” “estimate,” “project,” “continue”

or “anticipates” or similar expressions or words, or the negatives of those expressions or words. Although we believe

that our plans, intentions and expectations reflected in, or suggested by, such forward-looking statements are reasonable, we

can give no assurance that such plans, intentions, or expectations will be achieved.

Some

of the important factors that could cause actual results to differ materially from our expectations are disclosed under “Risk

Factors” and elsewhere in this prospectus supplement and the accompanying prospectus. All subsequent written and oral forward-looking

statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by these cautionary

statements. Additional risks, uncertainties and other factors are incorporated herein by reference to our most recent Annual Report

on Form 10-K and our subsequent Quarterly Reports on Form 10-Q, as updated by our subsequent filings under the Exchange Act. Except

as otherwise required by applicable securities laws, we undertake no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events, changed circumstances, or any other reason, after the date

of this prospectus supplement.

SUMMARY

About

Cadiz

We

are a land and water resource development company with 45,000 acres of land in three areas of eastern San Bernardino County, California.

Virtually all of this land is underlain by high-quality, naturally recharging groundwater resources, and is situated in proximity

to the Colorado River and the Colorado River Aqueduct (“CRA”), California's primary mode of water transportation for

imports from the Colorado River into the State. Our properties are suitable for various uses, including large-scale agricultural

development, groundwater storage and water supply projects. Our main objective is to realize the highest and best use of our land

and water resources in an environmentally responsible way.

We

believe that the long-term highest and best use of our land and water assets can best be realized through the development of a

combination of water supply and storage projects at our properties. Therefore, the Company has been primarily focused on the development

of the Cadiz Valley Water Conservation, Recovery and Storage Project (“Water Project” or “Project”), which

will capture and conserve millions of acre-feet

1

of native groundwater currently

being lost to evaporation from the aquifer system beneath our 34,000-acre property in the Cadiz and Fenner valleys of eastern

San Bernardino County (the “Cadiz/Fenner Property”), and deliver it to water providers throughout Southern California.

A second phase of the Water Project would offer storage of up to one million acre-feet of imported water in the aquifer system.

We believe that the ultimate implementation of this Water Project will provide a significant source of future cash flow.

The

primary factor driving the value of such projects is ongoing pressure on California’s traditional water supplies and the

resulting demand for new, reliable supply solutions that can meet both immediate and long-term water needs. Available supply is

constrained by environmental and regulatory restrictions on each of the State’s three main water sources: the CRA, the State

Water Project, which provides water supplies from Northern California to the central and southern parts of the state, and the

Los Angeles Aqueduct, which delivers water from the eastern Sierra Nevada mountains to Los Angeles. Southern California's water

providers rely on imports from these systems for a majority of their water supplies, but deliveries from all three into the region

have been below capacity over the last several years.

Availability

of supplies in California also differs greatly from year to year due to natural hydrological variability. Over the last several

years, California has struggled through an historic drought featuring record-low winter precipitation and reservoir storage levels.

However, following a series of strong storms through the 2016-2017 winter, California has received record amounts of rain and

snow, eliminating drought conditions in much of Northern California and easing drought in the South. The rapid swing from drought

to an extremely wet year has challenged California's traditional infrastructure system, and deliveries into Southern California

from the State Water Project, Colorado River Aqueduct and Los Angeles Aqueduct remain below capacity.

The

Water Project is a local supply option in Southern California that could help address the region’s water supply challenges

by providing new reliable supply and local groundwater storage opportunities in both dry and wet years. The Project has received

permits in accordance with the California Environmental Quality Act (“CEQA”) which allow the capture and conservation

of 2.5 million acre-feet of groundwater over 50 years under the terms of a groundwater management plan approved by San Bernardino

County, which is responsible for groundwater use at the Project area.

Our

2017 working capital requirements relate largely to the final development activities associated with the Water Project and those

activities consistent with the Water Project related to further development of our land and agricultural assets. While we continue

to believe that the ultimate implementation of the Water Project will provide the primary source of our future cash flow, we also

believe there is significant additional value in our underlying agricultural assets. Demand for agricultural land with water rights

is at an all-time high; therefore, in addition to our Water Project proposal, we are engaged in agricultural joint ventures at

the Cadiz/Fenner Property that put some of the groundwater currently being lost to evaporation from the underlying aquifer system

to immediate beneficial use. We have farmed portions of the Cadiz/Fenner Property since the late 1980s relying on groundwater

from the aquifer system for irrigation and have found the site is well suited for various permanent and seasonal crops. Presently,

the property has 2,100 acres leased to third parties for a variety of crops, including citrus, dried-on-the-vine raisins and seasonal

vegetables.

We

also continue to explore additional uses of our land and water resource assets, including renewable energy development, the marketing

of our approved desert tortoise land conservation bank, which is located on our properties outside the Water Project area, and

other long-term legacy uses of our properties, such as habitat conservation and cultural development.

Corporate

Information

We

are a Delaware corporation with our principal executive offices located at 550 South Hope Street, Suite 2850, Los Angeles, California

90071. Our telephone number is (213) 271-1600. We maintain a corporate website at www.cadizinc.com. The information contained

in, or that can be accessed through, our website is not a part of this prospectus.

1

One acre-foot is equal to approximately 326,000 gallons or the volume of water that will cover an area of one acre to a

depth of one-foot. An acre-foot is generally considered to be enough water to meet the annual water needs of one average California

household.

