Additional Proxy Soliciting Materials (definitive) (defa14a)

April 28 2017 - 5:33PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

|

|

|

|

Filed by the Registrant ☒

|

|

|

|

Filed by a Party other than the Registrant ☐

|

|

|

|

Check the appropriate box:

|

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under §240.14a-12

|

|

|

|

ALKERMES PLC

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

☒

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

|

2017 Annual General Meeting April 2017

|

|

|

Certain statements in this presentation constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, but not limited to, statements concerning our business strategy; potential transactions related to technologies, products or product rights and businesses complementary to our business and the potential that we may seek to enter into one or more of these transactions at any time in order to advance our business and increase shareholder value; and our ability to compete for, and complete, such transactions and execute our business strategy. Although we believe that such forward-looking statements are based on reasonable assumptions within the bounds of our knowledge of our business and operations, the forward-looking statements are neither promises nor guarantees and they are necessarily subject to a high degree of uncertainty and risk. Actual performance and results may differ materially from those expressed or implied in the forward-looking statements due to risks, assumptions and uncertainties. You are cautioned not to place undue reliance on the forward‑looking statements contained herein. The factors that could cause actual results to differ are discussed under the heading “Item 1A. Risk Factors” in the Alkermes plc Annual Report on Form 10-K for the year ended Dec. 31, 2016 and Quarterly Report on Form 10-Q for the quarter ended March 31, 2017 and in subsequent filings made with the U.S. Securities and Exchange Commission (“SEC”), which are available on the SEC's website at www.sec.gov and on our website at www.alkermes.com in the “Investors—SEC filings” section. The information contained in this presentation is provided as of the date hereof and, except as required by law, we disclaim any intention or responsibility for updating or revising any forward-looking information contained herein. Forward-Looking Statements 2

|

|

|

© 2017 Alkermes. All rights reserved. 3 About Alkermes plc

|

|

|

We apply our scientific expertise and proprietary technologies to research, develop and commercialize, both with partners and on our own, pharmaceutical products that are designed to address unmet medical needs of patients in major therapeutic areas. We have a diversified portfolio of marketed drug products and a clinical pipeline of products that address central nervous system disorders such as schizophrenia, depression, addiction and multiple sclerosis. Our ordinary shares are listed exclusively in the U.S. and the U.S. capital markets are the sole capital markets for our ordinary shares. We are incorporated in Ireland. 4 We Are a Fully-Integrated, Global Biopharmaceutical Company

|

|

|

We are listed exclusively on NASDAQ Global Select Market (“NASDAQ”) and incorporated in Ireland. Because our ordinary shares are listed exclusively in the U.S. and the U.S. capital markets are the sole capital markets for our ordinary shares we: follow the rules and regulations of the SEC and the NASDAQ rules and listing standards, and are subject to the same NASDAQ and SEC governance and share issuance requirements as all U.S.-incorporated companies listed on NASDAQ. Because we are incorporated in Ireland, we follow Irish corporate law. 5 We Are Listed in the U.S. and Incorporated in Ireland

|

|

|

© 2017 Alkermes. All rights reserved. 6 What are proposals 5 and 7 and why are they important?

|

|

|

|

|

|

Irish Law Requires Us to Obtain Shareholder Approval of Share Issuance Authorities As a matter of Irish law, directors of an Irish public limited company must: Have specific authority from shareholders to allot and issue any of the company’s ordinary shares (other than pursuant to employee equity plans), and When issuing shares for cash, first offer those shares on the same or more favorable terms to existing shareholders of the company on a pro-rata basis, unless this statutory obligation is dis-applied, or opted-out of, by approval of the shareholders. As a matter of Irish law, approval of these authorities is required only once every five years and there is no limit under Irish law on the amount of shares that these approvals may cover (apart from the Irish-incorporated company’s then authorized but unissued share capital). Companies incorporated in the U.S. are not subject to similar share issuance restrictions. Proposals 5 and 7, the Share Issuance Proposals, seek approval of the same full share issuance authorities under which we operated during our first five years as an Irish company, during which time we demonstrated responsible use of our equity: Engaging in one sale of less than five percent of our ordinary share capital in one capital-raising transaction, and During this period, our average burn rate, on an adjusted and unadjusted basis, was consistently less than the average for our GICS industry group. 7

|

|

|

|

|

|

Irish Law Does Not Require Us to Limit Our Share Issuance Authorities to Conform to Market Practice for Companies Listed on the ISE Share issuance limitations derived from Irish market practice are not required by Irish or U.S. laws or regulations and we do not believe that limitations derived from Irish market practice should apply to us as a company listed exclusively on NASDAQ. These limitations derived from Irish market practice are: NOT required or mandated by Irish or U.S. laws or regulations, and Part of the corporate governance framework applicable to companies whose share capital is listed on the Irish Stock Exchange (“ISE”) (regardless of whether such companies are incorporated in Ireland or elsewhere). Our ordinary shares are not, and never have been, listed on the ISE. We believe it is not appropriate to apply the ISE standards and market practices to a company like ours that is listed exclusively on NASDAQ, which provides its own separate restrictions on share issuances for the protection of shareholders. 8

