By Josh Mitchell

The U.S. economy stumbled during the first months of the year,

as consumers reined in spending despite a rise in household

confidence and a surge in stock prices that greeted the

inauguration of President Donald Trump.

Gross domestic product, a broad measure of national output, grew

at a 0.7% annual rate in January through March, the slowest pace of

expansion in three years, the Commerce Department said Friday.

Americans sharply cut back spending on big-ticket items like cars,

causing overall consumer purchases to grow at the slowest pace

since late 2009.

Major makers of household staples including Procter & Gamble

Co. and PepsiCo Inc. this week reported lackluster sales due partly

to weak consumer spending. Car maker Ford Motor Co. posted a 35%

drop in first-quarter profit. Online retailer Amazon.com Inc. was a

bright spot, reporting a jump in profit.

Temporary factors may have suppressed consumer spending in the

first quarter. The economy also has a habit of starting the

calendar year slowly and then picking up speed in the spring and

summer.

The report offered hopeful signs of stronger growth in the

coming months, with U.S. companies stepping up investment in

long-term projects.

"If you look at the backdrop for spending, including [rising]

income, wealth, as well as confidence, I think it's pretty clear

the trend in consumer spending has not suddenly collapsed," said

Jim O'Sullivan, chief U.S. economist at High Frequency

Economics.

Still, the GDP report was a stark reminder that Mr. Trump has

set out to reach a daunting goal. The economy has expanded at an

anemic annual rate of 2% since 2000 -- including the effects of two

recessions. Mr. Trump and his advisers have vowed to boost the

growth rate to 3% or more. They are up against long-running

headwinds that won't be easily reversed, including an aging

population and weak productivity growth.

The latest figures offered the broadest report card on the

economy's performance in the first 100 days of the Trump

administration. Few presidents have entered office with the kind of

expectations facing Mr. Trump. Confidence among consumers and

businesses hit multiyear highs and the stock markets hit record

levels in the first quarter.

Economists say it is far too early to judge the president's

impact on the economy, especially given that he hasn't put in place

the main components of his economic plans -- a broad tax overhaul

which dramatically reduces corporate tax rates, revamped trade

deals and a rollback of environmental, labor, health and other

regulations.

"Business and consumer sentiment is strong, but both must be

released from the regulatory and tax shackles constraining economic

growth," Commerce Secretary Wilbur Ross said in a statement after

the GDP report.

Most economists expect growth to rebound to a rate of between 3%

and 4% this quarter and then to settle back into its 2% trend in

the months ahead.

Sluggish consumer spending drove the first-quarter slowdown,

presenting the biggest puzzle of the economy this year. With

confidence and stock prices high, gasoline prices modest and jobs

and wages increasing, spending ought to be picking up.

Economists have several theories for why that didn't happen. The

unusually warm winter led Americans to spend less than usual on

heating their homes, meaning less output from big utilities. And

delays in many Americans receiving tax refunds from the Internal

Revenue Service may have left them with less spending money

relative to prior years.

Still, those theories don't entirely explain why consumer

spending on durable goods, such as cars and refrigerators, fell by

the most in nearly six years.

Concerns are building in the car industry, where a seven-year

run in sales growth appears to be petering out. Car sales likely

declined for the fourth straight month in April, despite discounts

and incentives increasingly pitched by car makers, industry data

show.

Strong auto sales have helped boost the economy in recent

years.

"Clearly it's a more competitive market that we're dealing in

than it was two or three years ago," General Motors Co. finance

chief Chuck Stevens told reporters Friday, adding that the

"industry is plateauing."

Car dealers were sitting on a 72-day supply of vehicles on

average in March, up from 66 days a year earlier, according to

researcher WardsAuto.com. Vehicles are piling up despite bigger

discounts. Car makers spent an average of $3,499 on incentives per

vehicle in the first half of April, the highest level for the month

since 2009, according to J.D. Power.

Indeed, a drawdown in inventories across the economy had a big

negative effect on growth last quarter. Instead of placing new

orders with manufacturers, many companies whittled down their

stockpiles. The lack of inventory investment dragged down the

overall growth in GDP by nearly a full percentage point.

That could reverse if consumer spending picks up, providing a

boost to output in the months ahead.

Still, other retailers this week expressed concern about

consumers. Nestlé Chief Executive Mark Schneider on an investor

call pointed to "fairly soft demand even in the face of pretty good

fundamental economic data." He said that might have to do with

lingering uncertainty, but that he remains optimistic about the

rest of the year.

Government spending also fell in the first quarter, though those

drops might be temporary. One possible factor: A three-month hiring

freeze imposed by the Trump administration that was recently

lifted. Declines in defense spending, which can vary greatly

quarter to quarter, and state and local government spending could

reverse later this year.

Perhaps the most encouraging sign from Friday's report is a

pickup in business investment. Throughout most of the recovery,

companies have largely put off building new factories and

purchasing equipment. Those are the kinds of projects that make

companies more efficient, boost worker productivity and, over the

long haul, lift economic growth.

Such spending grew at a 9.4% rate last quarter, the fastest

since late 2013. That coincides with surveys showing surging

confidence among businesses following Mr. Trump's November election

victory. Investment picked up broadly, but the biggest factor was a

pickup in mining-related structures, reflecting a rebound in the

energy industry that has led to renewed drilling and exploration

projects.

Jason Furman, a Peterson Institute senior fellow who served as

former President Barack Obama's top economic adviser, called the

investment figures "exciting to see" after years of waiting for

such an increase. "Maybe that rebound is finally here," he

said.

Arrowsight Inc. says it has seen a rise in investment spending

from clients. The Mount Kisco, N.Y.-based firm sells video-camera

software to monitor business facilities for quality control. It has

seen a bump in sales in recent months in the food industry,

particularly among meat producers seeking to improve food safety

and animal welfare, said Adam Aronson, the closely held company's

chief executive officer.

"Typically when you see very big companies that are investing in

things like that, it means that they're doing quite well," Mr.

Aronson said. "In tougher times, those are nice to have -- not

necessarily things that you would progressively invest in as much

as we're seeing."

--Mike Colias contributed to this article.

Write to Josh Mitchell at joshua.mitchell@wsj.com

(END) Dow Jones Newswires

April 28, 2017 17:43 ET (21:43 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

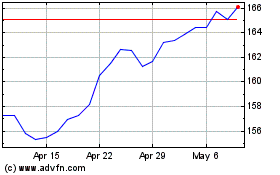

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

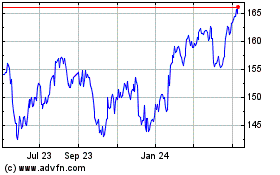

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024