THE

OFFERING

|

Securities

offered

|

We

are offering warrants for the purchase of an aggregate 357,500 shares of common stock to the Investors in connection with

entering into the Credit Agreement. The number of shares may be increased, upon the agreement of the Company and the Investors,

to 362,500 shares of common stock. This prospectus also relates to the offering of shares of common stock issuable upon exercise

of the warrants.

|

|

|

|

|

Common

stock outstanding after this offering

|

As

of May 1, 2017, the number of shares of common stock outstanding was 22,257,646. The number of shares to be issued

pursuant to this offering will depend on whether the warrants are exercised by the Investors. If the warrants are

fully exercised by the Investors, we will be required to issue an additional 357,500 shares of common stock (or 362,500 shares

of common stock upon the agreement of the Company and the Investors). Therefore, assuming the issuance of 357,500

shares of common stock upon exercise of the warrants, the total number of shares outstanding after giving effect to the offering

would be 22,615,146 (or 22,620,146 if the number of warrant shares is increased to 362,500 upon the agreement of the Company

and the Investors).

|

|

|

|

|

Warrant

terms

|

The

warrants have an exercise price of $14.94 per share, subject to adjustment as provided pursuant to the terms of the warrants. The

warrants have a five year term. A holder of a warrant may exercise the warrant, from time-to-time, from the Original Issue

Date, as defined in the warrants, through 4:00 P.M., Eastern Standard Time on the Expiration Date, as defined in the warrants. For

a more detailed discussion of the warrants, see “Description of Securities Being Offered.”

|

|

|

|

|

Use

of proceeds

|

If

the warrants are exercised for cash, we will receive the exercise price. Any proceeds we receive from exercise

of the warrants will be used for general corporate purposes.

|

|

|

|

|

NASDAQ

Global Market symbol

|

CDZI

|

RISK

FACTORS

Our

business is subject to significant risks. Before you invest in our securities you should carefully consider, among other matters,

the risks and uncertainties described below, as well as the other information contained or incorporated by reference in this prospectus

supplement and the accompanying prospectus, including our consolidated financial statements and accompanying notes and the information

under the heading “Risk Factors” in our most recent annual report on Form 10-K and quarterly reports on Form 10-Q.

See “Information Incorporated by Reference.” If any of the risks and uncertainties described in this prospectus supplement

or the accompanying prospectus or the documents incorporated by reference herein actually occur, our business, financial condition,

or results of operations could be adversely affected in a material way. This could cause the trading price of our common stock

to decline, perhaps significantly, and you may lose part or all of your investment. Please note that additional risks not presently

known to us or that we currently deem immaterial may also impair our business, financial condition and operations.

Risks

Relating to Ownership of the Warrants

You

may not be able to resell the warrants.

There

is no established trading market for the warrants being offered in this offering, and we do not expect such a market to develop.

In addition, we do not intend to apply for listing of the warrants on any securities exchange or other nationally recognized trading

system; therefore you may not be able to resell your warrants. If your warrants cannot be resold, you will have to depend upon

any appreciation in the value of our common stock over the exercise price of the warrants in order to realize a return on your

investment in the warrants.

Investors

will have no rights as a common stockholder with respect to their warrants until they exercise their warrants and acquire our

common stock.

Until

you acquire shares of our common stock upon exercise of your warrants, you will have no rights with respect to the shares of our

common stock underlying the warrants. Upon exercise of your warrants, you will be entitled to exercise the rights of a common

stockholder only as to matters for which the record date occurs on or after the exercise date.

If

an Investor owns a significant number of shares of our common stock, the Investor may be unable to exercise its warrants.

The

warrants being offered hereby will prohibit a holder from receiving shares of our common stock upon exercise of the warrants to

the extent that such exercise would cause the Holder Group, as defined in the warrants, to become, directly or indirectly, a beneficial

owner of more than 4.99% of our common stock. This percentage (i) may be increased or decreased, in the holder’s sole discretion,

upon 61 days’ written notice to the Company, provided, however, that in no event may the beneficial ownership limitation

exceed 19.99% of shares of common stock outstanding as of any date from the original issue date of the warrant through the Expiration

Date and (ii) shall automatically be increased to a maximum percentage of 19.99% on the date that is 15 days prior to the Expiration

Date.

As

a result, you may not be able to exercise your warrants for shares of our common stock at a time when it would be financially

beneficial for you to do so. In such circumstance, you could seek to sell your warrants to realize value but you may be unable

to do so.

USE

OF PROCEEDS

We

will receive no proceeds from the offering of the warrants that are being offered to the Investors in connection with entering

into the Credit Agreement. Assuming no increase in the number of shares of common stock subject to the warrants, if all of the

warrants for 357,500 shares of common stock are exercised for cash, we would receive the exercise price of the warrants, which

would total $5,341,050. If the number of shares of common stock subject to the warrants is increased to 362,500, we would receive

a total of $5,415,750 if the warrants are exercised in full. The proceeds from the exercise of the warrants, if any, will be used

for general corporate purposes.

DESCRIPTION

OF SECURITIES BEING OFFERED

We

are offering warrants to purchase an aggregate of 357,500 shares of our common stock. The number of shares subject to the warrants

may be increased, upon the agreement of the Company and the Investors, to 362,500 shares of common stock.

Following

the completion of this offering and assuming no increase in the number of shares of common stock covered by the warrants, we will

have warrants to purchase a total of up to 715,000 shares of our common stock outstanding. If the number of shares subject to

the warrants is increased to 362,500, we will have warrants to purchase a total of up to 720,000 shares of our common stock outstanding.

The

warrants have a term of five years and a per share exercise price of $14.94, subject to adjustment as follows:

If,

at any time after the warrants are issued, the number of shares of common stock outstanding is increased by a stock dividend payable

in shares of common stock or by a subdivision or split-up of shares of common stock, then, following the record date for the determination

of holders of common stock entitled to receive such stock dividend, or to be affected by such subdivision or split-up, the exercise

price shall be appropriately decreased by multiplying each price by a fraction, the numerator of which is the number of shares

of common stock outstanding immediately prior to such increase and the denominator of which is the number of shares of common

stock outstanding immediately after such increase.

If,

at any time after the warrants are issued, the number of shares of common stock outstanding is decreased by a combination or reverse

stock split of the outstanding shares of common stock into a smaller number of shares of common stock, then, following the record

date to determine shares affected by such combination or reverse stock split, the exercise price shall be appropriately increased

by multiplying the price by a fraction, the numerator of which is the number of shares of common stock outstanding immediately

prior to such decrease and the denominator of which is the number of shares of common stock outstanding immediately after such

decrease.

In

the event of any capital reorganization, any reclassification of our capital stock (other than changes in par value or as a result

of a stock dividend or subdivision, stock-split, reverse stock-split or combination of shares), any consolidation or merger where

we are not the survivor or where there is a change in or distribution with respect to our common stock, or sale, transfer or other

disposition of all or substantially all of our property, assets or business to a third party, each warrant will be exercisable

for the kind and number of shares of stock or other securities or property of ours or of any successor to which the holder of

the number of shares of common stock deliverable (immediately prior to the time of such reorganization, reclassification, consolidation,

merger or disposition of assets) upon exercise of the warrant would have been entitled upon such reorganization, reclassification,

consolidation, merger or disposition of assets.