|

|

|

|

|

|

We Are Seeking Full Share Issuance Authorities Our original share issuance authorities expired on September 15, 2016 and accordingly, we sought approval of the renewal of our share issuance authorities at our 2016 Annual General Meeting of Shareholders, and, in so doing, followed the market practice for companies whose share capital is listed on the ISE, in part because we believed that our shareholders might apply the same policies they apply to companies listed on the ISE when analyzing our share issuance authorities. Upon further analysis and engagement with our shareholders following our 2016 Annual General Meeting of Shareholders – we solicited the views of institutional investors representing greater than 71% of our outstanding shares – we believe that it is in the best interests of the company and our shareholders to seek full share issuance authorities. In discussions we have had with shareholders about the share issuance authorities, shareholders have generally understood that renewing our share issuance authorities to the maximum extent permitted by Irish law, as presented in Proposals 5 and 7, would be both consistent with Irish and U.S. laws and regulations and would allow us to compete on an equal footing with our U.S.-incorporated and exchange-listed peers. 9

|

|

|

Proposals 5 and 7 ask shareholders to approve, for a five-year period commencing on the date of approval of the Share Issuance Proposals, our directors’ authority to: Allot and issue shares up to a maximum of our authorized but unissued share capital (the “Share Allotment and Issuance Authority”), and Issue shares for cash without first being required to offer such shares to all of our shareholders on a pro-rata basis (the “Pre-Emption Opt-Out Authority”). Votes required for approval: The Share Allotment and Issuance Authority requires a majority of the votes cast on the proposal, and The Pre-Emption Opt-Out Authority requires 75% of the votes cast on the proposal. We are not asking shareholders to approve an increase to our authorized share capital. If Proposals 5 and 7 are approved, we will remain subject to all NASDAQ requirements and SEC rules, and fiduciary duties under Irish law, including our directors’ principal fiduciary duties to act in good faith and in the best interests of the company, and the protections afforded to our shareholders under the Irish Takeover Rules. 10 What Does “Full Share Issuance Authorities” Mean?

|

|

|

We regularly review potential transactions related to technologies, products or product rights and businesses complementary to our business and, if appropriate, we may seek to enter into one or more of these transactions at any time in order to advance our business and increase shareholder value. Many of these opportunities are highly competitive, with multiple parties often offering comparable or even the same economics. If the Share Issuance Proposals are not approved, we may be required to obtain shareholder approval prior to issuing any shares in connection with new strategic opportunities, even if we would not otherwise be required to obtain shareholder approval under the NASDAQ rules. This could put us at a distinct disadvantage compared to many of our peers in competing for, and completing, acquisitions and similar transactions, thus potentially limiting our ability to undertake transactions that are in our, and our shareholders’, best interests. 11 Obtaining Full Share Issuance Authorities Is Important to Our Business Strategy

|

|

|

It is important that we have the flexibility to quickly take advantage of strategic opportunities, including potentially transformative acquisitions and other capital-intensive opportunities. We believe that the additional restrictions on our ability to deploy capital if the Share Issuance Proposals are not approved would negatively impact our ability to quickly take advantage of such acquisitions and opportunities. Seeking general re-approval of our share issuance authorities on a more frequent basis than is required under Irish law would subject us to competitive disadvantages, particularly given the 75% vote threshold required to approve the Pre-Emption Opt-Out Authority. Our concern in this regard is that a single shareholder or small number of shareholders, including those with a short-term focus, could defeat a proposal to approve the Pre-Emption Opt-Out Authority given the high vote threshold to approve that dis-application, even if a substantial majority of our shareholders who are supportive of our business and strategy vote to approve the Pre-Emption Opt-Out Authority. 12 Proposals 5 and 7 Establish Equal Footing and Remove Competitive Disadvantages Compared to Our U.S. Exchange-Listed Peers

|

|

|

If our share issuance authorities are not renewed on the terms set forth in Proposals 5 and 7, it would negatively impact our ability to quickly take advantage of strategic opportunities, including potentially transformative acquisitions and other capital-intensive opportunities if and when such acquisitions or opportunities arise. We operate in a highly competitive industry, and believe that the failure to approve the share issuance authorities on the basis proposed would put us at a competitive disadvantage. We believe that the renewal of our share issuance authorities on the terms set forth in Proposals 5 and 7 would keep us on an equal footing with our peer companies who are incorporated and listed in the U.S. If Proposals 5 and 7 are not approved, when our current share issuance authorities expire we will generally not be able to allot and issue any shares, including shares for cash, without first seeking and obtaining shareholder approval for each such issuance. Obtaining shareholder approval is a costly process that can take a significant amount of time, without any assurance of success, and we do not think that seeking and obtaining shareholder approval for each issuance is a workable alternative to obtaining approval of the Share Issuance Proposals. 13 Risks if Proposals 5 and 7 Are Not Approved

