Amended Statement of Beneficial Ownership (sc 13d/a)

May 03 2017 - 6:10AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 13D

Under the Securities Exchange Act of

1934

(Amendment No. 2)

JAKKS Pacific, Inc.

--------------------------------------------------------------------------------

(Name of Issuer)

Common Stock, $.001 Par Value

--------------------------------------------------------------------------------

(Title of Class of Securities)

47012E106

--------------------------------------------------------------------------------

(CUSIP Number)

William Xu Zhang

c/o Hong Kong Meisheng Cultural Company

Limited

Room 1204, Mongkok Commercial Centre, 16

Argyle Street, Mongkok, Kowloon, Hong Kong

p.

+86-15397003086

With a copy to:

|

Ning Zhang

Morgan, Lewis & Bockius, LLP

Beijing Kerry Centre SouthTower, Suite 823,

8th Floor,

No. 1 Guang Hua Road, Chaoyang District,

Beijing, 100020

|

David A. Sirignano

Morgan, Lewis & Bockius, LLP

1111 Pennsylvania Avenue, N.W.

Washington, D.C. 20004

|

--------------------------------------------------------------------------------

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

April 27, 2017

--------------------------------------------------------------------------------

(Date of Event which Requires Filing of

This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box

¨

.

CUSIP No. 47012E106

|

|

1.

|

NAME OF REPORTING PERSONS

|

|

|

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

Hong Kong Meisheng Cultural Company Limited

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

¨

(b)

¨

WC

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

¨

|

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

Hong Kong, China

5,239,538

|

|

9.

|

SOLE DISPOSITIVE POWER

|

0

|

|

10.

|

SHARED DISPOSITIVE POWER

|

5,239,538

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

5,239,538

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨

|

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

19.5%

|

|

14.

|

TYPE OF REPORTING PERSON

|

CO

CUSIP No. 47012E106

|

|

1.

|

NAME OF REPORTING PERSONS

|

|

|

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

Meisheng

Cultural

and Creative Corp., Ltd.

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

¨

(b)

¨

WC

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

¨

|

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

PRC

0

5,239,538

|

|

9.

|

SOLE DISPOSITIVE POWER

|

0

|

|

10.

|

SHARED DISPOSITIVE POWER

|

5,239,538

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

5,239,538

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨

|

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

19.5%

|

|

14.

|

TYPE OF REPORTING PERSON

|

CO

This Amendment No. 2 to Schedule 13D is

filed by Meisheng Cultural and Creative Corp., Ltd., a PRC company listed on Shenzhen Stock Exchange (“Meisheng Cultural”)

and its wholly owned subsidiary, Hong Kong Meisheng Cultural Company Limited, a Hong Kong corporation (“Hongkong Meisheng”

and together with Meisheng Cultural, the “'Reporting Persons”), and supplements and amends the Statement on Schedule

13D filed on February 10, 2017, as well as Amendment No. 1 to that Schedule 13D filed on March 16, 2017, with respect to the Common

Stock, par value $0.001 per share (“Shares”) of JAKKS Pacific, Inc., a Delaware corporation (the “Issuer”).

Unless otherwise indicated, capitalized terms used but not otherwise defined herein shall have the meaning assigned to such terms

in the Statement on Schedule 13D filed on February 10, 2017, as amended.

Responses to each item of this Amendment

No. 2 to Schedule 13D are incorporated by reference into the response to each other item, as applicable.

|

|

Item 3.

|

Source and Amount of Funds.

|

As previously disclosed in Amendment No.

1 to this Schedule 13D, on March 15, 2017, Hongkong Meisheng and the Issuer entered into an Equity Purchase Agreement (the “Equity

Purchase Agreement”), under which the Issuer agreed to issue to the Hongkong Meisheng and Hongkong Meisheng agreed to purchase

3,660,891 shares of the Issuer’s Common Stock (the “Purchased Shares”) at US$5.275 per share for an aggregate

amount of US$19,311,200.00. The sale of the Purchased Shares pursuant to the Equity Purchase Agreement closed on April 27, 2017.

Funds for the purchase of the Purchased Shares reported herein were derived from general working capital of the Reporting Persons.