The

warrants also include a reduction to the exercise price in the following instances:

(i)

if, at any time after the warrants are issued, we issue any shares of common stock, options to purchase or rights to subscribe

for common stock, securities by their terms convertible into or exchangeable for common stock, or options to purchase or rights

to subscribe for such convertible or exchangeable securities (collectively “Equity Issuances”) without consideration

or for consideration per share less than the greater of (x) the exercise price in effect immediately prior to the issuance of

such common stock or securities and (y) the Fair Market Value per share of the common stock immediately prior to such issuance

(the greater of (x) and (y), the “Reference Price”), or

(ii)

if we directly or indirectly redeem, purchase or otherwise acquire any shares of our common stock, options to purchase or rights

to subscribe for our common stock, securities by their terms convertible into or exchangeable for shares of our common stock,

or options to purchase or rights to subscribe for such convertible or exchangeable securities (collectively, “Equity Acquisitions”),

for a consideration per share (plus, in the case of such options, rights, or securities, the additional consideration required

to be paid to us upon exercise, conversion or exchange) greater than the Fair Market Value per share of common stock immediately

prior to the earlier of (x) the announcement of such event or (y) such event.

In

the event of an Equity Issuance, the exercise price will be lowered to a price equal to the price obtained by multiplying the

exercise price in effect immediately prior to the Equity Issuance by a fraction of which (x) the numerator will be the sum of

(i) the number of shares of common stock outstanding immediately prior to the Equity Issuance and (ii) the number of additional

shares of common stock which the aggregate consideration for the number of shares of common stock so offered would purchase at

the Reference Price and (y) the denominator will be the number of shares of common stock outstanding immediately after the Equity

Issuance.

In

the event of an Equity Acquisition, the exercise price will be lowered to a price equal to the price obtained by multiplying (i)

the exercise price in effect immediately prior to the Equity Acquisition by (ii) a fraction (A) the numerator of which will be

(1) the product of (a) the number of shares of common stock outstanding and (b) the Fair Market Value per share of the common

stock, in each case immediately prior to the Equity Acquisition, minus (2) the aggregate consideration paid by the Company in

such event (plus, in the case of such options, rights, or convertible or exchangeable securities, the aggregate additional consideration

required to be paid to the Company upon exercise, conversion or exchange), and (B) the denominator of which will be the product

of (1) the number of shares of common stock outstanding immediately after the Equity Acquisition and (2) the Fair Market Value

per share of common stock immediately prior to the Equity Acquisition.

If

we have issued or issue in the future any of our securities to a financial institution, lender, other credit provider, leasing

company or other lessor in connection with the provisions of any financing or lending agreements, containing provisions (including,

without limitation, anti-dilution and registration rights) which are more favorable than those set forth in the warrants, we will

make such provisions (or any more favorable portion thereof) available to the warrant holders and will enter into amendments necessary

to confer such rights on the warrant holders.

None

of the adjustments discussed herein will apply to (i) the issuance and exercise of options to purchase shares of common stock

and the issuance of shares of common stock made to eligible recipients pursuant to any equity incentive plan duly adopted by our

Board of Directors in the ordinary course of business, or (ii) any issuance of shares of common stock upon conversion of our convertible

debt securities outstanding as of the business day immediately preceding the date of the Credit Agreement.

Upon

an adjustment of the exercise price as set forth above, a warrant holder will be entitled to purchase a number of shares of common

stock (calculated to the nearest 1/100th of a share) obtained by multiplying the exercise price in effect immediately prior to

such adjustment by the number of shares of common stock issuable on the exercise of the warrant immediately prior to such adjustment

and dividing that product by the exercise price resulting from such adjustment.

After

giving effect to all of the provisions discussed above, the number of shares of common stock purchasable upon exercise of the

warrants will be increased when the exercise price is adjusted to an amount below the then-existing par value of the common stock,

including successive adjustments to the exercise price to an amount further below the then-existing par value. The number of additional

shares purchasable upon exercise of the warrants will be equal to the number obtained by dividing (i) the product of (A) the number

of shares purchasable upon exercise of the warrants before application of this adjustment and (B) the difference between the then-existing

par value per share of the common stock minus the adjusted exercise price, by (ii) the difference between the Fair Market Value

of the common stock on the exercise date minus the then-existing par value per share of the common stock subject to the warrants.

The

exercise price may be paid (i) with cash, (ii) by instructing us to withhold a number of shares of common stock then issuable

upon exercise of the warrant with an aggregate Fair Market Value equal to the exercise price, (iii) by surrendering to us shares

of common stock previously acquired by the warrant holder with an aggregate Fair Market Value equal to the exercise price, or

(iv) any combination of the foregoing.

A

warrant holder generally will not receive shares of our common stock upon exercise of the warrant to the extent that such exercise

or receipt would cause the Holder Group, defined as any group in respect of Common Stock, where “group” has the meaning

established under Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the rules

promulgated thereunder, if the warrant holder or any other person having beneficial ownership of common stock beneficially owned

by the warrant holder is a member of such group, directly or indirectly, a beneficial owner of a number of shares of common stock

that exceeds the Maximum Percentage, defined as 4.99%, of outstanding shares of common stock, which percentage may be increased

or decreased by the warrant holder; provided, however, that if at any time after the date of the warrant the Holder Group beneficially

owns in excess of 4.99% of the outstanding common stock (excluding any common stock that could be acquired by exercise of the

warrant), then the Maximum Percentage will automatically increase to 9.99%, which may nonetheless be increased or decreased by

the warrant holder. In no event, however, will the warrant holder increase the beneficial ownership limitation described herein

to raise the Maximum Percentage in excess of 19.99% as of any date from the date of the warrant through the expiration date of

the warrant. The Maximum Percentage will automatically be increased to 19.99% on the date that is 15 days prior to the expiration

date of the warrant.