|

|

|

© 2017 Alkermes. All rights reserved. 14 Our Other 2017 Annual General Meeting Proposals

|

|

|

Election of directors (Proposal 1) Non-binding, advisory say-on-pay vote (Proposal 2) Ratify, in a non-binding, advisory vote, PricewaterhouseCoopers LLP’s re-appointment and authorize, in a binding vote, the Audit and Risk Committee’s determination of auditor remuneration (Proposal 3) 15 Recurring Annual Proposals

|

|

|

Approval of the Alkermes plc 2011 Stock Option And Incentive Plan, as amended (Proposal 4) Adjournment (Proposal 6) 16 Other Non-Recurring Proposals

|

|

|

© 2017 Alkermes. All rights reserved. 17 Approval of the Alkermes plc 2011 Stock Option and Incentive Plan, as Amended (Proposal 4)

|

|

|

|

|

|

Why Proposal 4 is on the Agenda and Why You Should Vote “FOR” Proposal 4 Shareholder approval is requested to: Increase the number of ordinary shares authorized for issuance under the Alkermes plc 2011 Stock Option and Incentive Plan, as amended (the “2011 Plan”), by 3,000,000 ordinary shares (subject to adjustment for stock splits, stock dividends and similar events), and Approve the performance measures set forth in the 2011 Plan. You should vote “FOR” Proposal 4 because: The size of our share reserve increase request (3,000,000) is reasonable, Equity awards are integral to our compensation program and to our success, We believe we have responsibly utilized our equity compensation to align employee interests with those of our shareholders to achieve and sustain share price growth, and We manage our equity incentive award use carefully. Required vote for approval – a majority of the votes cast on the proposal. 18

|

|

|

© 2017 Alkermes. All rights reserved. 19 Adjournment (Proposal 6)

|

|

|

|

|

|

Why Proposal 6 is on the Agenda and Why You Should Vote “FOR” Proposal 6 Proposal 7 (approve directors’ authority to issue shares for cash without first offering shares to existing shareholders) is a special resolution under Irish law that requires no less than 75% of the votes cast at a general meeting to be voted “FOR” the proposal in order to be passed. Given the high vote threshold associated with Proposal 7, we are proposing to have the ability to adjourn the 2017 Annual General Meeting to solicit additional proxies if there are insufficient votes at the time of the 2017 Annual General Meeting to approve Proposal 7. If you support Proposal 7, we believe that a vote for the adjournment proposal (Proposal 6) also warrants your support. Required vote for approval – a majority of the votes cast on the proposal. 20

|

|

|

© 2017 Alkermes. All rights reserved. 21 About Our Corporate Governance

|

|

|

|

|

|

Strong Corporate Governance Practices 7 out of 8 directors are independent Regular executive sessions of independent directors Audit, compensation and nominating and corporate governance committees are comprised solely of independent directors Endeavor to have a Board with diverse viewpoints Annual Board and committee self-evaluations, including individual director self-assessments Risk oversight by the full Board and committees Board and committees may engage outside advisors independently of management Independent compensation consultant reporting directly to the compensation committee Lead Independent Director role established to facilitate independent oversight Corporate Governance Guidelines Share Ownership and Holding Guidelines for directors and executive officers Majority vote standard to elect directors Anti-hedging/pledging policy Insider Trading Policy Code of Business Conduct and Ethics Annual advisory approval of executive compensation Clawback Policy for our named executive officers Compensation policy targeting the 50th percentile for all elements of pay, with the opportunity to increase or decrease the variable elements of pay from the 50th percentile based on performance 22

|

|

|

© 2017 Alkermes. All rights reserved. 23 2017 Annual General Meeting Logistics

|

|

|

|

|

|

We Value Your Support at our 2017 Annual General Meeting Our 2017 Annual General Meeting is on May 24, 2017. Our Board recommends that you vote “FOR” each of the nominees in Proposal 1 and “FOR” each of the other proposals. Your vote is important, no matter how many or few shares you may own. Please help us avoid the expense of further solicitation by voting today. If you require any assistance in voting your shares or have any other questions, please call Alliance Advisors, our proxy solicitation agent, at 1-855-737-3174. 24

|

|

|

© 2017 Alkermes. All rights reserved. 25

|

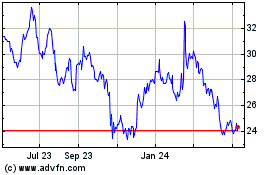

Alkermes (NASDAQ:ALKS)

Historical Stock Chart

From Mar 2024 to Apr 2024

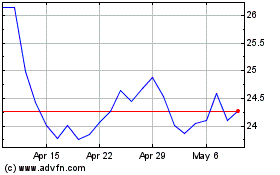

Alkermes (NASDAQ:ALKS)

Historical Stock Chart

From Apr 2023 to Apr 2024