No borrowed funds were used to purchase the Purchased Shares, other than any borrowed funds used for working capital purposes in

the ordinary course of business.

|

|

Item 4.

|

Purpose of Transaction.

|

The

Reporting Persons acquired Shares for investment purposes, because the Reporting Persons believed that the Shares, when purchased,

represented an attractive investment opportunity. The Issuer is one of the largest customers of the Reporting Persons and the Reporting

Persons and the Issuer have a joint venture in Hong Kong, China.

The Reporting Persons expect to review from

time to time its investment in the Issuer and may, depending on the market and other conditions: (i) purchase additional Shares,

options or related derivatives in the open market, in privately negotiated transactions or otherwise and (ii) sell all or a portion

of the Shares, options or related derivatives now beneficially owned or hereafter acquired by it.

In accordance with the Equity Purchase Agreement,

Hongkong Meisheng is entitled to appoint one director to the board of the Issuer on the closing date, and from and after the closing

date, for so long as Hongkong Meisheng or its affiliates beneficially own Common Stock of the Issuer constituting not less than

10% of the outstanding Common Stock of the Issuer. Xiaoqiang Zhao, Executive Director of Hongkong Meisheng and Chairman of the

Board of Meisheng Cultural was appointed to the Issuer’s board of directors as of April 27, 2017.

In accordance with the Equity Purchase Agreement,

Hongkong Meisheng and the Issuer entered into a Registration Rights Agreement as of April 27, 2017, under which Hongkong Meisheng

shall be entitled to customary registration rights under U.S. securities laws with respect to the shares of Common Stock held by

Hongkong Meisheng, including the demand registration, Form S-3 registration and piggyback registration.

Except as set forth above and in connection

with the Equity Purchase Agreement and the Registration Rights Agreement, the Reporting Persons do not have any plans or proposals

which relate to, or could result in, any of the matters referred to in paragraphs (a) through (j), inclusive, of the instructions

to Item 4 of Schedule 13D. The Reporting Persons may, at any time and from time to time, review or reconsider their position and/or

change their purpose and/or formulate plans or proposals with respect thereto.

|

|

Item 5.

|

Interest in Securities of the Issuer.

|

(a) As of the date hereof, Hongkong Meisheng

holds 5,239,538 Shares, or 19.5% of the issued and outstanding Shares of the Issuer, and the calculation is based upon 23,208,535

shares of Common Stock issued and outstanding as of March 15, 2017, according to the Form 10-K filed by the Issuer on March 16,

2017, plus the Purchased Shares.

(b) The Reporting Persons have the shared

power to vote or direct the vote of 5,239,538 Shares to which this filing relates; and have the shared power to dispose or direct

the disposition of 5,239,538 Shares to which this filing relates.

(c) None of the Reporting Persons nor the

persons listed in Appendix A has effected such transactions in Issuer common stock during the past 60 days other than pursuant

to the Equity Purchase Agreement.

(d) No person other than the Reporting Persons

has the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the Shares.

(e) Inapplicable

SIGNATURE

After reasonable inquiry and to the best

of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

Dated: May 3, 2017

|

HONG KONG MEISHENG CULTURAL COMPANY LIMITED

|

|

|

|

|

|

|

By:

|

/s/ Xiaoqiang Zhao

|

|

|

|

|

Xiaoqiang Zhao, its Executive Director

|

|

|

|

|

|

|

MEISHENG CULTURAL

AND CREATIVE CORP.,

LTD.

|

|

|

|

|

|

|

By:

|

/s/ Xiaoqiang Zhao

|

|

|

|

|

Xiaoqiang Zhao, its Director

|

Attention. Intentional misstatements or omissions of fact constitute

federal criminal violations (see 18 U.S.C. 1001).

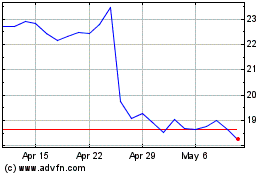

JAKKS Pacific (NASDAQ:JAKK)

Historical Stock Chart

From Mar 2024 to Apr 2024

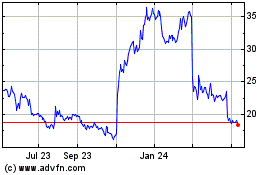

JAKKS Pacific (NASDAQ:JAKK)

Historical Stock Chart

From Apr 2023 to Apr 2024