In

addition, the Company may not, without stockholder approval as required by the applicable rules of the Company’s principal

Trading Market, as defined in the warrants, issue an amount of common stock upon exercise of the warrants that would exceed, in

the aggregate, 19.99% of the number of shares of common stock outstanding as of November 29, 2016. If such issuance cap is met,

warrant holders will receive Fair Market Value for the number of shares by which the exercise is reduced as a result of such issuance

cap.

The

term “Fair Market Value” is defined in the warrants as follows:

(i)

as to any common stock listed or quoted on a Trading Market, the 10-Day VWAP determined in respect of such primary Trading Market

and (ii) as to any common stock not listed or quoted on a Trading Market or any other security, (A) the Ten Day Average of the

average closing prices of such security’s sales on all domestic securities exchanges on which such security may at the time

be listed, or (B) if there have been no sales on any such exchange such that the foregoing Ten Day Average cannot be calculated,

the average of the highest bid and lowest asked prices on all such exchanges at the end of the Business Day immediately prior

to the date that Fair Market Value is determined as of, or (C) if on any day such security is not listed any domestic securities

exchange such that neither the foregoing Ten Day Average nor the foregoing bid-and-asked price average can be calculated, the

average of the highest bid and lowest asked prices at the end of the Business Day immediately prior to the date that Fair Market

Value is determined in the domestic over-the-counter market as reported by the National Association of Securities Dealers Automated

Quotation System or similar organization (and in each such case excluding any trades that are not bona fide, arm’s length

transactions). If neither the foregoing clause (i) nor clause (ii) is applicable, then (i) the “Fair Market Value”

of such security as of an applicable determination date shall be as determined in accordance with the Appraisal Procedure.

In

the event we declare or pay any dividends or if any other distribution is made on or with respect to our common stock, the warrant

holder as of the record date established by our Board of Directors for such dividend or distribution will be entitled to receive

a fee (the “Dilution Adjustment”) in an amount (whether in the form of cash, securities or other property) equal to

the amount (and in the form) of the dividends or distribution that such holder would have received had the warrant been exercised

as of the date immediately prior to the record date for such dividend or distribution; provided, however, that if we declare and

pay a dividend or distribution on our common stock consisting in whole or in part of common stock, then no Dilution Adjustment

will be payable in respect of the warrant and, in lieu thereof, the applicable adjustment will apply.

The

above description of the warrants is qualified in its entirety by reference to the full text of the Form of Warrant attached

as Exhibit E to the Credit Agreement, which is attached to the Current Report on Form 8-K we filed on May 2, 2017, which we

incorporate herein by reference.

PLAN

OF DISTRIBUTION

We,

the Investors and the Agent have entered into the Credit Agreement. Pursuant to the Credit Agreement, the Investors have agreed

to make secured term loans to us in an aggregate principal amount of $60,000,000.

We

are offering warrants for the purchase of 357,500 shares of common stock directly to the Investors in connection with entering

into the Credit Agreement. We may, with the agreement of the Investors, increase the number of shares of common stock subject

to the warrants to 362,500 shares.

We

will receive no proceeds from the offering of these securities, although if the warrants were to be exercised for cash we would

receive the exercise price. No underwriters or agents will be involved, and no commissions will be payable by us with respect

to the offering.

All

of our obligations under the Credit Agreement will be secured by first priority security interests in substantially all of our

assets. The Credit Agreement includes customary representations, warranties and covenants, and acceleration, indemnity and events

of default provisions.

LEGAL

MATTERS

The

validity of the securities offered hereby will be passed upon for us by Mitchell Silberberg & Knupp LLP, Los Angeles, California.

EXPERTS

The

financial statements and management’s assessment of the effectiveness of internal control over financial reporting (which

is included in Management’s Report on Internal Control over Financial Reporting) incorporated in this prospectus supplement

by reference to our Annual Report on Form 10-K for the year ended December 31, 2016 have been so incorporated in reliance on the

report (which contains an explanatory paragraph relating to the Company’s ability to continue as a going concern as described

in Note 2 to the financial statements) of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given

on the authority of said firm as experts in auditing and accounting.

WHERE

YOU CAN FIND MORE INFORMATION

We

have filed with the Commission a registration statement on Form S-3 under the Securities Act of 1933, as amended, to register

with the Commission the securities being offered in this prospectus supplement and the accompanying prospectus. This prospectus

supplement and the accompanying prospectus, which constitute a part of the registration statement, do not contain all of the information

set forth in the registration statement or the exhibits and schedules filed with the registration statement. For further information

about us, and the securities being offered, reference is made to the registration statement and the exhibits and schedules filed

with the registration statement. Any statements contained or incorporated by reference in this prospectus supplement regarding

the contents of any contract or any other document that is filed as an exhibit to the registration statement are not necessarily

complete, and each such statement is qualified in all respects by reference to the full text of such contract or other document

filed as an exhibit to the registration statement. We file annual, quarterly and current reports, proxy and registration statements

and other information with the Commission. You may read and copy any reports, statements, or other information that we file, including

the registration statement of which this prospectus supplement and the accompanying prospectus form a part, and the exhibits and

schedules filed with the registration statement, without charge at the public reference room maintained by the Commission, located

at 100 F Street, NE, Room 1024, Washington, D.C. 20549, and copies of all or any part of the registration statement may be obtained

from the Commission on the payment of the fees prescribed by the Commission. Please call the Commission at 1-800-SEC-0330 for

further information about the public reference room. Our filings with the Commission, including the registration statement, are

available to you on the Commission’s website at http://www.sec.gov. In addition, documents that we file with the Commission

are available on our website at www.cadizinc.com. Unless specifically incorporated by reference into this prospectus supplement

or the accompanying prospectus, information contained on our website is not, and should not be interpreted to be, part of this

prospectus supplement or the accompanying prospectus.

We

are “incorporating by reference” into this prospectus supplement and the accompanying prospectus specified documents

we file with the Commission. The information we incorporate by reference into this prospectus supplement is an important part

of the prospectus of which this prospectus supplement is a part.

We

incorporate by reference into this prospectus supplement the information contained in the following documents, which is considered

to be a part of this prospectus supplement:

|

|

●

|

our

Annual Report on Form 10-K for the year ended December 31, 2016, filed on March 16, 2017;

|

|

|

●

|

our

definitive Proxy Statement on Schedule 14A filed on April 21, 2017, but only to the extent

that such information was incorporated by reference into our Annual Report on Form 10-K

for the year ended December 31, 2016;

|

|

|

●

|

our

Current Reports on Form 8-K filed on February 3, 2017 and on May 2, 2017;

|

|

|

●

|

the

description of our common stock as set forth in our registration statement filed on Form

8-A under the Exchange Act on May 8, 1984, as amended by reports on:

|

|

|

o

|

Form

8-K filed with the SEC on May 26, 1988;

|

|

|

o

|

Form

8-K filed with the SEC on June 2, 1992;

|

|

|

o

|

Form

8-K filed with the SEC on May 18, 1999; and

|

|

|

o

|

Annual

Report on Form 10-K for the year ended December 31, 2003, filed on November 2, 2004.

|

We

also incorporate by reference all additional documents that we file with the Commission pursuant to Sections 13(a), 13(c), 14

or 15(d) of the Exchange Act, which are filed after the effective date of the registration statement and prior to the termination

of the offering of securities offered pursuant to this prospectus supplement and the accompanying prospectus. We are not, however,

incorporating, in each case, any documents or information that we “furnish” to, and not file with, the Commission

in accordance with its rules and regulations.

Any

statement contained in a document incorporated or deemed to be incorporated by reference into this prospectus supplement will

be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus

supplement or any other subsequently filed document that is deemed to be incorporated by reference into this prospectus supplement

modifies or supersedes the statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded,

to constitute a part of this prospectus supplement.

Our

filings with the Commission, including our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form

8-K, and definitive proxy statement, and any amendments to those filings, are available free of charge on our website (www.cadizinc.com)

as soon as reasonably practicable after they are filed with, or furnished to, the Commission. Our website and the information

contained on that site, or connected to that site, are not incorporated into and are not a part of this prospectus supplement.

You may also obtain a copy of these filings at no cost by writing or telephoning us at the following address:

Cadiz

Inc.

550

S. Hope Street

Suite

2850

Los

Angeles, California 90071

Attention:

Investor Relations

Telephone:

(213) 271-1600

We

will provide without charge upon written or oral request to each person, including any beneficial owner, to whom a prospectus

is delivered, a copy of any and all of the documents which are incorporated by reference in this prospectus but not delivered

with this prospectus (other than exhibits unless such exhibits are specifically incorporated by reference in such documents).

You may request a copy of these documents by writing or telephoning us at the above address.

No

person has been authorized to give any information or to make any representation not contained in this prospectus supplement,

and, if given or made, such information and representation should not be relied upon as having been authorized by us. Neither

this prospectus supplement nor the accompanying prospectus constitute an offer to sell or a solicitation of an offer to buy any

of the securities offered hereby in any jurisdiction or to any person to whom it is unlawful to make such offer or solicitation.

Neither the delivery of this prospectus supplement or the accompanying prospectus nor any sale made hereunder will under any circumstances

create an implication that there has been no change in the facts set forth in this prospectus supplement or the accompanying prospectus

or in our business, financial condition or affairs since the date hereof.

PROSPECTUS

$40,000,000

Cadiz

Inc.

DEBT

SECURITIES

COMMON

STOCK

PREFERRED

STOCK

Warrants

SUBSCRIPTION

RIGHTS

Units

By

this prospectus and an accompanying prospectus supplement, we may from time to time offer and sell, in one or more offerings,

up to $40,000,000 in any combination of debt securities, common stock, preferred stock, warrants, subscription rights and units.

We

will provide you with more specific terms of these securities in one or more supplements to this prospectus. You should read this

prospectus and the applicable prospectus supplement carefully before you invest.

We

may offer these securities from time to time in amounts, at prices and on other terms to be determined at the time of the offering.

We may offer and sell these securities to or through underwriters, dealers or agents, or directly to investors, on a continuous

or delayed basis. The supplements to this prospectus will provide the specific terms of the plan of distribution. The price to

the public of such securities and the net proceeds we expect to receive from such sale will also be set forth in the applicable

prospectus supplement.

Our

common stock is listed on the Nasdaq Global Market under the symbol “CDZI”. On October 28, 2016, the closing price

of our common stock as reported by the Nasdaq Global Market was $7.40 per share.

Investing

in these securities involves certain risks. See “Risk Factors” beginning on page 2.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR

PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Prospectus

dated November 14, 2016

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement we filed with the Securities and Exchange Commission, or the “Commission”,

using the “shelf” registration process. Under the shelf registration process, using this prospectus, together with

a prospectus supplement, we may sell from time to time any combination of the securities described in this prospectus in one or

more offerings. This prospectus provides you with a general description of the securities that may be offered. Each time we sell

securities pursuant to this prospectus, we will provide a prospectus supplement that will contain specific information about the

terms of the securities being offered. A prospectus supplement may include a discussion of any risk factors or other special considerations

applicable to those securities or to us. The prospectus supplement may also add to, update or change information contained in

this prospectus and, accordingly, to the extent inconsistent, the information in this prospectus will be superseded by the information

in the prospectus supplement. You should read this prospectus, any applicable prospectus supplement and the additional information

incorporated by reference in this prospectus described below under “Available Information” and “Information

Incorporated by Reference” before making an investment in our securities.

This

prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made

to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents.

Copies of the documents referred to herein have been filed, or will be filed or incorporated by reference as exhibits to the registration

statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Available

Information.”

Neither

the delivery of this prospectus nor any sale made under it implies that there has been no change in our affairs or that the information

in this prospectus is correct as of any date after the date of this prospectus. You should not assume that the information in

this prospectus, including any information incorporated in this prospectus by reference, the accompanying prospectus supplement

or any free writing prospectus prepared by us, is accurate as of any date other than the date on the front of those documents.

Our business, financial condition, results of operations and prospects may have changed since that date.

We

have not authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus,

a prospectus supplement or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We

take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give

you. We are not making an offer to sell securities in any jurisdiction where the offer or sale of such securities is not permitted.

Unless

the context otherwise requires, the terms “we,” “us,” “our,” “Cadiz,” and “the

Company” refer to Cadiz Inc., a Delaware corporation.

Special

Note Regarding Forward-Looking Statements

All

statements in this prospectus and the documents incorporated by reference that are not historical facts should be considered “Forward

Looking Statements” within the meaning of the “Safe Harbor” provisions of the Private Securities Litigation

Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results,

performance or achievements of the Company to be materially different from any future results, performance or achievements expressed

or implied by the forward-looking statements. Although we believe that our plans, intentions and expectations reflected in, or

suggested by, such forward-looking statements are reasonable, we can give no assurance that such plans, intentions, or expectations

will be achieved.

Certain

risks, uncertainties, and other factors are incorporated herein by reference to our most recent Annual Report on Form 10-K

and our subsequent Quarterly Reports on Form 10-Q, along with the other information contained in this prospectus, as updated

by our subsequent filings under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Except as otherwise

required by applicable securities laws, we undertake no obligation to publicly update or revise any forward-looking statements,

whether as a result of new information, future events, changed circumstances, or any other reason, after the date of this prospectus.

Available

Information

We

are subject to the informational requirements of the Exchange Act, and file reports, proxy statements and other information with

the Securities and Exchange Commission (the “Commission” or the “SEC”). We have also filed a registration

statement on Form S-3 with the Commission. This prospectus, which forms part of the registration statement, does not have all

of the information contained in the registration statement. You may read, free of charge, and copy, at the prescribed rates, any

reports, proxy statements and other information, including the registration statement, at the Commission’s Public Reference

Room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information concerning the operation of the Public Reference

Room by calling the Commission at 1-800-SEC-0330. The Commission also maintains a website that contains reports, proxy statements

and other information, including the registration statement. The website address is: http://www.sec.gov.

Information

Incorporated by Reference

The

Commission allows us to “incorporate by reference” into this prospectus the information we file with them. The information

we incorporate by reference into this prospectus is an important part of this prospectus. Any statement in a document we have

filed with the Commission prior to the date of this prospectus and which is incorporated by reference into this prospectus will

be considered to be modified or superseded to the extent a statement contained in the prospectus or any other subsequently filed

document that is incorporated by reference into this prospectus modifies or supersedes that statement. The modified or superseded

statement will not be considered to be a part of this prospectus, except as modified or superseded.

We

incorporate by reference into this prospectus the information contained in the following documents, which is considered to be

a part of this prospectus:

|

|

●

|

our

Annual Report on Form 10-K for the year ended December 31, 2015, filed on March

14, 2016;

|

|

|

●

|

our

Current Reports on Form 8-K filed on February 12, 2016, March 10, 2016, April 29,

2016, May 11, 2016, May 26, 2016, June 14, 2016 and June 23, 2016;

|

|

|

●

|

our

Quarterly Reports on Form 10-Q for the quarters ended March 31, 2016 and June

30, 2016, filed on May 9, 2016 and August 8, 2016, respectively;

|

|

|

●

|

the

description of our common stock as set forth in our registration statement filed on Form 8-A

under the Exchange Act on May 8, 1984, as amended by reports on:

|

|

|

●

|

Form 8-K

filed with the SEC on May 26, 1988;

|

|

|

●

|

Form 8-K

filed with the SEC on June 2, 1992;

|

|

|

●

|

Form 8-K

filed with the SEC on May 18, 1999; and

|

|

|

●

|

Annual

Report on Form 10-K for the year ended December 31, 2003, filed on November 2,

2004

|

We

also incorporate by reference all additional documents that we file with the Commission pursuant to Section 13(a), 13(c),

14 or 15(d) of the Exchange Act that are filed after the date of the initial registration statement and prior to the effectiveness

of the registration statement or that are filed after the effective date of the registration statement of which this prospectus

is a part and prior to the termination of the offering of securities offered pursuant to this prospectus. We are not, however,

incorporating in each case, any documents or information that we are deemed to “furnish” and not file in accordance

with the Commission rules.

You

may obtain a copy of these filings, without charge, by writing or calling us at:

Cadiz

Inc.

550 South Hope Street

Suite 2850

Los Angeles, California 90071

Attention: Investor Relations

(213) 271-1600

No

dealer, salesperson, or other person has been authorized to give any information or to make any representation not contained in

this prospectus, and, if given or made, such information and representation should not be relied upon as having been authorized

by us or any selling shareholder. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any

of the securities offered by this prospectus in any jurisdiction or to any person to whom it is unlawful to make such offer or

solicitation. Neither the delivery of this prospectus nor any sale made hereunder shall under any circumstances create an implication

that there has been no change in the facts set forth in this prospectus or in our affairs since the date hereof.

The

Company

About

Cadiz

We

are a land and water resource development company with 45,000 acres of land in three areas of eastern San Bernardino County, California. Virtually

all of this land is underlain with high-quality, naturally recharging groundwater resources, and is situated in proximity to the

Colorado River and the Colorado River Aqueduct (“CRA”), a major source of imported water for Southern California. Our

properties are suitable for various uses, including large-scale agricultural development, groundwater storage and water supply

projects. Our main objective is to realize the highest and best use of our land and water resources in an environmentally responsible

way.

We

believe that the long-term highest and best use of our land and water assets can best be realized through the development of a

combination of water supply and storage projects at our properties. Therefore, the Company has been primarily focused on the development

of the Cadiz Valley Water Conservation, Recovery and Storage Project (“Water Project” or “Project”), which

will capture and conserve millions of acre-feet

2

of native groundwater currently

being lost to evaporation from the aquifer system beneath our 34,000-acre property in the Cadiz and Fenner valleys of eastern

San Bernardino County (the “Cadiz/Fenner Property”), and deliver it to water providers throughout Southern California

(see “Water Resource Development”). We believe that the ultimate implementation of this Water Project will

provide a significant source of future cash flow.

The

primary factor driving the value of such projects is ongoing pressure on water supplies throughout California, which has led Southern

California water providers to actively seek new, reliable supply solutions to plan for both short and long-term water needs. Available

supply is constrained by environmental and regulatory restrictions on each of the State’s three main water sources: the

State Water Project, which provides water supplies from Northern California to the central and southern parts of the state, the

CRA and the Los Angeles Aqueduct. Southern California’s water providers rely on imports from these systems for

a majority of their water supplies, but deliveries from all three into the region have been below capacity over the last several

years.

Availability

of supplies in California also differs greatly from year to year due to natural hydrological variability. Over the

last several years, California has struggled through a historic drought featuring record-low winter precipitation and reservoir

storage levels. In 2015, for the first time in the state’s history, California Governor Jerry Brown mandated rationing of

25% statewide in an effort to curtail urban demand. An “El Nino” weather pattern developed at the end of

2015 and brought wet conditions to California, yet snowpack and precipitation remain average for the year, especially in Southern

California. According to the US Drought Monitor, as of February 2016, more than 99% of California remains abnormally dry.

The Water Project is one of the few nearly “shovel-ready” supply options in Southern California that could help alleviate

the region’s water supply challenges. (See “Water Resource Development” below.) In addition to our water resource

development activities, we also continue to explore additional uses of our land and water resource assets, including new agricultural

opportunities, the development of a land conservation bank on our properties outside the Water Project area and other long-term

legacy uses of our properties, such as habitat conservation and cultural uses.

In

addition to an urgent need in California for new, reliable water supplies, demand for agricultural land with water rights is also

at an all-time high. Therefore, in addition to our Water Project proposal, we are pursuing ways in which the groundwater currently

being lost to evaporation from the aquifer system at the Cadiz/Fenner property can be immediately put to beneficial use through

sales, leasing, or agricultural joint ventures that are complementary to the Water Project.

2

One acre-foot is equal to approximately 326,000 gallons or the

volume of water that will cover an area of one acre to a depth of one-foot. An acre-foot is generally considered to be enough

water to meet the annual water needs of one average California household.

We

have farmed portions of the Cadiz/Fenner Property since the late 1980s relying on groundwater from the aquifer system for irrigation

and we believe the site is well suited for various permanent and seasonal crops. In 1993, we secured permits to develop agriculture

on up to 9,600 acres of the property and withdraw groundwater from the underlying aquifer system for irrigation. We

initially developed 1,900 acres of agriculture at the Property, including a well-field and manifold system and since have maintained

various levels of agriculture at the Property as we focused on developing the Water Project. In February 2016 we completed

arrangements to lease 2,100 acres of the Cadiz/Fenner Property for agricultural development as a result of significant interest

from third parties in expanding agricultural activity at the Cadiz/Fenner Property.

As

part of the agricultural expansion to be conducted under the lease arrangements, the groundwater production capacity of the property’s

existing well-field is expected to be increased, which will provide additional infrastructure that is complementary to the Water

Project. Through work completed in 2015, including the drilling of three additional exploratory wells, we have now

identified suitable locations for the drilling of high-production wells powered by natural gas that could produce all of the water

allowable under our existing permit for implementation of the Water Project or alternatively to supply irrigation water for all

of the agricultural land. While any additional well-field development for agricultural use would be financed by our

agricultural partners as provided under our agricultural arrangements, the Company retained a call feature that allows us, at

any time in the initial 20 years, to acquire the well-field and integrate any new agricultural well-field infrastructure developed

into the Water Project’s facilities.

Our

2016 working capital requirements relate largely to the final development activities associated with the Water Project and those

activities consistent with the Water Project related to further development of our land and agricultural assets. While

we continue to believe that the ultimate implementation of the Water Project will provide the primary source of our future cash

flow, we also believe there is significant additional value in our underlying agricultural assets.

We

also continue to explore additional uses of our land and water resource assets, including the marketing of our approved desert

tortoise land conservation bank, which is located on our properties outside the Water Project area, and other long-term legacy

uses of our properties, such as habitat conservation and cultural development.

Corporate

Information

We

are a Delaware corporation with our principal executive offices located at 550 South Hope Street, Suite 2850, Los Angeles, California

90071. Our telephone number is (213) 271-1600. We maintain a corporate website at www.cadizinc.com. The information contained

in, or that can be accessed through, our website is not a part of this prospectus.

Risk

Factors

An

investment in our securities involves a high degree of risk. Certain risks relating to us and our business are described under

the headings “Business” and “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31,

2015, filed with the Commission on March 14, 2016, which is incorporated by reference into this prospectus and which you

should carefully review and consider, along with the other information contained in this prospectus or incorporated by reference

herein, as updated by our subsequent filings under the Exchange Act, before making an investment in any of our securities. Additional

risks, as well as updates or changes to the risks described in the documents incorporated by reference herein, may be included

in any applicable prospectus supplement. Our business, financial condition or results of operations could be materially adversely

affected by any of these risks. The market or trading price of our securities could decline due to any of these risks, and you

may lose all or part of your investment. In addition, please read the section of this prospectus captioned “Special Note

Regarding Forward-Looking Statements”, in which we describe additional uncertainties associated with our business and the

forward-looking statements included or incorporated by reference in this prospectus. Please note that additional risks not presently

known to us or that we currently deem immaterial may also impair our business and operations.

Investment

in any securities offered pursuant to this prospectus involves risks and uncertainties. If one or more of the events discussed

in the risk factors were to occur, our business, financial condition, results of operations or liquidity, as well as the value

of an investment in our securities, could be materially adversely affected.

You

should carefully consider the risk factors as well as the other information contained and incorporated by reference in this prospectus

before deciding to invest.

Use

of Proceeds

Unless

otherwise provided in the applicable prospectus supplement, the net proceeds from the sale of the securities offered by this prospectus

and each prospectus supplement, the “offered securities”, will be used for general corporate purposes, which may include

working capital needs, the refinancing or repayment of existing indebtedness, capital expenditures, expansion of the business

and acquisitions. If any of the net proceeds from the offered securities will be used for acquisitions, we will identify the acquisition

in the applicable prospectus supplement. The net proceeds may be invested temporarily in short-term securities or to repay short-term

debt until they are used for their stated purpose.

Ratios

of Earnings to Fixed Charges

and Combined Fixed Charges and Preferred Dividends

The

ratios of earnings to fixed charges and earnings to combined fixed charges and preferred stock dividend requirements are set forth

below for the periods indicated.

|

|

|

Six

months ended

|

|

|

Year

Ended December 31,

|

|

|

|

|

June

30, 2016

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

Ratio of Earnings to Fixed

Charges

|

|

|

(a

|

)

|

|

|

(a)

|

|

|

|

(a

|

)

|

|

|

(a

|

)

|

|

|

(a

|

)

|

|

|

(a

|

)

|

|

|

(a

|

)

|

|

Ratio of Earnings to Combined Fixed

Charges and Preferred Stock Dividend Requirements

|

|

|

(a

|

)

|

|

|

(a

|

)

|

|

|

(a

|

)

|

|

|

(a

|

)

|

|

|

(a

|

)

|

|

|

(a

|

)

|

|

|

(a

|

)

|

|

|

(a)

|

Both

(1) fixed charges and (2) combined fixed charges and preferred stock dividend

requirements exceeded our earnings (loss) for the six months ended June 30, 2016 by $14.4

million and for the years ended December 31, 2015, 2014, 2013, 2012 and 2011 by $24.0

million, $18.9 million, $22.7 million, $19.9 million, and $16.8 million, respectively.

|

For

the purpose of calculating both the ratios of earnings to fixed charges and earnings to combined fixed charges and preferred stock

dividend requirements, earnings represent net income from continuing operations before the cumulative effect of change in accounting

principles, less undistributed equity earnings, plus applicable income taxes plus fixed charges. Fixed charges, excluding interest

on deposits, include interest expense (other than on deposits) and the proportion deemed representative of the interest factor

of rent expense, net of income from subleases. Fixed charges, including interest on deposits, include all interest expense and

the proportion deemed representative of the interest factor of rent expense, net of income from subleases.

Description

of Debt Securities

This

prospectus describes certain general terms and provisions of the debt securities. The debt securities may constitute either senior

or subordinated debt securities, and in either case will be unsecured, and may also include convertible debt securities. We will

issue any debt securities that will be senior debt under an Indenture between us and U.S. Bank National Association, as trustee

(the “Senior Indenture”). We will issue any debt securities that will be subordinated debt under an Indenture between

us and U.S. Bank National Association, as trustee (the “Subordinated Indenture”). We may also issue debt securities

under the Indentures between Cadiz Inc., as Issuer, and U.S. Bank National Association, as Trustee, dated as of March 5, 2013

and December 10, 2015 (the “Existing Indentures”). This prospectus refers to the Senior Indenture and the Subordinated

Indenture individually as the “Indenture” and collectively as the “Indentures.” The form of Senior Indenture

and the form of Subordinated Indenture are included as exhibits to the registration statement of which this prospectus forms a

part while the Existing Indentures are incorporated by reference as exhibits to the registration statement. The term “trustee”

refers to the trustee under each Indenture, as appropriate.

The

Indentures are subject to and governed by the Trust Indenture Act of 1939, as amended. The Indentures are substantially identical,

except for the provisions relating to subordination, which are included only in the Subordinated Indenture. The following summary

of the material provisions of the Indentures and the debt securities is not complete and is subject to, and is qualified in its

entirety by reference to, all of the provisions of the Indentures, each of which has been filed as an exhibit to the registration

statement of which this prospectus is a part. We urge you to read the Indenture that is applicable to you because it, and not

the summary below, defines your rights as a holder of debt securities. You can obtain copies of the Indentures by following the

directions described under the heading “Available Information.”

The

senior debt securities will rank equally with all of our other unsecured and unsubordinated debt. The subordinated debt securities

will be subordinated in right of payment to our “Senior Indebtedness”, as defined below in the section titled “Subordination”.

As of June 30, 2016, all of our $118,891,459 aggregate principal amount of existing debt would have ranked senior to the subordinated

debt securities and $76,223,279 aggregate principal amount of our debt would have ranked equally with the senior debt securities.

The Indentures do not limit the amount of debt, either secured or unsecured, which may be issued by us under the Indentures or

otherwise. We may limit the maximum total principal amount for the debt securities of any series. However, any limit under the

Indentures may be increased by resolution of our Board of Directors. We will establish the terms of each series of debt securities

under the Indentures in a supplemental Indenture, board resolution or company order. The debt securities under the Indentures

may be issued in one or more series with the same or various maturities and may be sold at par, a premium or an original issue

discount. Debt securities sold at an original issue discount may bear no interest or interest at a rate which is below market

rates.

The

Indentures do not prohibit us or our subsidiaries from incurring debt or agreeing to limitations on our subsidiaries’ ability

to pay dividends or make other distributions to us, although the terms of specific debt securities may include such limitations.

The agreements governing our indebtedness, including the Existing Indentures, contain limitations on our ability to incur debt

or liens, conduct asset sales and pay dividends.

Unless

we inform you otherwise in a prospectus supplement, we may issue additional debt securities of a particular series under the Indentures

without the consent of the holders of the debt securities of such series outstanding at the time of issuance. Any such additional

debt securities, together with all other outstanding debt securities of that series, will constitute a single series of securities

under the applicable Indenture.

Unless

we inform you otherwise in a prospectus supplement, each series of our senior debt securities will rank equally in right of payment

with all of our other unsubordinated debt. The subordinated debt securities will rank junior in right of payment and be subordinate

to all of our unsubordinated debt.

We

may issue debt securities from time to time in one or more series under the Indentures or under the Existing Indentures. We will

describe the particular terms of each series of debt securities we offer in a supplement to this prospectus or other offering

material. The prospectus supplement and other offering material relating to a series of debt securities will describe the terms

of such debt securities being offered, including (to the extent such terms are applicable to such debt securities):

|

|

●

|

the

title of the debt securities;

|

|

|

●

|

designation,

aggregate principal amount, denomination and currency or currency unit;

|

|

|

●

|

the

price or prices at which we sell the debt securities and the percentage of the principal

amount at which the debt securities will be issued;

|

|

|

●

|

whether

the debt securities are senior debt securities or subordinated debt securities and applicable

subordination provisions, if any;

|

|

|

●

|

any

limit on the total principal amount of the debt securities and the ability to issue additional

debt securities of the same series;

|

|

|

●

|

currency

or currency units for which such debt securities may be purchased and in which principal

of, premium, if any, and any interest will or may be payable;

|

|

|

●

|

interest

rate or rates (or the manner of calculation thereof), if any;

|

|

|

●

|

the

times at which any such interest will be payable;

|

|

|

●

|

the

date or dates from which interest will accrue on the debt securities, or the method used

for determining those dates;

|

|

|

●

|

the

place or places where the principal and interest, if any, will be payable;

|

|

|

●

|

any

redemption, sinking fund, satisfaction and discharge, or defeasance provisions;